As Bitcoin exchange holdings decline over the medium term, trading activity is shifting from Asian to US time zones, shifting the axis of capital flow within the market.

According to CoinGlass, as of 3:40 PM on the 5th, the total Bitcoin holdings on major exchanges were approximately 2,489,268 BTC.

There was a net outflow of 702.93 BTC over the past day, 13,865.58 BTC over the past week, and 34,668.1 BTC over the past month. The net outflow trend continues in both the short and medium term, demonstrating the continued movement of Bitcoin out of exchanges.

Coinbase Pro holds the largest balance among major exchanges, holding 799,040 BTC. It recorded a daily net outflow of 210.58 BTC and a weekly net inflow of 1,661.70 BTC.

Binance holds 650,251 BTC. While it saw a daily net inflow of 299.22 BTC, it saw a weekly net outflow of 4,802.04 BTC.

Bitfinex holds 412,302 BTC and has a net outflow of 223.39 BTC per day and 331.23 BTC per week, showing a relatively gentle decline among major exchanges.

Daily maximum net inflow : Binance (+299 BTC), Bybit (+297 BTC), Bitstamp (+46 BTC)

Daily net outflows : Kraken (-662 BTC), Bitfinex (-223 BTC), Coinbase Pro (-211 BTC).

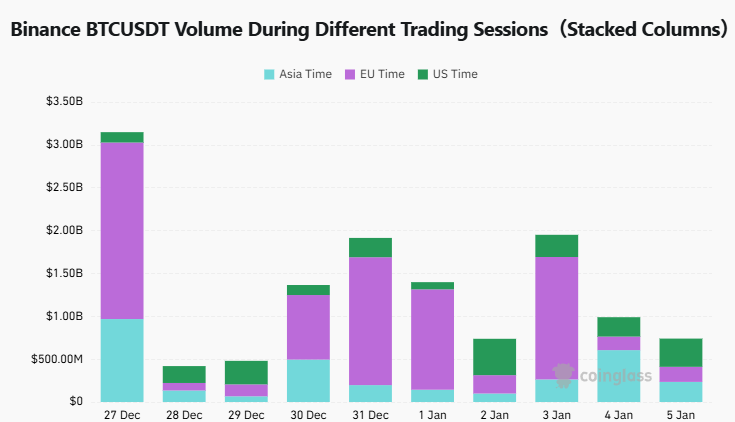

Binance BTCUSDT trading volume was recorded at $234.56 million during Asian hours, $175.8 million during European hours, and $329.39 million during American hours.

Compared to the previous day (Asia $605.36 million, Europe $157.73 million, and the US $226.25 million), the Asian market decreased by 61.2%, while the European market increased by 11.5% and the US market expanded by 45.6%.

Looking at regional trends, Asian time zones showed a significant decline in trading volume following the previous day's surge, signaling a correction. European time zones continued a gradual upward trend, maintaining moderate levels of participation. The US time zone saw a significant increase in trading volume, demonstrating the most pronounced recovery in liquidity. Overall, regional differences were evident, with trading participation shifting from Asia to the US.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.