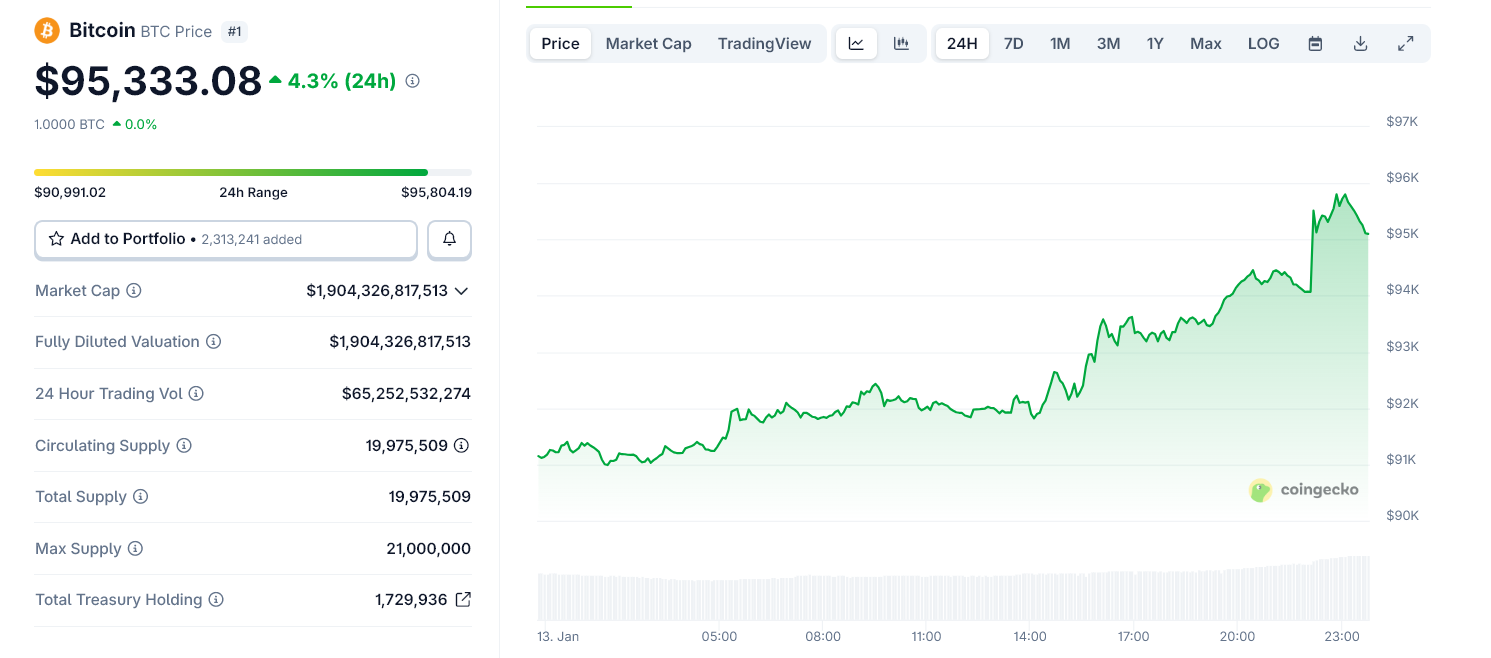

Bitcoin surged above $95,000 on Tuesday, reaching its highest level in more than 50 days, as a mix of easing US inflation and escalating geopolitical risk triggered a broad move into crypto markets.

The rally followed a sharp warning from the US State Department telling American citizens to “leave Iran now” and to prepare for prolonged communication outages.

The alert came as mass protests continue across Iran and Washington’s rhetoric toward Tehran hardens, raising fears of a wider regional conflict.

Iran: U.S. citizens should leave Iran now. Consider departing by land to Türkiye or Armenia, if safe to do so. Protests across Iran continue to escalate. Increased security measures, road closures, public transportation disruptions, and internet blockages are ongoing. The… pic.twitter.com/w9suu499Ef

— TravelGov (@TravelGov) January 13, 2026

US CPI Removed a Key Macro Risk and Geopolitical Risk Revived Bitcoin’s Hedge Appeal

The US travel warning to Iran added a second catalyst. Markets often move into safe or alternative assets when war risk rises.

Bitcoin has increasingly traded as a geopolitical hedge during global crises. The combination of possible Middle East escalation and internet shutdowns in Iran reinforced its role as an asset outside government control.

As headlines intensified, traders moved quickly into Bitcoin and other liquid crypto assets.

BREAKING: Bitcoin rises above $96,000 for the first time since November 16th.

— The Kobeissi Letter (@KobeissiLetter) January 13, 2026

Bitcoin is now up +10% in 2026. pic.twitter.com/FZ3Iu0jNcB

Bitcoin, which started the day near $91,000, jumped more than 5% within hours. The broader crypto market also climbed, with Ethereum, Solana, and XRP prices also surging.

The rally began earlier in the day after the US Consumer Price Index showed inflation running at a stable pace. Prices are still rising, but not accelerating.

That matters for crypto. When inflation stays under control, the Federal Reserve does not need to raise interest rates further. It also avoids the risk of a sudden recession caused by aggressive tightening.

