Compiled by | TechFlow TechFlow

Original link:

https://www.techflowpost.com/article/detail_28169.html

The content of this article does not constitute any investment or financial advice. Readers are advised to strictly abide by the laws and regulations of their locality.

How do you assess the success and growth of a crypto protocol or product? In Web2, marketers have a variety of strategies for measuring success. But in the crypto space, especially in L1, L2, and protocol areas, marketing strategies are still being developed. Some metrics are not yet available, some are less important, and many others need to be rethought specifically for blockchain.

I've spoken with many growth and marketing heads, and each of them has a different dashboard, which is normal because the definition of growth for L1 or L2 is not the same as the definition for a DeFi protocol, wallet, or game. Let's explore these differences more broadly:

The growth of both L1 and L2 is closely tied to the user and developer communities. We can measure their success by looking at the monthly active addresses (MAA) of L1 and L2 and the number of apps built on them. Growth in MAA without significant app growth may simply indicate the presence of a few popular or low-quality apps; ideally, both should grow in tandem. In this case, the Chief Marketing Officer (CMO) acts more like a marketing engine for the community, beyond simply promoting the protocol itself.

The protocol's basic growth metrics are user numbers, transaction volume, and Total Value Locked (TVL) – the total value of assets deposited in the protocol's smart contracts, or Total Value Secured (TVS) – the total value of assets secured by the protocol. While TVL is a controversial metric, it provides a general understanding of the protocol's growth when combined with other metrics discussed below. One founder shared that they also calculate the "cost of capital" for "active TVL," which is the ratio between the reward amount they need to provide to obtain a certain amount of locked value and the resulting fees or locked value.

Growth in infrastructure and other Software-as-a-Service (SaaS) offerings is often tied to the growth of individual products. For example, developer platform Alchemy focuses on customer and revenue growth within each product line, similar to what we see in traditional SaaS companies. More specifically, focusing on the percentage of recurring revenue retained from existing customers, or Total Revenue Retention Rate (GRR), indicates product stickiness and a stable customer base, which is crucial for measuring recurring revenue. Net Revenue Retention Rate (NRR) also considers upselling and reflects the ability to increase revenue from the existing customer base.

The growth in wallets and games also appears more traditional (similar to the SaaS example above). But here, it focuses on using the following metrics to measure overall usage and revenue:

• Daily Active Addresses (DAA): The number of unique addresses that are active on the network each day;

• Daily Transaction Users (DTU) is the number of unique addresses that conduct revenue-generating transactions on the network (a subset of DAA).

• Average Revenue Per User (ARPU): Revenue generated from users or customers within a specific period.

However, when it comes to tokens, token prices and holder distribution will be affected, but even these metrics depend on your objectives. For example, do you want a large number of small token holders or a few whale? This depends on the category, stage, and strategy of your product or service, and you will need to choose the appropriate metrics.

So, how do you build a company-specific metrics dashboard? Here are some potential metric suggestions, along with insights into their placement within the marketing funnel. Ultimately, however, you need to decide what to measure, how to weigh the importance of each metric, and how to act on the data…

Key metrics: What really matters?

