A rejected proposal exposed Aave's true predicament.

Article Authors: M3S & BA

If we only look at the data, Aave remains the undisputed king in the DeFi lending field.

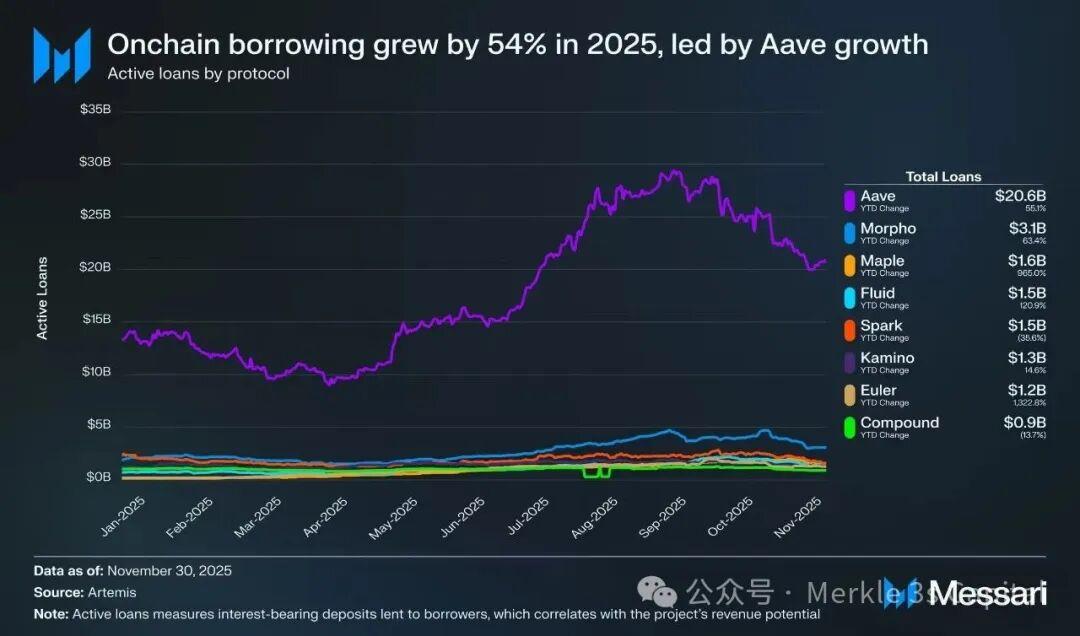

In 2025, on-chain lending volume increased by 54% year-on-year, with the vast majority of the growth coming from Aave; as of early 2026, Aave's TVL remained the highest in the industry, ETH deposits hit a record high, and the protocol continued to contribute stable and predictable real revenue to the Ethereum ecosystem.

But just when everything "looked good," a governance vote exposed the most acute contradictions within Aave.

In a proposal to hand over brand and front-end control to the DAO, the community unequivocally rejected the direction with 55% of the votes against it. Subsequently, Aave founder Stani Kulechov publicly pledged to explore new solutions for sharing off-protocol revenue with token holders to alleviate the current governance tensions.

This was not a typical DAO disagreement.

It occurred at a crucial juncture when Aave clearly bet on RWA (Real-World Assets) and the institutional market, and it points precisely to a deeper issue:

When a DeFi protocol begins to move into the real world of finance, are its growth, governance, and value distribution mechanisms still compatible with the original model?

Chapter 1 | The 55% of votes against did not reject "decentralization".

On the surface, this vote appears to be a failed case of "community vetoing Labs' power".

However, if we only focus on the binary opposition of "decentralization vs. centralization," we will misjudge the true meaning of this event.

1. What do the voting results really indicate?

The core of this proposal is not about modifying parameters or economic models, but rather involves three highly sensitive assets:

• Aave Brand

• Official front-end (App/UI)

• Control of foreign products

The final result is:

• 55% Oppose

• 41% abstentions

Only 3.5% support

This means two things:

First, the community is not prepared to take over the complex responsibilities of a “full product company”;

Second, Aave token holders do not believe that "direct control of the product" is the optimal solution at present.

2. DAO is not suitable for products; this is actually a consensus.

In his subsequent response, Stani clearly expressed a reality that many mature DeFi projects encounter but rarely articulate publicly:

World-class consumer or institutional products often require strong initiative, high execution capabilities, and rapid iteration, which are not the strengths of DAOs.

This is not to deny the value of DAOs, but rather to redefine their boundaries:

• DAO is suitable for:

• Protocol layer economic design

• Risk parameters and incentive mechanisms

Long-term direction consensus

• DAO is not suitable for:

• Front-end product experience

Commercialization pace

• External Branding and Distribution Strategy

The issue is not about "decentralization," but rather—which layers can be decentralized and which layers must be centrally executed.

3. So why did the controversy still erupt?

As Aave moves towards the RWA and institutional markets, an issue that could previously be ignored is becoming unavoidable:

If products and brands are not owned by the DAO, will new revenue and value growth gradually become decoupled from the token?

This is the real anxiety behind the 55% of dissenting votes.

Chapter 2 | Why RWA is a must for Aave, rather than a "new story"

If we understand this governance dispute merely as a power struggle between the DAO and Labs, we will overlook a more important context:

Aave is actively moving away from the comfort zone of "pure crypto-native lending".

1. The growth ceiling for crypto-native lending has already appeared.

Over the past few years, Aave's growth logic has been very clear:

• Using ETH, BTC, and stablecoins as core collateral

• Serving leverage demand through floating interest rates

• In a bull market, as asset prices rise and risk appetite increases, the scale of lending expands rapidly.

This model was repeatedly validated between 2020 and 2024, making Aave the de facto standard for DeFi lending.

However, it also brings three structural constraints:

• Strong cyclicality: Lending volume is highly correlated with ETH/BTC prices.

• High asset concentration: The vast majority of collateral still comes from a small number of crypto assets.

• The source of incremental growth is singular: it's more about leverage cycles than genuine credit demand.

In other words, Aave is strong, but its growth is still a function of the crypto market's beta.

2. RWA brings not traffic, but "balance sheets of a different nature".

The reason Aave has explicitly listed RWA (Real-World Assets) as a strategic priority is not because of narrative updates, but because it fundamentally changes three things:

• Asset sources: Expanding from native on-chain assets to real-world assets such as government bonds, funds, and credit.

• Nature of returns: Shifting from highly volatile interest rate spreads to more stable and predictable cash flows.

• User structure: From native crypto users to institutions, enterprises, and financial intermediaries

This means that once RWA becomes the main storyline, Aave's pursuit will no longer be just "higher TVL", but rather:

Can it become a long-term infrastructure connecting on-chain liquidity with the real financial system?

3 This is why RWA amplifies governance issues.

It is against this backdrop that governance and income distribution issues have been rapidly amplified.

In the pure DeFi phase:

• Most of the value comes from the interest rate spread within the agreement.

• The connection between the token and protocol revenue is relatively direct.

However, in RWA and the institutionalization path:

• Incremental value comes more from products, compliance structure, brand trust, and distribution capabilities.

These capabilities do not entirely reside at the protocol layer.

This makes an issue that could previously be glossed over now unavoidable:

As Aave's growth increasingly relies on "capabilities outside the protocol," how should the revenue generated by these capabilities be aligned with the token?

Chapter 3 | The Horizon Model: Compliance First, But the Costs Are Equally Clear

Faced with the real-world constraints of RWA, Aave's first answer was Horizon.

1. Horizon is a pragmatic but conservative solution.

In Horizon, Aave has chosen a clear path:

• RWA assets are imported using the Permissioned method.

• Completely isolated from Aave V3 Core

• Independent risk pool, independent participants

From a compliance perspective, this is a very rational choice, and it also makes Aave one of the DeFi protocols with the largest lending volume in RWA.

2. However, Horizon did not form a "flywheel".

The problem is that Horizon has not been truly integrated into Aave's core growth engine.

• RWA liquidity cannot be shared with the main pool.

Leverage, liquidation, and portfolio diversification are strictly limited.

• Returns and risks are locked within the sub-market

turn out:

• RWA "exists"

However, it did not drive a leap in the scale of the Aave main protocol.

In other words, Horizon is more of a compliance wing than a second growth curve.

3 This brings us back to the issue of governance and incentives.

If RWA cannot be directly integrated into the main protocol and amplify TVL and revenue like native crypto assets, then:

How does Labs recoup its product and compliance costs?

How can Token Holders share long-term value?

This is the real-world context of the disputes over front-end development, branding, and revenue attribution, rather than a simple power struggle.

Chapter 4 | The debate between front-end development and revenue is essentially a value reconstruction in the RWA era.

As Aave moves into the institutional market, a previously less important aspect of DeFi is beginning to become crucial:

Front end and brand.

1. In the RWA era, growth doesn't just occur within the protocol.

From the perspective of institutions and real-world users, the factors that determine whether to use Aave are often not:

• Interest rate parameters

• Liquidation threshold

• Governance proposal details

Instead:

• Is the product experience stable?

• Is the compliance path clear?

Is the brand trustworthy?

These values are more deeply embedded in the product and brand layers than in the agreements and contracts themselves.

2. Both sides' logic is actually valid.

This is why this conflict seems particularly difficult to resolve.

• Aave Labs' logic:

World-class products require centralized execution.

• DAOs are not suitable for managing commercialization and product pacing.

• Token Holder Logic:

• AAVE assumes systemic risk

• Long-term value should not be diluted outside the agreement.

This is not a debate about "who is right and who is wrong", but a tug-of-war over the fact that the boundaries of values have not yet been reconstructed.

Chapter 5 | Revenue sharing is the first step in easing tensions, not the end.

After the proposal was rejected, Stani's proposed "off-the-agreement revenue sharing" scheme sent an important signal:

Aave recognized the need to realign tokens with growth.

However, this step is more about stopping the bleeding than about shaping the wound.

• The source of income is still unclear

• The allocation mechanism still needs to be designed.

• It is still not fully compatible with the long-term structure of RWA after scaling.

If these problems cannot be systematically solved, RWA may remain at the "edge expansion" stage and fail to become a true growth engine.

Conclusion | Aave is not in decline, but redefining the boundaries of DeFi.

Aave is facing more than just governance failure today.

It is undergoing a more difficult and more advanced transformation:

• From DeFi Protocols to Financial Platforms

• From Token Governance → Multi-layered Authority and Responsibility Structure

• From interest rate spread growth to income diversification

This path is destined to be accompanied by conflict.

What truly determines Aave's next round of growth is not the success or failure of a particular proposal, but whether it can connect with real-world finance without sacrificing the spirit of decentralization.

This is the true meaning of Aave standing at the crossroads.