For Ethereum, this may not be a rapid reversal driven by emotion, but rather a process in which the system is gradually restoring structural stability after a period of deep adjustment.

Article by: Dingdang

Article source: Odaily Odaily

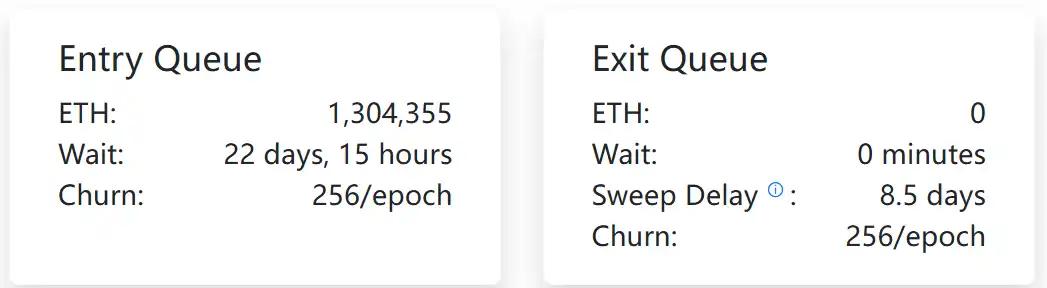

On January 7th, the staking exit queue under the Ethereum PoS mechanism was officially cleared. At least from the on-chain data, the exit pressure that had lasted for months has finally been completely absorbed, and no new large-scale redemption requests have been observed so far.

