Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author and source: 0x9999in1, ME News

The crypto market as a whole showed a fluctuating upward trend, with the RWA sector performing particularly well, rising 2.38% in the last 24 hours. Among them, Sky (SKY) rose 1.90%, Ondo Finance (ONDO) rose 2.74%, and Pendle (PENDLE) rose 5.52%. Meanwhile, Bitcoin (BTC) and Ethereum (ETH) both traded in a narrow range, at $92,000 and $3,200 respectively.

In other sectors, the AI sector rose 2.06% in the last 24 hours, with Kite (KITE) up 7.79%; the Meme sector rose 1.80%, with MemeCore (M) up 3.61%; the PayFi sector rose 1.30%, with Safe (SAFE) up 4.27%; the Layer 1 sector rose 0.97%, with Cosmos Hub (ATOM) up 4.10%; the CeFi sector rose 0.83%, with Binance Coin (BNB) up 1.69%; the DeFi sector rose 0.75%, with River (RIVER) continuing its upward trend at 15.72%; and the Layer 2 sector rose 0.47%, with SOON (SOON) up 10.83%.

In addition, the NFT sector fell 0.22%, and the SocialFi sector fell 1.61%.

BTC Directional Data

According to CoinFound data, 192 listed companies currently hold a total of 1,144,067 BTC, accounting for 5.75% of the total Bitcoin supply. Among them, Strategy Inc (MSTR) holds 687,410 BTC, accounting for 60.1% of the total holdings of listed companies.

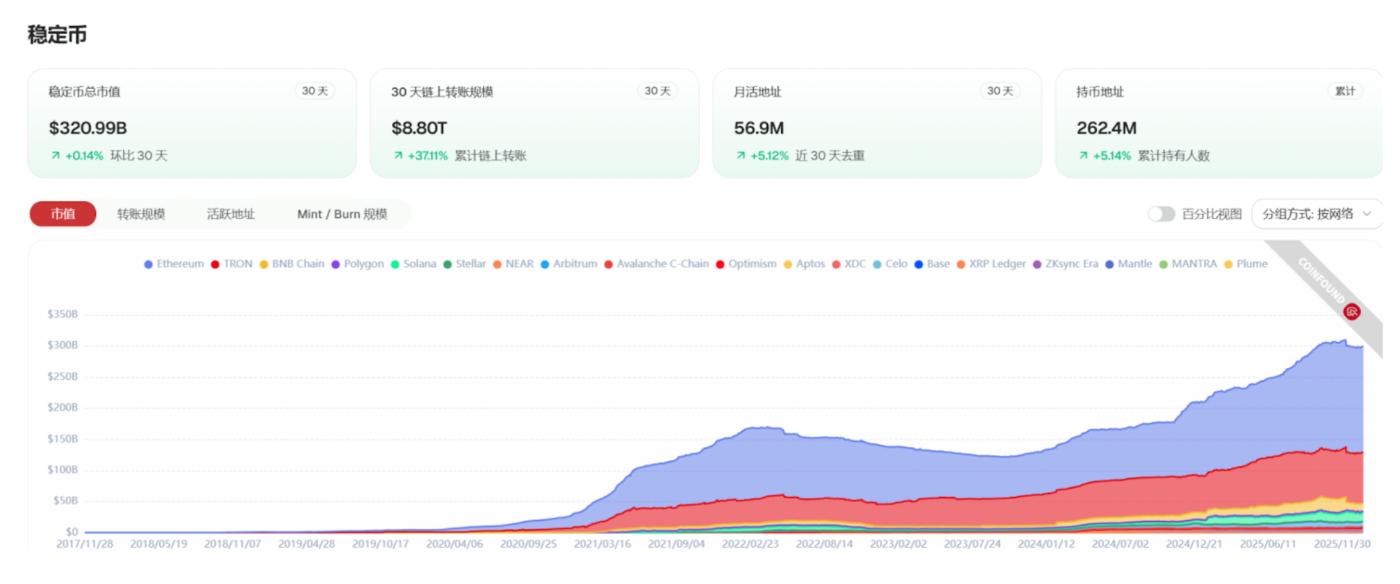

Stablecoin data

According to CoinFound data:

USDT market capitalization: US$199.11 billion

USDC market capitalization: $76.54 billion

USDS market capitalization: $11.05 billion

USDe market capitalization: $6.54 billion

PYUSD Market Cap: $3.77 billion

USD1 Market Cap: $3.44 billion

Market Dynamics:

RWAX launched 30 minutes ago: the platform has issued 20+ assets, covering various RWA assets including energy, mining, funds, and real estate.

Trump's inaugural address and expectations for the "digital dollar" strategy

Davos Forum: Circle Releases White Paper on "Global Economic Operating System"

Coinbase plans to launch a custom stablecoin that would allow businesses to issue digital dollars backed 1:1.

PayPal (PYUSD) announces testing of integration with the "confidential transfer" feature on the Solana network.

Summarize:

The market's focus has shifted from the legislative deadlock in Congress (the delay of the CLARITY Act) to expectations regarding the implementation of the new administration's "digital dollar strategy".

RWA Directional Data

According to CoinFound data:

Commodity market capitalization: $4.48 billion

Market value of government bonds: US$1.37 billion

Market capitalization of institutional funds: US$2.67 billion

Private lending market capitalization: $29.01 billion

Market value of US Treasury bonds: $9.33 billion

Market value of corporate bonds: US$260 million

Market capitalization of tokenized stocks: $620 million

Market Dynamics:

The New York Stock Exchange announced that it is developing a tokenized securities platform.

Tether has partnered with digital asset exchange Bitqik to promote stablecoin education in Laos.

BlackRock BUIDL establishes its status as "on-chain collateral".

Asseto Finance launches tokenized fixed-income product BOND+

Summarize:

The overall market size remained robust, and substantial progress was made in institutional strategic shifts and the financialization of underlying assets.