Original article | Odaily Odaily( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

Following yesterday's strong breakout above the key resistance level of $95,000, BTC continued its upward momentum in the early hours of this morning, reaching a high of $97,924, and is currently trading at $96,484. ETH broke through $3,400 and is currently trading at $3,330. SOL's price rose to a high of $148 and is currently trading at $145. Compared to BTC, ETH and SOL are still hovering around key resistance levels and have not yet formed a clear trend breakout.

Regarding derivatives, according to Coinglass data, total liquidations across the network reached $680 million yesterday, including $578 million in short positions and $101 million in long positions. Glassnode stated that the market rebound led to the largest short position liquidation since the "1011 crash" .

According to data from msx.com, while the three major U.S. stock indexes generally fell at the close, crypto stocks generally rose, with ALTS up over 30.94% and BNC up over 11.81%. This is a rare occurrence; what exactly is driving such a strong rally in the crypto market?

ETF Funds Shift

In terms of funding, since mid-October 2025, BTC spot ETFs have generally been in a weak state with net outflows or small net inflows, lacking clear signals of incremental funds. However, after four consecutive trading days of net outflows in the past week, BTC spot ETFs have turned to two consecutive days of net inflows, with a single-day net inflow of $750 million on January 13th , becoming an important signal in this phase. In contrast, ETH spot ETFs continue to perform weakly.

From a price behavior perspective, a noteworthy change is underway. Bitcoin's cumulative return during the North American trading session was approximately 8%, while it only recorded a modest increase of about 3% during the European session, and the Asian trading session even dragged down its overall performance.

This phenomenon contrasts sharply with the end of 2025, when Bitcoin fell by as much as 20% during North American trading hours, with the price dropping to around $80,000. In the fourth quarter, the opening hours of the US market were often accompanied by selling pressure, and spot Bitcoin ETFs faced almost daily outflows of funds.

The strongest returns have now come shortly after the US stock market opens, a period that coincides with Bitcoin's weakest performance over the past six months.

Macroeconomic data: No bad news, but also a lack of catalysts for easing.

On the macro level, the December CPI, released this week, remained at 2.7% year-on-year (unchanged from the previous value and in line with market expectations), while the core CPI rose slightly to 2.7% year-on-year (previous value 2.6%, slightly higher than some expectations), indicating that inflationary pressures still have some stickiness; however, the November PPI unexpectedly rose to 3.0% year-on-year (higher than the expected 2.7%), and retail sales also recorded strong month-on-month growth (exceeding market expectations). The strong performance of consumption data, to some extent, supports the view that economic growth remains resilient.

Although the December CPI data was generally moderate (0.3% month-on-month, in line with expectations, and the annual rate did not accelerate further), inflation has not yet clearly fallen back to the Fed's comfortable range. Combined with the resilience of the labor market shown in the previous employment report, the market generally believes that the probability of the Fed keeping interest rates unchanged at its meeting at the end of January is extremely high, with almost no expectation of a rate cut. This also means that catalysts for policy easing in the short term are still relatively scarce. According to CME's "FedWatch," the probability of the Fed keeping interest rates unchanged in January is 95%.

However, the expectation of a rate cut in 2026 is worth looking forward to, with Federal Reserve Governor Milan reiterating that a 150 basis point rate cut is needed this year.

Regulatory Legislative Progress: The Clarity Act Takes Center Stage

Beyond short-term market movements, the most noteworthy medium- to long-term variable is the legislative progress of the Clarity Act. This act aims to establish a comprehensive regulatory framework for the US crypto market, with key objectives including:

- Clarify the regulatory boundaries between the SEC (Securities and Assets) and the CFTC (Commodity and Digital Assets);

- Clearly define the classification of digital assets (securities, commodities, stablecoins, etc.);

- It introduces stricter requirements for information disclosure, anti-money laundering, and investor protection, while reserving room for innovation.

With the Senate Banking Committee's revision and vote scheduled for January 15, US crypto legislation has officially entered its final "sprint." Committee Chairman Tim Scott (Republican) released a 278-page revised text on January 13. This text followed months of closed-door bipartisan negotiations and quickly garnered over 70 proposed amendments (some counts say 137). Disagreements surrounding stablecoin yields and DeFi regulation have rapidly intensified, with the crypto industry, banking lobbying groups, and consumer protection organizations all fully involved.

