Seeker price has staged a sharp post-launch rally. The SKR token is up more than 200% over the past 24 hours and is now trading near $0.041 after briefly tagging highs close to $0.059. The move comes after a large Solana ecosystem airdrop, a setup that usually creates heavy selling pressure.

What makes this rally stand out is not the size of the move, but who absorbed the supply. While airdrop recipients possibly sent large amounts of SKR to exchanges, wallet data shows smart money and whales stepping in aggressively. The result is a rally that looks speculative on the surface, but structurally supported underneath.

Airdrop Selling Hit Exchanges but Failed to Break Structure

The first wave of selling was aggressive.

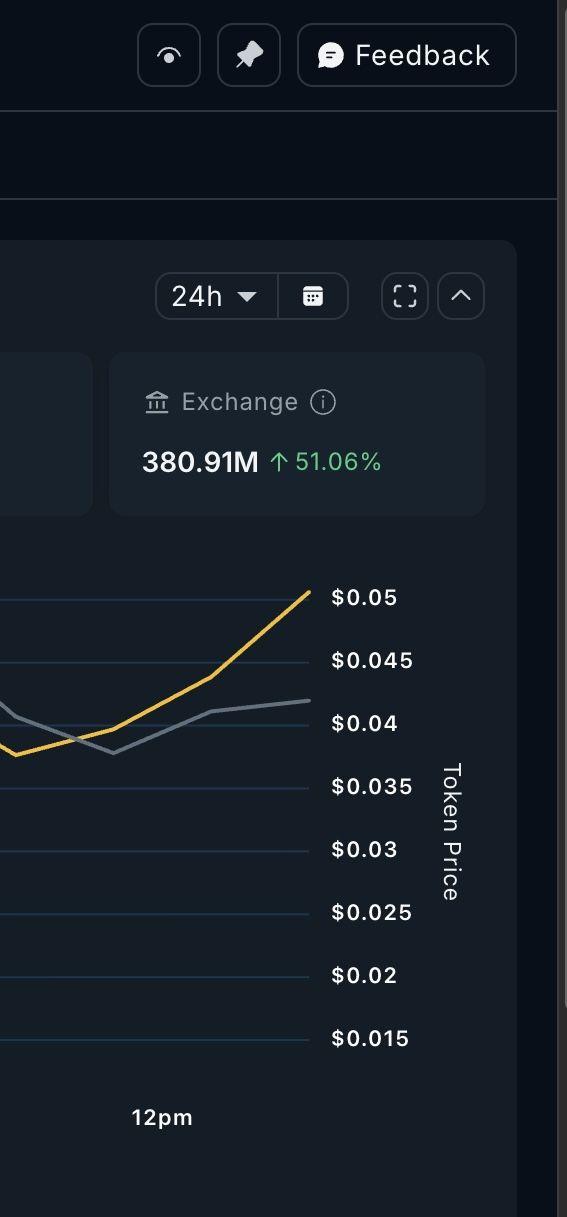

Over the past 24 hours, exchange balances rose by roughly 51%, lifting total exchange-held SKR to about 380.9 million tokens. That implies nearly 129 million SKR moved onto exchanges, likely from airdrop recipients taking quick profits. This selling pressure briefly pushed the price below VWAP on the one-hour chart.

Exchange Selling Spikes: Nansen

Exchange Selling Spikes: NansenWant more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

VWAP stands for Volume Weighted Average Price. It represents the average price traders paid, weighted by volume, and often acts as a short-term fairness level. Losing VWAP usually signals aggressive selling.

But in SKR’s case, that breakdown did not last.

Price quickly reclaimed VWAP, with the 9-period exponential moving average (EMA) holding as support.

An EMA is a trend indicator that gives more weight to recent prices, making it useful for spotting short-term momentum shifts. The 9-period EMA reflects very near-term trader behavior and often acts as the first support in strong, fast-moving trends.

In this case, the 21-period EMA (black line), which represents a deeper short-term trend, was never tested. That showed sellers failed to force deeper weakness. The pullback was absorbed rather than accelerating, signaling controlled profit-taking instead of a trend breakdown.

One-Hour SKR Price Chart: TradingView

One-Hour SKR Price Chart: TradingViewThe question then became: who was buying?

Smart Money and Whales Absorbed More Than Exchanges Sold

Wallet data gives a clear answer.

While exchanges gained about 129 million SKR, non-exchange cohorts accumulated even more. The top 100 addresses (mega whales) added roughly 144 million SKR, raising their total holdings to about 8.3 billion tokens. This single cohort absorbed more supply than exchanges received.

Standard Seeker whale wallets increased holdings by about 25.6 million SKR, pushing their balances to roughly 133.8 million tokens. Smart money wallets added another 2.4 million SKR, a 32.5% increase in that cohort. Even public-facing wallets showed accumulation from a low base.

