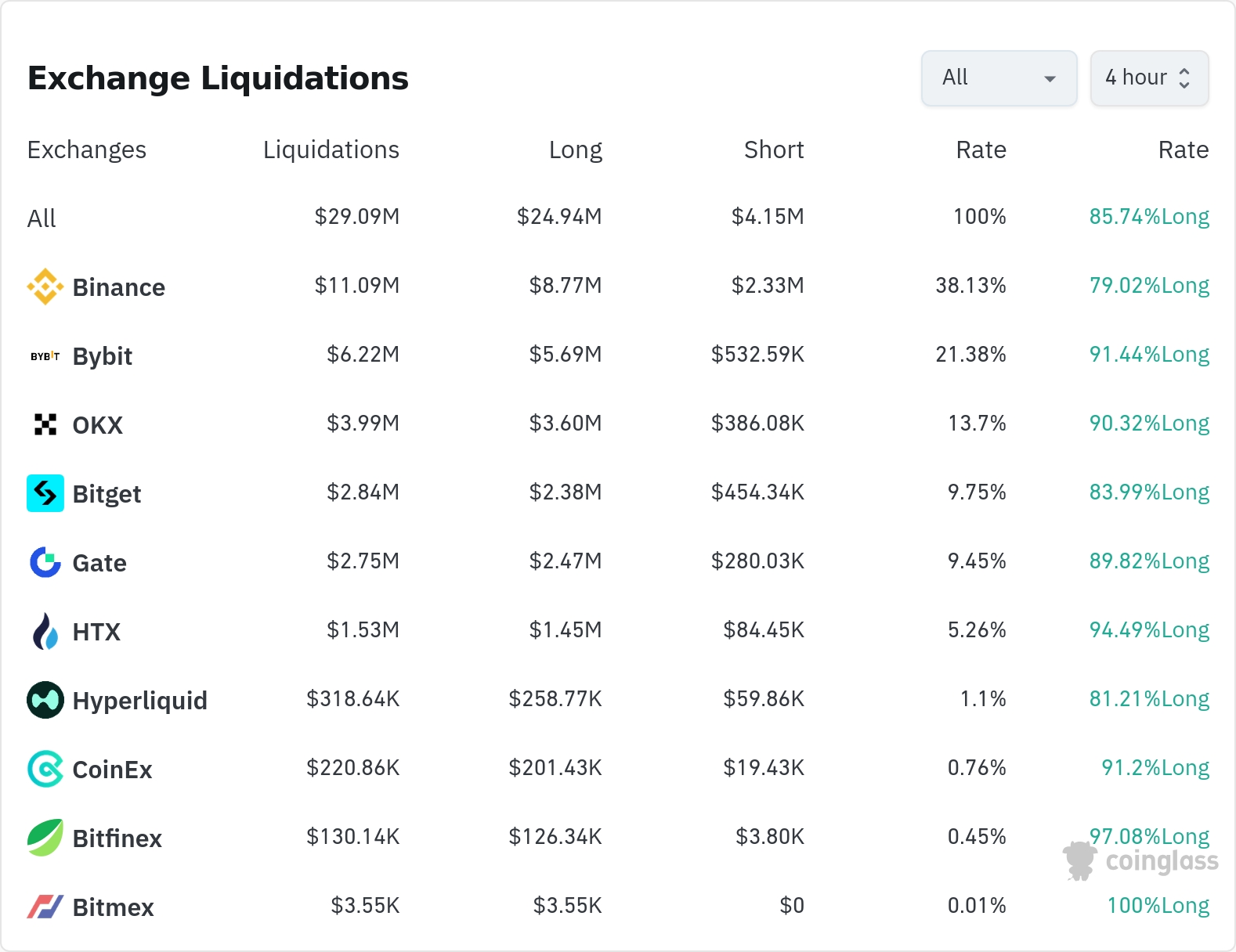

Approximately $290.9 million worth of leveraged positions were liquidated in the cryptocurrency market over the past 24 hours.

According to currently compiled data, long positions accounted for 85.74% of the total liquidated positions, or $249.36 million, while short positions accounted for 14.26%, or $41.54 million.

Binance saw the most position liquidations over the past four hours, with a total of $110.9 million (38.13% of the total). Of this, long positions accounted for $87.64 million, or 79.02%.

The second exchange with the most liquidations was Bybit, where $62.2 million (21.38%) of positions were liquidated, of which long positions accounted for $56.88 million (91.44%).

OKX saw liquidations of approximately $39.9 million (13.7%), with a long position ratio of 90.32%.

Notably, Bitfinex had a high long position liquidation rate of 97.08%, higher than other exchanges, while BitMEX had a rate of 100%, with only long positions being liquidated.

