- A Prediction Market uses blockchain and financial incentives to convert collective beliefs into real-time, tradable probability signals.

- Outcome tokens, smart contracts, and market pricing enable transparent, trustless forecasting without centralized intermediaries.

- While powerful for price discovery, Prediction Markets still face risks from liquidity limits, regulation, and information asymmetry.

A crypto Prediction Market lets users trade on future event outcomes using blockchain, smart contracts, and market pricing to turn collective expectations into real-time probabilities.

WHAT IS PREDICTION MARKET?

A crypto Prediction Market is a decentralized platform that allows users to trade on the outcomes of future events using blockchain technology. Instead of relying on traditional betting systems or centralized bookmakers, a Prediction Market uses cryptocurrencies, smart contracts, and market-driven pricing to reflect real-time probabilities of specific outcomes.

As the Web3 ecosystem continues to evolve, crypto Prediction Market platforms have become increasingly popular tools for forecasting a wide range of events, including elections, sports competitions, financial indicators, and trends within the cryptocurrency market itself.

📌 How Prediction Markets Harness Collective Intelligence

At its core, a Prediction Market combines financial incentives with collective intelligence. Participants are encouraged to express their expectations by committing capital, not merely opinions. When thousands of users trade based on their individual insights, information, and risk assessments, the resulting market price aggregates these views into a single probability signal.

Rather than counting votes, a Prediction Market weights opinions by conviction and capital at risk. This mechanism allows prices to represent what the market collectively believes is the most likely outcome, making prediction markets a powerful information-discovery tool.