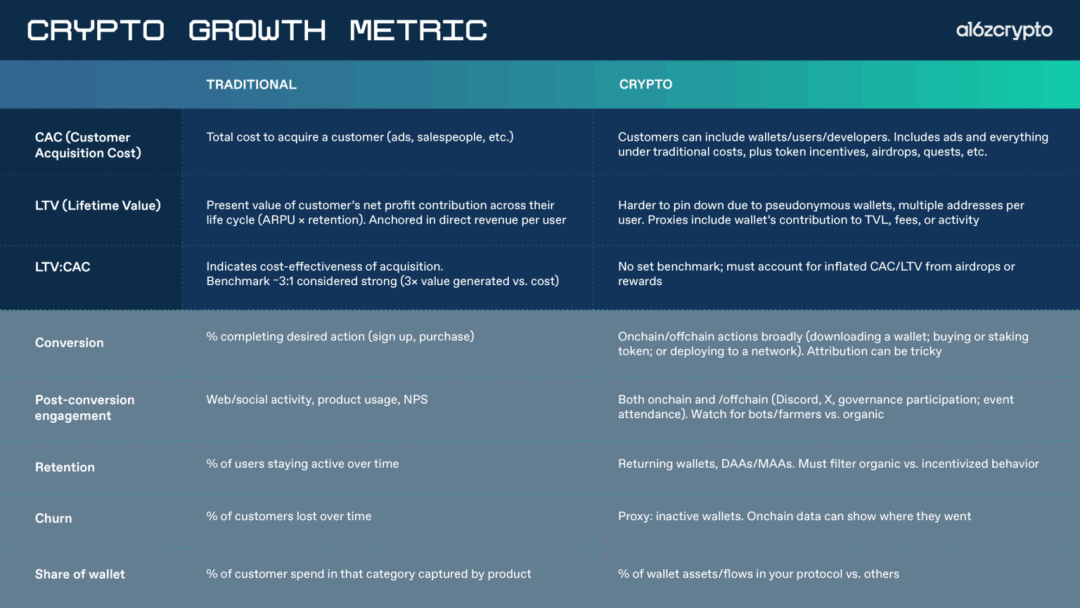

Metrics such as Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), and Average Revenue Per User (ARPU) are key to understanding the success and efficiency of customer acquisition efforts (we will define these metrics below).

While these concepts are widely accepted in traditional SaaS, they require some adjustments in the crypto space because "customer" here often refers to "wallet," and the form of value creation differs. We will redefine these metrics below and explore their unique nuances in the crypto domain.

1. Customer Acquisition Cost (CAC)

Customer acquisition cost (CAC) refers to the total cost of acquiring a customer, and it can be measured in several different ways:

Broadly speaking, hybrid customer acquisition cost (CAC) is calculated by dividing the total customer acquisition cost by the total number of new customers. It tells you the average price paid for each new customer across all channels—including not only the acquisition cost but also the organic growth cost (which makes it difficult to see which specific growth strategies are driving performance growth).

On the other hand, paid CAC focuses solely on customers acquired through paid marketing. Often, teams invest in paid marketing "aimlessly" without measuring results. Paid CAC can reflect the cost of acquiring these customers and whether a particular marketing campaign was truly effective. Measuring this is especially important in the cryptocurrency space, as we found early on that many teams were distracted by paid rewards without figuring out what their products were actually doing.

What counts as “cost”? When calculating CAC, costs may include advertising expenditure, sponsorships, marketing material development, task token incentives (on platforms such as Galaxe, Layer3, or Coinbase Quests), and airdrops to target wallets.

Who qualifies as a "customer"? In this context, "customer" could refer to either a "user" or a "developer"; for example, a new wallet that transacts on a protocol could be considered a customer of that protocol.

2. Lifetime Value (LTV) and Average Revenue Per User (ARPU)

Lifetime Value (LTV) represents the present value of a customer's future net income over the lifetime of the customer relationship. Essentially, LTV measures the returns a customer makes after becoming a customer, including the amount they spend on products.

LTV itself is a complex calculation and concept. In the cryptocurrency world, this concept is not always translated directly because "users" are not always "customers" in the traditional sense. For example, they might be anonymous wallets, and a user might hold multiple different wallets. Therefore, LTV may reflect the contribution of a single wallet to the Total Value Locked (TVL), which refers to the total dollar value of assets stored in the protocol's smart contracts, as we have already discussed above.

For DeFi protocols, TVL can provide a snapshot of the "current total assets," while LTV can help answer the question of "the value of a particular wallet to the protocol over its lifetime."

3. LTV:CAC ratio

Customer Lifetime Value (LTV) is typically used to assess Initial Customer Acquisition Cost (CAC) and the "value" of that customer over a future period. The LTV:CAC ratio provides insights into the cost-effectiveness of attracting new customers by comparing the value delivered by a current customer with the cost of acquiring a new one.

For traditional SaaS products, a 3:1 ratio is considered reasonable because it means that the value you create from a customer is three times the customer acquisition cost, and the remaining profits can be reinvested in growth. In the cryptocurrency space, we haven't established such a benchmark yet.

In the cryptocurrency space, when evaluating the LTV:CAC ratio, it's also necessary to consider other acquisition incentives, such as airdrops or points, as these can mislead the metric. Ideally, these incentives can help attract users and get them started, but when users are already engaged enough, the product can continue to grow even without incentives—in which case CAC will decrease while LTV will increase, thus improving the LTV:CAC ratio.

Here is a brief summary of the key metrics we outlined in the article and their implications for the crypto space:

In summary, these metrics provide a foundation for measuring the effectiveness of your growth marketing efforts in engaging users at different stages of the marketing funnel, while also taking into account the cost of these efforts.

