Ethereum set a record with $8 trillion in stablecoin transfer volume in Q4 2025, nearly double that of Q2, while active addresses and daily transactions reached historical peaks.

Ethereum has solidified its leading position in digital asset payment infrastructure by processing a record volume of stablecoin transfers exceeding $8 trillion in Q4 2025. According to Token Terminal announcement on Monday, this figure is nearly double the Q2 volume of just over $4 trillion, reflecting exceptional growth in on-chain payment activity.

The issuance of stablecoins on Ethereum is projected to increase by approximately 43% in 2025, from $127 billion to $181 billion by the end of the year, according to BlockWorks. BMNR Bullz commented on X that this isn't speculation but rather global payments taking place on-chain, and this is happening before SWIFT-style integrations, before full-scale Tokenize of real assets, and before institutional rails are operational. The infrastructure is already built, and adoption is catching up.

Network activity reached a record high.

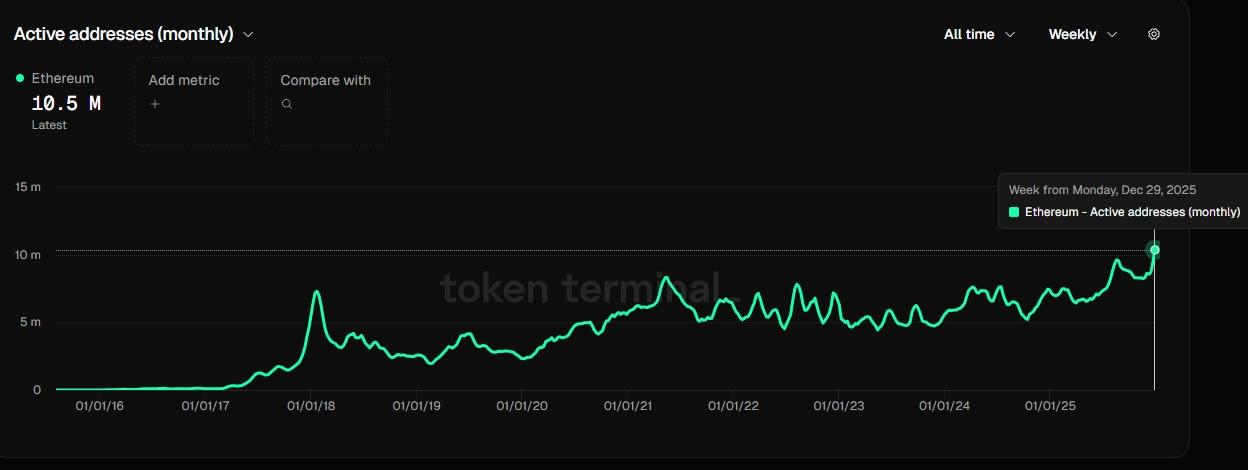

This milestone in stablecoin transfer volume coincides with several Ethereum activity indicators reaching historical peaks. The total daily transaction volume on the Ethereum network reached 2.23 million at the end of December 2025, according to Etherscan , a 48% increase year-on-year. Token Terminal reported that the monthly active addresses on Ethereum reached an All-Time-High of 10.4 million in December.

Simultaneously, the number of unique addresses actively operating daily on the network as Vai sender or receiver also surpassed one million by the end of December. This simultaneous increase in these indicators shows that Ethereum is not only handling a larger volume of value but also attracting more real users to participate in the ecosystem.

Ethereum remains the dominant payment layer for stablecoins and Tokenize real assets, holding approximately 65% of the total on-chain RWA value, equivalent to around $19 billion according to RWA.xyz. This market dominance increases to over 70% when including layer-2 and Ethereum Virtual Machine compatible networks.

Ethereum currently holds 57% of the market share of all issued stablecoins, while the TRON network ranks second with 27%. Tether remains the leading issuer with $187 billion, accounting for 60% of the entire stablecoin market, and more than half of that is on Ethereum.

These impressive figures reinforce Ethereum's position as the global payment infrastructure for digital assets, especially as traditional financial institutions increasingly explore and deploy blockchain solutions. The exceptional growth in Q4 2025 not only reflects the demand for payments but also demonstrates growing confidence in the scalability and reliability of the Ethereum network in supporting real-world financial transactions.