📌 How Prices Represent Probabilities in a Prediction Market

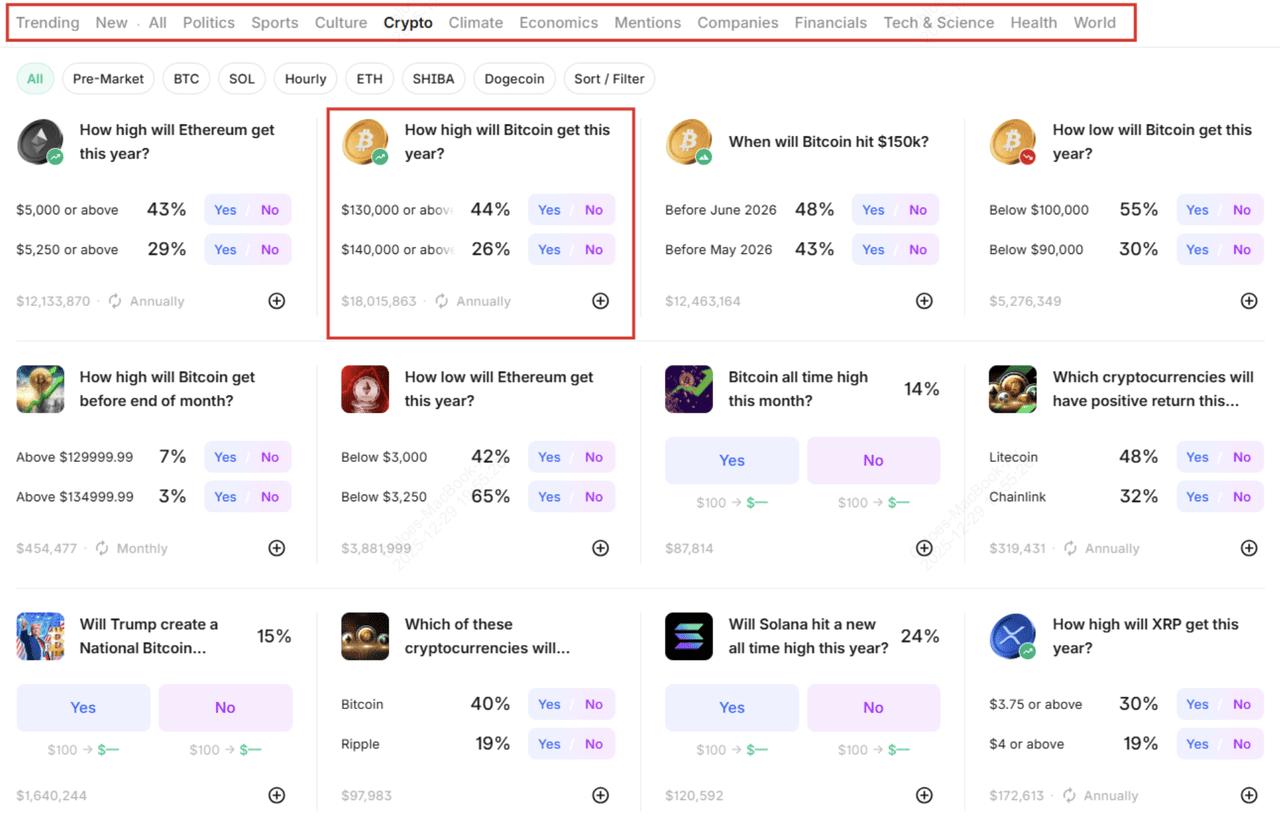

For example, consider a Prediction Market asking: “Will Bitcoin exceed $200,000 in 2026?” This market would typically issue two outcome tokens: “Yes” and “No.”

If the “Yes” token is trading at 0.60, the market is effectively pricing a 60% probability that Bitcoin will surpass $200,000 by that time. This price does not guarantee the outcome—it simply reflects the market’s aggregated expectation based on current information and participant behavior.

This pricing mechanism is what allows a Prediction Market to translate subjective beliefs into quantifiable probabilities.

(source: kalshi.com)

📌 Why Blockchain Is Essential for Prediction Markets

Blockchain technology provides the foundation that makes a crypto Prediction Market transparent, secure, and globally accessible. All transactions are recorded on-chain, smart contracts enforce settlement rules automatically, and users from around the world can participate without relying on trusted intermediaries.

These properties significantly reduce trust assumptions and centralized risks, while increasing market openness and credibility. As a result, crypto Prediction Market platforms are often viewed as one of the most direct Web3 applications for aligning information, capital, and consensus within a single system.

📌 Key Advantages of Crypto Prediction Markets

Crypto Prediction Market platforms offer several distinct advantages over traditional forecasting or betting systems, largely due to their decentralized and incentive-driven design.

▶ Decentralization

A core strength of a crypto Prediction Market is its decentralized structure. There is no central authority controlling the market or managing payouts. All trades, fund custody, and settlements are executed on-chain through smart contracts, ensuring transparency and reducing reliance on trusted intermediaries.

▶ Real-Time Forecasting

In a Prediction Market, prices adjust immediately as new information enters the market. When participants react to news, data releases, or shifting expectations, outcome token prices update in real time. This allows the market to function as a continuously evolving probability signal rather than a static forecast.

▶ Higher Predictive Accuracy

Financial incentives play a critical role in improving accuracy within a Prediction Market. Because participants risk capital on their beliefs, they are motivated to make informed decisions rather than random guesses. Over time, this mechanism helps filter noise and reward well-reasoned predictions.

▶ Global Accessibility

Crypto Prediction Market platforms are accessible to users worldwide. Participation is not restricted by geography, institutional status, or traditional financial infrastructure. As long as users can access the blockchain and hold crypto assets, they can take part—making prediction markets open, inclusive, and globally representative.

>>> More to read: What is Polymarket? Web3 Prediction Market

HOW CRYPTO PREDICTION MARKETS WORK

From a structural perspective, a crypto Prediction Market operates entirely on-chain. Each event is broken down into a set of possible outcomes, and each outcome is represented by a token. Users buy and sell these outcome tokens based on what they believe will happen.

Once the event concludes and the result becomes verifiable, smart contracts automatically handle settlement. Participants holding tokens tied to the correct outcome receive payouts according to predefined rules, without the need for manual intervention or centralized control.

A crypto Prediction Market operates through a combination of outcome tokens, trading mechanisms, smart contracts, and automated settlement. Together, these components allow markets to transform uncertainty into real-time, tradable probabilities.

🪙 Outcome Tokens

In a Prediction Market, each event is divided into multiple possible outcomes, and every outcome is represented by a dedicated token. Users purchase the token corresponding to the result they believe will occur.

If the outcome tied to a token is correct once the event concludes, that token can be redeemed for its full value. Tokens associated with incorrect outcomes become worthless after settlement. This structure ensures that market participants are financially incentivized to price outcomes accurately.

✏️ Trading Mechanisms

Outcome tokens in a Prediction Market can be traded using several common market structures, including:

Regardless of the mechanism, prices continuously adjust based on supply and demand. As traders enter and exit positions, token prices fluctuate in real time—effectively turning the Prediction Market into a live probability indicator for the event in question.

📜 Smart Contracts

Smart contracts form the backbone of every crypto Prediction Market. They handle the creation of markets, the issuance and exchange of outcome tokens, and the final settlement process.

