First, this is not emotional trading, but rather a cycle selection.

If you've been paying attention to the market, you'll know:

This year has been an absolutely perfect year for precious metals.

Gold prices have risen steadily, continuously setting new historical highs.

Silver is projected to become the highest-returning asset in the metals sector by 2025.

A significant portion of my funds was allocated to this during this period.

But the market is never about "what assets you like".

The market only cares about three things:

cycle

opportunity

Rotation

When an asset completes its mission in the cycle...

It will then be sold.

II. Where does confidence come from? From historical capital rotation.

Why am I so confident in making such a decisive switch at this time?

There is only one answer:

Historically, every liquidity cycle has followed a similar path.

After a strong rally in gold and silver prices,

Funds continue to flow from "defensive assets"—

Entering risky assets:

stock

science and technology

And—Crypto Assets

And now, we are in that stage.

III. Clear Signals the Market is Sending

If you set aside emotions and only look at the structure, you will find that:

Precious metals have shown signs of reaching their annual highs.

Volatility began to decline

High demand has weakened significantly.

Funds are seeking new "narratives and venues".

This was not a sudden event.

Instead, it exhibits typical characteristics of the latter half of a cycle.

IV. This is not 2017 or 2021, but the market is not just made up of charts.

From a technical perspective,

This time it is not a complete copy of 2017 or 2021.

But the market is never just about candlestick charts.

The market is truly driven by the following three factors:

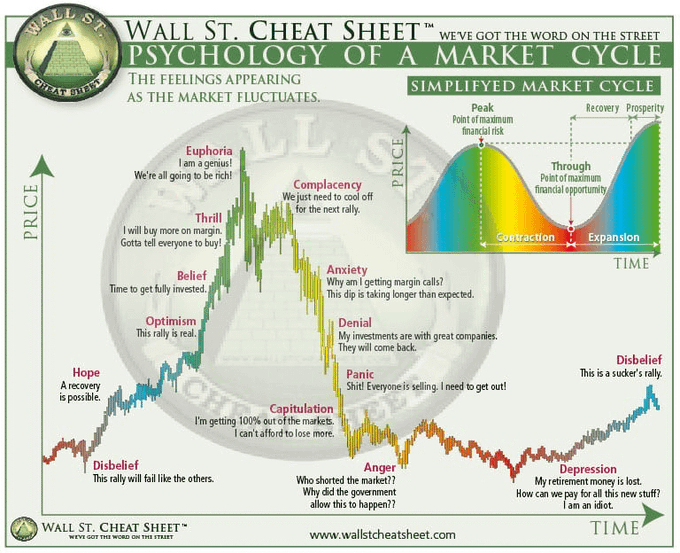

psychology

expected

belief

Currently, most participants have begun to believe:

The four-year cycle is still valid

Funds are undergoing structural rotation.

This in itself is enough to change the price path.

V. Why is "belief" more important than facts?

Because the core principle of the market is:

Price precedes fact, expectation precedes price.

Fear and belief will prevail before prices actually start to move.

This creates real demand.

This is precisely why most people are always "a step behind".

VI. Gold has fulfilled its role.

Gold did everything it was supposed to do in this round:

Absorbing liquidity

To meet the demand for risk aversion

Complete price discovery

Subsequently:

Entering correction

And transfer funds to higher risk levels

This is a perfectly natural step in the cycle.

VII. Crypto assets: the next stop

And now, the next destination for these funds is Crypto.

Why?

It is still severely underestimated.

It is still rejected and questioned by a large amount of funding.

From a mainstream perspective, it still "looks dangerous."

But all major market trends begin in a phase that "looks uncomfortable".

in conclusion:

My selling of precious metals does not mean I deny their value.

Instead, it acknowledges a fact:

Liquidity has changed direction.

Making money in the market doesn't rely on faith-based assets.

And it relies on adapting to the cycle and respecting the choices of capital.

While most people are still hesitating, doubting, and waiting for confirmation

This is the optimal time for the rotation to occur.

Adapt to change

Instead of clinging to the past.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush