Over the past year, gold has left little room for doubters.

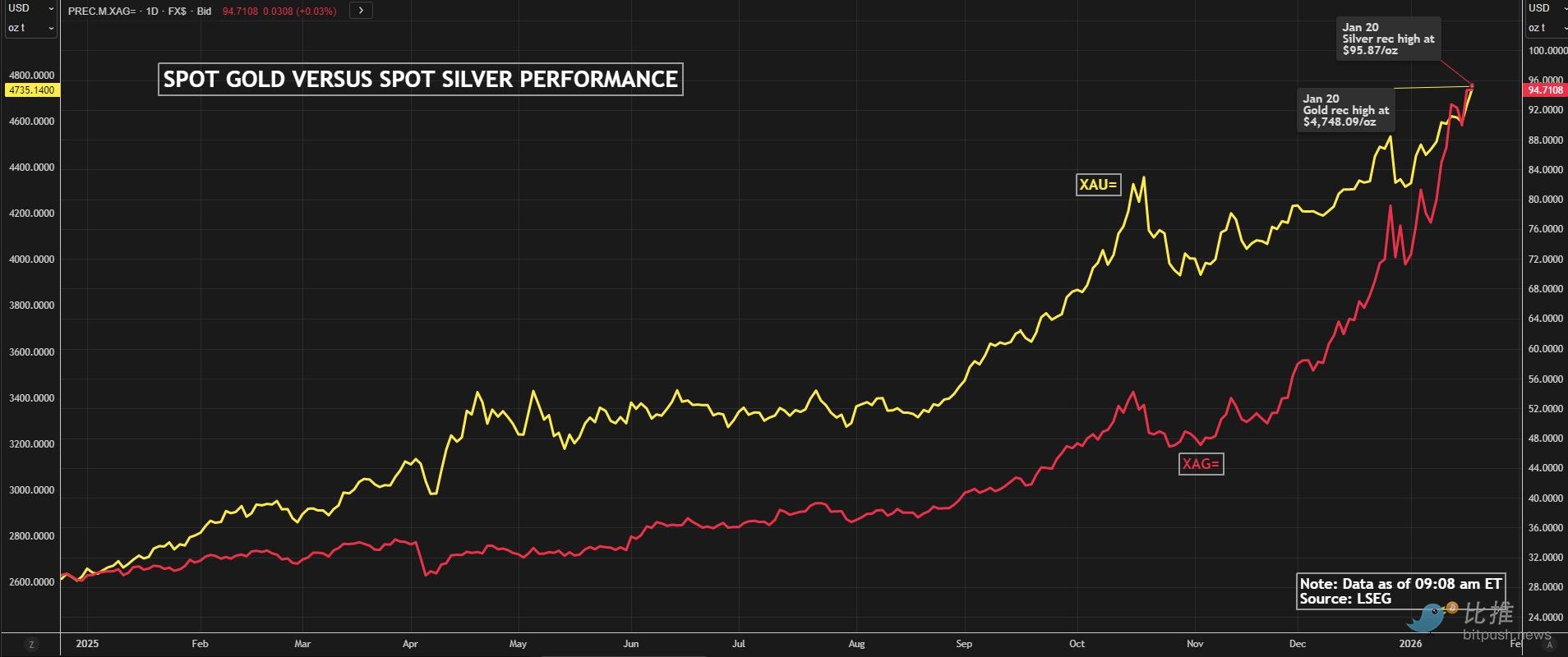

In less than 12 months, gold prices have surged by nearly 70%, marking one of the strongest annual performances in almost half a century. Repeated geopolitical conflicts, the lingering shadow of tariffs and trade frictions, a temporary weakening of the US dollar, and bets on future interest rate cuts have all contributed to pushing gold back to the center of global asset allocation.

Gold is not a new answer when both institutional and retail investors are looking for safe-haven assets.

The truly noteworthy change has occurred in the "property management" of gold exposure .

