Ethereum's challenge is no longer simply scaling up, but has evolved into finding a dynamic balance point in the Blockchain Trilemma of maintaining decentralization, preserving technological advantages, and strengthening value capture.

Article by: Jae

Article source: MarsBit

2026 marked a magical start for Ethereum. On one hand, it presented a prosperous scene with staking scale, TVL, stablecoin share and other indicators hitting new highs; on the other hand, token prices were severely "decoupled" from the fundamentals of the ecosystem.

Ethereum may be facing a "dammed lake" situation right now. Upstream, it benefits from technological advancements such as native DVT and the Fusaka upgrade, along with a deep asset base. Downstream, it faces concerns about centralization, a failure to capture value, and misallocated market pricing.

The massive staking scale of hundreds of billions cannot mask the risks of centralization; Vitalik intends to counterattack with the DVT scheme.

With record-breaking staking and exits resulting in total liquidation, the Ethereum staking ecosystem has recently delivered a seemingly perfect performance.

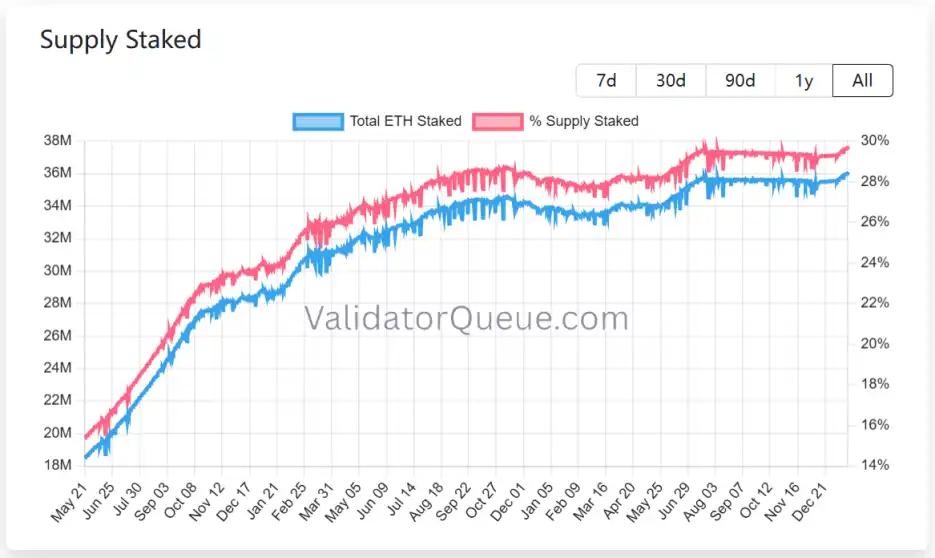

According to data from ValidatorQueue, as of January 22, 2026, the total amount of Ethereum staked reached a record high of nearly $120 billion, with more than 36 million ETH in a staked state, accounting for about 30% of the circulating supply.