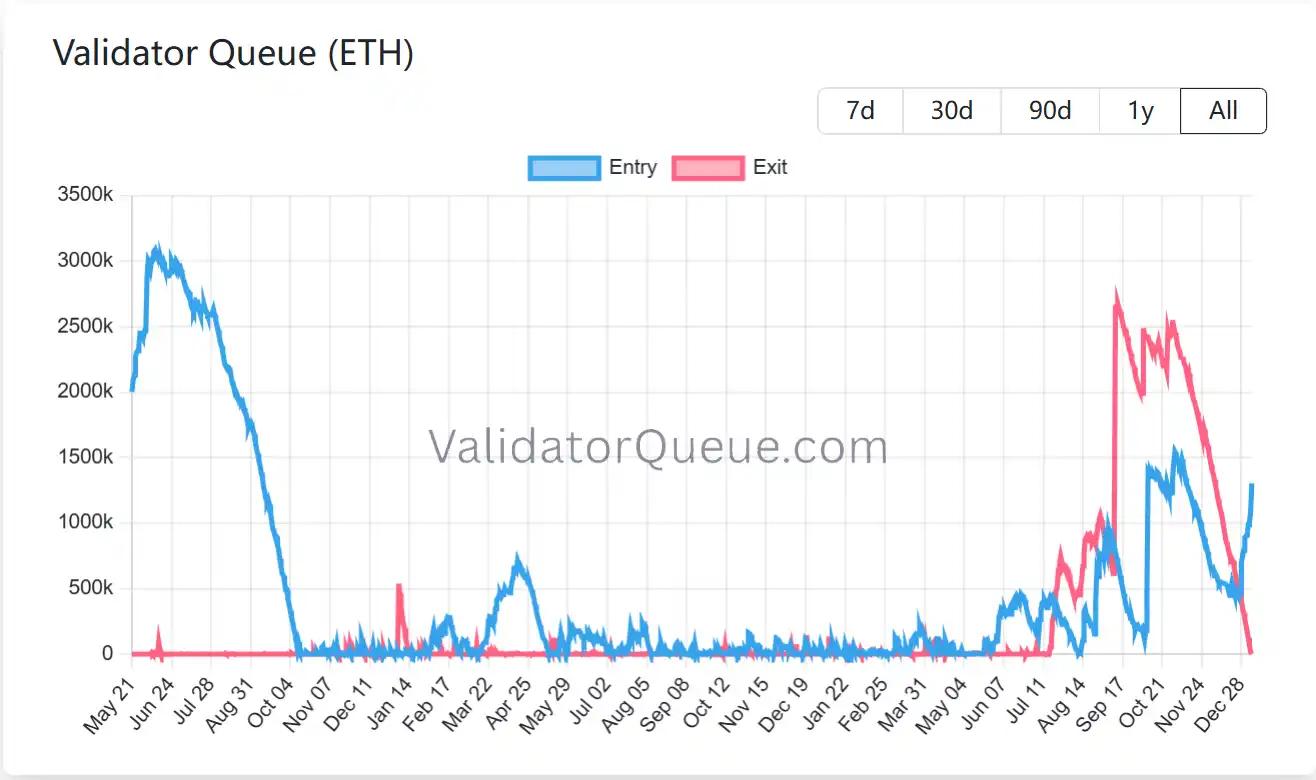

At the same time, the size of the staking queue has increased significantly, with the current queue size increasing to approximately 1.3044 million ETH and a waiting time of about 22 days and 15 hours. This situation is almost a complete reversal from that in mid-September last year.

At the time, the price of ETH was at a relatively high point of around $4,700, and market sentiment was high. However, the staking side showed a different attitude: 2.66 million ETH chose to exit staking, and the waiting time in the exit queue once exceeded 40 days. In the following three and a half months, the price of ETH fell by about 34%, from $4,700 to $3,100.

Now, after a deep price correction, the exit queue has finally been fully digested.

Is the staking queue a "sentiment indicator," but not a price signal?

Generally speaking, changes in the validator queue are considered an important indicator of market sentiment. The underlying logic is that, to ensure consensus stability, Ethereum's Proof-of-Stake (PoS) does not allow nodes to freely enter or leave the market. Instead, it uses a flow control mechanism to regulate the pace of staking and exiting.

Therefore, when the price of ETH is high, the demand for exiting tends to accumulate, and some stakers may choose to cash out their profits. However, the potential selling pressure will not be released instantly, but will be "stretched" on the chain through the exit queue. When the demand for exiting gradually dries up or is even completely absorbed, it may mean that a round of structural selling pressure is coming to an end.

From this perspective, the current clearing of the exit queue and the simultaneous rise in the entry queue do constitute a noteworthy change. However, I believe that while this change superficially creates a positive resonance, its impact on market prices—note the emphasis on "impact"—is not equivalent to the "high exits, low entries" phase in September. This is because the ETH entering the staking queue does not equate to "new funds actively buying ETH at present." A significant portion of the staked tokens may have already been accumulated at an earlier stage, simply being reallocated at this point in time. Therefore, the rise in the staking queue reflects more a shift in investors' preferences for long-term returns, network security, and the stability of staking rewards , rather than a significant increase in immediate price demand. This also means that the current improvement in the queue structure is more of a correction in expectations than a force that provides a similarly strong boost to short-term prices.

Nevertheless, the significant increase in staking activity is still noteworthy. The primary driving force behind this is BitMine, Ethereum's largest DAT treasury. CryptoQuant data shows that BitMine has staked approximately 771,000 ETH in the past two weeks, representing 18.6% of its total ETH holdings of approximately 4.14 million.

This means that the recent shift in staking trends is driven by asset allocation behavior led by a single large institution , rather than a result of a synchronized recovery in overall market risk appetite. Therefore, it cannot be simply interpreted as a "return to a broad-based bullish sentiment." However, in emerging markets like the crypto industry, where liquidity is unevenly distributed, the actions of large institutions are often more likely to provide a degree of emotional support and expectation repair in the short term.

Whether this trend will continue and spread to a wider range of participants remains to be seen. However, looking at on-chain fundamental data, several core Ethereum metrics are showing signs of marginal improvement.

From "Changes in Pledged Assets" to "Synergistic Improvement in Fundamentals"

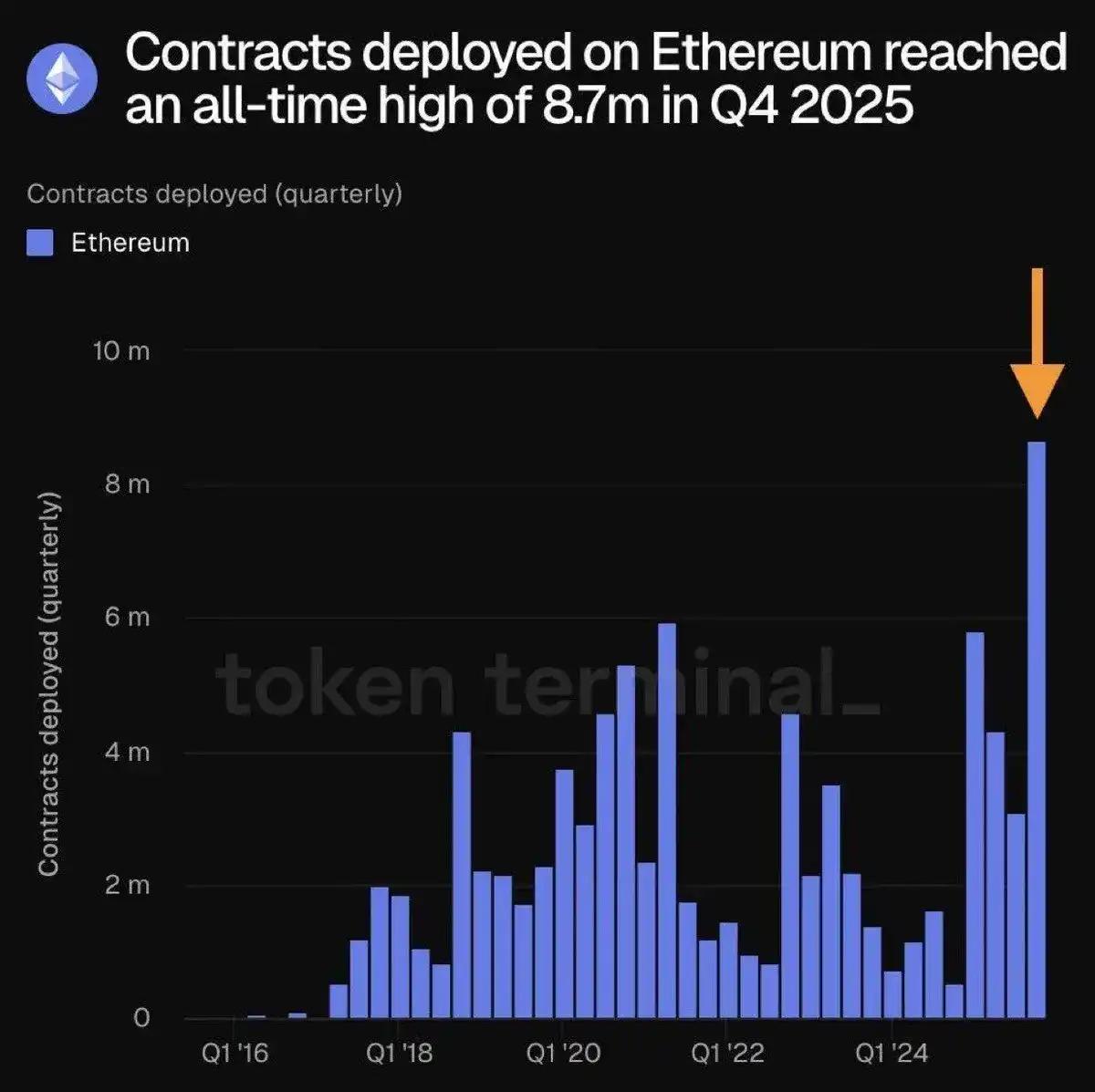

First, from a developer perspective, Ethereum's development activity is reaching record highs. Data shows that in the fourth quarter of 2025, approximately 8.7 million smart contracts were deployed on Ethereum, breaking the previous single-quarter record. This change is more akin to ongoing product and infrastructure development than short-term speculative activity. The deployment of more contracts signifies the implementation of more DApps, RWAs, stablecoins, and infrastructure, further strengthening Ethereum's role as the core execution and settlement layer.

