Written by: Dudu Bitcoin

Compiled by: Saoirse, Foresight News

In 2025, the rebound in cryptocurrency funding will be comparable to that of Dennis Rodman at his peak (Dennis Rodman, a former American professional basketball player known for his explosive power and consistent performance).

Total funding for the year reached $25 billion, the second-highest on record, second only to the frenzied period of 2021.

But there is a key difference this year:

The current enthusiasm for financing is actually more sustainable.

To figure out where the funds were going, I spent several weeks analyzing 6,723 funding rounds.

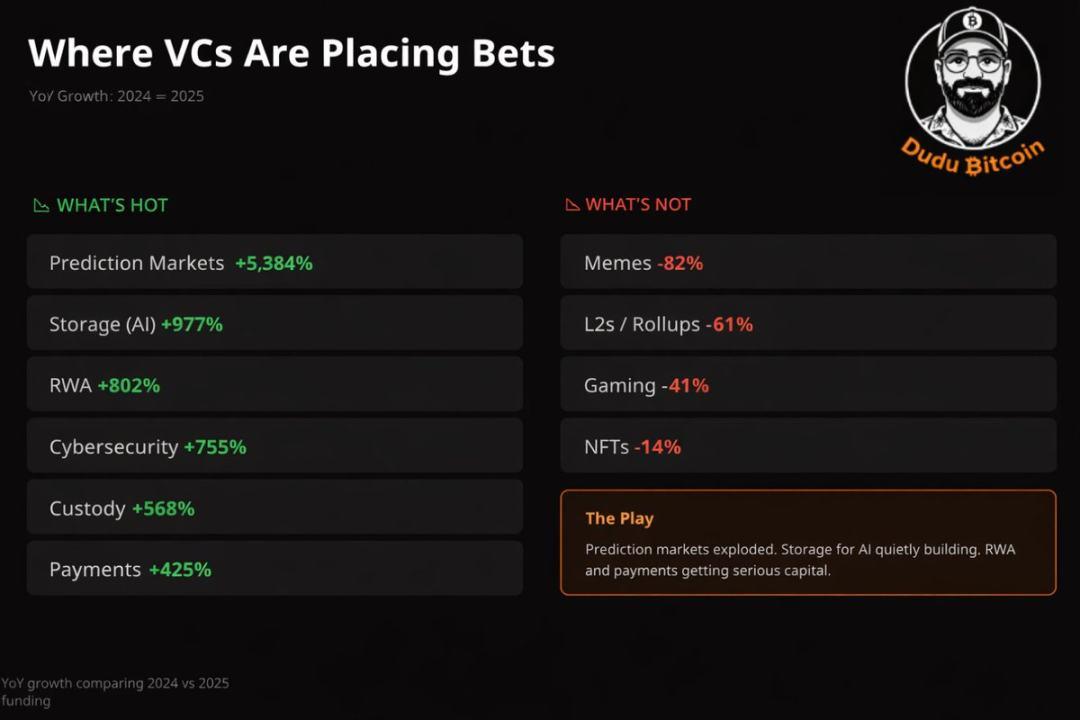

Winning Areas: Prediction Markets, AI Storage, and RWA

It's not surprising that the prediction market emerged as the biggest winner.

2025 will be a banner year for prediction markets – it is the only sector in the Web3 space to successfully attract a mainstream consumer base.

Polymarket and Kalshi are locked in fierce competition, both vying for more top-tier partners.

Today, prediction markets are embedded in Google Search and major mainstream media organizations, further integrating into everyday life.

The fact that Real-World Assets (RWA) and Cybersecurity are among the most popular areas for funding confirms a core viewpoint: cryptocurrencies are gradually maturing and becoming an increasingly solid foundation as an important part of the financial system.

However, the situation is not optimistic for entrepreneurs who focus on NFT development.