In traditional markets, funds are flowing into gold ETFs; while in the crypto market, a previously inconspicuous corner is rapidly heating up – tokenized gold.

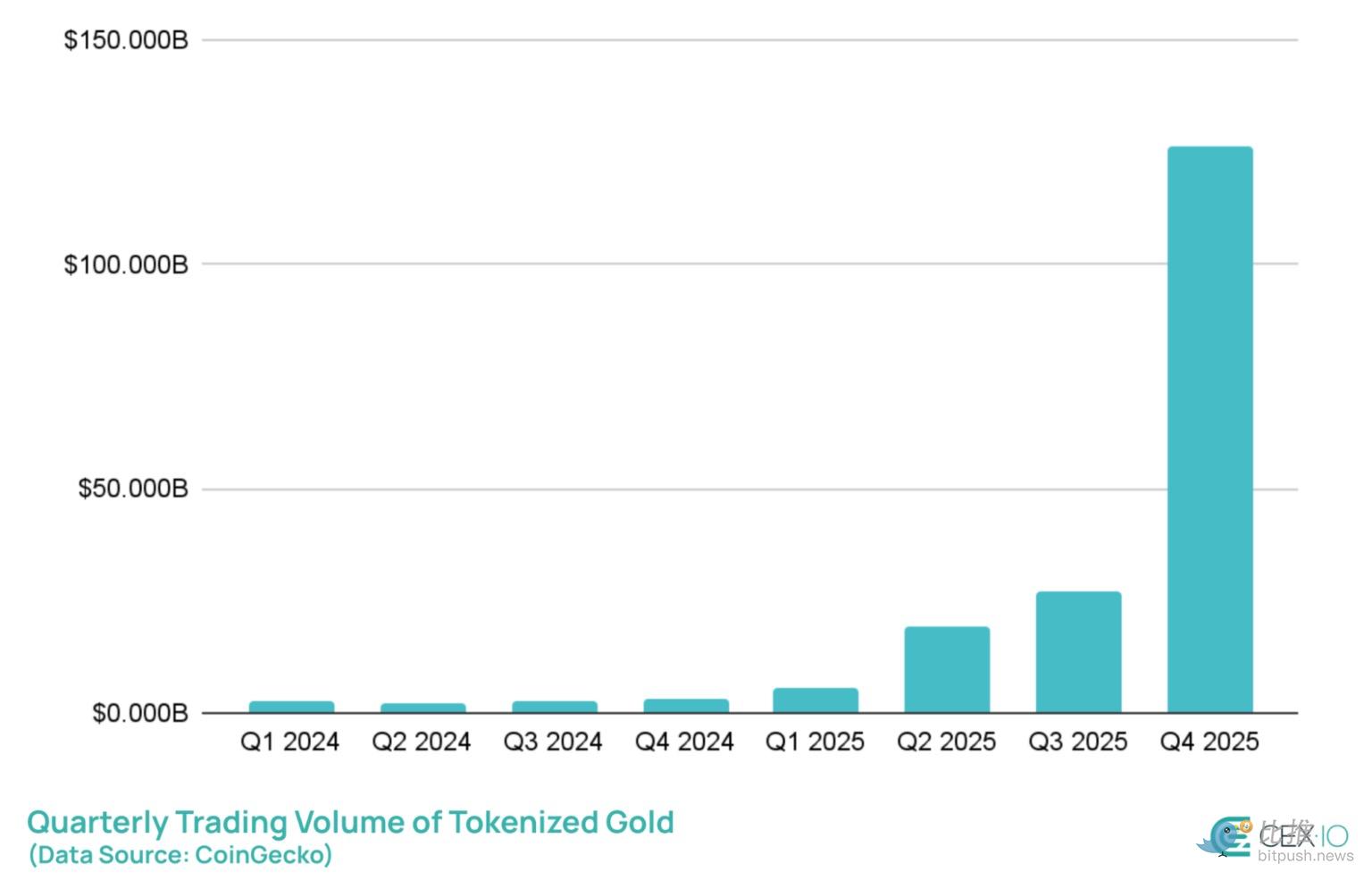

According to a research report by crypto exchage CEX.io, tokenized gold trading volume experienced explosive growth in 2025, with a total annual trading volume of approximately $178 billion. The trading volume in the fourth quarter alone exceeded $120 billion, surpassing the trading volume of most traditional gold ETFs .

