Coinbase Bitcoin supply and demand is showing a simultaneous net inflow and premium negative trend, with institutional investors exhibiting a cautious re-entry and a wait-and-see attitude.

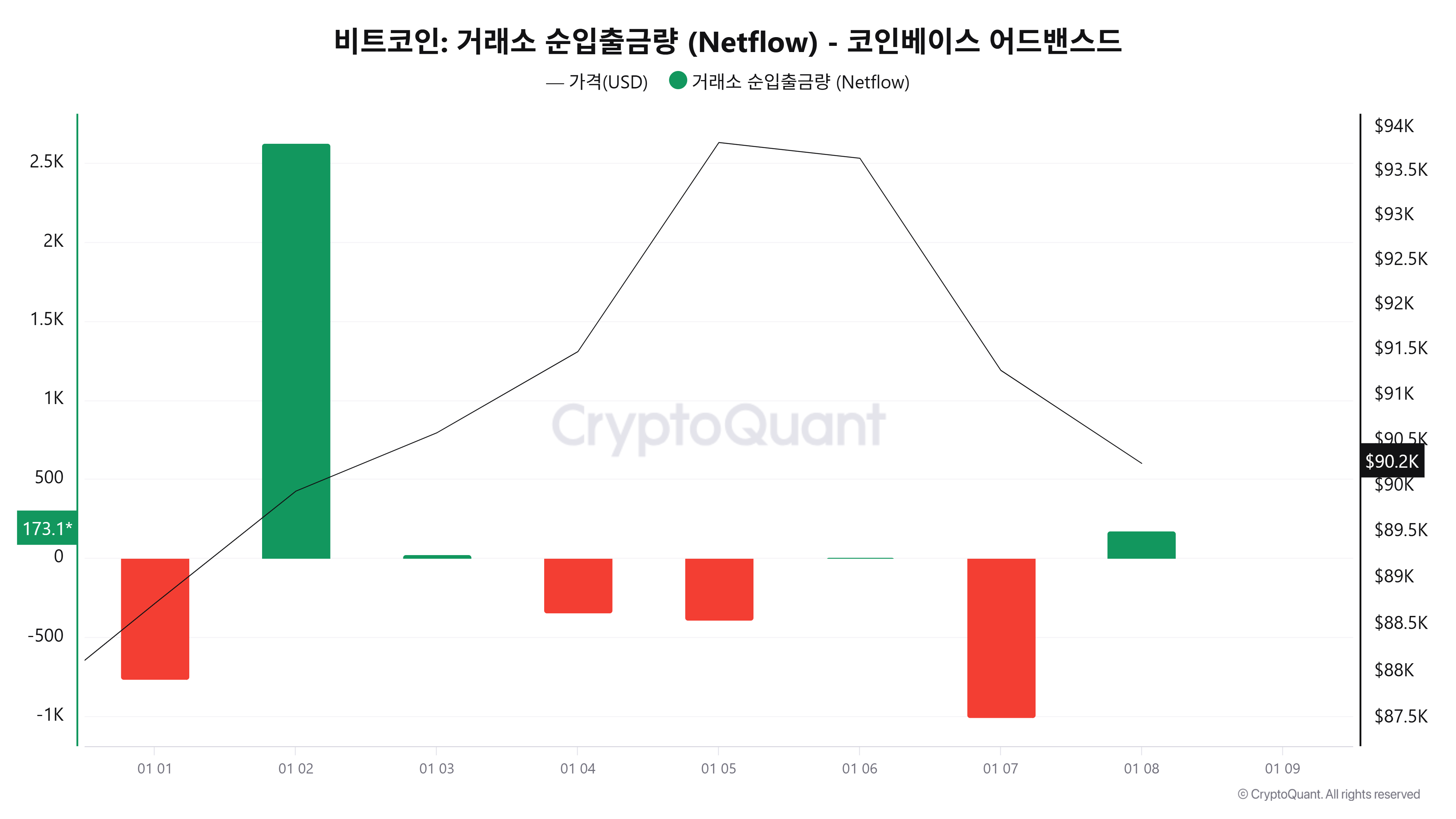

According to CryptoQuant data, Coinbase's Bitcoin net inflow on January 8 (UTC, incomplete) recorded a net inflow of +173.14 BTC, reversing the previous day's large net outflow.