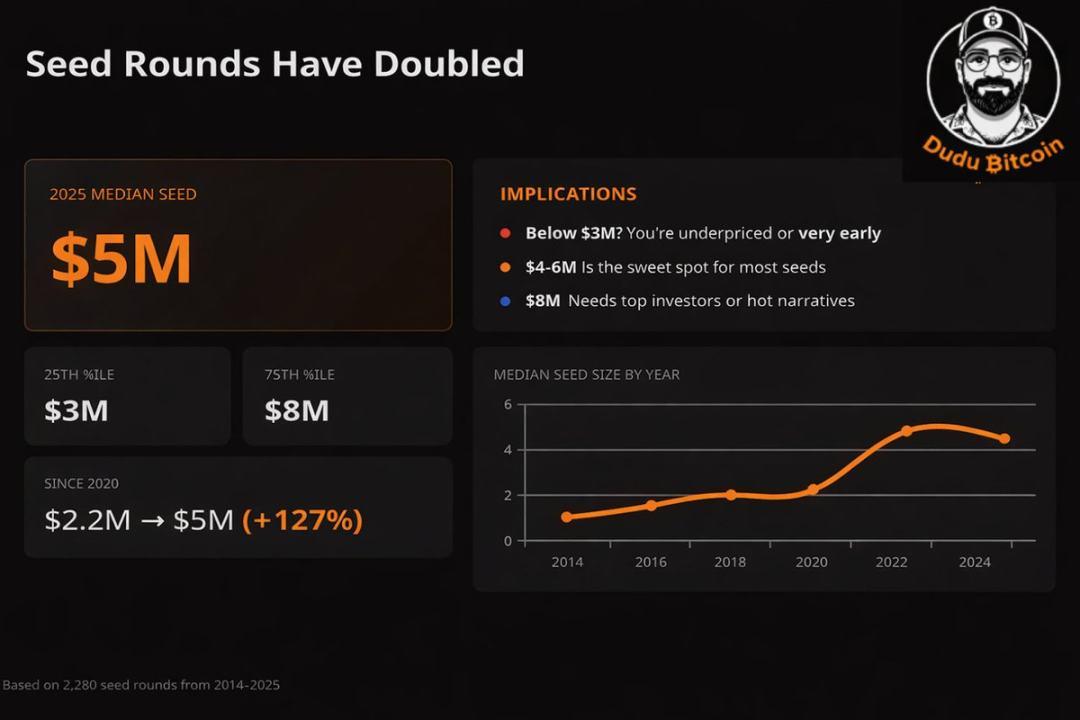

Seed funding is maturing.

The era of launching projects with small amounts of seed funding is long gone. In the AI era, the resources required to develop a product that people actually use have been greatly reduced. This means that entrepreneurs can be "self-sufficient" (operating with their own funds) for a longer period of time, only needing to enter the financing market to seek funding support when they have truly demonstrable results.

Recommendation: Try your best to establish a partnership with Coinbase Ventures.

I've seen far too many so-called "VC matchmakers"—they connect entrepreneurs with investors but take a cut in the process. More importantly, these matchmakers mostly only know third-tier investors, making the time investment for entrepreneurs completely unworthy. Therefore, look for someone who can connect you with top-tier institutions like Coinbase Ventures, not niche organizations like "Soulja Boy Fund" (Note: Soulja Boy is an American rapper whose fund is relatively small and has limited investment influence).

Cryptocurrencies are gradually maturing

Looking at the projects with the largest financing scale this year, the trend is actually quite obvious.

Of course, the crypto space still retains some "speculative activity" (note: referring to the high-risk, highly speculative trends unique to the crypto space):

- Binance: Received a huge sum of money from the UAE to build a top-tier Altcoin trading platform;

- Pump.fun: Set a record for the number of Meme coins issued per second;

- TON: It gained considerable attention by leveraging the widespread popularity of Telegram in the crypto space;

- Monad: Its L1 public chain has gained a lot of popularity in the community, but the subsequent TGE performance was disappointing.

Every industry cycle needs some "stimulating elements," but if you step outside the short-term perspective, you will clearly see the maturing trend in the crypto space.

Two of the largest funding rounds this year came from prediction markets—Polymarket and Kalshi.

As mentioned before, 2025 is a banner year for prediction markets, the only sector in the Web3 space that truly captivates a mainstream consumer base. Polymarket and Kalshi continue to fiercely compete for more top-tier partners, and their services are now embedded in Google Search and major mainstream media outlets.

The stablecoin sector also performed exceptionally well in 2025:

- Bullish: Co-founded by Brendan Blumer, who previously caused controversy with the EOS project, its IPO raised $1 billion;

- Ripple: Successfully attracted Wall Street funding and entered the stablecoin field;

- Circle: After raising $1 billion through its IPO, its stock price experienced a significant surge.

- Payment giant Stripe's launch of its L1 public blockchain "Tempo" proves that fintech companies are also actively entering the crypto space;

- Figure: Completed a $1 billion IPO, also focusing on stablecoin-related businesses.

Finally, cryptocurrency exchanges Kraken and Gemini also completed their funding rounds, which are likely their last before their IPOs.

The total financing amount for the aforementioned four "speculative" projects was approximately US$3.27 billion;

The total funding for the forecasting market is estimated at $3 billion;

Meanwhile, projects in the Web3 field that are more mature have received a total of $3.4 billion in funding.

Today's cryptocurrencies are no longer limited to a single attribute.

It is splitting into three parallel development tracks:

- Speculative and cultural sectors (such as Meme Coin and niche public chains);

- Information and Truth Market Track (with prediction markets at its core);

- The real economy and financial infrastructure sector (such as stablecoins and RWA).