Over the past seven days, stablecoin supply has been concentrated in the payments sector, the Tron chain, and a few assets such as USDS and USDT, while large-scale liquidity withdrawals have occurred simultaneously on Ethereum and centralized exchanges.

According to Artemis, as of the 7th, the sector that has seen the largest increase in stablecoin supply over the past seven days is payments, with a net increase of $576 million.

Next, supply expanded in the following order: ▲Stablecoin issuers $123.6 million ▲DeFi $48.3 million ▲Staking $20.9 million, leading to an influx of funds into on-chain utilization and deposit-related sectors.

Conversely, the sector with the most pronounced supply decline was centralized exchanges (CEXs), with a net loss of $569.7 million. Supply reductions were also observed in the following sectors: blockchain (-$72.4 million), gaming (-$66 million), market makers (-$56 million), asset management (-$36.6 million), and others (-$25.1 million).

While stablecoins are moving into on-chain applications like payments, DeFi, and staking, centralized exchanges and infrastructure-related sectors have seen a significant supply reduction.

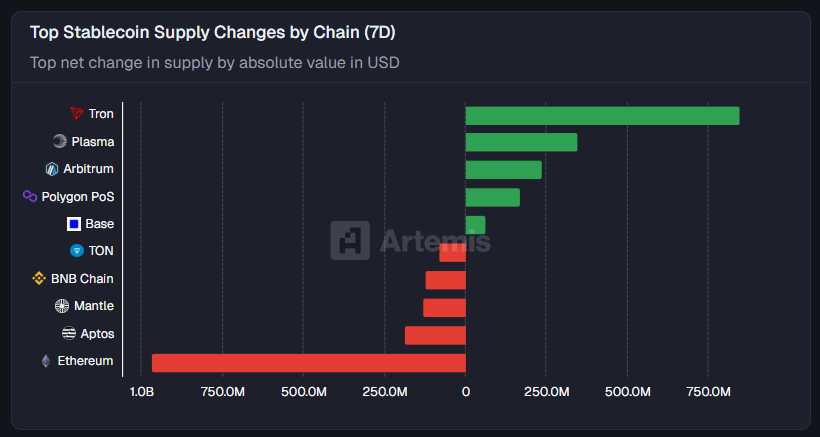

The blockchain with the largest increase in stablecoin supply over the past seven days was Tron, with a supply increase of approximately $850 million.

The supply of stablecoins continued to increase in the following order: Plasma $349.3 million, Arbitrum $238.4 million, Polygon PoS $169.8 million, and Base $63.2 million.

Meanwhile, supply declines were noticeable across several major networks. Supply decreased in the following order: Ethereum - $967.4 million, Aptos - $185.1 million, Mantle - $129.4 million, BNB Chain - $122 million, and TON - $79.2 million.

While stablecoin liquidity is concentrated on some chains, such as Tron and Plasma, major networks, including Ethereum, are experiencing large-scale supply reductions, leading to a clear trend of liquidity reallocation across chains.

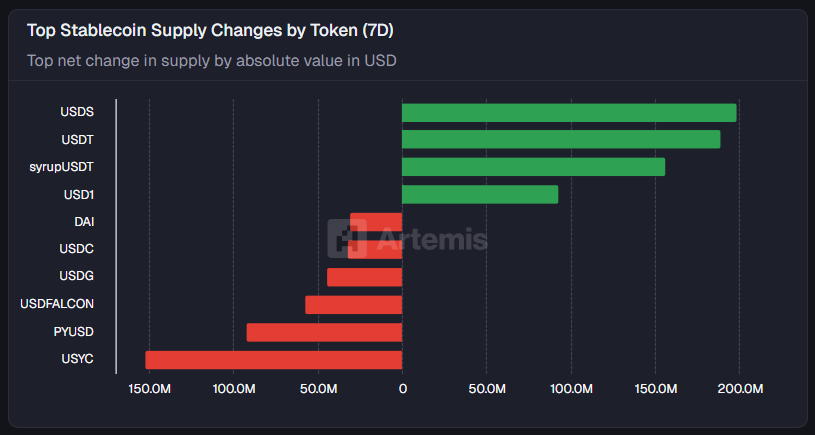

The asset with the largest supply increase among stablecoins over the past week was USDS, with a net increase of $198.5 million.

The supply then expanded in the following order: ▲USDT $189.1 million ▲syrupUSDT $155.9 million ▲USD1 $92.6 million, and the liquidity increase trend centered around dollar-linked stablecoins continued.

Meanwhile, some major stablecoins experienced supply reductions. Supply decreased in the following order: USYC - $152.1 million, PYUSD - $91.9 million, USDFALCON - $57 million, USDG - $44 million, USDC - $32.3 million, and DAI - $30.4 million.

As a result, in the stablecoin market over the past week, supply has been concentrated in certain assets such as USDS and USDT, while liquidity has been withdrawn from USYC, USDC, and DAI, showing different supply and demand rebalancing trends by asset.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.