Massive Buying Pressure: Nansen

Massive Buying Pressure: NansenIn total, non-exchange wallets absorbed around 182 million SKR, outweighing exchange inflows by more than 50 million tokens. That imbalance explains why the VWAP loss failed and why the SKR price stabilized quickly.

In simple terms, airdrop sellers sold into strength, and larger players took the other side.

SKR Price Levels That Decide Whether the Rally Extends

From here, the Seeker price structure matters more than headlines.

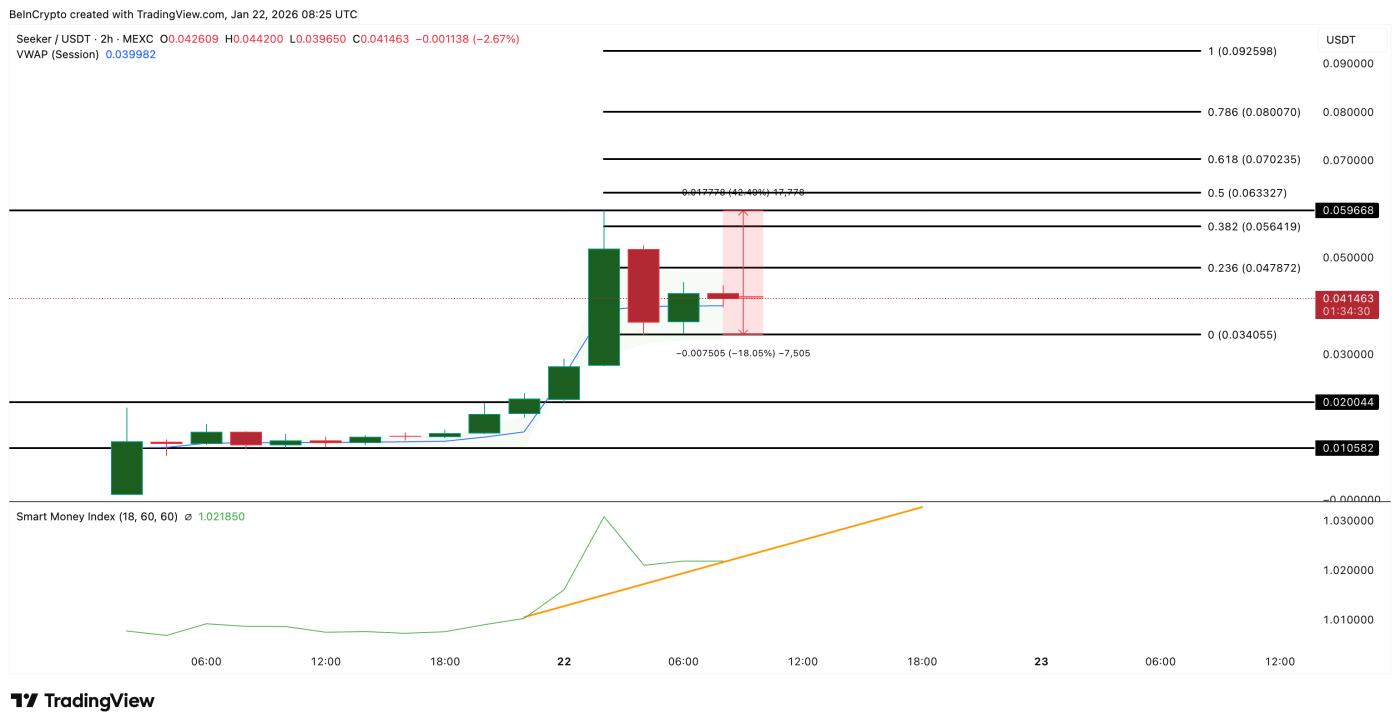

On the two-hour charts, the most important level is VWAP (same as the one-hour chart). As long as the SKR price holds above this level on closing candles, the short-term trend remains constructive.

This is also reflected in the Smart Money Index, which tracks institutional-style positioning using price behavior. The index surged during the rebound and has since flattened rather than turned down. A flat Smart Money Index after a strong rise usually signals consolidation, not rapid selling. That means the smart money buyers we saw earlier might be waiting for a better price point or a better trigger.

If VWAP holds and the Smart Money Index remains stable or resumes rising, SKR price can retest the recent highs near $0.059. A clean break above that level would open price discovery, with $0.080 and $0.092 emerging as upside extension zones.

SKR Price Analysis: TradingView

SKR Price Analysis: TradingViewThe risk case is clear as well. If VWAP fails on the two-hour chart and the Smart Money Index breaks below its current structure, selling pressure could return quickly. In that scenario, $0.034 becomes the first downside level to watch. A deeper loss of confidence would expose $0.020, where early consolidation formed.

For now, the SKR price is holding its ground. Exchange selling has been heavy, but it has been absorbed. As long as smart money behavior stays constructive and VWAP remains defended, this rally looks less like a one-day airdrop spike and more like a move that may still be seeking its next leg higher.