The crypto market just experienced an unprecedented wave of project crashes in 2025, with over 11.6 million Token being defunct in a single year, according to new data from CoinGecko.

This figure accounts for 86.3% of all failed Token recorded since 2021, making 2025 the most "devastating" year for Token survival in the history of the cryptocurrency industry.

The number of new Token has surged—while the survival rate has decreased, according to a report from CoinGecko.

CoinGecko data ( XEM details ) points to structural problems in the Token Economy, due to the explosion of new projects, the proliferation of meme coins, and an increasingly volatile market.

In total, 53.2% of the cryptocurrencies tracked on GeckoTerminal are now inactive. Notably, the majority of these failed Token have appeared in the last two years.

53.2% of all cryptocurrencies have "died" since 2021. Source: CoinGecko

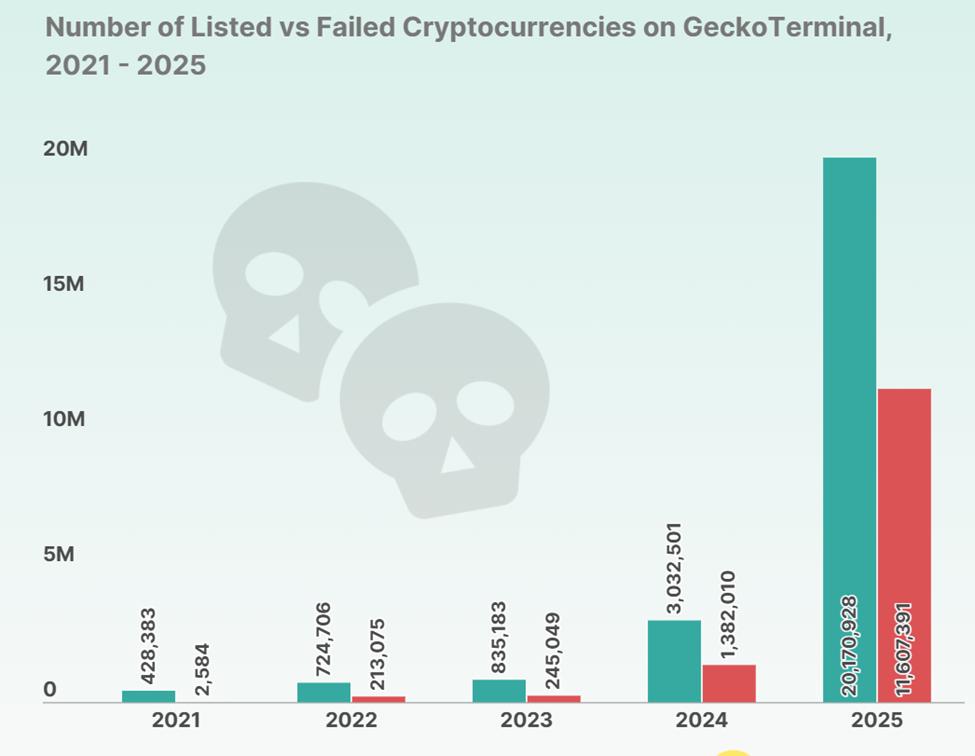

53.2% of all cryptocurrencies have "died" since 2021. Source: CoinGeckoBetween 2021 and 2025, the number of listed crypto projects surged from 428,383 to nearly 20.2 million. This rapid growth demonstrates the increasing accessibility of Token creation tools , but it also brings with it growing oversupply and market saturation.

The number of failed Token each year shows a huge amount of variation. In 2021, there were only 2,584 failed Token . By 2022, this number had jumped to 213,075, and in 2023 it reached 245,049.

The situation escalated sharply in 2024 with 1,382,010 Token "disappearing". However, 2025 broke all previous records with a staggering 11,564,909 Token failing to materialize.

The years 2024 and 2025 alone account for over 96% of all crypto Token that have been "killed off" since 2021, clearly reflecting how recent market conditions have drastically changed the survival rate of Token.

CoinGecko's statistical methodology focuses only on cryptocurrencies that were previously traded and listed on GeckoTerminal before becoming inactive.

Token with no transactions will not be counted, and only Token graduating from Pump.fun will be included, to ensure the transparency of the dataset.

Q4/2025 marks a turning point amidst the saturation of meme coins and the challenges facing "Crime SZN".

The wave of crashes intensified in the final months of the year. In Q4 2025 alone, 7.7 million Token failed, equivalent to 34.9% of the total number of crashes recorded over the past five years.

This wave coincided with the massive liquidation event on October 10th . At that time, $19 billion in leveraged positions were wiped out in just 24 hours, becoming the largest single day of leverage reduction in crypto history.

This shock exposed the weaknesses of many types of thinly liquidation Token , in many cases:

- Insufficient liquidation or

- No investor is "tough" enough to withstand such massive market fluctuations.

CoinGecko also noted that the sharp decline in viability was most evident in the meme coin segment – where the number of projects surged last year.

The trend of easy Token creation platforms has contributed significantly to this wave of failures. Platforms like Pump.fun have made Token creation incredibly simple and fast, allowing almost anyone to launch a Token in just a few minutes.

While this allows anyone to experiment with ideas, it has also flooded the market with poorly executed projects lacking long-term development strategies.

Andrei Grachev of DWF Labs calls this a "crime season," reflecting systemic pressure on both founders and investors.

His opinion suggests that the entire crypto market is entering a consolidation phase, with money increasingly flowing into Bitcoin, established assets, and short-term speculative trading. This makes it very difficult for new projects to attract sustainable Capital .

The fact that the majority of failures occurred in 2025 has raised serious concerns about the long-term "health" of Token creation operations.

While innovation remains crucial in the crypto industry, data suggests the market's resilience to the influx of new projects has been pushed to its limit.

As millions of Token disappear, retail investor confidence continues to decline, market liquidation becomes more limited, and the requirements for each new project wanting to launch become more stringent.

Why could the Token failure cycle extend until 2026?

Meanwhile, the factors leading to a 2025 “crypto catastrophe” show no signs of abating. Token creation remains extremely easy, liquidation from retail investors is dispersed, and market attention is still focused on Bitcoin , leading cryptocurrencies, and short-term speculation.

Data from CoinGecko shows that the supply of Token is increasing much faster than the market's absorption capacity. By the end of 2025, nearly 20.2 million projects had been listed. If launchpads continue to release Token at this rate, the risk of projects failing in 2026 will increase, especially if market demand and liquidation do not recover.

Market-pressuring events remain a major weakness. The massive liquidation on October 10th wiped out $19 billion in leveraged positions in just 24 hours, demonstrating how major shocks can quickly spread across the market, especially to liquidation assets.

Token lacking deep liquidation or a loyal user community were the most severely affected, suggesting that further volatility could lead to the collapse of many similar projects.

Andrei Grachev, managing partner of DWF Labs, warned that the current environment is indeed unfriendly to new projects, even calling it a “ liquidation battle” across the crypto market.

As retail investor Capital flows decrease and competition intensifies, new Token will face numerous hurdles to survival. Without changes in Token distribution at launch, disclosure standards, or increased investor awareness, the market risks repeating the old cycle: mass issuance, short-term speculation, and subsequent collapse.

Although many in the industry believe this cleanup will ultimately weed out weak projects and strengthen the crypto market, the actual data suggests that the correction is unlikely to end anytime soon.

If the rate of new Token creation continues to outpace liquidation growth, the number of launched projects may decrease in 2026, but the number of failed projects may not necessarily decrease.