Bots and AI-powered trading strategies are rapidly transforming the ultra-short-term crypto market on Polymarket, turning small investments into massive profits while retail investors struggle to keep up.

From time-dependent arbitrage trading to advanced machine learning models, these automated systems leverage mispriced contracts, thin liquidation , and slow market price updates—something humans struggle to do consistently.

Bots on Polymarket make money from price differences and AI predicts market changes.

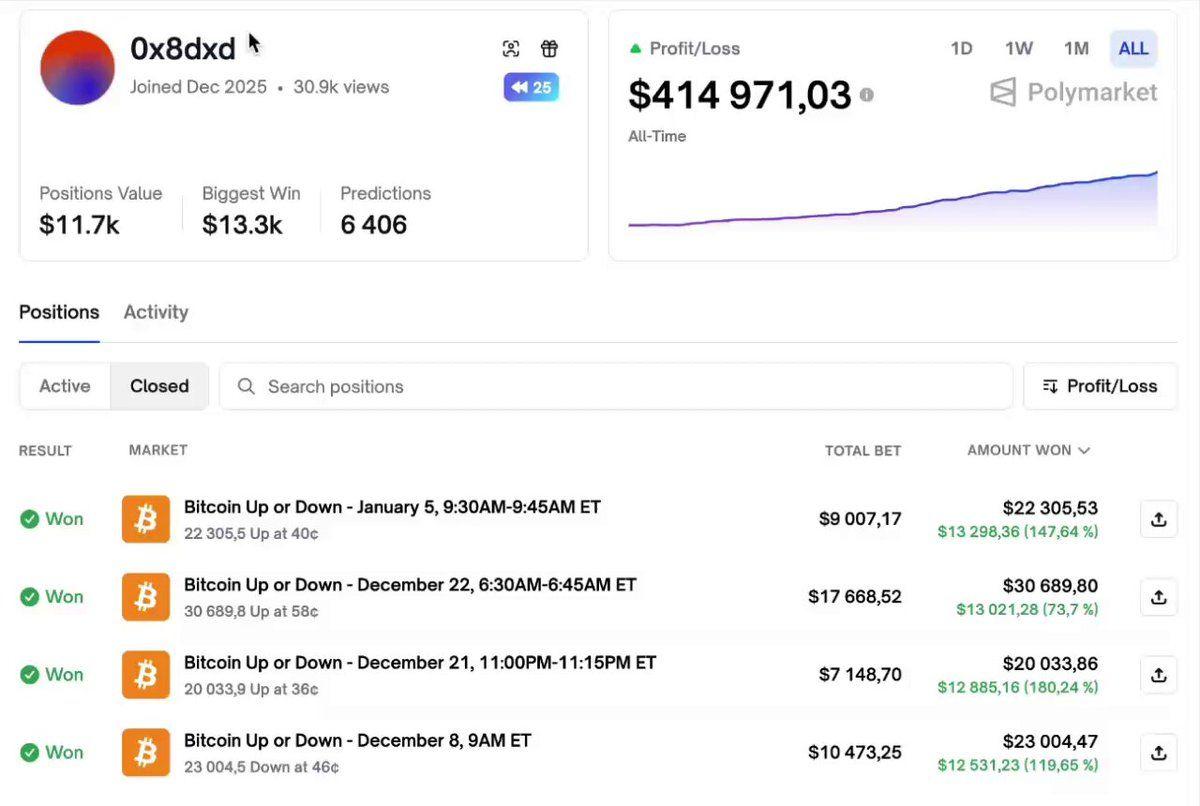

A prime example shared by Dexter's Lab, a market analysis and Chia firm, is a bot that allegedly turned $313 into $414,000 in just one month.

This bot only trades on 15-minute up/down markets of BTC, ETH , and SOL, placing bets of $4,000–$5,000 each time with a win rate of up to 98%.

The secret of this bot doesn't lie in predicting market trends, but rather in taking advantage of a very small time slot when prices on Polymarket update slower than on larger exchanges like Binance and Coinbase .

The bot will enter a trade when the actual probability outside the market is around 85%, but the market is still showing a 50/50 chance, thereby continuously buying "certainty" at an incorrect price.

As a result, thousands of small, regular transactions generate consistent profits , minimizing risk and smoothing out volatility. Meanwhile, retail investors are still busy debating news and trying to hunt for huge profits.

Performance statistics show consistent profits thanks to continuous arbitrage trading (DextersSolab).

