This article is machine translated

Show original

The Solana Foundation's annual report seems to only highlight the positive aspects, concealing some of the negatives. Here are a few concerns I have about the Solana ecosystem:

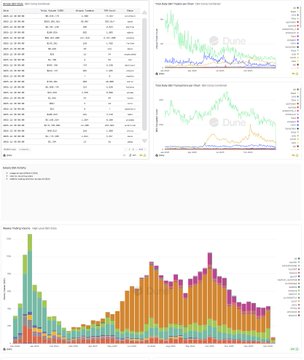

1/ Memecoin trading volume decreased by 10% year-over-year, despite an 80-fold increase in two years. However, switching to a weekly or monthly perspective reveals a continued downward trend in trading volume, with a precipitous drop in the number of traders. This decline, carried over to the next year, could result in a significant drop.

2/ Solana's over-reliance on Memecoin. Many of Solana's projects generating over $100 million in revenue are primarily launchers and DEXs, essentially deriving their income from Memecoin demand.

In emerging areas such as prediction markets, RWA, and AI, Solana currently lags behind its competitors.

Furthermore, the pool locking mechanism locks up a large amount of Sol, effectively reducing circulation. However, the growth of TVL (Total Value Limit) on major platforms has slowed significantly since the second half of the year, putting greater pressure on Sol inflation.

3/ The summary doesn't mention crypto-equities and ETFs. Theblock's data shows that the total size of the SOL ETF is currently around $1.5 billion USD, while the total amount of SOL locked in crypto-equities is less than $4 billion USD, and the growth has slowed significantly.

4/ Stablecoin trading has seen significant growth, but it's below average. Compared to January 2025, Solana's current stablecoin market share has decreased from 5.27% to 5.19%, and its monthly trading volume market share has fallen from 12%-40% to 4%. Its ranking has dropped from first to fifth.

5/ The annual data is largely driven by the explosive growth during Trump's cryptocurrency issuance period in January and February 2025, resulting in distorted data for the entire year.

As a Solana holder, I give the Solana Foundation a score of 0 for 2025.

Sol's tag is a meme chain 😆

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content