Bitcoin Price Analysis: Sideways Start to 2026

$Bitcozin has kicked off the first week of 2026 with sideways price action, showing hesitation after the strong volatility seen at the end of 2025. As traders assess macroeconomic signals and institutional flows, BTC remains range-bound, struggling to establish a clear short-term trend.

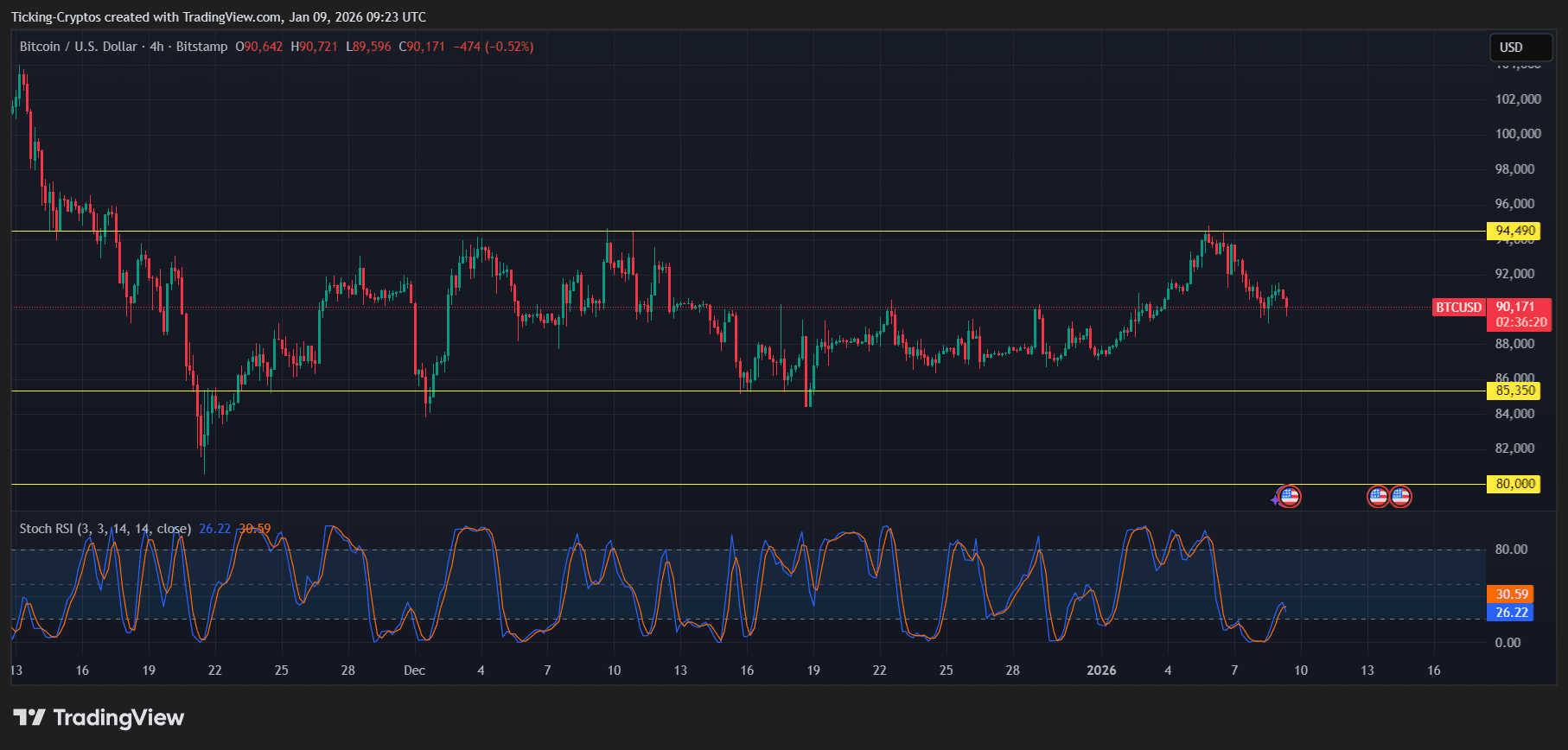

Bitcoin price in the past week - TradingView

At the time of writing, Bitcoin is trading near $90,000, caught between well-defined support and resistance zones.

Bitcoin Analysis: Clear Range With No Breakout Yet

Looking at the 4-hour BTC/USD chart, Bitcoin is still moving inside a horizontal range, confirming consolidation rather than trend continuation.

- Key resistance: ~$94,500

- Key support: ~$85,300

- Lower psychological level: ~$80,000

Price has repeatedly failed to break above the $94.5K resistance, while buyers continue to step in above the $85K area, keeping Bitcoin locked in a sideways structure.

BTC/USD 4H - TradingView

Momentum indicators support this view. The Stochastic RSI is currently hovering near oversold territory, suggesting short-term relief bounces are possible, but without strong volume, any upside move remains limited.

As long as Bitcoin stays within this range, the market remains in wait-and-see mode.

ETF Outflows Add Bearish Pressure

Adding to the cautious tone, Bitcoin and Ethereum ETFs saw notable outflows this week:

- $400.2 million worth of $Bitcoin sold

- $159.9 million worth of $Ethereum sold

These outflows, including activity linked to BlackRock and other major ETF issuers, signal reduced institutional appetite in the short term. While not a full trend reversal, the selling pressure explains why Bitcoin has struggled to reclaim higher levels above resistance.

US Unemployment Data: A Key Catalyst Ahead

Markets are now closely watching US unemployment data, scheduled for release at 8:30 AM ET today.

- Expected unemployment rate: 4.5%

This data point is critical. A higher-than-expected figure could fuel rate-cut expectations, potentially supporting Bitcoin and risk assets. Conversely, stronger labor data may reinforce a cautious Fed outlook, keeping pressure on crypto markets.

Bitcoin Prediction: What to Watch Next

For now, Bitcoin remains neutral to slightly bearish in the short term:

- A break above $94,500 could open the door toward $98,000–$100,000

- A loss of $85,300 support would expose BTC to a deeper pullback toward $80,000

Until a decisive breakout occurs, traders should expect continued range trading, with macro data and ETF flows acting as the main drivers.