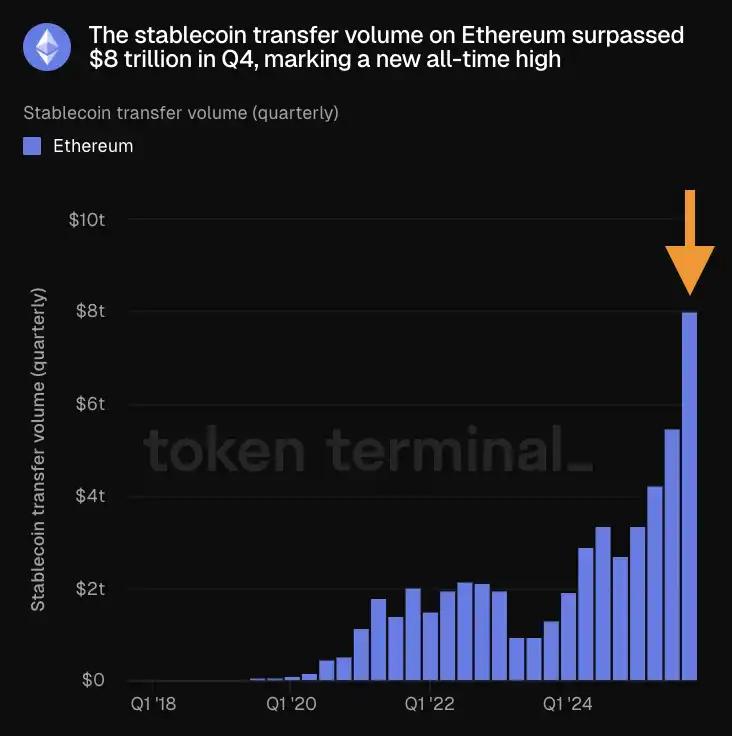

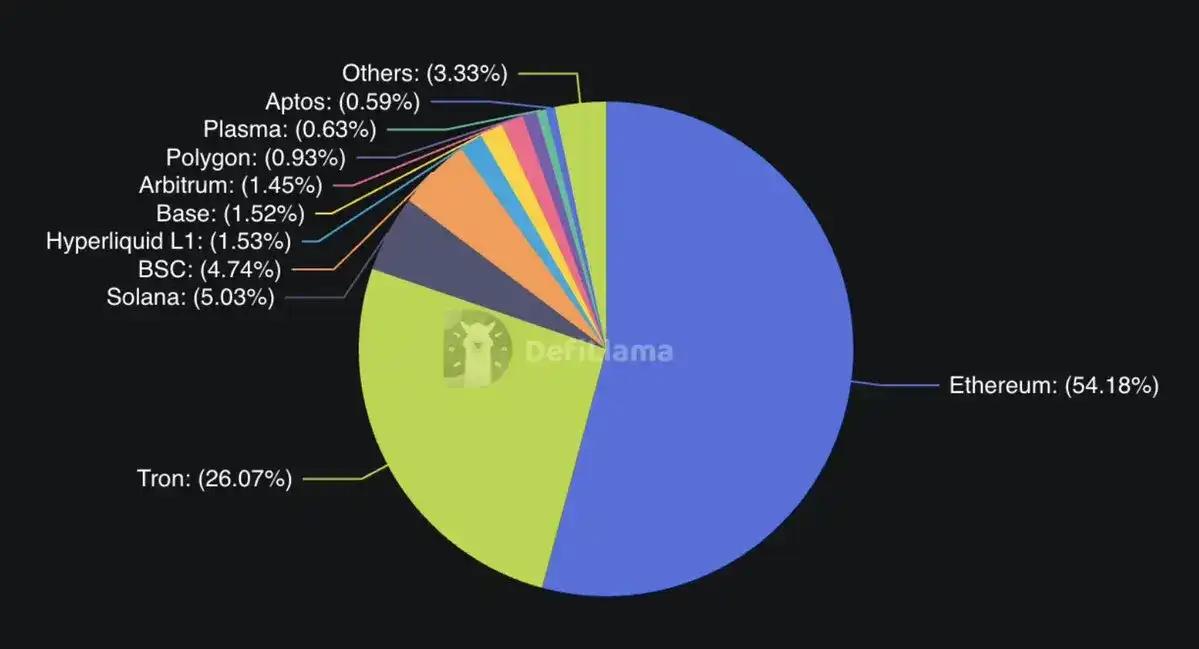

In the stablecoin sector, Ethereum's on-chain stablecoin transaction volume exceeded $8 trillion in the fourth quarter , also setting a new record. Looking at the issuance structure, Ethereum's advantage in the stablecoin ecosystem remains significant. Data shows that Ethereum's on-chain stablecoin issuance accounts for a high 54.18%, far exceeding other mainstream blockchain networks such as TRON (26.07%), Solana (5.03%), and BSC (4.74%).