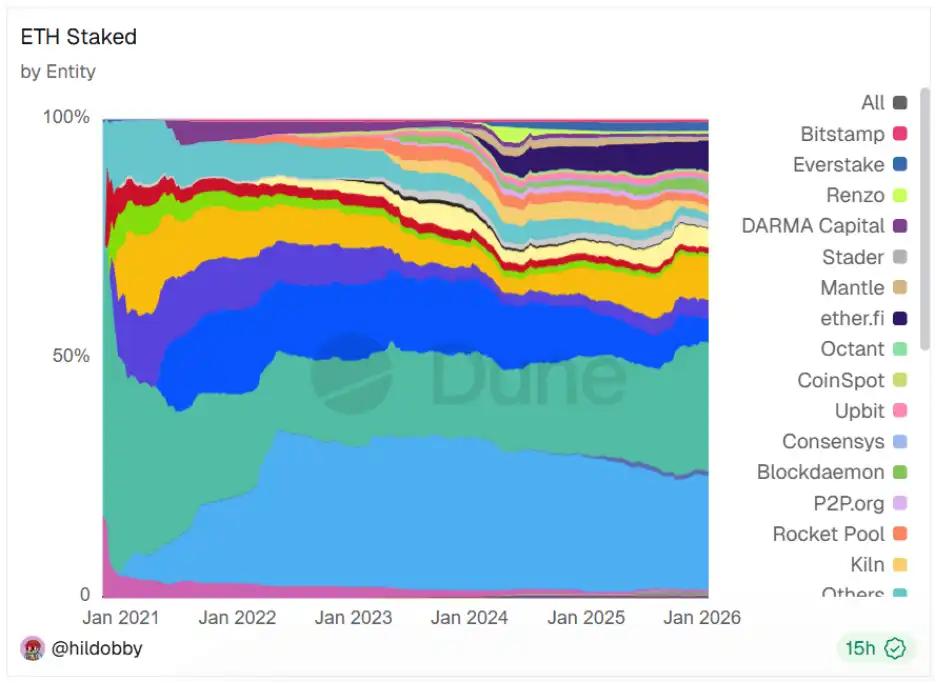

However, behind this apparent prosperity lies the risk of centralization. The top five liquidity staking providers alone control nearly 18 million tokens, accounting for 48% of the market share. This high concentration not only violates the original intention of decentralization but also exposes the network to single points of failure and censorship risks, thereby affecting network security and the healthy development of the ecosystem.

On January 21, Vitalik officially proposed the "Native DVT (Distributed Validation Technology) Staking" solution on the Ethereum Research Forum, aiming to solve the persistent problems of single point of failure of validators and centralized staking, and improve the security and decentralization of Ethereum.

First, Vitalik frankly stated that Ethereum, in its pursuit of user growth, has become overly centralized in node operation and block construction. Native DVT will aim to eliminate dependence on a single physical node or a single cloud service provider such as AWS.

Secondly, the high market share of liquidity staking providers such as Lido has always been a major concern for the community. The native DVT attempts to further lower the staking threshold, allowing small and medium-sized validators to participate, thereby increasing Ethereum's Satoshi coefficient.

Finally, Vitalik indicated a greater focus on censorship and quantum threat resistance. Native DVT allows validators to distribute nodes across different geographical locations and clients, significantly enhancing the network's resilience against geopolitical risks or specific client vulnerabilities.

Related reading: Ethereum at a crossroads: The looming quantum threat and the double squeeze on Wall Street capital.

The native DVT solution proposes four major technical pillars:

- Multi-private key cluster management: Allows a single validator identity to register up to 16 independent private keys.

- Threshold signature mechanism: A block proposal or proof is considered valid only when more than 2/3 of the associated nodes (e.g., 11 out of 16) sign it simultaneously.

- Protocol-level integration: Unlike third-party DVT solutions such as SSV or Obol, native DVT runs directly at the consensus layer, eliminating the need for a complex external coordination layer and lowering the operational threshold.

- Low performance overhead: This design only adds one round of delay during block production, has no impact on proof speed, and is compatible with any signature scheme.

If the native DVT scheme is implemented, it will have a profound impact on the validator ecosystem, reducing the risk of single points of failure and improving the redundancy and fault tolerance of validators.

For individual pledgers, they can achieve "non-downtime" operation at a lower cost by teaming up or renting multiple inexpensive servers, significantly reducing the pressure of being penalized.

For institutional validators, they no longer need to build expensive and complex customized failover systems. Native DVT will provide a standardized fault tolerance solution, thereby reducing operation and maintenance costs.

For the entire staking sector, the native DVT solution may reshape the Ethereum liquidity staking market landscape. Smaller service providers and independent validators will have a more level playing field, while the advantages of large service providers may be weakened.

Although the native DVT proposal is still in the conceptual stage and needs the consent of the Ethereum community to be implemented, it clearly points out the future direction of Ethereum. Instead of sacrificing security for short-term efficiency and adoption, it aims to regain Ethereum's lost ground in autonomy and trustlessness through native technical means. This is also Vitalik's vision this year.

TVL surpasses $300 billion, firmly holding its financial stronghold.

