$Bitcoin is consolidating after recent volatility, but the macro backdrop has just turned decisively more supportive.

Following confirmation that MSCI will not remove Strategy ($MSTR) and other crypto treasury companies from its indexes, a major source of market fear has been eliminated.

At the same time, US equities surged, with roughly $500 billion added to market capitalization in a single session, and the S&P 500 printing fresh all-time highs. Historically, this combination of institutional clarity and rising risk appetite has been constructive for Bitcoin.

Why the MSCI Decision Changes the Narrative

The earlier concern was clear: if MSCI excluded crypto-heavy treasury companies, index-tracking funds would be forced to sell, potentially triggering billions in liquidation pressure — not only on stocks like Strategy ($MSTR), but indirectly on Bitcoin itself.

That fear peaked around early October, when markets reacted sharply to the uncertainty, wiping out around $19 billion from the crypto market in a single day.

Now, MSCI’s confirmation that:

- $MSTR remains index-eligible

- No forced rebalancing sales are coming

- A broader review will happen later, not now

This killed the $MSTR forced-selling FUD. For Bitcoin, this removes a major institutional risk overhang.

Wall Street Is Ripping, and That Matters for Bitcoin

Beyond MSCI, the macro picture is hard to ignore:

- US equities added ~$500B in one day

- Mega-cap stocks dominated green heatmaps

- The S&P 500 pushed to another all-time high

This matters because Bitcoin has increasingly traded as a high-beta risk asset during expansionary phases. When equities break higher and liquidity flows back into markets, crypto typically follows — often with a lag.

The current setup points to capital rotation, not capital flight.

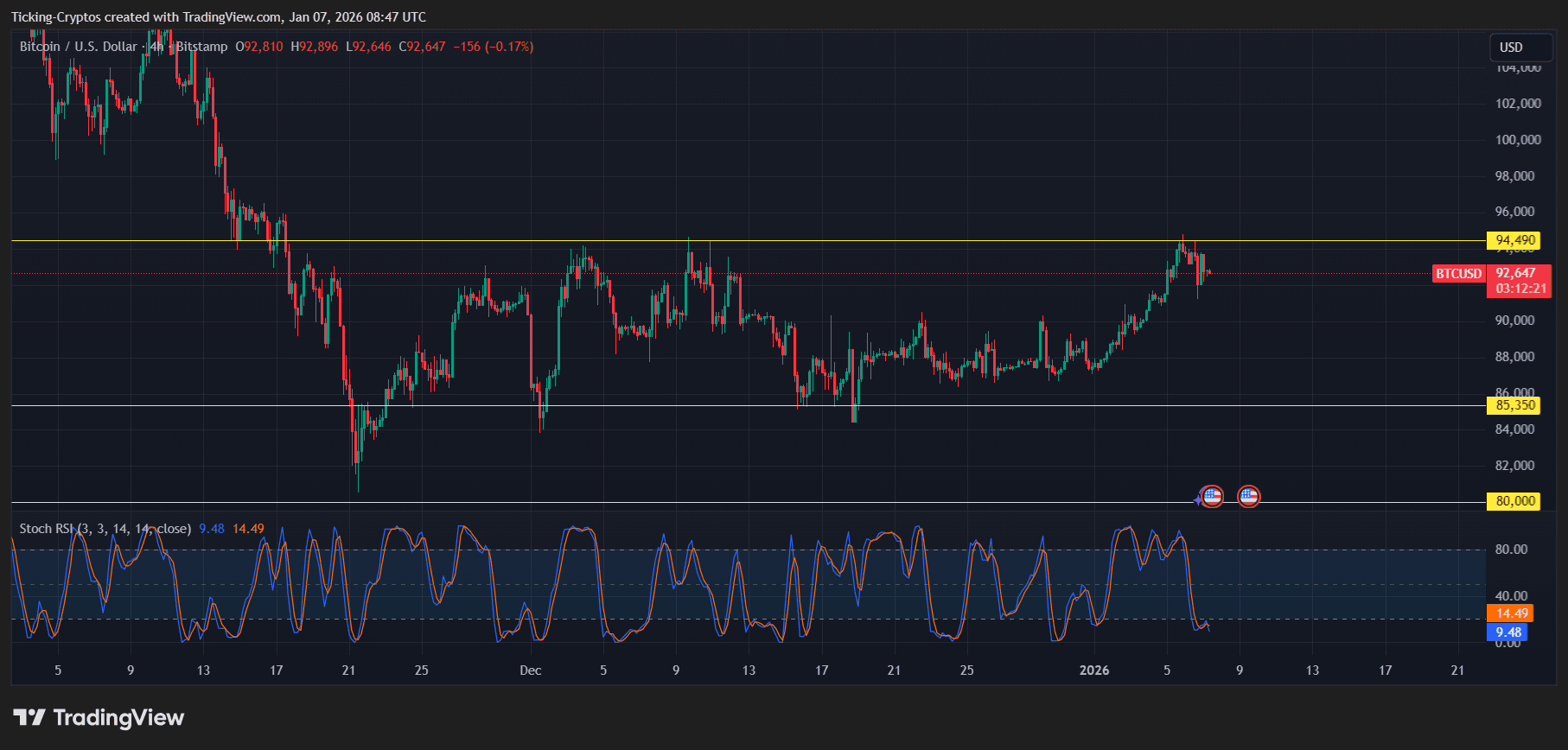

Bitcoin Price Analysis: Key Levels to Watch

Bitcoin is currently trading in a defined range, with price respecting both support and resistance levels visible on the chart.

BTC/USD 4H - TradingView

Key support zones

- $85,000 – Major structural support from previous lows

- $80,000 – Psychological and long-term demand zone

As long as $BTC holds above $85K, downside remains controlled and corrective rather than bearish.

Key resistance zones

- $94,500 – Short-term range high and rejection zone

- $100,000+ – Psychological breakout level

A clean break above $94.5K would open the door for a renewed test of six figures. Momentum indicators show consolidation rather than exhaustion, suggesting the market is digesting news, not topping out.

Bitcoin Price Prediction: What Comes Next?

With MSCI risk removed, equities at record highs, and institutional confidence stabilizing, Bitcoin’s setup remains constructive.

Bullish scenario:

- BTC holds above $85K

- Breaks $94.5K resistance

- Targets $100K–$105K in the next leg

Neutral scenario:

- Continued range between $85K and $94K

- Sideways consolidation while equities lead

Bearish invalidation:

- Loss of $85K support

- Deeper retrace toward $80K

At this stage, the macro and institutional signals favor continuation over collapse.