The knock-off season will come, but not on your schedule, but on the schedule of mobility.

Written by: Dami-Defi

Compiled by: AididiaoJP, Foresight News

Bitcoin surged 20%, Ethereum followed closely, but what about your Altcoin investments? Stagnant water.

You're scrolling through Twitter and everyone's celebrating new highs, but your portfolio looks like it's stuck in 2023. Why is that?

This is a fact nobody wants to hear: a surge in Bitcoin prices doesn't necessarily drive up Altcoin. To understand why, we need to discard a dangerous assumption.

Misconception: "You should immediately follow the Beta trend."

Most traders expect instant rotation. Bitcoin rises on Monday, so Altcoin should surge on Tuesday, right? Wrong.

The reality is that liquidity enters the crypto market in tiers, rather than flooding in all at once. Mainstream coins can rise for weeks on end, while Altcoin stagnate. This isn't a market structure issue; it's simply how capital flows. The sooner you accept this, the better positioned you'll be when the real rotation arrives.

Liquidity stratification: the order in which funds actually enter the market

Stop staring at Altcoin charts; you're seeing fake liquidity. Capital enters the crypto market through three distinct tiers:

First layer: Spot ETFs and mainstream spot markets (the most direct channel, with the largest amount of capital)

This is where institutions, family offices, and large asset allocators operate. They buy Bitcoin and Ethereum spot through regulated products. Zero leverage, zero complexity, maximum scale. These funds aren't "exploring"Altcoin; they're moored in these two assets with clear regulatory transparency.

Second layer: Derivatives (fastest, but usually not for targeted purchases of Altcoin)

Basis trading, funding rate arbitrage, and open interest in perpetual contracts. These activities can drive up the price of BTC/ETH without triggering widespread risk appetite.

The third layer: Retail investors and on-chain risks (the last wave, usually the Altcoin price surge).

Altcoin will only take off when ordinary traders finally have enough confidence to rotate out of mainstream coins and start seeking beta returns. But this is the last liquidity to arrive, not the first.

Understanding this stratification changes everything. When Bitcoin rises while your Altcoin remains stagnant, it simply means that liquidity is still at the first or second tier.

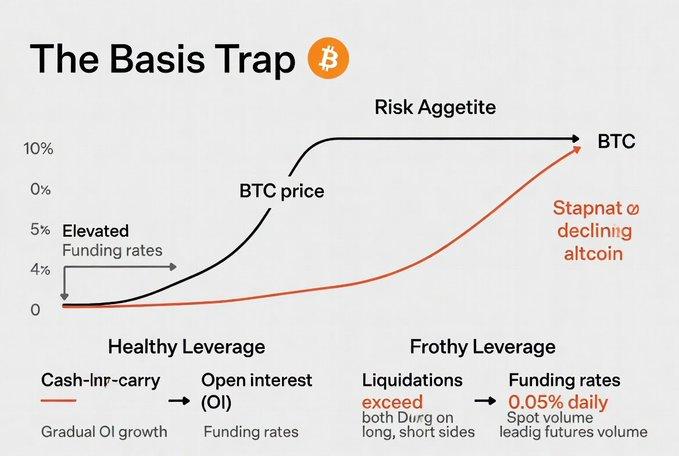

Basis Trap: When prices rise but risk appetite remains unchanged

This is a harsh reality test: Bitcoin can rebound strongly, while actual risk appetite may remain unchanged.

How is this achieved? Through cash-holding arbitrage. Institutions buy spot Bitcoin, short futures, and profit from the basis. This behavior drives up the price of Bitcoin, but they have no intention of buying Altcoin. Funding rates may remain high, open interest may rise, and prices may slowly increase, while Altcoin remain completely unaffected.

Healthy leverage looks like this: gradually increasing open interest, moderate funding rates, and leading spot trading volume.

A bubble-like leverage structure looks like this: open interest grows faster than price, funding rates are greater than 0.05% per day, and liquidation orders from both long and short positions pile up.

The basis trap explains why the assumption that "Bitcoin went up, so Altcoin should follow" often fails. The leverage that drives Bitcoin up is not the liquidity that buys Altcoin.

Bitcoin's Dominance Range: More Than Just "Up or Down"

The Bitcoin market capitalization percentage (BTC.D) is not a simple indicator of "good when it goes up, good when it goes down." It operates under three conditions:

Risk aversion drives BTC.D price increase – Altcoin flees altcoins to Bitcoin. Altcoin holders suffer heavy losses.

Risk appetite dominates: BTC.D rises – Bitcoin's rally is so strong it's "sucking oxygen out of everything else." The market is technically bullish, but Bitcoin has captured all the gains, while Altcoin may even fall in dollar terms.

Rotation Period (BTC.D Decline) – Bitcoin consolidates or cools down. Traders finally start seeking Beta gains. Altcoin gain attention; this is the altcoin season you've been waiting for.

Be wary of a false BTC.D break below; a single red candle on the daily chart doesn't confirm the start of a rotation. You need a clear trend with multiple lower highs.