Moreover, a unified stance has not yet been formed within the crypto industry. On January 14, Coinbase CEO Brian Armstrong publicly announced the withdrawal of his support, stating that after reviewing the text, he believed the bill "has too many problems, including the DeFi ban, the stifling of stablecoin rewards, and excessive government surveillance, making it worse than the current situation." He emphasized that Stand With Crypto would score Thursday's amendment vote to see whether senators "stand on the side of bank profits or on the side of consumer/innovation rewards." Industry insiders believe that Coinbase's public opposition has "significant implications" and could determine the fate of the bill.

Following Coinbase's public opposition, several leading institutions and associations, including a16z, Circle, Kraken, Digital Chamber, Ripple, and Coin Center, publicly expressed their support for the Senate Republican version, arguing that "any clear rule is better than the status quo," injecting long-term certainty into the market and positioning the US as the "global crypto capital." (Recommended reading: " CLARITY Deliberations Suddenly Delayed: Why is There Such Severe Division in the Industry? ")

Other observations: Strong Ethereum staking demand and Strategy's continued investment.

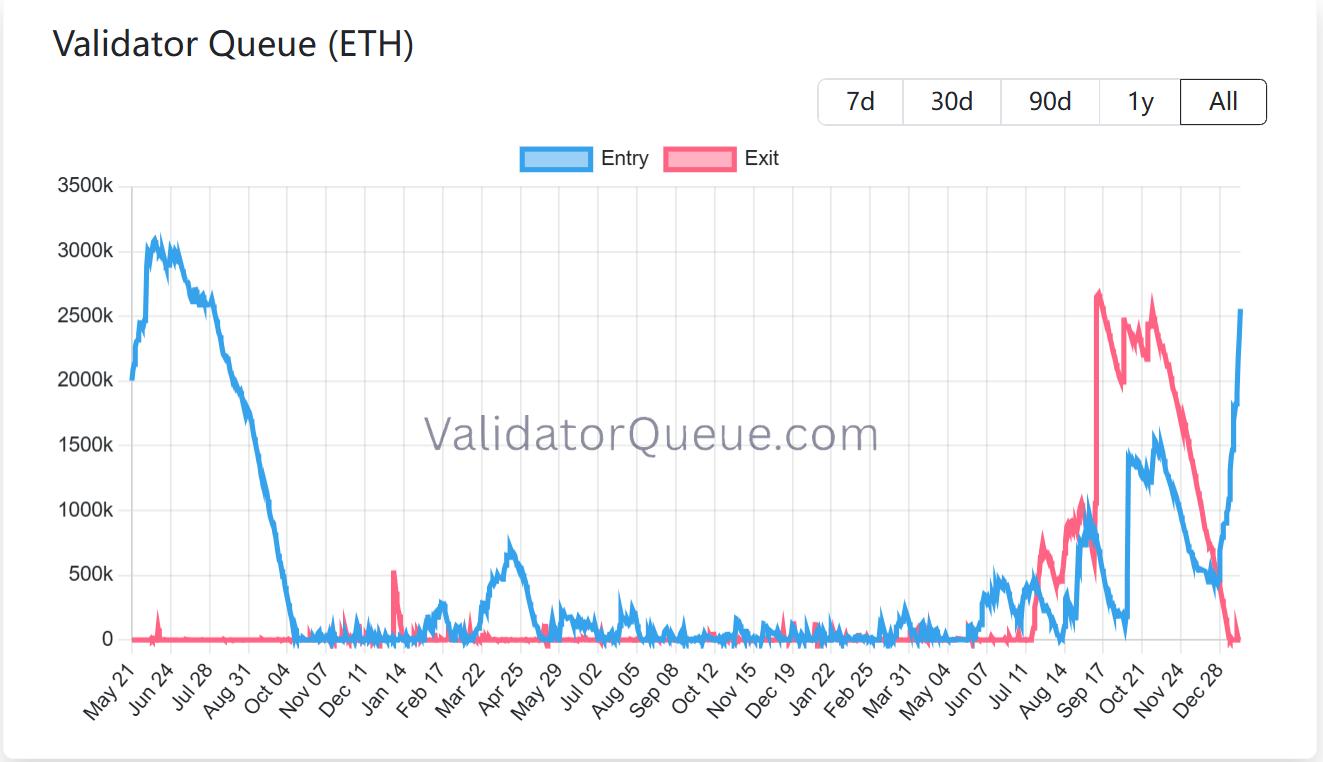

Ethereum staking demand continues to strengthen. Currently, the amount of ETH locked in the Beacon Chain exceeds 36 million, accounting for nearly 30% of the network's circulating supply, corresponding to a staked market value of over $118 billion, continuously setting new historical highs. The previous highest percentage was 29.54%, occurring in July 2025. The Ethereum network currently has approximately 900,000 active validators, while approximately 2.55 million ETH are still waiting in the staking queue. This means that, at least from an on-chain behavior perspective, existing stakers' short-term selling intentions remain limited, and the network as a whole tends to "lock rather than release."