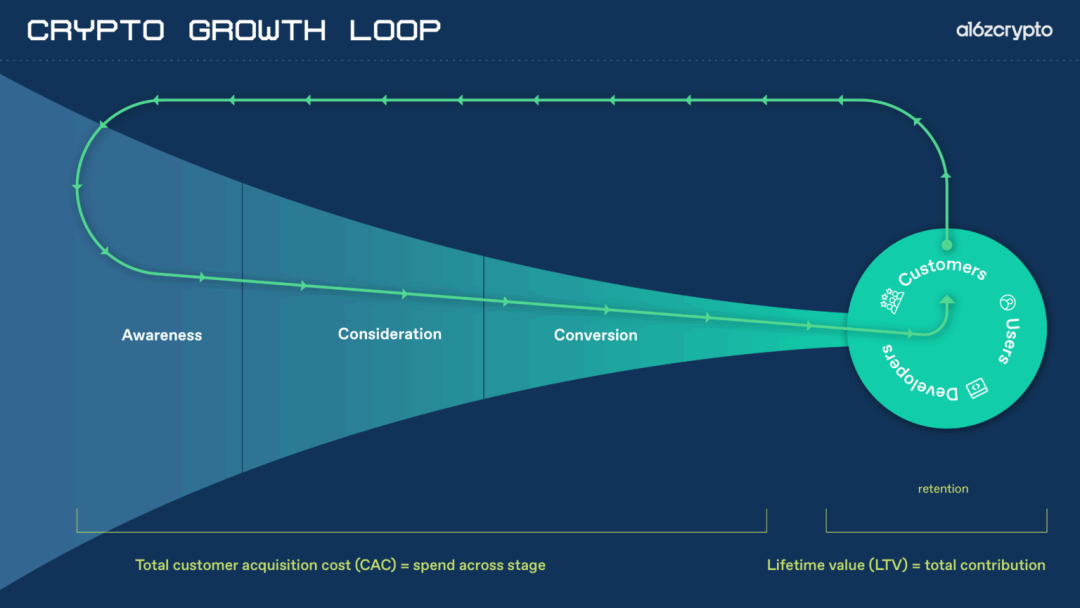

Analyzing the growth funnel in the crypto space

After identifying the core metrics, the next step is to map them down the marketing funnel. It's important to note that while the growth marketing funnel in the crypto space differs from that of traditional Web2, the key differences lie in the crypto-specific marketing strategies, behavioral characteristics, and unique opportunities at each stage, such as on-chain behavior, token incentives, and community-driven dynamics.

Next, we will explore each stage of the funnel one by one, analyze key strategies and metrics, and how they differ from Web2 in the crypto space…

1. Awareness/Lead Generation

Whether through traditional channels or in the cryptocurrency space, the first stage of the marketing funnel is raising brand awareness. Even in the cryptocurrency world, raising brand awareness is a prerequisite for everything else.

At this stage, you will also begin measuring Customer Acquisition Cost (CAC). Reach (the number of unique individuals who see your content) should also be a core metric. Reach is especially important when evaluating the success of mass marketing channels such as news, media, and public relations. The challenge at this stage is distinguishing between short-term attention spikes and genuinely "sticky" interest: are users just curious, or are they truly interested in using the product?

Beyond the core acquisition metrics, each of the channels you use to find new users has its own advantages, risks, and unique nuances within the crypto space:

2. Key Opinion Leaders (KOLs) and Influencers

Paying random influencers or KOLs with large audiences may seem like a reliable way to increase visibility, but this approach often fails to generate meaningful engagement, especially when the influencers have no real connection to the project and their audience does not resonate with it.

However, partnering with influencers who align with the project's vision is valuable, as they can share their excitement in a credible way. Consider "micro-influencers"—voices that are more segmented, targeted, and trusted by their audience; or even local influencers, such as experts within the team who have already built a strong personal influence. Claire Kart, Chief Marketing Officer of Aztec, a privacy-focused L2 company, is a prime example. She not only works with in-house influencers but also actively seeks out emerging influencers, organically connects with them, and brings them into the Aztec ecosystem.

