Author: Prathik Desai

Original title: The CLARITY Paradox: When clearer rules cloud competition

Compiled and edited by: BitpushNews

Historically, money has rarely been neutral; it inherently possesses the property of appreciating in value . Long before the advent of modern banking, people expected that holding or lending money should bring returns.

In the third millennium BC, ancient Mesopotamia already had the practice of charging interest on silver loans. From the fifth century BC onwards, ancient Greece used maritime loans to finance high-risk maritime trade.

In this system, lenders provided cargo financing for merchants on a single voyage, bearing all losses if the ship sank, but demanding high interest rates (usually 22%-30%) if the ship successfully returned. In Rome, interest was deeply embedded in economic life, often triggering debt crises, making voluntary debt relief a political necessity.

Throughout these systems, one idea remains consistent: money is not merely a passive store of value. Holding money without receiving compensation is the exception. Even with the advent of modern finance, this view of the nature of money has been further reinforced. Bank deposits can earn interest for depositors. It is generally accepted that money that cannot appreciate in value will gradually lose its economic value.

It is against this backdrop that stablecoins have entered the financial system. Stripped of their blockchain veneer, they share almost nothing in common with any cryptocurrency or speculative asset. They bill themselves as digital dollars, adapting to a blockchain world that eliminates geographical boundaries and saves costs. Stablecoins promise faster settlements, lower friction, and 24/7 availability.

However, US law seeks to prohibit stablecoin issuers from paying returns (or interest) to holders.

This is why the CLARITY Act , currently under consideration in the U.S. Congress, has become such a highly controversial piece of legislation. Combined with its sister bill , the GENIUS Act, which was passed in July 2025, the CLARITY Act prohibits stablecoin issuers from paying interest to holders but allows for "activity-based rewards."

This prompted strong opposition from the banking industry to the current form of the draft legislation. Some amendments, lobbied by the banking industry, aim to completely eliminate stablecoin rewards.

In today's in-depth analysis, I will tell you why the current form of the CLARITY Act may impact the crypto industry, and why this has led to significant discontent within the industry regarding the proposed legislation.

Now let's get down to business...