In addition, developer activity and stablecoin trading volume on Ethereum both hit record highs. Recommended reading: " ETH Staking Data Reversal: Exit to Zero vs. Inflow of 1.3 Million Tokens, When to buy the dips? "

Bitcoin reserve firm Strategy (formerly MicroStrategy) continued its long-term accumulation strategy this week, spending approximately $1.25 billion to purchase 13,627 BTC at a price of approximately $91,519 per BTC. This brings its total Bitcoin holdings to 687,410 BTC, valued at approximately $65.89 billion, with an average cost basis of approximately $75,353 per BTC.

Investment bank TD Cowen recently lowered its one-year price target for Bitcoin from $500 to $440, citing the dilution effect of continued issuance of common and preferred shares, which weakens expected Bitcoin yields. Analysts predict that Strategy may increase its holdings by approximately 155,000 Bitcoins in fiscal year 2026, higher than previously forecast, but the higher proportion of equity financing will limit the growth rate of Bitcoin holdings per share.

TD Cowen also pointed out that although short-term yields are under pressure, relevant indicators are expected to improve in fiscal year 2027 as Bitcoin prices recover. The report also emphasized that Strategy continued to increase its investment during the recent Bitcoin price correction, and most of the funds raised were directly used to purchase Bitcoin, indicating that its strategic goals remain unchanged. Overall, analysts remain relatively positive about the long-term value of Strategy as a "Bitcoin exposure tool," and believe that some of its preferred shares are attractive in terms of returns and capital appreciation. Regarding index inclusion, MSCI has not yet removed Bitcoin reserve companies from its index system, which is seen as a positive factor in the short term, but uncertainty remains in the medium to long term.

Arthur Hayes also stated that his core trading strategy for this quarter is to go long on Strategy (MSTR) and Metaplanet (3350), using them as leveraged instruments to bet on BTC returning to an uptrend.

Market Outlook: Structural Changes and Conditions for a Rebound

In summary, the crypto market is at a critical juncture, and whether the traditional "four-year cycle" is still valid will likely be revealed in the coming months.

In its latest review of the digital asset over-the-counter market, crypto market maker Wintermute analyzed that in 2025, Bitcoin did not exhibit the strong characteristics expected in a typical four-year cycle, while the Altcoin cycle almost disappeared. Wintermute views this phenomenon not as short-term fluctuations or a misalignment of rhythm, but as a deeper structural change.

Given this premise, Wintermute believes that for a truly strong rebound to occur in 2026, the triggering conditions will be significantly more stringent than in previous cycles, and will no longer rely on a single variable. Specifically, at least one of the following three outcomes needs to be verified.

First, the allocation scope of ETFs and Crypto Treasury (DAT) companies must expand beyond Bitcoin and Ethereum. Currently, US spot BTC and ETH ETFs objectively concentrate a large amount of new liquidity on a few large-cap assets. While this improves the stability of top assets, it also significantly compresses market breadth, leading to severe divergence in overall performance. Only when more crypto assets are included in ETF products or corporate balance sheets can the market regain broader participation and a stronger liquidity base.

Secondly, core assets such as BTC, ETH, BNB, and SOL need to experience another sustained and strong upward trend to recreate a sufficiently significant wealth effect. In 2025, the traditional transmission mechanism of "Bitcoin rise - funds spreading to Altcoin" essentially failed. The average upward cycle of Altcoin was compressed to about 20 days (compared to about 60 days the previous year), and many tokens continued to weaken under the pressure of unlocking and selling. Without the sustained upward movement of leading assets, it is difficult for funds to generate downward momentum, and the altcoin market will naturally be difficult to activate.

Third, and most decisively, retail investor attention needs to genuinely return to the crypto market. While retail investors haven't completely left, their new funds are currently flowing more towards high-growth themes such as the S&P 500, AI, robotics, and quantum computing. The extreme drawdowns, platform bankruptcies, and forced liquidations of 2022-2023, coupled with the reality that crypto assets will generally underperform traditional stocks in 2025, have significantly weakened the appeal of the "crypto = get rich quick" narrative. Only when retail investors regain faith in the crypto market's potential for excess returns and return in a large-scale manner can the market regain the highly emotional, almost frenzied upward momentum of the past.

In other words, given that structural changes have already occurred, the question of whether a rebound will occur is no longer "whether it will happen," but rather "under what conditions and through what path it will be reignited."