3. Advertising

Advertising in the crypto space faces a number of challenges. For example, due to the vague and ever-changing policies regarding crypto advertising, many crypto companies are unable to run ad campaigns on traditional platforms such as Google or Meta. Furthermore, the crypto community is somewhat wary of traditional advertising, as similar ad formats are sometimes used by scammers to redirect users to malicious websites.

Crypto marketers have seen more success promoting specific apps on platforms like X (formerly Twitter), LinkedIn, Reddit, TikTok, or the Apple App Store. They could also consider alternatives such as Brave browser ads, Spindl ads within the Coinbase/Base app, or MiniApps and sponsored posts on Farcaster, and even optimize for suggestions and integrate them into AI search answers.

4. Referral and affiliate marketing

The idea behind referral programs is the same as traditional marketing: you earn rewards when others sign up through your referral. The difference with cryptocurrency is that rewards can be sent instantly and verified directly on-chain, thus harmonizing the incentive mechanism and making the entire process smoother. Projects like Blackbird demonstrate how on-chain referrals can develop into a compound network effect through ongoing loyalty programs and community engagement, rather than just a one-off customer acquisition campaign.

Word-of-mouth marketing is one of the most powerful growth drivers in the crypto space: for consumer-facing products, adoption is often recommendation-driven, with users recommending the product to others because they enjoy the experience and discover its value. For infrastructure projects, recommendations typically originate from existing customers and developers.

Word-of-mouth growth can be measured simply by tracking the Net Promoter Score (NPS) or by directly surveying whether new users are referred after signing up or completing onboarding and who the referrer is.

In this sense, referrals are like an inverted, bottom-up marketing funnel: users don't just stay at the conversion stage, but bring new potential users back to the top of the funnel. Early adopters become promoters, bringing more people into the network (and potentially being rewarded for their contributions), thus keeping the growth flywheel running.

Regarding accuracy: Accurately measuring the growth of real users/customers versus bots is a challenge across industries, especially in social media. Cryptocurrencies offer unique identity primitives that we can use, such as verifying "human proof" via World ID or verifying identity via zero-knowledge proofs (through zkPassport). These primitives can distinguish real users from bots or airdrop users. Growth teams can leverage these primitives not only to build Sybil protection against community growth mechanisms like airdrops, but also to better understand real users and help plan product retention rates.

5. The power of ever-growing networks

Finally, one of the unique growth drivers of cryptocurrencies is the token, which is often the best way to attract users, developers, and liquidity into markets that traditionally struggle with the cold start problem. However, this isn't just speculation: more importantly, when the token price rises, it can attract new users who want to participate in a movement or something that's developing. Developers also notice this, as a price increase can indicate an active community and genuine demand, making the platform more attractive.

6. Considerations/Interests

The next stage of the traditional marketing funnel is consideration, which is the stage where potential customers develop a positive interest in the product and evaluate and compare it with other products.

This is especially important in the cryptocurrency space because every decision—from buying tokens to ordering a hardware wallet—often requires significant education, as cryptocurrency remains a relatively new (and often complex) industry for both users and developers. Providing users with the right information to help them make decisions and weigh competing products or platforms has a huge impact. This is why numerous companies, from Coinbase to Alchemy, invest in educational content for both consumers and developers.

Effective educational content goes beyond simply detailing a product's features and benefits; it also includes explaining how the product works (e.g., security, custody, community and treasury governance, token economics, etc.). Developers may require in-depth technical documentation and tutorials, while consumers typically need explanatory content (e.g., before transferring real funds between wallets or blockchains).

Standard tools include user education via email in key processes such as product registration or purchase, in-product tips and tooltips, interactive onboarding, and product trials or "testnet" setups to demonstrate and experience features before committing to asset transfer. Companies are also beginning to optimize their educational content to fit Large Language Models (LLMs) so that the company's content can be retrieved when someone asks a question.

Successful teams measure interest not only by clicks or downloads, but also by intermediate actions users take, such as adding them to a wallet waitlist or adding a small-funds test feature, to demonstrate trust and intent. However, understanding the success of these efforts depends on the channels chosen, as each has its own set of metrics. Ultimately, you need to map these metrics to some form of conversion, which we'll discuss below.

7. Transformation

Conversion is the stage in the marketing funnel where users complete a desired action. At this stage, users have been engaged, received relevant information, and ultimately take the action you want them to take.

As a metric, "conversion rate" is a broad term: in traditional marketing, it might refer to the number of customers who buy a product, the number of users who sign up for a demo, or the number of people who request to speak with the sales team. In the crypto space, conversions could also include downloading a wallet, purchasing tokens, or even deploying code on a platform. The specific form a conversion takes depends on the product and objectives, but accurately defining conversion metrics is crucial for developing best-practice measurement methods.

Tracking conversions through marketing channels (e.g., wallet downloads resulting from offline events) is crucial. Understanding which sources are driving results can help teams optimize budget allocation, messaging, and other aspects.

Accurate measurement of conversions also relies on attribution mechanisms, which are particularly complex in the crypto space, especially since the journey of users between traditional websites, social networks, and on-chain behavior (such as behavior from off-chain to on-chain or vice versa) is difficult to track accurately.

Web tracking tools like Google Tag Manager can track website conversions, while new tools for wallet users (such as Addressable) can bridge the gap between off-chain advertising and on-chain behavior, enabling teams to track on-chain behavior from website or Web2 advertising. However, the user journey is often not linear; for example, a user might see a post on X, attend an offline event, and then make their first transaction.

While attribution tracking has historically been difficult in the crypto space, improvements in analytics tools have allowed teams to gain a more comprehensive understanding of growth. Although many people own multiple wallets, advancements in analytics have made it easier to match multiple wallets with individual users, allowing on-chain behavior to be linked to specific users. As privacy regulations (such as GDPR and cookie restrictions) make Web2 attribution more difficult, the transparency of on-chain data offers an advantage while also protecting user identity.

8. Post-conversion engagement

In the traditional marketing funnel, the engagement/interest stage typically measures product interactions before purchase. These interactions are how users better understand the product and brand, and are a crucial stage in converting initial interest into loyal engagement.

In the crypto marketing funnel, post-conversion user engagement is equally important, encompassing online and offline, on-chain and off-chain behavior. This not only helps teams gain insights into how to retain users but also how to maintain the overall health of the community, regardless of where users are.

For example, online engagement (which we also cover in our social media guidelines) can include the following metrics: engagement on Discord or other forums/chat platforms; activity on X (formerly Twitter); sentiment analysis on social channels; and user participation in governance or voting.

While many crypto marketers still rely on traditional social listening tools, these methods need to be adapted for the crypto space. For example, sentiment tracking can provide direction for understanding how the community feels about a project, but it shouldn't be the sole basis for decision-making. Sentiment tracking can help teams identify active contributors, key influencers, and assess the effectiveness of messaging. However, the crypto community is fragmented across multiple platforms, with varying metrics quality and depth, and a few highly active accounts can have an excessively large impact, resulting in a lot of data noise.

Beyond sentiment tracking tools, some teams use other social media monitoring tools (such as Fedica) to track and reward user engagement. For example, identifying contributors who amplify content, create memes, participate in discussions, or energize the community. However, it's worth noting that incentive programs are easily manipulated: some incentives may attract those more focused on the reward than the project itself, potentially leading to short-lived but unsustainable community activity in the long run.

Marketing in the crypto space can still achieve meaningful organic growth through unincentivized or non-paid methods. For example, by weaving together different types of content. Eco, a stablecoin liquidity layer, employed an organic content strategy based on the "4-1-1 principle": publishing four pieces of educational content about its market opportunity; one "soft sell" piece (such as a third-party endorsement); and one "hard sell" piece (such as "Use our product"); repeating this cycle every few hours over seven days. Through this organic publishing strategy alone, along with leveraging major product announcements and joint marketing campaigns, Eco increased its total monthly exposure by nearly 600%.

Offline engagement (such as attending meetings or events) also plays a significant role in helping users engage through deeper connections. Traditionally, these activities are measured by collecting email addresses to expand mailing lists (e.g., by scanning attendees' QR codes). More sophisticated tools include using NFC chips to tag giveaways (e.g., via IYK) and running various campaigns to encourage users to click or scan them. Online platforms (such as Discord or Towns) provide dedicated spaces for sustained interaction and relationship building, allowing teams to track the number of user interactions (posts, likes, replies) over a period of time and perform quality and sentiment analysis on these interactions.

9. Retention

Retention rate answers a key question: "Who stays?" Retention can be measured as the percentage of users who complete on-chain activity after a set period of time, or more broadly, as the level of continued user activity. Retention rate is calculated by dividing the number of existing users at the end of a period by the number of users at the beginning of that period. If you are measuring mailing list subscribers or wallet downloads, retention tracking is not about initial registrations, but rather measuring users who remain active after a period of time. Common retention metrics include returning users, or the number of daily active addresses over a period of time.