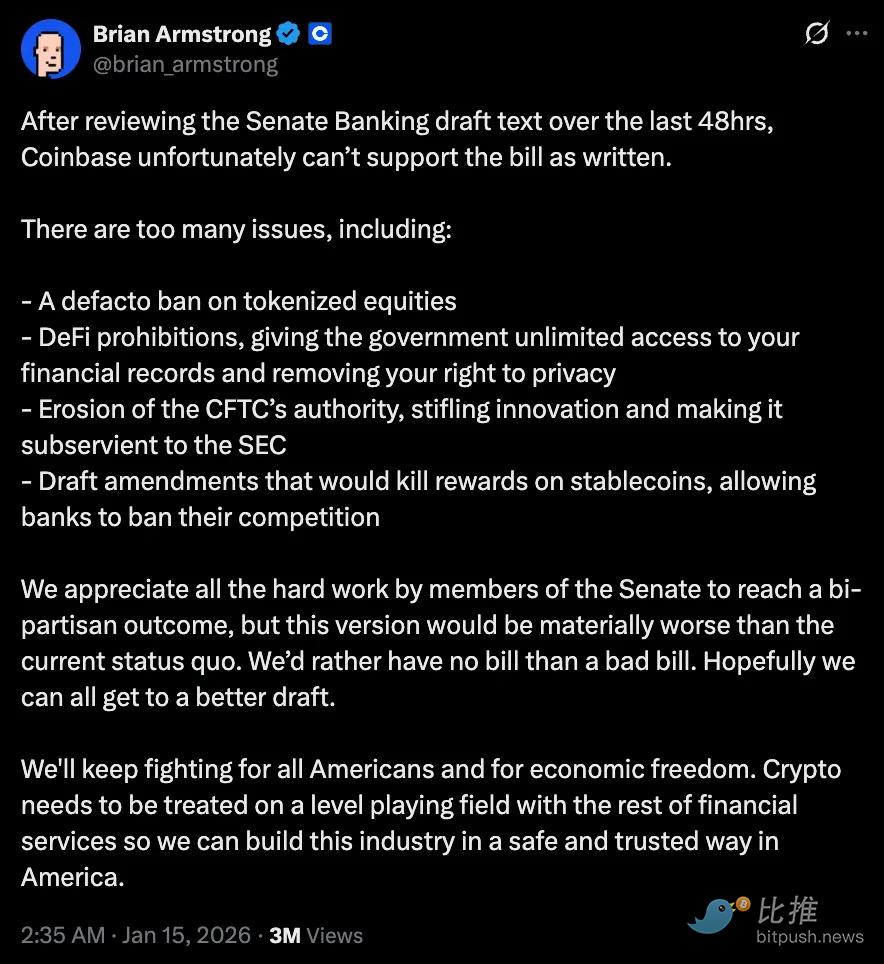

Within 48 hours of reviewing the Senate Banking Committee's draft bill, Coinbase publicly withdrew its support.

“We would rather have no bill than a bad one,” CEO Brian Armstrong tweeted, adding that he believes the proposal, which claims to provide regulatory clarity, will make the current state of the industry worse than it is now.

Just hours after the largest publicly traded crypto company in the U.S. withdrew its support, the Senate Banking Committee postponed its review session—which was supposed to discuss amendments to the bill.

The core objection to the bill cannot be ignored. The bill aims to treat stablecoins purely as a means of payment, rather than any form of monetary equivalent. This is the key point of contention, enough to unsettle anyone hoping that stablecoins will fundamentally change the way payments are made.

This version of the bill reduces stablecoins to mere conduits rather than assets that can be used to optimize capital. As I described earlier, money has never worked this way. By prohibiting interest at the underlying level and banning activity-based rewards for stablecoins, the bill restricts stablecoins from achieving yield optimization, which is precisely what they claim to excel at.

This is precisely where concerns about competition arise. If banks are allowed to pay interest on deposits and offer rewards for debit/credit card use, why prohibit stablecoin issuers from doing the same? This tilts the competitive landscape in favor of existing financial institutions and undermines many of the long-term benefits promised by stablecoins.

Brian's criticisms extend beyond stablecoin yields and rewards; they also touch upon how the bill does more harm than good. He also points out the problems with the decentralized finance ban.

@brian_armstrong

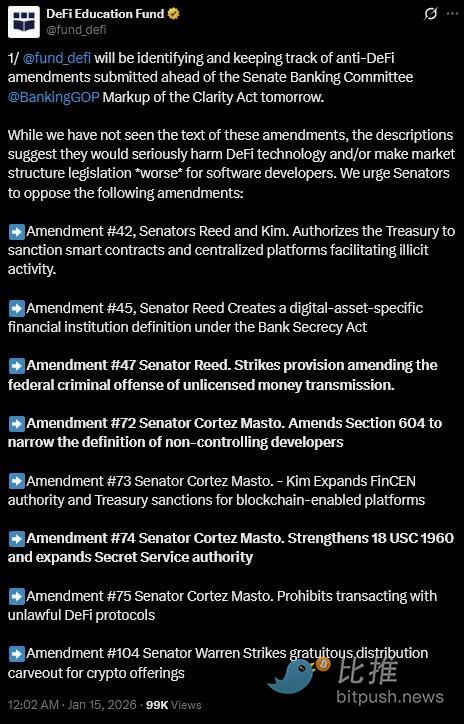

The DeFi Education Foundation, a DeFi policy and advocacy organization, has also urged senators to oppose legislative amendment proposals that appear to be “anti-DeFi.”

“While we haven’t seen the text of these amendments yet, their descriptions suggest they will severely harm DeFi technology and/or make market structure legislation more disadvantageous to software developers,” the organization wrote on X.