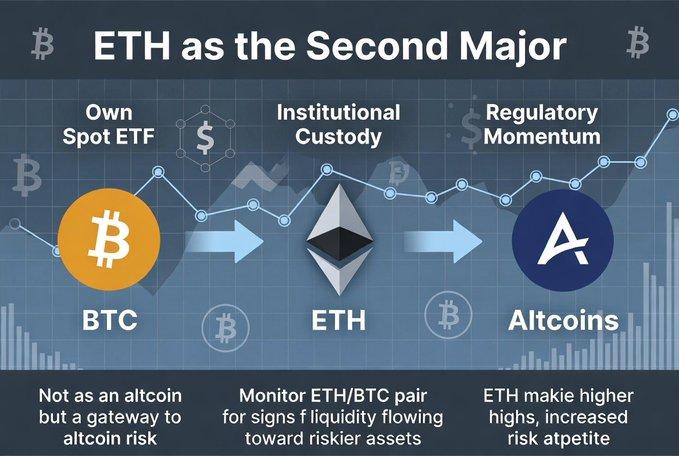

Ethereum is not an Altcoin; it is the "second largest mainstream cryptocurrency."

Stop categorizing Ethereum with your Layer 1 projects. Ethereum serves as a bridge between the risks of mainstream cryptocurrencies and Altcoin. Institutions buy Ethereum when they want a higher beta than Bitcoin but lower risk than Altcoin.

Ethereum also has its own spot ETFs, institutional custody services, and regulatory trends. Closely monitor the ETH/BTC exchange rate; only when this rate begins to reach new highs will liquidity finally start flowing into riskier assets.

Why Altcoin Lag Behind: Five Structural Obstacles Nobody Wants to Acknowledge

Let's face reality. The structural problems facing Altcoin weren't as severe in previous cycles as they are now:

- Dilution and Unlocking Selling Pressure – Supply Continues to Be Released. Billions of dollars worth of unlocked tokens enter the market every month. Early investors and the team are selling, creating persistent selling pressure.

- Fragmentation – There are now thousands of Altcoin. There is no clear "Altcoin index" for institutional investors to buy, resulting in capital dilution.

- Narratives are fragmented—AI coins, DePIN, meme coins, games, RWA… each sector is vying for attention. In 2017, the “Ethereum killer” narrative was dominant. Now? 47 different narratives coexist.

- The lack of clear use cases—many projects have yet to prove their products fit the market. Speculation is fine, but without real users, tokens are unlikely to take off.

- Regulatory uncertainty – Most Altcoin lack regulatory clarity. Institutions can't get involved even if they wanted to.

These are not temporary obstacles; this is the new reality.

Rotation Strategy: How the Imitation Season Truly Arrives

Forget about those random rallies; true rotation follows a sequence:

- Bitcoin experienced a sharp upward surge, followed by consolidation.

- Ethereum received buying interest. The ETH/BTC exchange rate began to improve.

- Major cryptocurrencies are cooling down. Traders are getting bored and starting to seek beta returns.

- Altcoin are rising in waves. Large-cap Altcoin rise first, followed by mid-cap altcoins, and finally small-cap altcoins.

This process may take weeks or months, but patience will pay off.

Counterfeit Season Trigger Signal Board

This is your checklist; you need several signals:

- BTC.D Trend: Confirmed downtrend.

- ETH/BTC Trend: Higher highs, reclaiming key levels.

- Stablecoin supply growth: New capital is entering the system.

- Funding rates + open interest: Risk appetite is picking up, but not overheating.

- Altcoin breadth: Most Altcoin break through.

Additional traffic lights (professional mode):

- TOTAL2 vs. BTC: Do Altcoin outperform Bitcoin in terms of total market capitalization?

- Perpetual contract trading volume share: Are traders really trading Altcoin or only mainstream coins?

- Memecoin Frenzy Index: A Thermometer of Retail Investor Sentiment.

When most of these traffic lights turn green, the actual rotation is underway.

Fake Counterfeit Season: Trap Images

Not every price surge is a period of rampant speculation; be wary of the following illusions:

- Trap 1: Localized Surge – Only two or three Altcoin experience a surge, while broader gains remain stagnant. This isn't rotation; it's a rotation performance.

- Trap 2: Meme coins rise while genuine altcoins don't – When Dogecoin and Frogcoin surge, but your Layer-1 and DeFi blue-chip coins remain stagnant, this is unsustainable. This is retail investor gambling, not institutional rotation.

- Trap 3: ETH rises but ETH/BTC remains unconfirmed – If ETH rebounds but the ETH/BTC exchange rate remains weak, it's just Bitcoin dragging everything up. It's not a genuine strengthening of ETH.

The fake season can trap impatient traders.

Summarize

Bitcoin and Ethereum surged first because that's where liquidity first entered. Altcoin lagged behind due to structural resistance, the decentralized narrative, and the simple fact that risk appetite takes time to build.

Stop expecting instant rotations and start observing liquidity stratification. The altcoin season will become clearer. Until then, mainstream coins are the trading opportunities.

The knock-off season will come, but not on your schedule, but on the schedule of mobility.