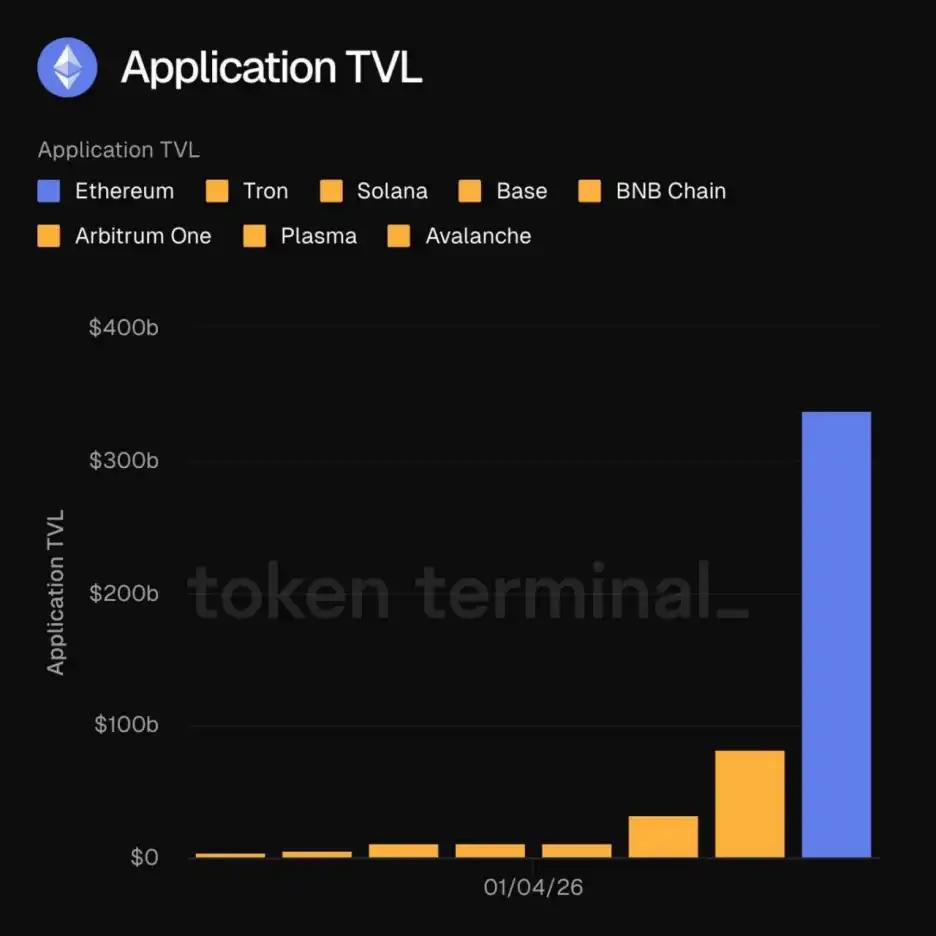

In early 2026, Ethereum reached a historic moment when the TVL (TVL) of on-chain applications surpassed the $300 billion mark. This milestone is not merely a numerical increase, but also signifies that Ethereum's ecosystem is becoming increasingly diversified.

The funds held within the Ethereum ecosystem are no longer just speculative bubbles. According to Leon Waidmann, Head of Research at Onchain, these funds are active in on-chain applications such as DeFi, stablecoins, RWA, and staking, representing real economic activity. Ethereum leads other networks in liquidity depth, composability, predictability, and user and capital reserves, and its network effects are becoming apparent.

The funds held within the Ethereum ecosystem are no longer just speculative bubbles. According to Leon Waidmann, Head of Research at Onchain, these funds are active in on-chain applications such as DeFi, stablecoins, RWA, and staking, representing real economic activity. Ethereum leads other networks in liquidity depth, composability, predictability, and user and capital reserves, and its network effects are becoming apparent.

When Ethereum's total value (TVL) surpassed the $300 billion mark, it ceased to be merely an application platform, transforming into a global settlement protocol capable of supporting sovereign-level assets. This scale signifies that any competitor attempting to challenge Ethereum's dominance must not only compete on performance but also on liquidity depth.