By encoding rules directly into code, smart contracts remove the need for intermediaries and ensure that market operations remain transparent, automated, and trustless. Participants do not need to rely on a central authority to enforce payouts or manage funds.

📈 Market Settlement

When an event concludes, verified data sources are used to determine the final outcome. Once the result is confirmed, smart contracts immediately execute settlement and distribute payouts to holders of the correct outcome tokens.

This automated settlement process ensures speed, accuracy, and fairness—key characteristics that distinguish a blockchain-based Prediction Market from traditional, centralized alternatives.

>>> More to read: What is Kalshi Prediction Market? How Does It Work

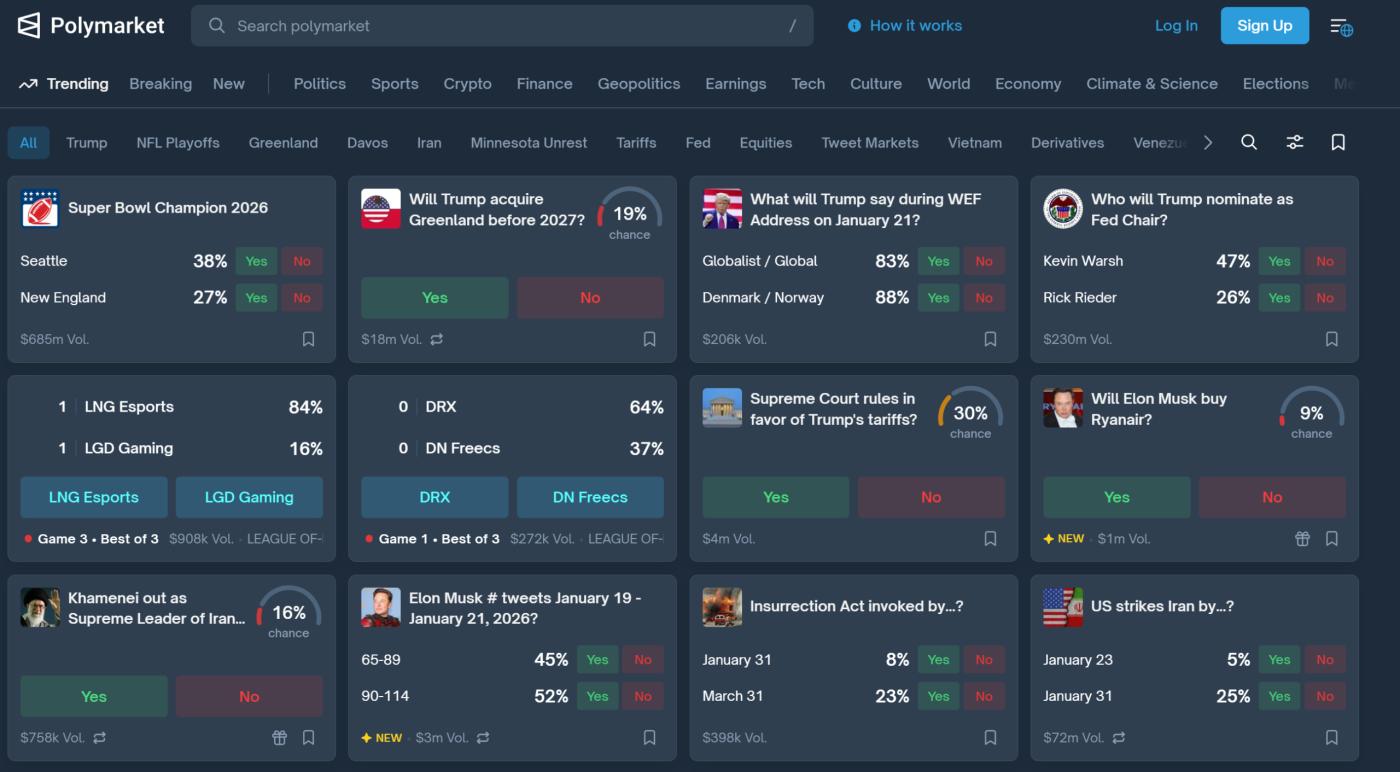

EVENT TYPES TRADED IN CRYPTO PREDICTION MARKETS

A crypto Prediction Market supports a wide range of event categories, allowing users to trade on outcomes across many real-world and digital domains. This diversity is one of the reasons Prediction Market platforms attract both casual participants and professional forecasters.

