Smart Cashtags may seem like a tag upgrade, but it is actually an important step for X in trying to transform "attention" into "financial infrastructure".

Article author: 0xArthur

Article source: ME News

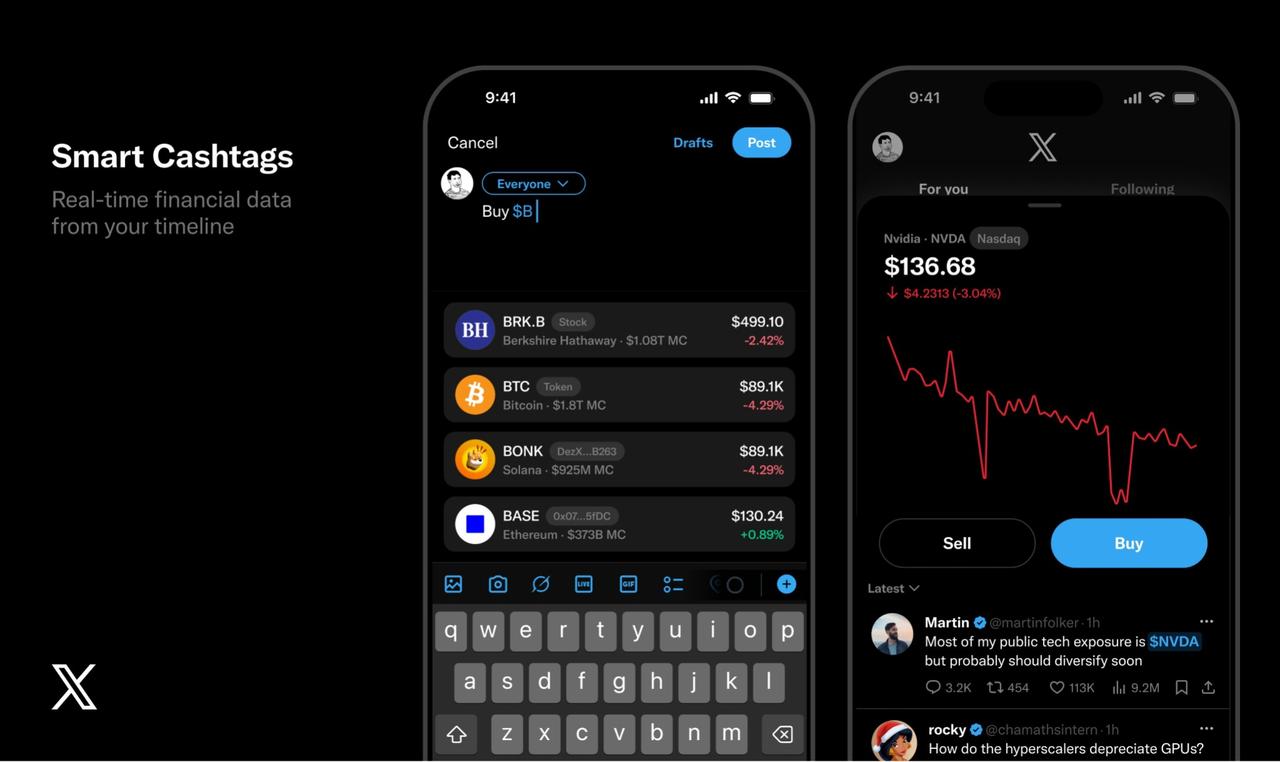

In mid-January, the keyword that sparked a wave of discussion on X (formerly Twitter) in the crypto and finance circles was "Smart Cashtags". The key to this feature is not just adding a new tag, but its attempt to bring together three things that have long been scattered across external websites, market data tools, and community discussions— precise asset targeting, real-time price data, and the aggregation of discussions surrounding assets —back into X's information flow system.

According to official statements from the product level, Nikita Bier, the product manager of X, said that the platform is building "Smart Cashtags," which aims to allow users to clearly point to specific assets or smart contracts when publishing token codes such as $BTC and $ETH, rather than using vague symbolic references. At the same time, users can directly click on the tag in the timeline to view the real-time price of the corresponding asset and related discussions aggregated within the platform .

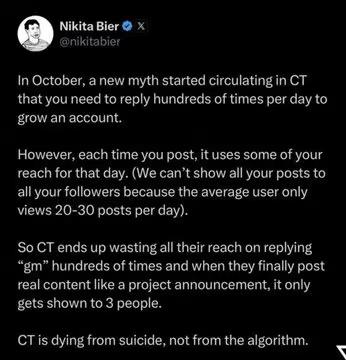

The rapid spread of this news is closely related to its timing. Just the day before the announcement of Smart Cashtags, Bier posted a message that was subsequently deleted, which some in the crypto community interpreted as a possible restriction on high-frequency interaction or replies, thereby weakening the high-density discussion atmosphere that "Crypto Twitter" has long relied on. Although X did not directly link the two events, the close timing led many users to view Smart Cashtags as a positive signal from the platform to the crypto community.

I. What exactly has Smart Cashtags changed?

The limitations of traditional cashtags on social media platforms are very clear.