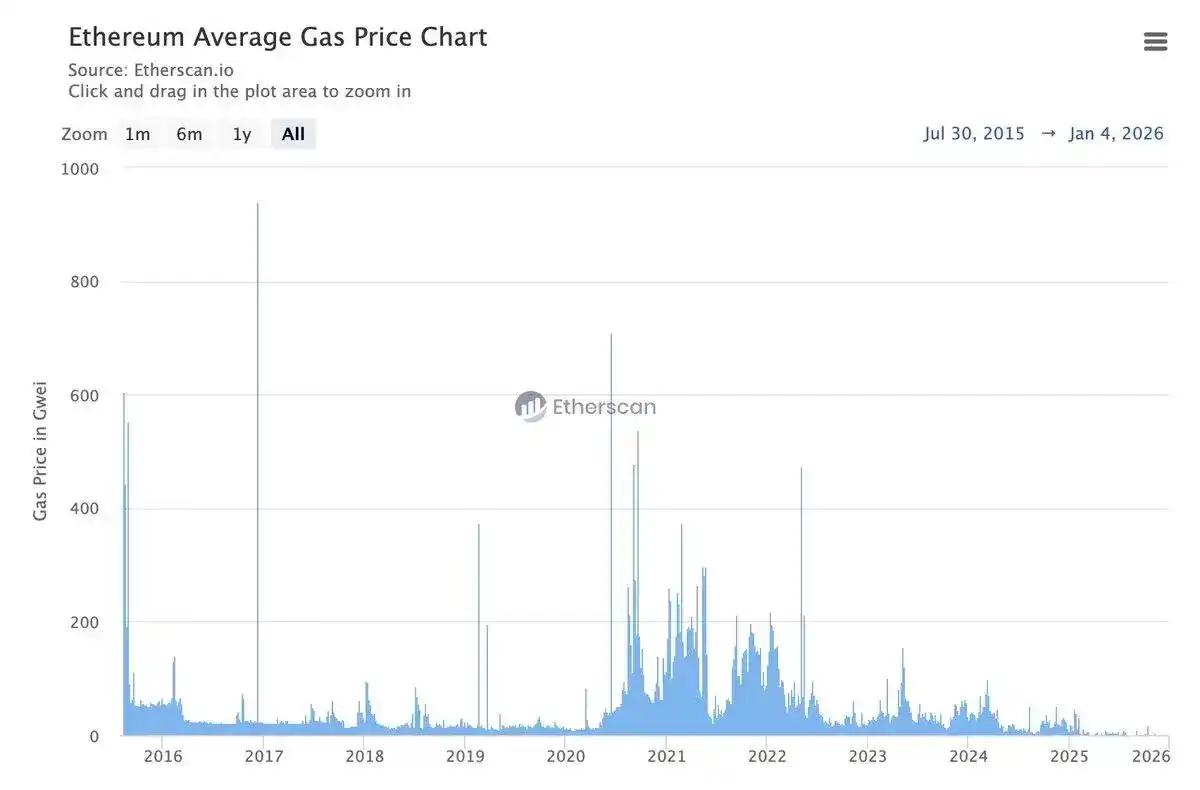

Meanwhile, Ethereum gas fees have hit a record low since the mainnet launch and continue to break records. At times, gas fees have even fallen below 0.03 Gwei. Given that Ethereum will continue to increase block size this year, this trend is likely to continue in the medium term. Lower transaction costs directly reduce the barrier to on-chain activity and provide a realistic basis for the continued expansion of the application layer.