In the cryptocurrency space, retention metrics must consider the contradiction between "long-term" and "short-term" behavior, as this involves robust token mechanisms and behaviors. For example, a surge in users airdropping rewards at launch might seem like growth, but many will leave once the rewards stop. This is why it's important to define your "ideal" users and measure retention relative to that group, not just the original total number of users. This is also why measuring product metrics (both inherent to the product itself and natural interest in it) is crucial to avoid confusing what works with what doesn't, especially if your product hasn't yet achieved product-market fit. Otherwise, you might think you've found product-market fit when you haven't; that is, people's interest isn't actually in your product, but in the rewards.

Retention rates naturally drive Customer Lifetime Value (LTV) because the longer users stay on the platform, the more money they spend or transact. This not only increases their LTV but also makes the LTV:CAC ratio more desirable.

10. Loss

Churn is the opposite of retention, used to measure how many users are lost and when they are lost during a user's lifecycle. Churn rate is calculated by dividing the number of users who churned at the end of a period by the total number of users at the beginning of that period, expressed as a percentage. In the crypto space, an alternative metric for churn (though not a perfect mapping to traditional churn metrics) is the percentage of wallets that remain inactive after a certain period. For example, users register for wallets during a marketing frenzy or cycle but never use them again. Some of these users may re-engage at some point in the future, but the key to calculating churn is identifying active users, frequently engaged users, and returning users, rather than those "dormant" users who have only performed one on-chain action.

Several tools exist to monitor user interactions with decentralized applications (dApps) (such as Safary) and help identify friction points that lead to user churn, such as high transaction fees, complex user experiences, or the need to complete multiple onboarding steps. For example, when Solana released the Seeker phone, some users wanted a pre-installed funds wallet (similar to the early Saga phone) to reduce initial barriers to use, as requiring manual top-ups for trading could delay adoption. While Solana has shifted to dApp rewards programs after users receive their phones, reducing friction in the onboarding process remains crucial.

To reduce churn, funnel tracing and user group targeting platforms can be used, which support crypto-specific user engagement (such as Absolute Labs' "Wallet Relationship Management"). These tools allow teams to create custom user groups and re-engage users through Web2 channels and crypto-native strategies such as targeted airdrops. Furthermore, sending messages directly to wallets via secure decentralized messaging tools like XMTP can provide timely, personalized prompts, encouraging user return and continued engagement.

11. Wallet Share

Another way to track churn and retention is to look at “wallet share”: the percentage of a customer’s total spending in a particular category that is allocated to your product or service. In the crypto space, this concept can be applied very intuitively. By analyzing the composition of a wallet, a team can see the types and amounts of assets it holds, as well as the direction of its activity. If users stop interacting with your protocol, on-chain data can reveal whether they have switched to a competitor. Of course, as protocol products and services become more complex, the reasons for user migration can become more difficult to determine. But if you observe user behavior shifting towards a competitor or another product with unique features, this can reveal important information.

Similarly, if many of your token holders also hold tokens from a related project, this can present opportunities for joint marketing—for example, partnering with the project to host joint events or giving away your tokens to its holders. General analytics tools like crypto datacenter Dune can perform this analysis, while more specialized platforms can provide in-depth insights specific to particular tokens. Since most users own multiple wallets, linking them to a single end-user identity is also important; on-chain analytics tools like Nansen can provide wallet tagging across multiple chains, enabling more accurate wallet share analysis.

Growth measurement in the crypto space is not simply about replicating the Web2 approach, but rather adapting effective strategies, discarding ineffective ones, and building new frameworks around the unique strengths of blockchain. Given the diversity of crypto products, from L1 to gaming, each team's growth dashboard will differ.

But data doesn't tell the whole story. Ultimately, quantitative metrics are only one part of the story: qualitative insights into your audience and users are equally irreplaceable. Community conversations (whether it's discussions about the project or simply memes and atmosphere), the energy felt during events, and even intuition about what works and what doesn't—all play a crucial role in guiding growth strategies. In the early stages, the behavior of a few core users may be more valuable than that of other users. These qualitative signals are often the earliest indications of product-market fit. The best crypto growth strategy is a balance between data and intuition, combining short-term tactics to generate excitement with a long-term strategy to build a stronger community.