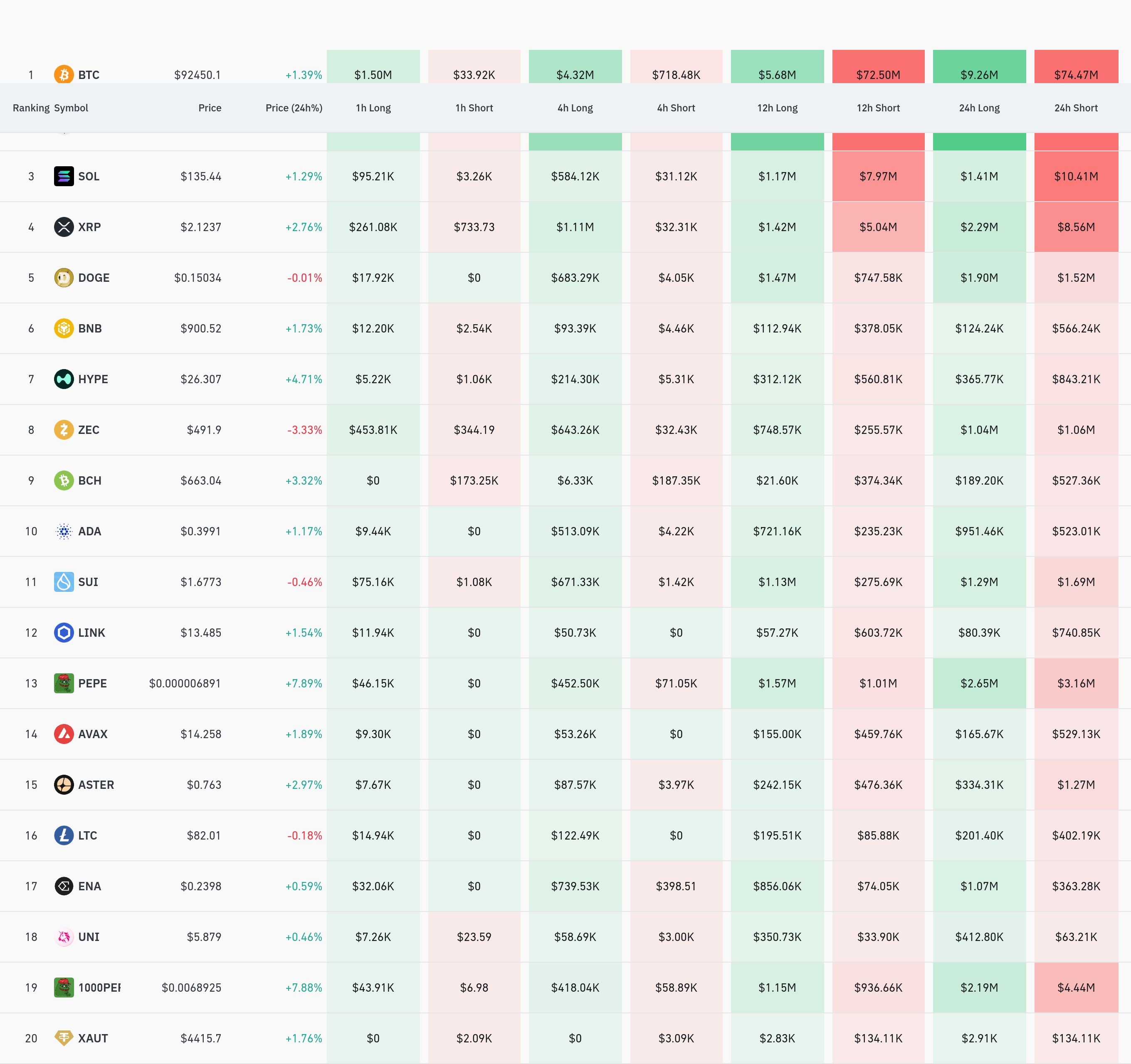

By coin, Bitcoin (BTC) positions saw the most liquidations. Approximately $83.77 million worth of Bitcoin positions were liquidated over the past 24 hours, with approximately $5.04 million liquidated over the past four hours. Bitcoin's current price is $92,450.1, up 1.39% over the past 24 hours.

Ethereum (ETH) saw approximately $56.23 million in positions liquidated over the past 24 hours, making it the second-largest cryptocurrency in total liquidation volume after Bitcoin.

Solana (SOL) saw approximately $11.82 million liquidated over the past 24 hours, with the current price at $135.44, up 1.29% over the past 24 hours. Approximately $615,000 in liquidations occurred over the past four hours.

XRP saw approximately $10.87 million liquidations over the past 24 hours, and is currently trading at $2.1237, showing a 2.76% increase over the past 24 hours.

Dogecoin (DOGE) is currently trading at $0.15034, with approximately $3.42 million worth of positions liquidated over the past 24 hours. Interestingly, while other major coins are rising, Dogecoin is down slightly (-0.01%).

Among meme coins, PEPE showed a strong upward trend of 7.89%, leading to the liquidation of approximately $5.81 million worth of positions. Notably, both long positions (2.65 million) and short positions (3.16 million) saw significant liquidations over the past 24 hours.

Additionally, 1000PEPE tokens also saw a massive liquidation, totaling $6.63 million, with a 7.83% price increase. This demonstrates market participants' high-leverage bets on high-risk tokens.

In the cryptocurrency market, "liquidation" refers to the forced closure of leveraged positions when traders fail to meet margin requirements. This liquidation data demonstrates the recent volatility in the cryptocurrency market and the consequent concentration of long positions.

Article Summary by TokenPost.ai

🔎 Market Interpretation

Liquidations occurred in the past 24 hours, totaling approximately $290.9 million, with long positions accounting for 85.74%.

- Large-scale liquidations occurred in the order of Binance, Bybit, and OKX.

Bitcoin liquidated $83.77 million, Ethereum liquidated $56.23 million, accounting for the largest portion.

- Mass liquidations also occurred in meme coins PEPE (up 7.89%) and 1000PEPE (up 7.83%).

💡 Strategy Points

- The phenomenon of long position concentration (85.74%) reflects market participants' expectations of an increase.

- Large-scale liquidations due to the rapid fluctuations in meme coins require caution in high-risk investments.

- Differences in liquidation rates by exchange reflect the positioning tendencies of users of each exchange.

📘 Glossary

Liquidation: A situation in which a position is forcibly closed when the margin requirement is not met in a leveraged transaction.

- Long Position: A position purchased in anticipation of a price increase.

- Short Position: A position sold in anticipation of a price decline.

TokenPost AI Notes

This article was summarized using a TokenPost.ai-based language model. Key points in the text may be omitted or inaccurate.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.