New research cited by The Wall Street Journal shows that US tariffs are quietly having a negative impact on the domestic economy. This partly explains why the crypto market has struggled and has failed to rebound since the sell-off in October.

A study by the Kiel Institute for World Economy (Germany) indicates that, with tariffs applied from January 2024 to November 2025, up to 96% of the tariff costs will be borne by US consumers and importing businesses, while foreign exporters will only bear 4%.

Nearly $200 billion in tariffs have been paid almost entirely into the US economy.

Tariffs are becoming similar to domestic consumption taxes.

This study refutes a popular political argument that "tariffs are paid by foreign producers." In reality, it is the US importing businesses that pay the tariffs at the port of entry, and they either bear this cost themselves or pass it on to the end consumer.

Most foreign exporters kept prices unchanged. They simply sold less to the US or redirected their products to other markets. As a result, trade volume decreased, but import prices did not become cheaper.

Economists liken this impact to a kind of consumption tax that gradually increases over time. Prices don't surge dramatically; instead, the increased costs gradually spread through the supply chain and to consumers.

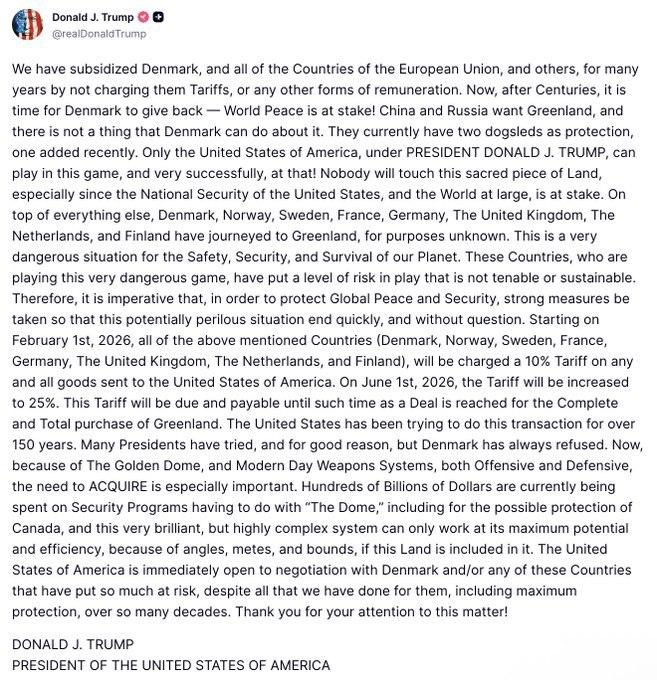

Former US President Trump imposed new tariffs on several European countries for opposing his proposed purchase of Greenland. Source: Truth Social

Former US President Trump imposed new tariffs on several European countries for opposing his proposed purchase of Greenland. Source: Truth SocialUS inflation remains stable, but pressure is mounting.

Inflation rates in the US have generally remained fairly stable throughout 2025, leading many to believe that tariffs will not have a significant impact .

However, according to studies cited by the WSJ, only about 20% of tariff costs are reflected in retail prices after six months. The rest is silently borne by importers and retailers, reducing business profits.

This delay helps explain why inflation hasn't skyrocketed while people's purchasing power has gradually declined, a fact that few have noticed. In other words, economic pressure has been accumulating instead of erupting immediately.

How this relates to the stagnation of the crypto market.

The crypto market is heavily reliant on idle cash flow. Crypto prices often surge when households and businesses feel confident and willing to Capital in risky assets.

Tariffs have quietly drained this money flow. Consumers have to spend more, and businesses bear additional costs. As a result, there is less idle cash, and investment in speculative assets like crypto is also restricted.

This is why, even though crypto prices didn't fall sharply after October, there was no new upward momentum either. The market entered a liquidation stagnation phase , not a bear market.

The October price drop wiped out much of the leveraged debt and slowed the inflow of Capital into ETFs. Under normal circumstances, when inflation falls, risk appetite would return sooner.

But in reality, tariffs have quietly kept financial conditions tight. Inflation remains above target, and the Federal Reserve continues to maintain a cautious stance. Liquidation has therefore not been loosened.

As a result, crypto prices have been trading sideways for quite some time. There's no panic, but neither is there any catalyst for a long-term uptrend.

In short, the new tariff figures cannot explain the entire volatility of crypto. However, they do explain why the market remains stagnant.

Tariffs have quietly forced a tightening of the financial system, draining idle investment Capital and delaying the return of risk appetite.