(source: polymarket.com)

🚩 The most common event types include:

- Elections and political events

- Sports competition outcomes

- Cryptocurrency price movements and broader market trends

- Macroeconomic events

- Celebrity-related and cultural news

- Technology product launches

By covering both high-impact global events and everyday news topics, a Prediction Market offers opportunities for users with different expertise, interests, and risk preferences. This broad event coverage helps maintain active participation and improves the overall quality of market-based predictions.

>>> More to read: What Is a Prediction Market: How Markets Turn Uncertainty Into Usable Knowledge

CRYPTO PREDICTION MARKETS BENEFITS & RISKS

Compared with traditional online betting platforms, blockchain technology introduces meaningful improvements to how a Prediction Market operates, particularly in terms of transparency, efficiency, and security.

✅ Transparent Settlement

In a blockchain-based Prediction Market, smart contracts handle settlement automatically once an outcome is verified. This ensures that results are resolved fairly and immediately, without manual intervention or discretionary decisions from a central operator.

✅ Lower Fees

By eliminating intermediaries, a crypto Prediction Market significantly reduces operational overhead. Fewer middlemen mean lower fees for participants, allowing more value to flow directly between traders rather than being absorbed by platform costs.

✅ Security and Data Integrity

All transactions in a Prediction Market are recorded on-chain, creating a transparent and immutable transaction history. This makes it far more difficult to manipulate outcomes or alter records, strengthening trust in the integrity of the market.

✅ Interoperability

Outcome tokens issued by a Prediction Market are not confined to a single platform. They can be held in wallets, integrated into applications, or even used within DeFi protocols, increasing flexibility and expanding potential use cases beyond simple event settlement.

❗Incorrect Predictions

If a prediction turns out to be wrong, participants will lose the capital committed to that outcome. A Prediction Market rewards accuracy, not participation, and losses are a natural part of the system.

❗Low Liquidity

Smaller or less active Prediction Market events may suffer from limited liquidity. In such cases, prices can be more volatile and potentially more vulnerable to manipulation.

❗Regulatory Uncertainty

The legal status of Prediction Market platforms varies by jurisdiction. In some regions, regulations remain unclear or are still evolving, which may affect platform availability or user access.

❗Smart Contract Vulnerabilities

Participants in a crypto Prediction Market ultimately rely on the security of the underlying code. Bugs or vulnerabilities in smart contracts could lead to unexpected losses or operational issues.

>>> More to read: How does polymarket work: a complete guide to prediction markets

CONCLUSION: THE FUTURE OF PREDICTION MARKETS

A crypto Prediction Market is fundamentally a decentralized system that allows users to trade on the outcomes of future events. By combining market-based incentives with blockchain technology, Prediction Market platforms enable transparent settlement while transforming dispersed opinions into measurable probability signals.

As the Web3 ecosystem continues to evolve, Prediction Market platforms have moved beyond their early experimental phase. They are increasingly becoming an important component of both crypto-native markets and the broader financial landscape. Their ability to reflect expectations in real time gives them a unique role in price discovery and forecasting.

That said, challenges remain. Information asymmetry, the risk of insider behavior, and regulatory uncertainty continue to shape the industry’s development. However, as adoption grows and regulatory frameworks mature, Prediction Market platforms are likely to operate within more structured and balanced market environments.

In the long run, Prediction Market may emerge as one of the most influential applications in the crypto ecosystem—one that most clearly demonstrates how markets can aggregate information, capital, and collective expectations into a single, transparent system.

PREDICTION MARKET FAQ

🔍 What is a prediction market?

A Prediction Market is a market that allows participants to trade on the probability of future events. By taking positions on outcomes that have not yet occurred, participants can profit if their predictions prove correct. Market prices are often interpreted as the collective probability assigned to a specific outcome.

🔍 Why do prediction markets suffer from information asymmetry?

The core mechanism of a Prediction Market relies on participant forecasts, which are influenced by access to information. Some participants may benefit from earlier or more detailed information, allowing them to gain an advantage over others. This dynamic can place less-informed participants at a disadvantage, resulting in information asymmetry within the market.

🔍 How are prediction markets regulated?

The regulatory status of Prediction Market platforms remains unclear and inconsistent across jurisdictions. In some countries, prediction markets are subject to strict financial regulations, while in others they operate in regulatory gray areas with limited oversight. This lack of uniform regulation continues to shape how prediction markets evolve globally.

ꚰ CoinRank x Bitget – Sign up & Trade!

〈What is Crypto Prediction Market? A Beginner’s Guide〉這篇文章最早發佈於《CoinRank》。