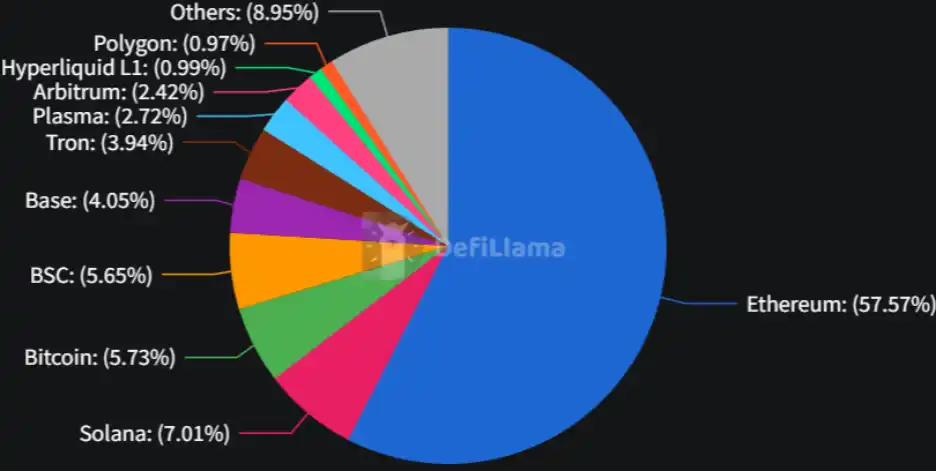

If TVL (Total Value Link) is Ethereum's "muscle," then stablecoins are its "blood." As of January 22, the Ethereum network held approximately 58% market share in the stablecoin sector. Against the backdrop of continuously growing global on-chain demand for US dollars, Ethereum, as the initial launchpad for stablecoins, has built a strong liquidity moat for its ecosystem.

Electrical Capital highlighted in a report that stablecoins on Ethereum are not only a medium of exchange, but also serve as collateral to back more than $19 billion in DeFi lending.

The introduction of regulatory frameworks such as the Genius Act is a strong boost, and the adoption of stablecoins by mainstream payment companies and traditional financial institutions will enter a period of explosive growth.

USDC's share on Ethereum continues to rise, further solidifying its status as a compliance "passport." Meanwhile, yield-generating stablecoin protocols such as Ethena weave ETH staking rewards into the underlying returns of stablecoins, and their large-scale adoption has strengthened the deep coupling between ETH and the stablecoin ecosystem.

Although public chains such as Solana, Polygon, and Tron challenged Ethereum in the areas of micro-payments and high-frequency transfers in 2025, Ethereum's dominance in institutional funding, large-scale transactions, and DeFi integration remains unshakable.

As long as Ethereum maintains its status as a stablecoin "settlement hub," its "liquidity black hole" effect will continue to play a role, even if other chains have an advantage in the number of transactions.

21shares predicts that the stablecoin market could reach $1 trillion by 2026. This means that the liquidity of stablecoins deposited on Ethereum, as the underlying settlement asset, will directly translate into long-term demand for ETH.

Turned into a "poisoning paradise," L2 diverts mainnet revenue.

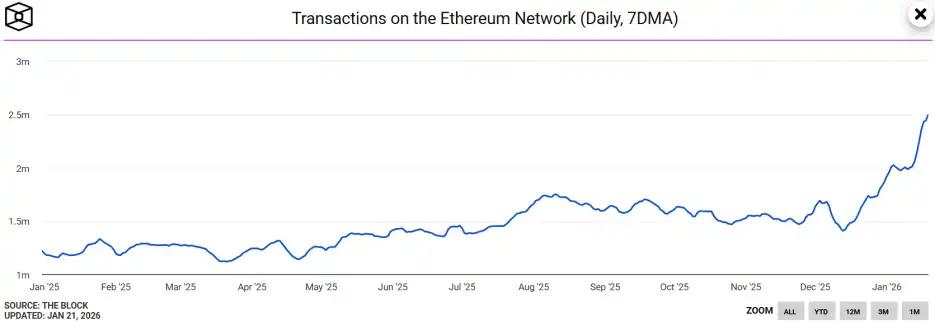

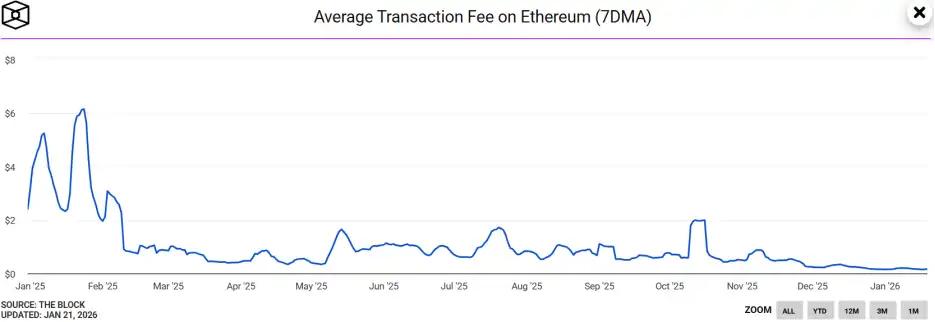

Recently, Ethereum staged a counterintuitive and spectacular performance, with its 7-day moving average of 2.49 million transactions, setting a new all-time high and more than double the number in the same period last year.

