Bitcoin (BTC) has risen 6.54% so far in 2026, showing early signs of recovery amid geopolitical uncertainty and a gradually improving market sentiment.

As the recovery continues, one analyst has identified a key threshold that could determine whether Bitcoin will shift from a downtrend to a new bull cycle in 2026.

Bitcoin continues to grow in early 2026.

Despite lingering anxieties into late 2025, the new year started quite positively for Bitcoin and the entire crypto market . On Monday, the largest cryptocurrency surged to over $95,000, a price not seen since early December last year.

At the time of writing, Bitcoin is trading at $93,230, up 0.69% in the last 24 hours. The crypto market as a whole is also strengthening, with many asset classes recording significant gains as investors' risk appetite gradually returns.

Bitcoin price movement. Source: BeInCrypto Markets

Bitcoin price movement. Source: BeInCrypto MarketsExperts believe this recovery stems from several factors simultaneously, such as new capital inflows at the beginning of the year following the year-end tax-closing sales period, increased demand for safe haven assets amid the US attack on Venezuela, and a gradually more optimistic market sentiment.

This positive trend is further reinforced by strong inflows into ETFs . According to BeInCrypto, on January 5, 2026, ETFs attracted nearly $695 million – the largest single-day Capital in the past three months.

What Bitcoin needs to reverse its uptrend.

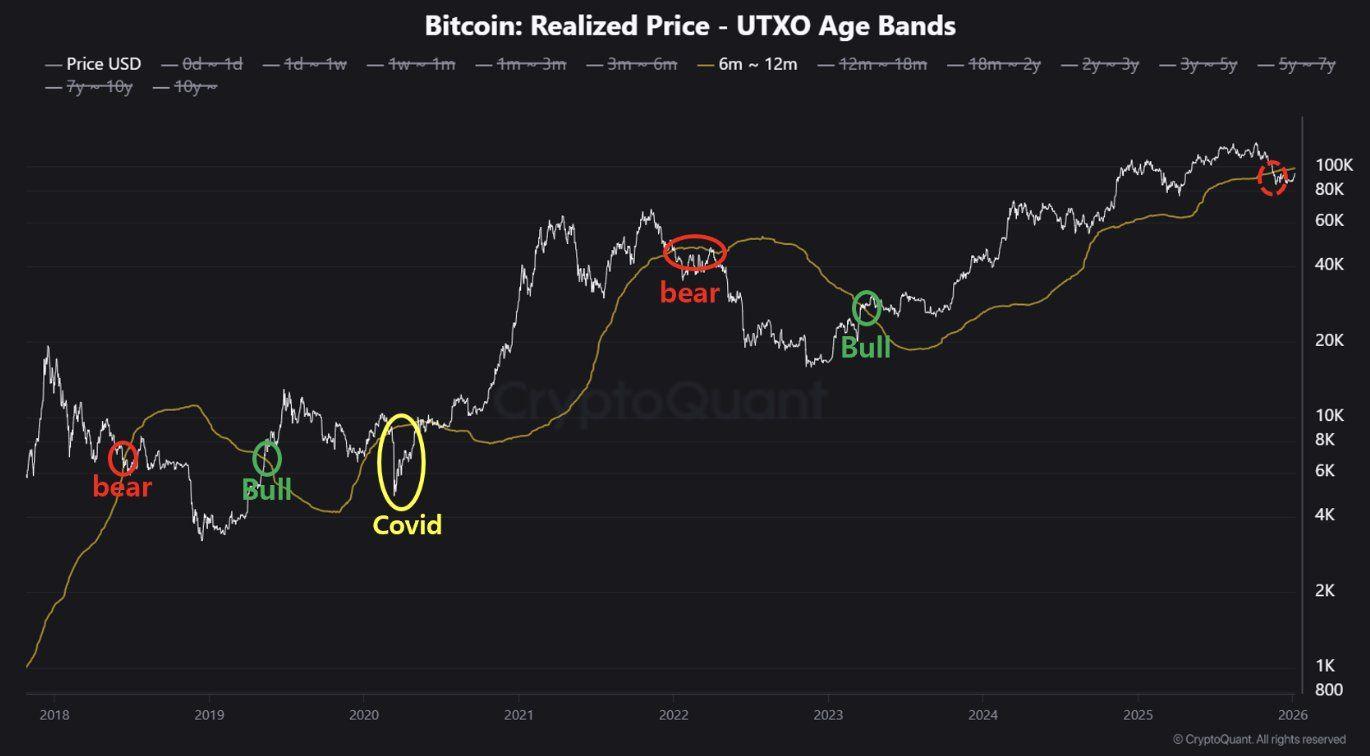

Amid a recovering market, crypto analyst Dan has identified a key on- chain price zone that will determine Bitcoin's future trend. Dan notes that Bitcoin is currently trading below a crucial level: the cost Capital of the coins from 6 to 12 months ago, around $100,000.

Historically, when prices remain below this level, the market tends to be more pessimistic and the risk of further price declines remains high.

Bitcoin's key Capital level. Source: CryptoQuant

Bitcoin's key Capital level. Source: CryptoQuantThis expert analyzes that if Bitcoin regains this Capital level, the market structure will change significantly. In previous cycles, after breaking through this level, the market shifted to an uptrend as selling pressure from buyers at high prices decreased, creating conditions for the price to continue rising.

“After weeks of sideways movement, Bitcoin is showing early signs of recovery, and this is a crucial price zone to watch closely. If it fails to break above this level, the overall downtrend remains intact. Ultimately, whether the market turns bullish or not depends heavily on this threshold – and we’ll soon know the outcome,” Dan Chia .

The big question now is when Bitcoin will retest that key price zone. Analyst Ted Pillows says Bitcoin is trying to reclaim its opening price from early 2025. According to him, if Bitcoin closes above this zone for a few sessions, reaching $100,000 in the next few weeks is entirely possible.

"If it's just a false breakout, BTC will fall to the $90,000-$91,000 support zone," Pillows commented .

Besides technical indicators, macroeconomic factors are also influencing expectations for Bitcoin's next move. Some experts believe that if the US gains control of Venezuela's oil supply, the increased global oil supply will help lower energy prices and shift global money flows.

Falling energy costs could encourage capital flows into alternative assets like Bitcoin. The crypto market could then benefit as retail investors reallocate Capital amid changing macroeconomic conditions.

Rumors about Venezuela's stockpile of over 600,000 Bitcoin would also have a long-term impact on the market. If this Bitcoin is seized, the circulating supply would decrease, creating conditions that support higher Bitcoin prices in the long term.