@fund_defi

While the Clarity Act formally recognizes decentralization, its definition is narrow. Protocols under "common control" or that retain the ability to modify rules or restrict transactions risk being subject to banking-style compliance obligations.

Regulation aims to introduce scrutiny and accountability. However, decentralization is not static. It is a dynamic spectrum that requires evolving governance and contingency controls to provide resilience, not dominance. These rigid definitions introduce additional uncertainty for developers and users.

Secondly, there is a significant gap between promises and policy in the tokenization space. Tokenized stocks and funds offer faster settlement, lower counterparty risk, and more continuous price discovery. Ultimately, they enable more efficient markets by compressing clearing cycles and reducing capital tied up in post-trade processes.

However, the current draft of the CLARITY Act leaves tokenized securities in a regulatory vacuum. While its wording does not explicitly prohibit them, it introduces considerable uncertainty regarding the custody of tokenized shares.

If stablecoins are confined to the payment sector, and tokenized assets are restricted in their issuance, then the path to a more efficient capital market will be significantly narrowed .

Some argue that stablecoins can function as payment instruments, with yields offered through tokenized money market funds, DeFi vaults, or traditional banks. This isn't technically wrong. However, there will always be market participants seeking more efficient ways to optimize capital. Innovation drives the discovery of workarounds. Often, these workarounds involve transferring capital overseas. Sometimes, these transfers can be opaque, and regulators may later regret not anticipating such capital outflows.

However, one argument stands out above all others as the primary reason for opposing the bill. It is difficult not to believe that the current form of the bill structurally strengthens banks, diminishes prospects for innovation, and stifles industries that could have helped optimize our current markets.

Worse still, it may achieve this at two very high costs. First, the bill kills any hope of healthy competition between the banking and crypto industries, while allowing banks to profit even more. Second, it leaves customers at the mercy of these banks, preventing them from optimizing their returns in a regulated market.

These are high costs, which is why critics are reluctant to offer support.

Worryingly, the bill is packaged as an effort to protect consumers, provide regulatory certainty, and bring encryption into the system, while its provisions subtly suggest the opposite.

These provisions predetermine which parts of the financial system are allowed to compete for value. While banks can continue to operate within familiar boundaries, stablecoin issuers will feel compelled to exist and operate within a narrower economic framework.

But money doesn't like to remain passive. It flows toward efficiency . History shows that whenever capital is constrained in one channel, it always finds another. Ironically, this is precisely what the regulation is designed to prevent.

To the benefit of the crypto industry, the disagreements over the bill are not limited to the crypto space.

The bill still lacks sufficient support in Congress. Some Democrats are unwilling to vote in favor without deliberating and considering certain proposed amendments. Without their support, the bill cannot move forward, even if it ignores the crypto industry's opposition and dismisses it as noise. Even if all 53 Republicans vote in favor of the bill, at least seven Democrats are needed in the full Senate for it to pass with an absolute majority and overcome obstruction.

I don't expect the U.S. to pass a bill that satisfies everyone. I even think it's impossible and undesirable. The problem is that the U.S. isn't just regulating a new class of assets, but trying to legislate for a form of currency whose inherent properties make it highly competitive. This makes it more difficult because it forces lawmakers to face competition and draft provisions that may challenge existing institutions (in this case, banks).

The impulse to tighten definitions, restrict licensing, and maintain existing structures is understandable. However, this risks turning regulation into a defensive tool that excludes rather than attracts capital.

Therefore, the criticisms of the Clarity Act must be understood correctly—they are not against regulation itself. If the goal is to truly integrate crypto assets into the financial system, rather than simply isolating them, then the rules the United States needs to establish should allow new currencies to compete, experiment, and evolve within clearly defined regulatory boundaries. This, in turn, will force traditional financial institutions to improve their competitiveness.

Ultimately, legislation that harms what it is supposed to protect is worse than no legislation at all.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush