BlackRock-led fund concentration: $100 million in Bitcoin and $164 million in Ethereum

The U.S. spot virtual asset exchange-traded fund (ETF) market saw a net inflow of over $268 million (KRW 395.032 billion) the previous day. ETFs managed by BlackRock led the inflow.

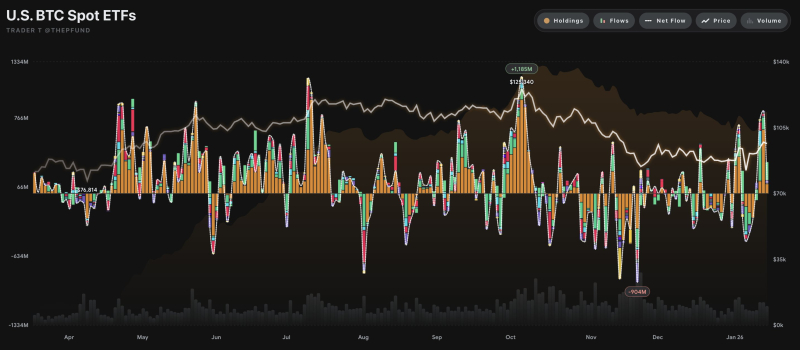

Bitcoin ETF sees net inflows of $104.08 million

The US spot Bitcoin ETF recorded a net inflow of $104.08 million (KRW 153.41392 billion) on the 15th.

By product, BlackRock's IBIT attracted the most funds, at $319.7 million (KRW 471.2538 billion). Grayscale Mini Bitcoin Trust (BTC) and Valkyrie's BRRR recorded $6.74 million (KRW 9.93076 billion) and $2.96 million (KRW 4.36304 billion), respectively.

On the other hand, Fidelity's FBTC recorded a net outflow of $188.89 million (KRW 278.38786 billion), and Grayscale's GBTC recorded a net outflow of $36.43 million (KRW 53.71782 billion).

Bitwise (BITB), Ark Investments (ARKB), Invesco (BTCO), Franklin (EZBC), VanEck (HODL), and WisdomTree (BTCW) saw no movement of funds.

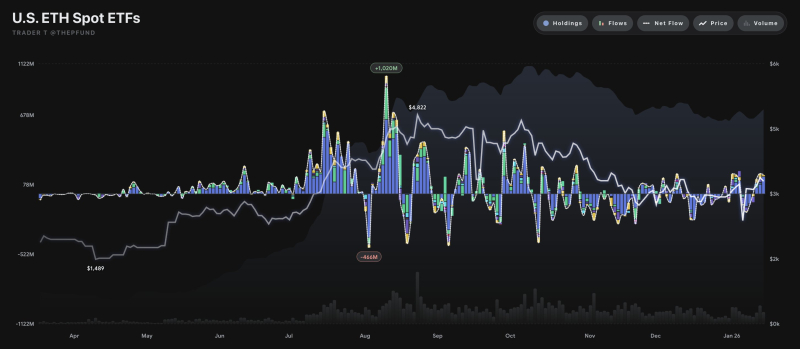

Ethereum ETFs see net inflows of $164.32 million.

The US spot Ethereum ETF saw a net inflow of $164.32 million (KRW 242.24768 billion) on the same day, outpacing the Bitcoin ETF.

BlackRock's ETHA recorded an overwhelming inflow of $149.11 million (KRW 219.82 billion), while Grayscale Mini Ethereum Trust (ETH) saw a net inflow of $15.21 million (KRW 22.419 billion).

The remaining products, including Fidelity (FETH), Bitwise (ETHW), 21Shares (CETH), Invesco (QETH), Franklin (EZET), VanEck (ETHV), and Grayscale (ETHE), saw no change in funds.

BlackRock solidifies its monopoly

The most striking feature of the day's fund flow was BlackRock's overwhelming dominance. BlackRock products alone, including Bitcoin and Ethereum ETFs, saw an inflow of $468.81 million (KRW 691.07394 billion), accounting for 175% of total net inflows.

Meanwhile, Grayscale, which led the early Bitcoin ETF market, is experiencing continued fund outflows from its existing products and is only attracting some funds through its low-fee mini-trust products.

Market experts predict that capital inflow into the ETF market will continue as institutional investors' preference for cryptocurrency investments increases.

Joohoon Choi joohoon@blockstreet.co.kr