The Bitcoin (BTC) recovery in early 2026 may not last long, as new data suggests potential selling pressure is increasing. Investors holding Longing positions should consider the opposite scenario to mitigate risk.

on-chain data shows that Bitcoin whales are increasing their activity on exchanges. This action is particularly risky given the low volume .

The rate of Bitcoin whale inflows increased sharply in January 2024.

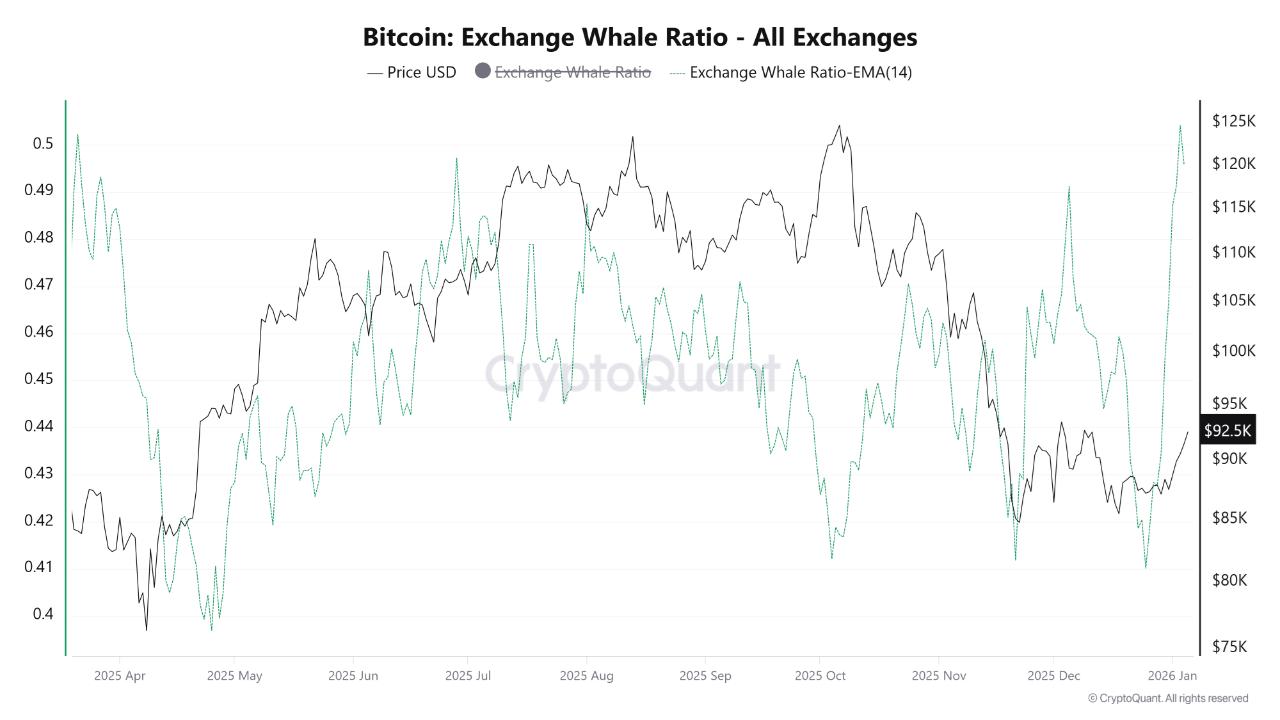

One of the most worrying indicators is the All Exchanges Whale Ratio (EMA14), which just reached its highest level in the past ten months.

This index reflects the ratio of money flowing into the top 10 exchanges to the total money flowing into all exchanges. A high value indicates that whales are using the exchange with large volumes.

The proportion of whales on Bitcoin exchanges. Source: CryptoQuant

The proportion of whales on Bitcoin exchanges. Source: CryptoQuantAlthough Bitcoin reserves on exchanges continue to decline due to demand from DATs and ETFs , the sudden surge in this index could be an early warning sign. It suggests that BTC balances on exchanges may be on the verge of increasing again.

“This development coincides with the time when Bitcoin prices are trying to recover after a correction phase. This pattern could be a strategy by whales to leverage buyer liquidation to take profits and use the current market as a source of liquidation to exit their positions,” commented CryptoOnchain, an analyst at CryptoQuant.

Furthermore, increasingly weak market liquidation also increases the risk of sharp and unpredictable price fluctuations.

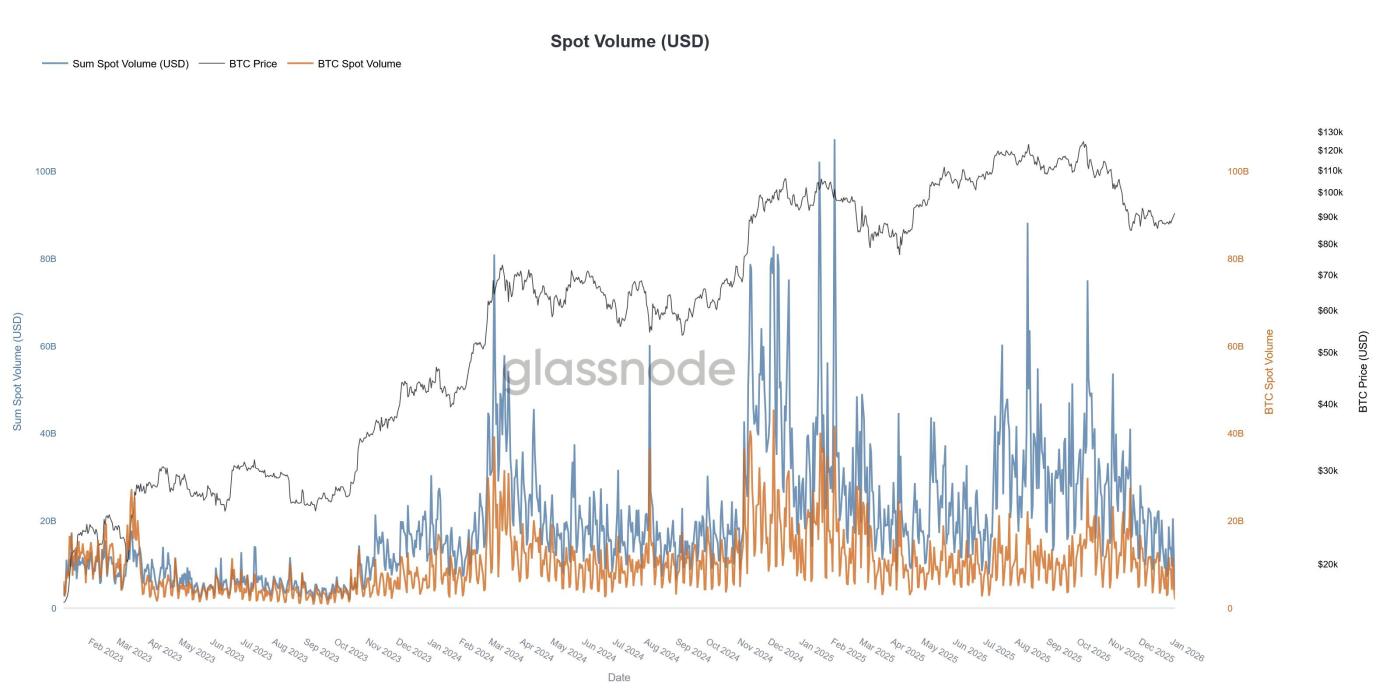

Spot volume for Bitcoin and Altcoins. Source: Glassnode

Spot volume for Bitcoin and Altcoins. Source: GlassnodeAccording to Glassnode 's post on the X platform, spot volume for Bitcoin and altcoins has fallen to its lowest level since November 2023.

“This weakening demand is in stark contrast to the recent price surge in the market. This highlights the increasingly thin liquidation behind the price growth,” Glassnode reported .