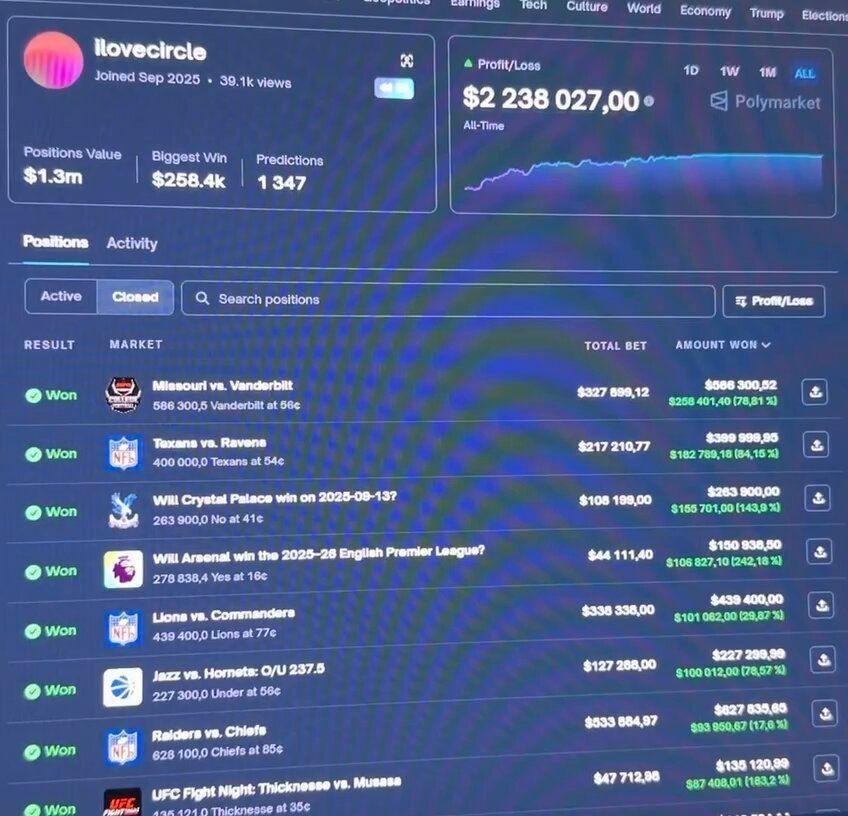

Performance statistics show consistent profits thanks to continuous arbitrage trading (DextersSolab).AI-powered strategies have also been making waves. A bot introduced by Igor Mikerin reportedly earned $2.2 million in just two months. This bot used a synthetic probabilistic model, trained on news and social media data, to exploit mispriced contracts.

The bot continuously updates its predictive model to ensure it stays close to the market, proactively targeting contracts that are undervalued.

This represents a new advancement in the prediction market: the accuracy of the algorithms and their real-time analytical capabilities have clearly surpassed human judgment.

The AI trading bot's performance report shows sustainable profits thanks to its comprehensive model (igor_mikerin).

The AI trading bot's performance report shows sustainable profits thanks to its comprehensive model (igor_mikerin).Arbitrage trading and high-frequency trading (HFT) strategies are now very popular on Polymarket. Ethan, another analyst, describes a bot that specializes in buying large orders in liquidation markets, snapping up contracts just before the price is pushed up.

High-frequency trading bot interface, displaying the ability to find and execute arbitrage trades in real time (0xEthan)

High-frequency trading bot interface, displaying the ability to find and execute arbitrage trades in real time (0xEthan)Another strategy is to buy both sides of a contract when the total price of both sides is less than $1, guaranteeing a small profit with almost no risk.

Such bots have executed thousands of trades with smooth profit-to-loss (PnL) lines, demonstrating that repetition and timing are far more effective than human intuition.

What does the Polymarket automation boom mean for traders?

Retail investors are still facing many difficulties in this environment. Comparisons show that bots can earn $206,000 with a win rate of over 85%, while humans using similar strategies only earn around $100,000.

Overly large bets, poor risk control, or entering trades too late can lead to cumulative losses , even when the strategy is still in the right place.

Discipline, understanding of probability, and proper position management are still necessary for success in the prediction market. However, bots are increasingly raising these standards to levels that most small retail investors find difficult to meet.

The bot wave has also sparked more debate within the community about fairness and ethics in the marketplace. Polymarket users continuously Chia lists and profiles of prominent bot accounts and the most effective strategies.

Currently, dozens of bots are quietly "mining" the BTC market on the 15-minute timeframe, with many generating tens of thousands of USD in profit each month. So the question is:

Is this just a temporary loophole, or the beginning of a long-term "new meta" that will completely change the forecasting market?

Even as the market changes, there are lessons to be learned. Traders can learn from the bot's systematic approach:

- Only enter a trade when you see incorrect pricing.

- Avoid over-investing and focus on taking advantage of recurring, low-risk opportunities.

While automation is gaining dominance in short-term markets, knowledge, discipline, and probability-based strategies remain crucial if retail investors want to survive long-term on Polymarket and other prediction markets.

Polymarket shows that bots and AI are not only generating millions of dollars in profits but are also rewriting the rules of the game. Without adapting, retail investors will fall behind as everything increasingly relies on the speed, repetition, and precision of algorithms.