This isn't just a price story; it's a story of usage intensity . In other words:

The rise in gold prices has not led to a "rediscovery" of tokenized gold, but rather has made the market realize that gold can be used more frequently and efficiently in the on-chain world.

What happens on the blockchain from "holding" to "using"?

If we only look at market capitalization, tokenized gold is still a relatively small market.

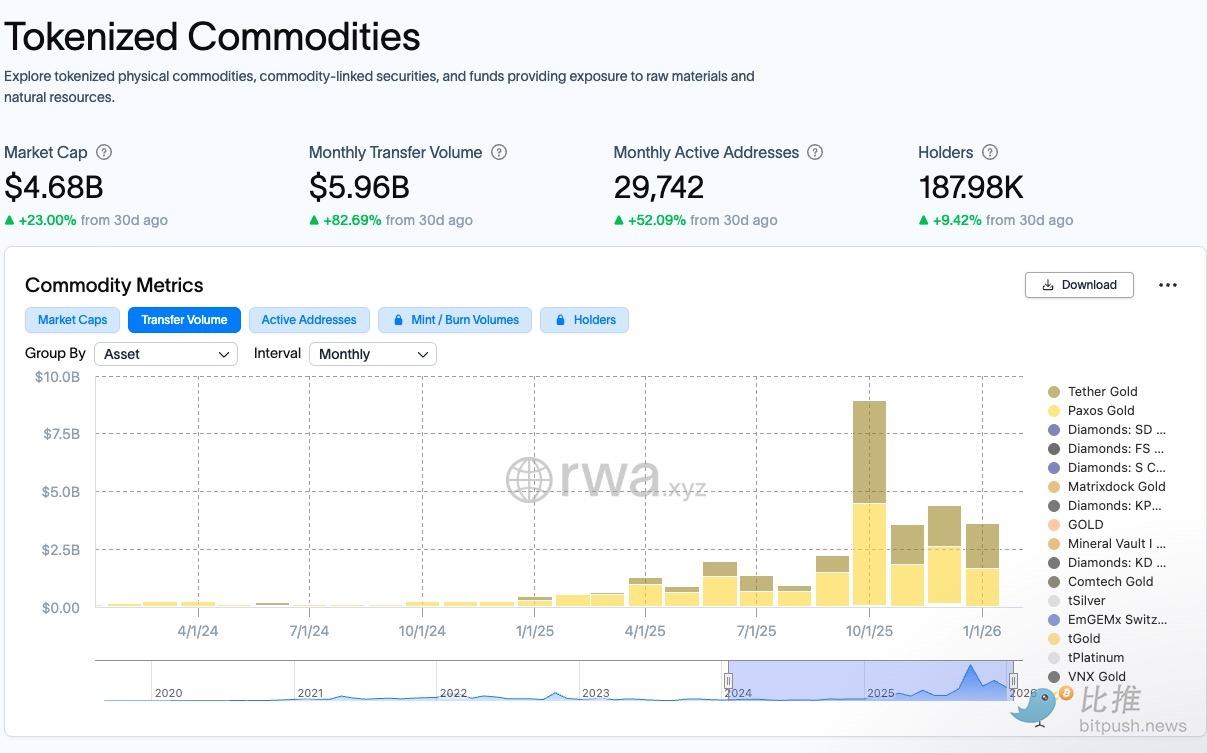

As of January 2026, the total market capitalization of tokenized commodities (mainly gold) was approximately $4.5 billion, negligible compared to the global gold market. However, if you focus on on-chain behavior , the conclusion will be entirely different.