On the one hand, the same code name may correspond to stocks, crypto assets, or even tokens with the same name on different chains, leading to long-standing symbolic ambiguity; on the other hand, a cash tag is more of a redirection point, and users still need to frequently leave the platform if they want to verify prices, contracts, or market discussions.

The core upgrade of Smart Cashtags lies in transforming cashtags from "text symbols" into "asset objects." Based on currently disclosed information, when users enter the $ symbol, the system may prompt them to select a specific asset or contract; after being published, the cashtag will be linked to a specific asset page, directly displaying the real-time price within the X timeline and aggregating discussion content related to that asset.

This design addresses at least two high-frequency pain points in the context of encryption.

Firstly, there's the "contract-level targeting." Bier explicitly mentioned that Smart Cashtags can identify not only tokens but also smart contracts. This is particularly crucial for DeFi, Meme tokens, and scenarios with a large number of assets sharing the same name, because "same name but different contracts" is a significant source of misinterpretation and misjudgment in the crypto market.

Secondly, there is the "structured binding of discussions with assets." When opinions, comments, and reposts are uniformly categorized under asset objects, users will experience significantly reduced search costs when trying to understand market consensus, and the degree of information fragmentation is also expected to decrease.

2. Does this mean "in-app transactions"?

The most sensitive question in the market is: Does Smart Cashtags mean that X is moving towards "in-app transactions"?

Based on currently available information, this issue still requires careful consideration. Multiple media outlets have pointed out that the "Buy / Sell" button appeared in the Smart Cashtags product preview screenshot shared by Bier, sparking speculation that X may be exploring in-app crypto trading. However, as of now, X has not disclosed any specific trading mechanisms, including whether it integrates with third-party exchanges, how it handles compliance and regional restrictions, and other key issues.

Therefore, a more prudent statement would be: Smart Cashtags significantly reduces the friction costs of going from "seeing assets" to "understanding assets" in terms of information presentation. Whether this will be further extended to trading functions remains to be clarified by subsequent product and regulatory authorities.

III. From Function to Strategy: How to Structure "Emotional Signals"?

From a broader perspective, the significance of Smart Cashtags goes beyond simply optimizing the product experience.

For a long time, X has played a highly unique role in the crypto and macro finance fields: it is neither a market data terminal nor a trading platform, but rather the starting point for the formation of a large amount of market sentiment, narratives, and consensus. As Bier stated in his post, "A large number of financial decisions are based on the information that users read on X."

The potential value of Smart Cashtags lies in making these "emotional and attention assets" more aggregateable, searchable, and easier to productize. Placing real-time prices and discussion content on the same interface essentially strengthens X's position in the "information-emotion-decision" chain.

For the crypto market, this could have three main impacts:

First, it reduces symbolic noise. The information confusion caused by assets with the same name and misused codes is expected to be partially alleviated by the asset-aware cashtag mechanism.

Secondly, it improves research and tracking efficiency. The systematic aggregation of discussions surrounding assets helps in analyzing market attention and sentiment shifts.

Third, it paves the way for subsequent financial services. Even if transactions are not involved yet, payment, wallet, and account systems still require more sophisticated asset identification and display capabilities, and Smart Cashtags completes this foundational work at the information level.

IV. Why did this step attract so much attention from the crypto community?

The popularity of Smart Cashtags cannot be explained by a single function, but is the result of multiple factors.

On the one hand, the crypto community is highly sensitive to the reach and quality of content on platforms; any policy changes that affect the efficiency of discussions will be quickly amplified and interpreted. On the other hand, X's continuous efforts in recent years to advance its payment license, wallet products, and "Everything App" narrative have led the market to view Smart Cashtags as part of a financialization path rather than an isolated update.

In this context, even changes to the "information layer" can easily be interpreted as a prelude to a larger strategy.

Conclusion: What should we focus on next?

If Smart Cashtags is rolled out to a wider range of users as planned in the near future, what is truly worth tracking is not the interface changes themselves, but rather the three key issues behind them: the accuracy of asset and smart contract identification in scenarios involving tokens with the same name and cross-chain operations; how the platform will address the risks of inflated trading volume, manipulation, and commercial content amplification after assets are aggregated into asset objects; and whether clearer signals regarding transaction or payment integration will be gradually released, including partner disclosures, regional restrictions, and compliance pathways.

Before these issues are fully clarified, it is reasonable to position Smart Cashtags as "an important step in the financialization of X," but it is still too early to equate it directly with "X becoming a trading platform."

More importantly, the changes brought about by Smart Cashtags go beyond mere functionality. If the previous X was the most concentrated amplifier of market sentiment, then the emergence of this feature means that this amplifier has begun to have structure. When prices, asset objects, and discussions are unified into a single information interface, information is no longer simply forwarded rapidly, but is continuously accumulated, compared, and verified. For a crypto market that heavily relies on narrative and emotion-driven factors, this adjustment in information structure often has a more lasting impact than the trading button itself.

Smart Cashtags is not the end point, but rather a key starting point for X to reshape the relationship between information flow and capital flow on the path of financialization.