On January 2nd, a massive net inflow of +2,629.68 BTC occurred, leading to a surge in short-term sell orders. On January 3rd, the inflow plummeted to +24.27 BTC, rapidly weakening the momentum of follow-up buying. Subsequently, net outflows of -343.85 BTC and -392.05 BTC occurred on January 4th and 5th, respectively, and -1,008.50 BTC on January 7th, indicating a gradual easing of the supply burden on exchanges.

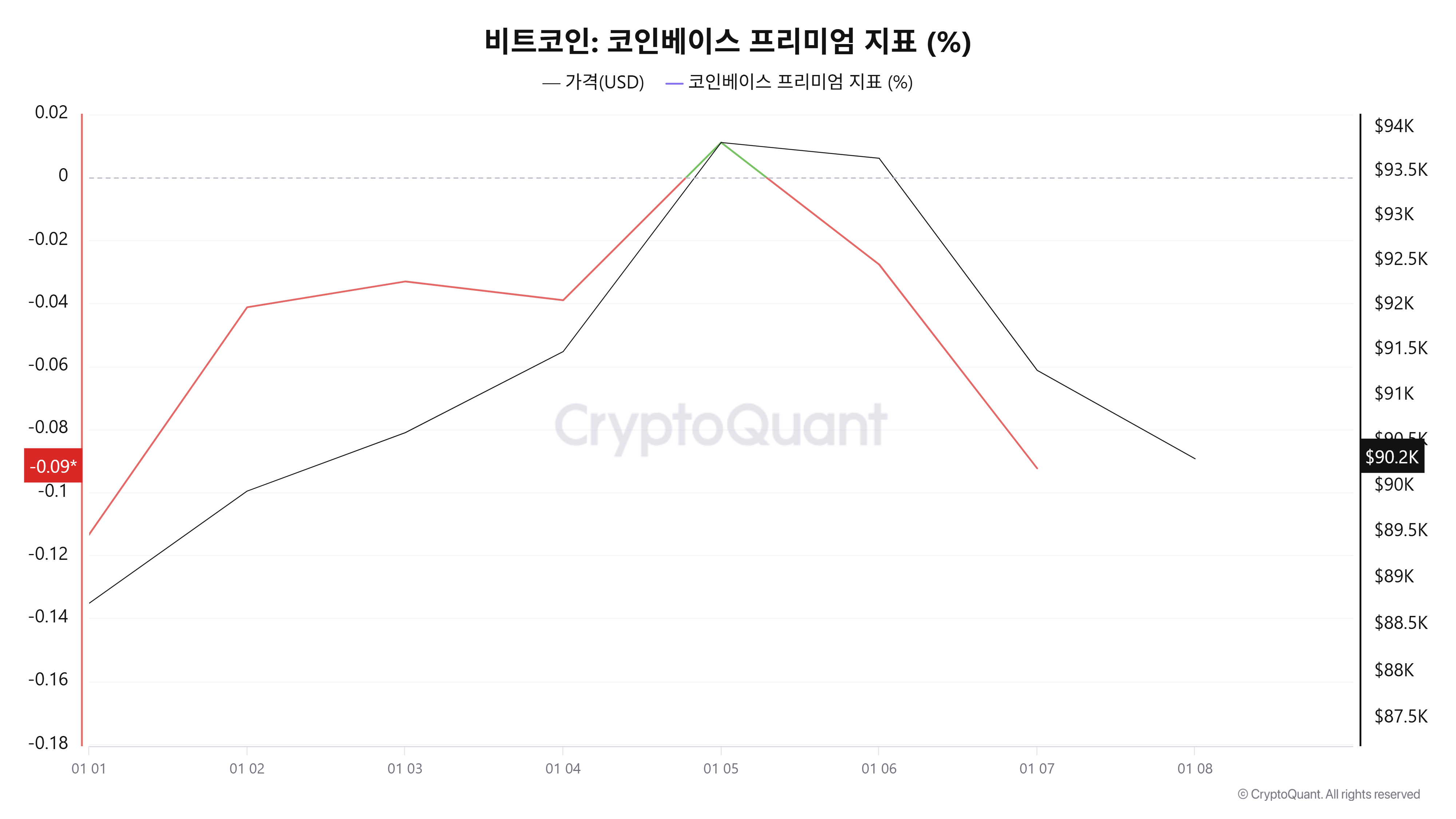

According to CryptoQuant data, the Coinbase Premium Index stood at -0.0924% on January 7 (UTC). This suggests that spot buying from the US is weakening again, leading to a conservative supply-demand environment in the short term.

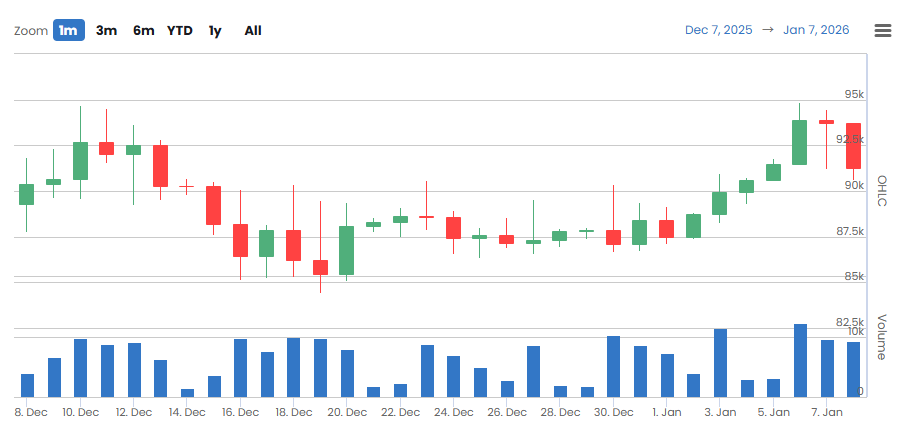

By comparison, the premium index recovered to 0.0110% on January 5th, entering positive territory after about three weeks. However, it then turned negative again, reaching -0.0277% on January 6th and -0.0924% on January 7th. The price also returned to a correction after peaking at $93,830 on January 5th.

Considering that the premium, which plummeted to -0.17% late last month, rebounded in early January, the current level is interpreted as a phase where US institutional and spot buyers attempted to re-enter the market and then switched to a wait-and-see approach. The renewed negative premium trend signals a short-term pause and re-examination of direction, rather than a resumption of an upward trend.

According to Coinage, Bitcoin trading volume on Coinbase Prime reached 9,316.12 BTC. This represents a decrease of approximately 3.8% compared to the previous day's 9,674.24 BTC, confirming a slight easing in trading intensity following a short-term surge. The 24-hour trading volume in dollar terms was approximately $428.08 million. While the slight adjustment in trading volume compared to the previous day suggests a wait-and-see attitude following a short-term overheating period, it also demonstrates that institutional trading participation remained intact during the price correction.

[Editor's Note] The Wall Street Liquidity Radar monitors Bitcoin supply and demand in the US market and tracks changes in investor sentiment. It analyzes market participant sentiment and supply and demand conditions through key indicators, including inflows and outflows of Coinbase, a popular exchange for US institutional investors, premium index, and OTC trading volume. It can be used as a reference for assessing short-term market trends and overall investment climate.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.