According to the latest statistics from RWA.xyz, on-chain activity in the tokenized goods sector has accelerated significantly over the past 30 days: monthly transaction volume reached approximately $5.96 billion, a month-over-month increase of 82.69%, significantly faster than the market capitalization increase of 23%. Meanwhile, the number of monthly active addresses increased by 52.09%, while the number of holders only increased by 9.42%.

This is a very typical signal. The difference in slope between these indicators suggests that this round of growth is not primarily driven by the expansion of the holder base, but rather by the increase in participation depth and usage frequency. In other words, the market is not simply "attracting more people to hold," but rather existing and new participants are using tokenized commodities more frequently to complete transactions and portfolio adjustments, resulting in a significant increase in asset turnover.

In the traditional financial system, gold is a "low-frequency asset"; but on the blockchain, it begins to exhibit a relatively "high-frequency" attribute.

To understand this round of changes, we cannot simply look for reasons in the adoption of encryption.

The macroeconomic environment at the beginning of 2026 was in an extremely delicate position:

On the one hand, the narrative of declining inflation and AI boosting productivity continues; on the other hand, geopolitical frictions have not eased, the absolute security status of the US dollar has been repeatedly discussed, and US stock valuations have long been in historical extremes.

This is not the time to "completely eliminate risk," but rather a phase where people are unwilling to leave the market but must hedge their bets .

In traditional markets, funds can be hedged through futures, ETFs, and structured products; however, in the crypto market, if you don't want to completely convert back to fiat currency, the options are actually quite limited.

Stablecoins can avoid volatility, but they lack directionality;

Bitcoin has a long-term narrative, but short-term volatility remains high.

Tokenized gold falls somewhere in between.

It inherits the safe-haven properties of gold while also possessing the characteristics of on-chain assets that are tradable, combinable, and capable of rapid portfolio adjustments 24/7. This is not "narrative innovation," but rather a functional complement .

A highly concentrated market

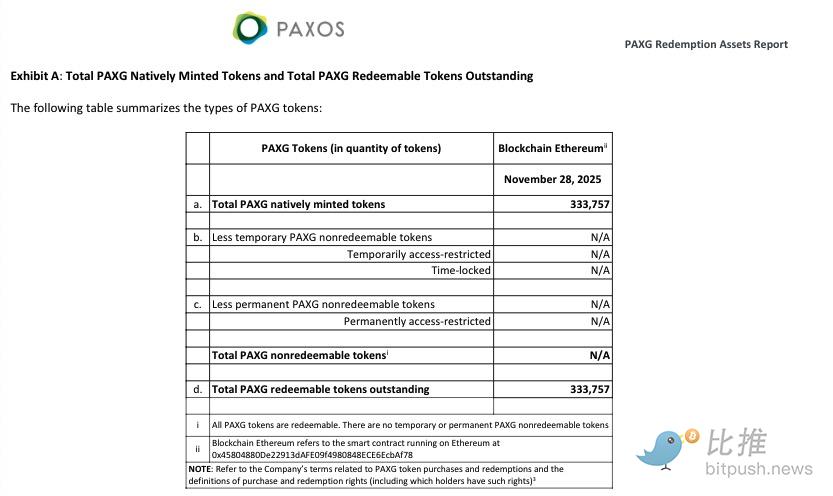

When we zoom out, we find that the tokenized gold market is almost monopolized by two names: XAUt and PAXG.

This is not the typical "winner-takes-all" scenario in the crypto world, but rather a result imposed by the real world.

Unlike ordinary tokens, the underlying assets of tokenized gold are not on-chain. Where the gold bars are stored, who holds them, whether they comply with LBMA standards, how they are audited, and under what conditions they can be redeemed—none of these questions can be answered by smart contracts.

