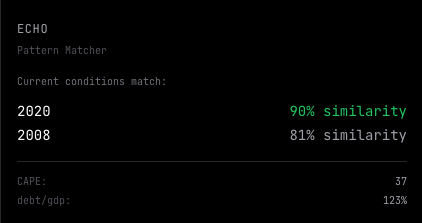

1/ "The fiat monetary order is breaking down" — Ray Dalio, yesterday

So what do you do?

I vibe-coded a Bloomberg terminal that shows what actually worked in every debt crisis since 1933 🧵

2/ Every government debt crisis ends the same way:

PRINT: inflate it away slowly

RESTRUCTURE: reset the system fast

Different speed.

Same result for cash.

Let's look at previous examples.

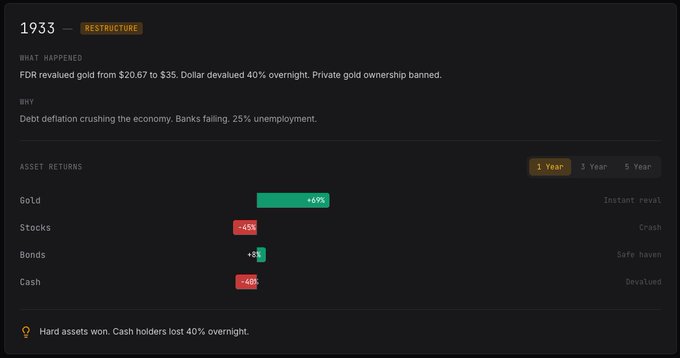

3/ 1933: FDR revalued gold from $20.67 to $35.

CASH

Y1: -40% | Y3: -45% | Y5: -48%

GOLD

Y1: +69% | Y3: +69% | Y5: +69%

STOCKS

Y1: -15% | Y3: +50% | Y5: +105%

Gold jumped once. Cash kept bleeding.

16/ 100 years of data:

1. Cash losses, always

2. Gold wins resets (+175% avg)

3. Stocks recover, but survive Y1 first

4. 5Y returns hide Y1 pain

5. Hard assets win both paths

The fork always comes.

17/ I built a bunch of tools so you can see for yourself.

Historical data. Live signals. Both scenarios.

Position accordingly.

Love this man :)

naly underrated af

Thanks dude! Should check this out:

naly

@defi_naly

01-22

Full analysis: http://naly.dev/research/the-signals-are-flashing…

Also on the site:

> The Money Game - how money actually works

> Decay - your purchasing power, visualized

> Saeculum - the 80-year cycle

> TruValue - price anything in gold, inflation, or housing

All free. All live.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content