In all cases, the combined effect of gold and Bitcoin is better than holding either one alone.

Written by: Juan Leon, Mallika Kolar

Compiled by: AididiaoJP

The continued depreciation of the US dollar has led many investors to consider whether to allocate their investments to gold or Bitcoin. Historical experience suggests that they might be better off with both.

Ray Dalio, founder of Bridgewater Associates and one of the most influential figures in hedge fund history, recently made headlines by saying that investors should allocate 15% of their portfolios to gold and Bitcoin.

His reasoning? Soaring federal debt and persistent deficit spending foreshadow continued dollar depreciation. This environment makes holding assets that enhance portfolio resilience and protect against the loss of purchasing power even more crucial.

This naturally caught our attention. Therefore, we decided to stress test Dalio's recommendation. We analyzed major market downturns over the past decade, examining a traditional 60/40 portfolio (60% stocks, 40% bonds) and several variations, including allocating 15% to Bitcoin, 15% to gold, or both.

The results are quite interesting: in all cases, gold and Bitcoin together outperformed holding either one alone, and together they constituted one of the strongest complements to a traditional 60/40 portfolio.

"Cushioning pad" and "spring"

If we examine every major stock market downturn in the past decade—the trade wars of 2018, 2020, 2022, and 2025—gold has provided a good buffer against market corrections.

In 2018, the stock market plummeted 19.34% due to escalating US-China trade tensions, concerns about a global economic slowdown, and the Federal Reserve's hawkish monetary policy. Bitcoin also suffered a significant drop, falling 40.29%. In contrast, gold rose 5.76%.

In 2020, the COVID-19 pandemic brought the global economy to a standstill, causing the stock market to fall by 33.79%. Bitcoin also fell sharply again, dropping by 38.10%. Gold also declined, but by only 3.63%.

The market downturn in 2022 was driven by a variety of factors, including spiraling inflation, the Federal Reserve's aggressive interest rate hikes, and supply chain issues left over from the COVID-19 pandemic. The market reacted sharply, with stocks falling 24.18%. Bitcoin fared even worse, plummeting 59.87% due to the unique complications arising from the FTX bankruptcy. Gold significantly outperformed both, falling only 8.95%.

In 2025, a similar pattern emerged when the market corrected due to President Trump's announcement of tariffs and an escalation of the trade war. Stocks fell 16.66%, Bitcoin fell 24.39%, while gold rose 5.97%.

So, should we only hold gold and abandon Bitcoin? Hold on. Let's look at what happened during the market recovery:

After bottoming out at the end of 2018, the stock market rose 39.89% over the following year. Gold rose 18.14%, while Bitcoin surged 78.99%.

In 2020, after the announcement of massive government stimulus packages quelled the panic caused by the COVID-19 pandemic, the stock market rebounded by 77.80%, and gold rose by 111.92%. However, Bitcoin rebounded sharply by 774.94%.

In 2023, with declining inflation and expectations that the Federal Reserve would shift to cutting interest rates, the stock market rose 22.82%, gold climbed 17.53%, and Bitcoin surged nearly 40.16%.

Since the market recovered from the tariff scare of 2025, stocks have risen 38.65%, while gold has jumped 44.79%. Bitcoin is currently lagging behind both, having risen only 14.04%; however, the one-year recovery period doesn't end until April 2026, giving Bitcoin several months to regain its leading position.

What's the key takeaway? If history is any guide, then you need to hold gold during market corrections and Bitcoin during market recoveries.

Examine the complete cycle

Looking at this data, it's easy to think the obvious course of action is to hold gold precisely when the market starts to fall, and then switch to Bitcoin at the exact moment it bottoms out. But that's obviously impossible. In fact, if you foresee an impending downturn, the best course of action is to exit the market entirely and sell all assets, including stocks.

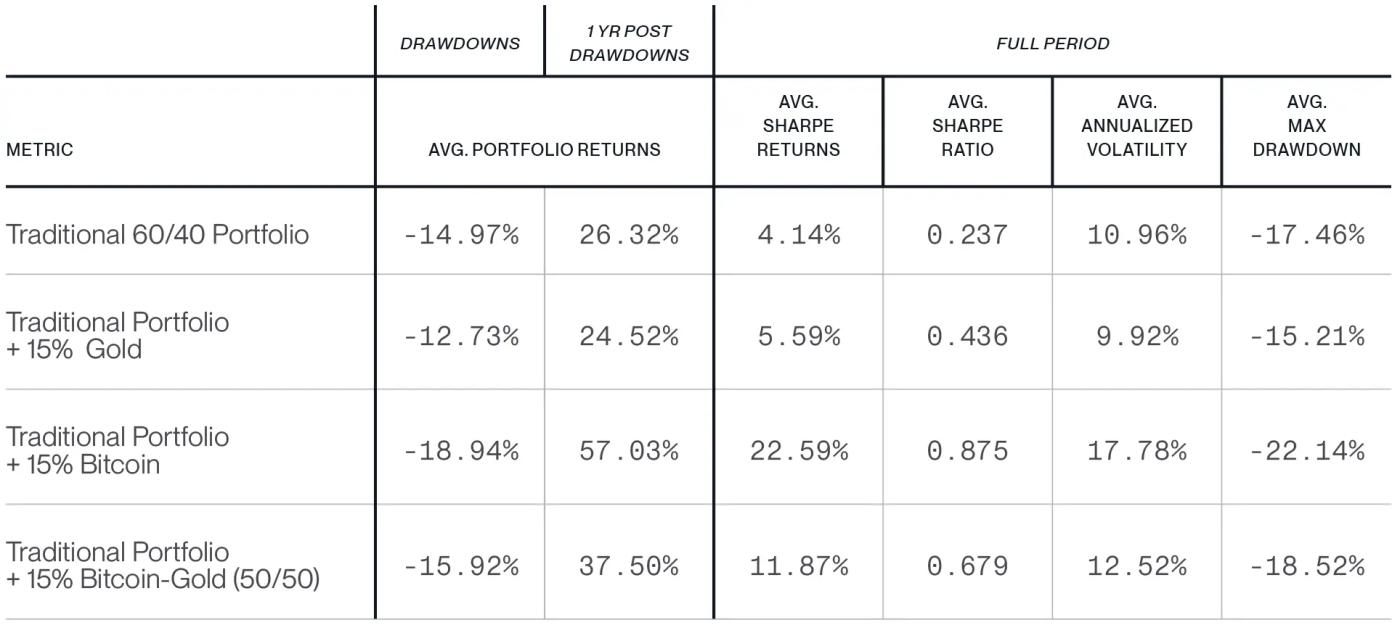

A more practical approach is to consider performance over the entire cycle. Here, the data is conclusive: historically, incorporating both gold and Bitcoin offers the optimal balance between cushioning market corrections and enhancing returns during recovery. Statistically, a portfolio containing both gold and Bitcoin has a Sharpe ratio of 0.679, almost three times that of a traditional portfolio (0.237) and significantly higher than the 0.436 of a portfolio containing only gold (excluding Bitcoin). While the portfolio containing only Bitcoin (excluding gold) has the highest Sharpe ratio (0.875), its volatility is also significantly higher than that of the gold/Bitcoin combination.

Performance of portfolios including gold, Bitcoin, and combinations of both

Source: Bitwise Asset Management, data from Bloomberg. Note: The "One-Year Post-Decline" and "Full Cycle" metrics in the report include complete 12-month cycles following the declines in 2018, 2020, and 2022. These metrics do not include cycles following the decline in 2025.

By holding both assets simultaneously throughout the cycle, a portfolio can benefit from gold's defensive nature during market downturns and Bitcoin's offensive nature during market rallies. The question of gold versus Bitcoin is often framed as an either-or choice. As data shows, historically, the best answer is "both."