From freshly minted vaults to $1B incentives, the DeFi yield ecosystem is overflowing with opportunities

𝘎𝘳𝘦𝘢𝘵 𝘰𝘱𝘱𝘰𝘳𝘵𝘶𝘯𝘪𝘵𝘪𝘦𝘴, 𝘥𝘰𝘶𝘣𝘭𝘦-𝘥𝘪𝘨𝘪𝘵 𝘈𝘗𝘠𝘴/𝘈𝘗𝘙𝘴, 𝘢𝘯𝘥 𝘧𝘳𝘦𝘴𝘩 𝘷𝘢𝘶𝘭𝘵𝘴 𝘢𝘤𝘳𝘰𝘴𝘴 𝘉𝘢𝘴𝘦, 𝘗𝘭𝘢𝘴𝘮𝘢, 𝘢𝘯𝘥 𝘌𝘵𝘩𝘦𝘳𝘦𝘶𝘮.

Lets have a look 🧵👇

------------------------------

➢ @Ledger introduced a new BTC yield feature enabling users to access yield on Bitcoin via @Lombard_Finance’s LBTC through Ledger’s interface and Figment infrastructure.

This adds a non‑ETH yield product into a major self‑custody wallet, expanding how retail users can earn yield on BTC.

------------------------------

➢ @pendle_fi announced an upgrade to its native token called sPENDLE, designed to boost liquidity depth and integrate better with broader DeFi markets.

This upgrade reflects a strategic shift toward more scalable and diversified yield derivative products, improving Pendle’s position in the on‑chain yield and interest‑rate segment.

------------------------------

➢A flash loan attack hit the @makinafi DUSD/USDC pool, draining roughly $5 million by manipulating the pool’s oracle price. The team is investigating and has advised LPs to withdraw funds

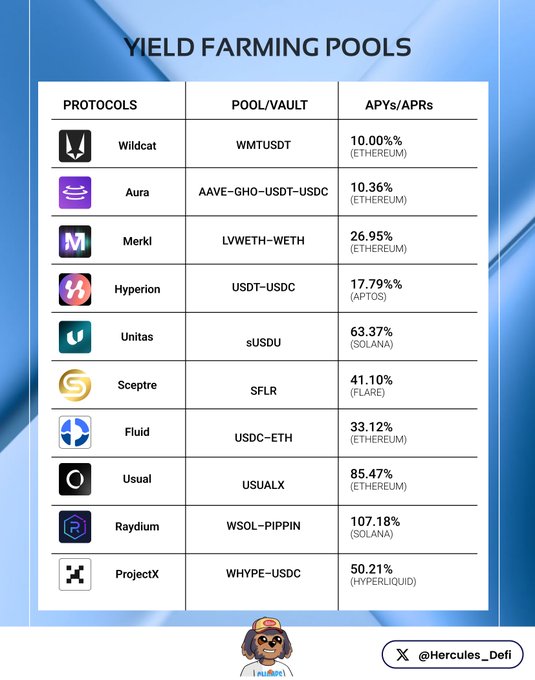

𝐘𝐢𝐞𝐥𝐝 𝐅𝐚𝐫𝐦𝐢𝐧𝐠 𝐏𝐨𝐨𝐥𝐬

➢ WMTUSDT

DApp: @WildcatFi

Chain: Ethereum

APY: 10.00% (current), 10.02% (30-day avg)

TVL: $30.25M

Pool/Vault type: Uncollateralized Lending

➢ AAVE–GHO–USDT–USDC

DApp: @AuraFinance ( @Balancer v2 & @aave V3 )

Chain: Ethereum

APY: 10.36% (current), 9.69% (30-day avg)

TVL: $27.37M

Pool/Vault type: Yield Strategy

➢ LVWETH–WETH

DApp: @merkl_xyz

Chain: Ethereum

APY: 26.95% (current), 32.97% (30-day avg)

TVL: $25.95M

Pool/Vault type: High-Yield ETH Lending

➢ USDT–USDC

DApp: @hyperion_xyz

Chain: Aptos

APY: 17.79% (current), 17.54% (30-day avg)

TVL: $24.52M

Pool/Vault type: DEX Liquidity

➢ sUSDU

DApp: @UnitasLabs

Chain: Solana

APY: 63.37% (current), 15.11% (30-day avg)

TVL: $22.17M

Pool/Vault type: Basis Trading

➢ SFLR

DApp: @SceptreLS

Chain: Flare

APY: 41.10% (current), 41.10% (30-day avg)

TVL: $21.05M

Pool/Vault type: Liquid staking

➢ USDC–ETH

DApp: @0xfluid DEX

Chain: Ethereum

APY: 33.12% (current), 18.95% (30-day avg)

TVL: $17.23M

Pool/Vault type: DEX Liquidity

➢ USUALX

DApp: @usualmoney

Chain: Ethereum

APY: 85.47% (current), 91.93% (30-day avg)

TVL: $15.31M

Pool/Vault type: RWA / Locked Yield

➢ WSOL–PIPPIN

DApp: @Raydium AMM

Chain: Solana

APY: 107.18% (current), 76.55% (30-day avg)

TVL: $11.69M

Pool/Vault type: DEX Liquidity

➢ WETH–cBBTC

DApp: @PancakeSwap

Chain: Base

APY: 37.80% (current), 22.32% (30-day avg)

TVL: $9.06M

Pool/Vault type: DEX Liquidity

➢ WHYPE–USDC

DApp: @prjx_hl

Chain: HyperEVM

APY: 50.21% (current), 23.48% (30-day avg)

TVL: $6.72M

Pool/Vault type: DEX Liquidity

𝘞𝘩𝘪𝘤𝘩 𝘪𝘴 𝘺𝘰𝘶𝘳 𝘧𝘢𝘷𝘰𝘳𝘪𝘵𝘦 𝘱𝘰𝘰𝘭?

Aura still alive ':V

Lots of new watchlist here mate. What's your top 3?

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content