For investors, that creates a safer backdrop for holding risk assets such as Bitcoin. The CPI report removed a major downside risk just as Bitcoin was stabilizing after weeks of ETF-driven selling.

Bull Market Signs are Reforming

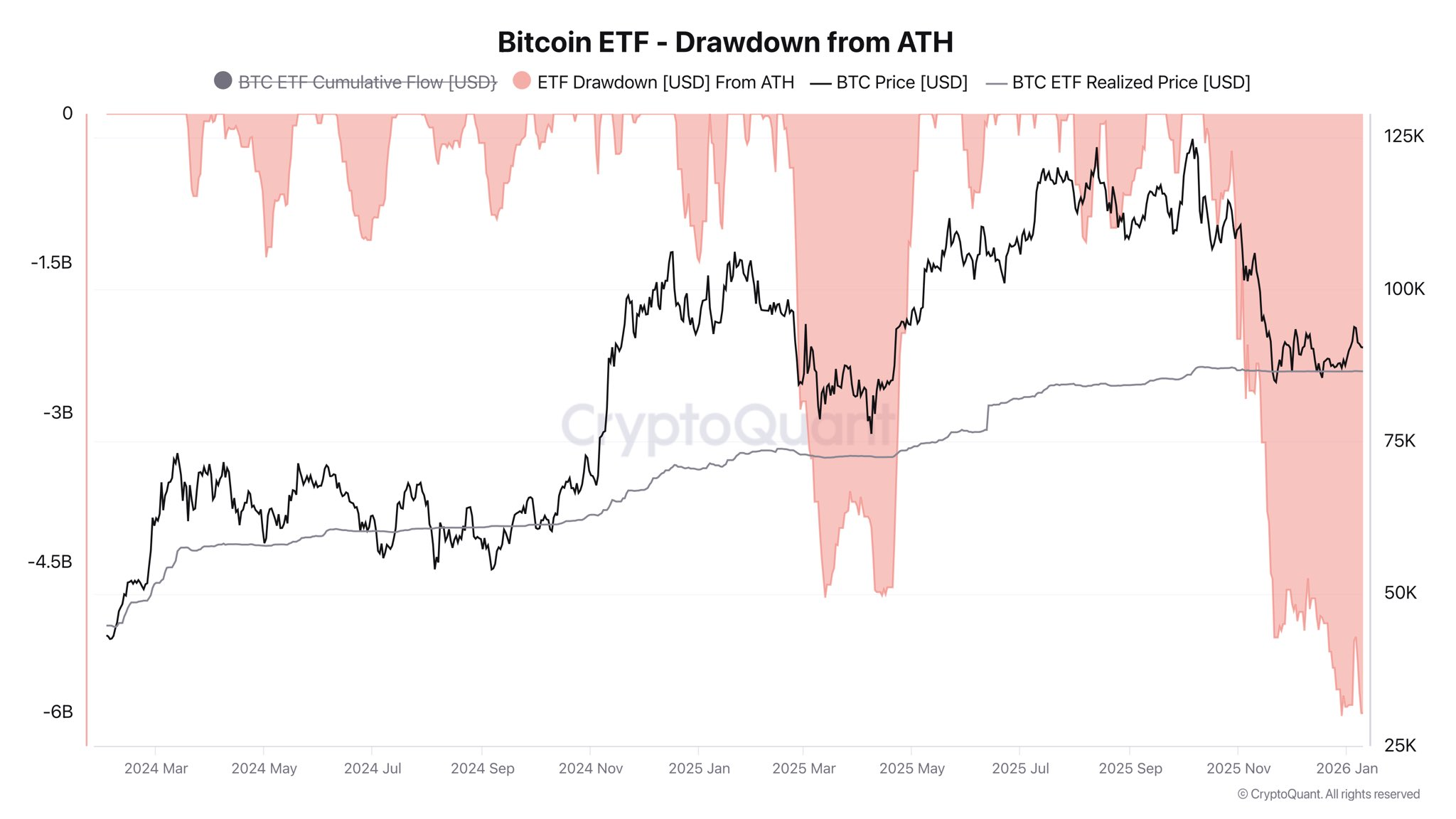

The move did not come from nowhere. Earlier in January, US spot Bitcoin ETFs saw more than $6 billion in outflows as late buyers from the October rally exited at a loss.

That selling pushed Bitcoin down toward the ETF cost basis near $86,000, where pressure eased. ETF flows have since stabilized, suggesting the washout phase is largely complete.

At the same time, exchange data showed global buyers absorbing ETF-driven supply, while US institutions paused rather than exited the market. Coinbase’s premium turned negative, indicating caution, not washout.

Bitcoin To Reclaim $100,000?

Bitcoin breaking back above $93,000 after the CPI report signaled that selling had lost control. The push through $95,000 confirmed fresh demand.

With inflation stable and ETF pressure fading, geopolitical stress became the spark that forced sidelined capital back into the market.

For now, Bitcoin is rebuilding momentum after a mid-cycle reset. If ETF inflows resume and geopolitical risk remains elevated, traders will look toward $100,000 as the next major test.

This rally shows Bitcoin is still acting as both a macro asset and a crisis hedge in a world growing more unstable.