This is why the market naturally tends to concentrate liquidity in a few issuers.

It's not because they are "more decentralized," but because they are more verifiable in the real world.

PAXG is issued by the regulated Paxos Trust Company, with gold custody in accordance with the standards of the London Bullion Market Association, and provides regular reserves and redemption instructions; XAUt, on the other hand, relies on Tether 's issuance and distribution system to quickly establish its scale and liquidity advantages.

This difference will be further amplified as the frequency of transactions increases.

High-frequency use requires depth, depth requires consensus, and consensus ultimately points to a path of trust and compliance.

This is why, during the surge in trading volume over the past year, liquidity did not disperse but instead became more concentrated at the top .

Who is buying on-chain gold? This is not a simple story of retail investors seeking safe haven.

If we only consider the word "safe haven," it's easy to simply attribute the demand for tokenized gold to retail investor sentiment. However, from the perspective of on-chain structure and product attributes, the composition of participants in this market is actually more complex than imagined.

First, tokenized gold has indeed attracted some macro-sensitive funds. These funds don't necessarily intend to completely exit the crypto market, but rather are looking for an asset that can significantly reduce portfolio volatility while remaining on-chain during periods of increased uncertainty. For them, tokenized gold is more like a risk management tool than a directional bet.

Meanwhile, another significant force comes from trading and portfolio rebalancing funds. As the on-chain usage of tokenized gold increases significantly, it is gradually being used as an "intermediate asset" between stablecoins and highly volatile assets for position switching, hedging, and liquidity management. This demand explains why the growth in transaction volume and activity has significantly outpaced the expansion of the number of holders.

However, ignoring the role of retail investors is equally incomplete. Unlike many tokenized assets that are restricted to qualified investors, gold tokens are characterized by low barriers to entry, divisibility, and no minimum investment. This allows individual investors to gain exposure to gold with minimal capital, without the account, quota, or geographical limitations of the traditional financial system.

This structural advantage makes tokenized gold particularly attractive in emerging markets. In some regions, gold-related financial products are not readily available or are costly; on-chain gold offers an alternative with virtually no barriers to entry. The retail demand here reflects not short-term speculation, but rather a natural demand for allocating assets to gold as a traditional asset, driven by improved accessibility.

Tokenized gold ≠ zero risk

It must be made clear that tokenized gold is not a risk-free asset.

Its risk lies not in the price, but in the counterparty and the institutional structure .

All anchors must ultimately be realized through real-world custody, legal, and redemption chains, which can be impacted by regulatory, sanction, or operational disruptions in extreme circumstances.

Furthermore, even for top-tier assets, liquidity remains limited compared to the global gold market. In the event of a systemic shock, their anchor stability could still be under pressure.

This is why tokenized gold is better understood as an asset with a different form of risk , rather than an "absolutely safe asset."

Prior to this, the crypto market had virtually no truly meaningful "in-system hedging tools".

Now, for the first time, the market has an asset class that can buffer and hedge risks without exiting the system.

When Bitcoin corrects, stablecoins increase in size, and the trading activity of tokenized gold amplifies simultaneously, this divergence itself becomes a new risk thermometer.

In conclusion

Gold itself hasn't changed; what has changed is how this era requires it.

When Bridgewater's Ray Dalio warned that Trump's policies could trigger a "capital war" and shake confidence in dollar assets, the market had already voted with its feet, and gold was becoming the most direct expression of this game of expectations.

This consensus is rapidly forming. UBS strategists recently put it more bluntly: if market concerns about the Federal Reserve's independence persist, gold prices could challenge $5,000 in the first half of this year. Silver and copper, among other metals, are also being repriced along with gold in their respective supply and demand narratives.

In an era where uncertainty persists yet people are unwilling to completely withdraw, the market will ultimately choose the tools that minimize friction, ease of use, and cost of explanation.

And on-chain gold stands right at the crossroads of this story.

Author: seed.eth

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush