■ Current status of long positions in major currencies

Based on open interest, long positions in Bitcoin (BTC) accounted for 69.23% of USD margin (up 1.42% from the previous day) and 62.85% of coin margin (down 0.15% from the previous day).

Ethereum (ETH) recorded a USD margin of 71.04% (+1.30%p) and a cryptocurrency margin of 68.99% (+0.09%p). XRP showed a USD margin of 61.92% (+0.79%p) and a cryptocurrency margin of 43.95% (-0.56%p).

Solana (SOL) reported a USD margin of 71.96% (+3.47%p) and a cryptocurrency margin of 76.68% (-1.99%p). Dogecoin (DOGE) recorded a USD margin of 70.69% (-2.03%p) and a cryptocurrency margin of 45.26% (-1.31%p).

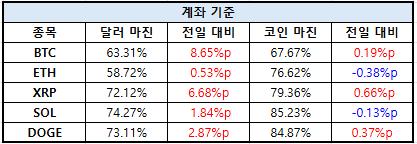

■ Percentage of accounts holding long positions

Based on account balances, long positions in Bitcoin (BTC) accounted for 63.31% (+8.65%p) of USD margin and 67.67% (+0.19%p) of coin margin.

Ethereum (ETH) recorded a USD margin of 58.72% (+0.53%p) and a cryptocurrency margin of 76.62% (-0.38%p). XRP's statistics show a USD margin of 72.12% (+6.68%p) and a cryptocurrency margin of 79.36% (+0.66%p).

Solana (SOL) showed a USD margin of 74.27% (+1.84%p) and a cryptocurrency margin of 85.23% (-0.13%p). Dogecoin (DOGE) showed a USD margin of 73.11% (+2.87%p) and a cryptocurrency margin of 84.87% (+0.37%p).

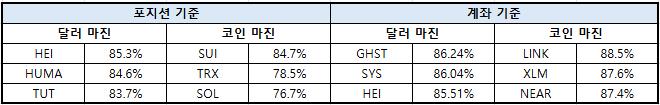

■ Top traders hold HUMA·FIO

[Editor's Note] The trading patterns of top cryptocurrency futures traders are an important indicator for measuring the future trend of the cryptocurrency market. Due to their high level of trading expertise and market sensitivity, observing which cryptocurrencies this group is long in helps to grasp the overall investment psychology and direction. However, it should be noted that some traders may use futures contracts to hedge their spot positions, therefore additional analysis is required when interpreting the data. CoinGlass defines top traders as investors in the top 20% of their margin balance.

The USD margin market (U market) is primarily favored by institutional investors seeking stable returns, used to reduce volatility and for short-term trading and hedging. The C market, on the other hand, is mostly used by cryptocurrency bulls or long-term holders looking to leverage their assets. An increase in open interest in the C market during a bull market may indicate market optimism, while increased trading volume in the U market during a bear market may indicate institutional inflows.