In a low liquidation environment, even a small amount of buying can push prices up. Conversely, moderate selling pressure can easily cause prices to fall sharply.

If whales on the exchange start selling as predicted, combined with weak liquidation , Bitcoin's more than 6% recovery and the 10% increase in total altcoin market Capital could soon come to an end.

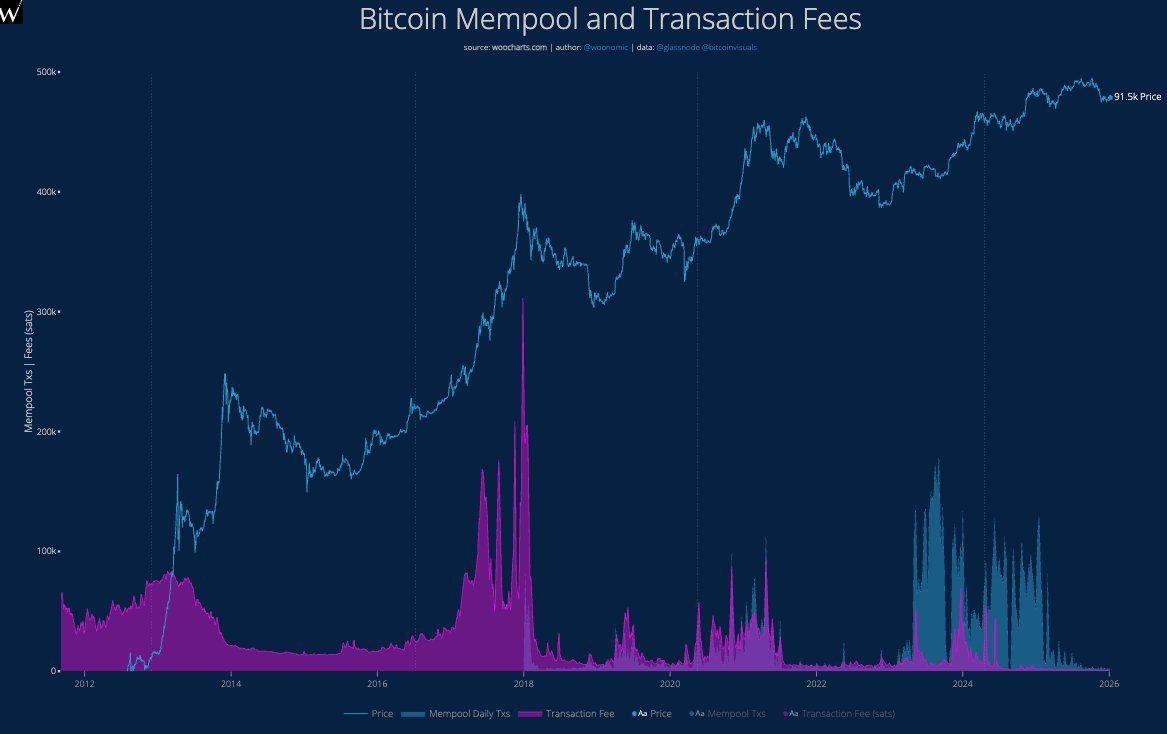

Additionally, analyst Willy Woo noted the sharp drop in Bitcoin transaction fees, describing the market as "a ghost town."

The chart shows that both the mempool and transaction fees are currently at record lows. Both indicators have fallen sharply, reflecting a decline in the number of transactions. As on-chain activity decreases, the flow of Capital into and out of the market also weakens, making the market less vibrant.

Mempool and Bitcoin transaction fees. Source: Willy Woo

Mempool and Bitcoin transaction fees. Source: Willy WooWoo predicts a potential short-term "price pump" in January as liquidation hits a local Dip . However, the long-term outlook remains pessimistic due to a lack of real market activity.

In the short term, some analysts suggest that Bitcoin could correct to the $90,000 and $88,500 levels. These levels also coincide with the recently formed CME gap.