Looking at the exchange balance metric, potential selling pressure on Ethereum is also at a low level. In mid-December, the Ethereum supply on exchanges dropped to 12.7 million, the lowest level since 2016. In particular, this metric has seen a significant decline of over 25% since August 2025. Although the exchange balance has recently rebounded slightly, the increase is only about 200,000 coins, and it remains at a historically low level, indicating that traders' willingness to sell is not strong.

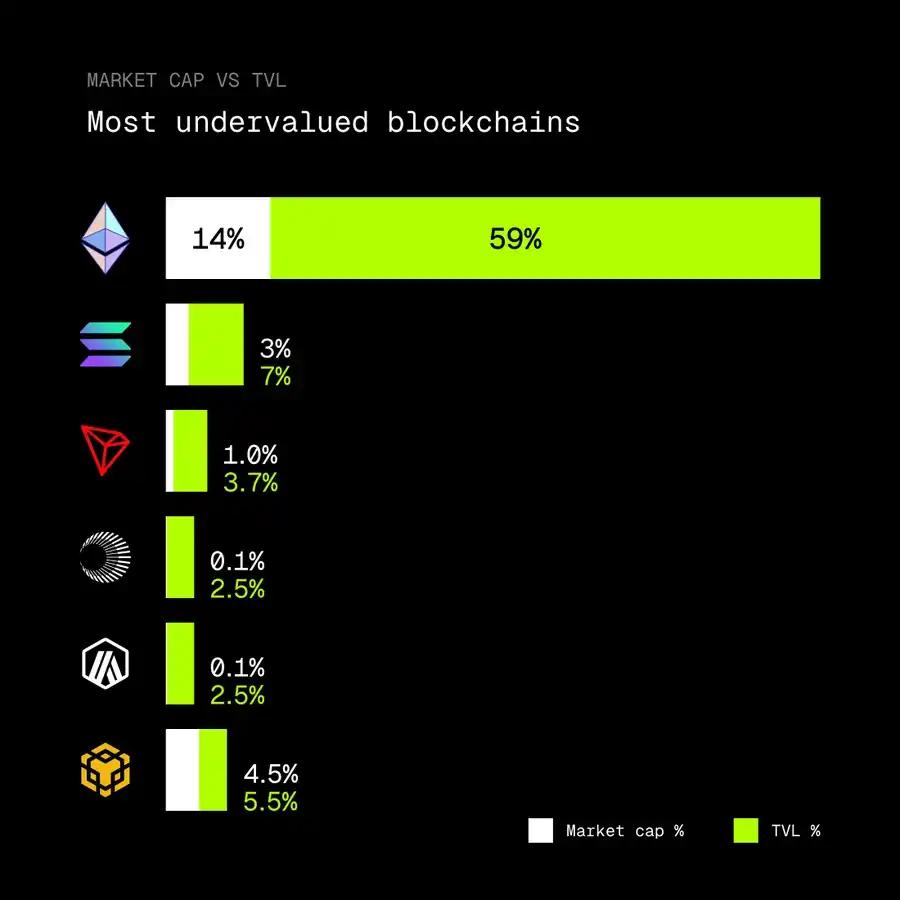

Furthermore, crypto KOL rip.eth recently pointed out in an article on the X platform that, based on the gap between Total Value Locked (TVL) and market capitalization, Ethereum may be the most undervalued blockchain network currently. Data shows that Ethereum carries 59% of the crypto market's TVL, but its token ETH accounts for only about 14% of the market capitalization. In comparison, Solana's token market capitalization/TVL ratio is 3%/7%, Tron's is 1%/3.7%, and BNB Chain's is 4.5%/5.5%. This reflects, to some extent, a significant mismatch between ETH's valuation and the scale of economic activity it supports.

Conclusion

In summary, changes in the staking queue may not be a "single variable" determining price trends, but when it improves in tandem with multiple indicators such as developer activity, stablecoin usage, transaction costs, and exchange balances, it no longer presents an isolated signal, but rather a more comprehensive picture of the fundamentals.

For Ethereum, this may not be a rapid reversal driven by emotion, but rather a process in which the system is gradually restoring structural stability after a period of deep adjustment.