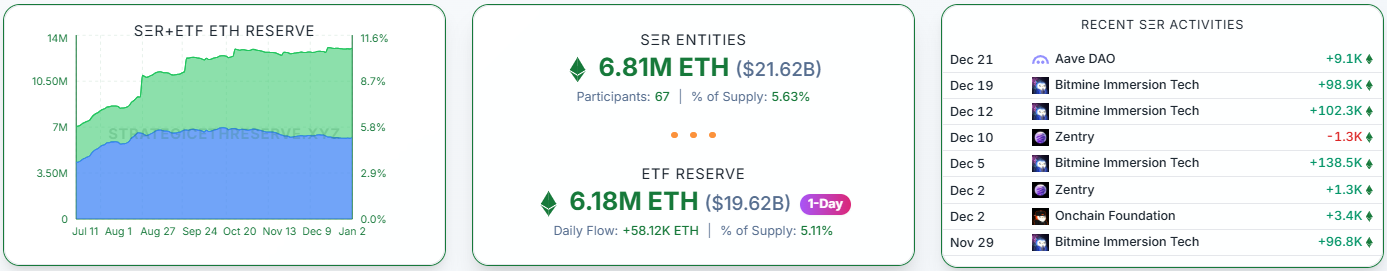

The total holdings of Ethereum strategic assets (SER) and ETFs were tallied at 13 million ETH.

According to the Strategic Ether Reserve at the baseline, the total amount of Ethereum, including ‘strategic asset (SER) holdings’ and ‘ETF holdings’, was confirmed to be approximately 13 million ETH (approximately $41.262 billion).

The strategic asset (SER) holding amount was 6.81 million ETH (approximately $21.62 billion), accounting for 5.63% of the total Ethereum supply.

A total of 68 organizations were identified as holding more than 100 ETH as strategic assets. Their total holdings amount to 6.81 million ETH, representing 5.63% of the total Ethereum supply.

Of these, 20 are listed companies, and their combined holdings are estimated at 6 million ETH (approximately $19.05 billion), representing 4.96% of the total Ethereum supply.

Looking at the overall ranking by holdings, Bitmine Immersion Tech (BMNR) holds the largest Ethereum holding position, holding 4.07 million ETH (approximately $12.91 billion). This represents 3.36% of Ethereum's total supply. BMNR continued its buying spree, with purchases of 138,500 ETH on the 5th, 102,300 ETH on the 12th, and 98,900 ETH on the 19th.

Sharplink Gaming (SBET) ranked second with 863,020 ETH (approximately $2.74 billion). The Ether Machine (ETHM) held 496,710 ETH (approximately $1.58 billion) in third place.

The Ethereum Foundation ranked fourth with 229,470 ETH (approximately $728.3 million). Bit Digital (BTBT) and Coinbase (COIN) ranked fifth and sixth, respectively, with 154,400 ETH (approximately $490.1 million) and 148,720 ETH (approximately $472 million).

Next, ▲Mantle (MNT·101,870 ETH) ▲Golem Foundation (GLM·101,030 ETH) ▲ Etherzilla Corporation (ETHZ·93,790 ETH) ▲ BTCS Inc. (BTCS·73,030 ETH) formed the 7th to 10th places.

The amount indirectly held through Ethereum-based ETFs is 6.18 million ETH (approximately $19.62 billion), which is approximately 5.11% of the total supply.

Looking at the recent ETF fund flow, ▲December 26 (-13,300 ETH) ▲December 29 (-3,300 ETH) ▲December 30 (+23,100 ETH) ▲December 31 (-24,200 ETH) ▲January 2 (+58,100 ETH), only 2 out of 5 trading days recorded net inflows, and the remaining 3 trading days showed net outflows.

The structure in which increased holdings of strategic assets (SER) and ETFs lead to a reduction in Ethereum's medium- to long-term supply remains intact, but in the short term, supply is showing a mixed pattern due to the impact of issuance and ETF outflows.

Over the past seven days, Ethereum's supply has decreased by 35,400 ETH. During this period, 18,700 ETH were newly issued and 100 ETH were burned. Strategic asset (SER) tokens saw a net inflow of 250 ETH, while ETFs saw a net inflow of 53,800 ETH, leading the supply reduction trend.

+2,500 ETH per day | +1,400 ETH per 30 days | -11 million ETH after merge

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.