Meanwhile, Ethereum's 7-day moving average gas fee dropped to a historic low of below 0.03 Gwei, with a single transaction costing only about $0.15.

Puzzlingly, despite the surge in on-chain activity on the Ethereum network, the price of ETH has remained relatively flat. Security researcher Andrey Sergeenkov suggests this may stem from a large-scale "address poisoning" attack rather than genuine demand growth.

Research has found that about 80% of the abnormal growth in new addresses on Ethereum is related to stablecoins, and about 67% of the new active addresses made their first transfer of less than $1, which is consistent with the characteristics of a "dust attack".

This phenomenon is thanks to the Fusaka upgrade that came last December.

The Fusaka upgrade is considered a "technological gift" from Ethereum to its ecosystem. Its main innovation lies in the introduction of PeerDAS (Peer Data Availability Sampling), which effectively "reduces the data burden" on the network.

PeerDAS allows nodes to verify the availability of the entire block's data by sampling a portion of the data, thereby significantly improving the network's ability to carry Blob data (L2 data storage space).

Related reading: Ethereum activates Fusaka upgrade, L2 gas fees drop by another 60%

With the Fusaka upgrade significantly reducing transaction fees, low-cost attacks such as dust attacks have become feasible. This suggests that Ethereum's record transaction volume may be inflated by spam transactions, undermining the credibility of increased demand and preventing the market from viewing it as a catalyst for ETH price increases.

To make matters worse, in addition to the false demand created by the "address poisoning attack," Ethereum is also experiencing the "growing pains" of capturing value on the mainnet.

In order to foster the expansion of the L2 ecosystem, the Ethereum mainnet proactively reduced the "toll" that L2 pays to upstream in 2025.

Growthepie data indicates that L2's total revenue in 2025 is $129 million, but the fees paid to the mainnet will plummet to only $10 million. This means that the Ethereum mainnet is sacrificing more than $100 million in potential revenue.

While this strategy of sacrificing resources to subsidize losses has fostered the growth of the L2 ecosystem, it has also raised questions within the community about ETH's ability to capture value. If mainnet revenue fails to grow in the long term, the amount of ETH burned will decline significantly, thereby impacting its deflationary expectations.

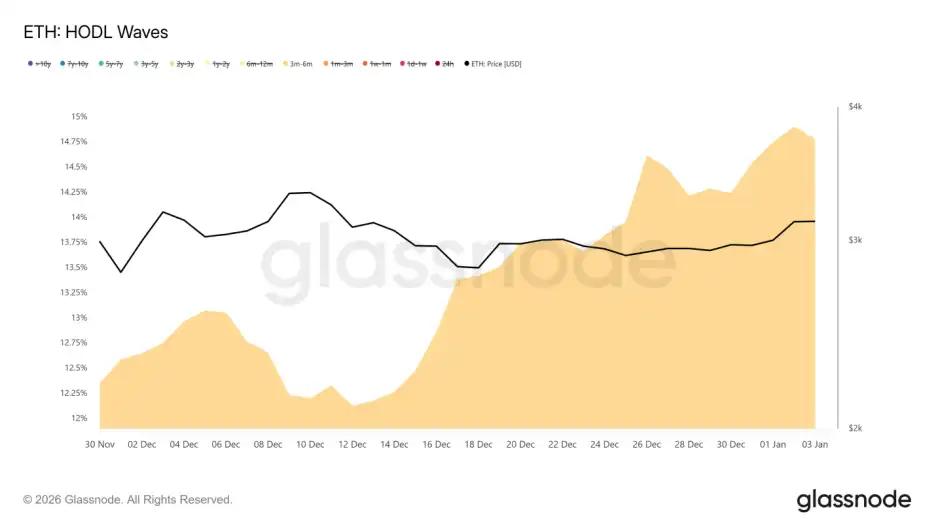

Furthermore, the HODL Waves indicator shows that a significant number of new positions were added between July and October 2025. These medium- to long-term holders exhibited a strong willingness to exit at breakeven when the price approached $3,200, which partly explains why, despite the strong on-chain data, the ETH price encountered resistance in the short term.

"Digital Oilfields" with Inverted Valuations

On the one hand, there is an extreme boom in ecosystem data, and on the other hand, there is a serious lag in market pricing. ETH is deeply mired in a "valuation inversion" quagmire.

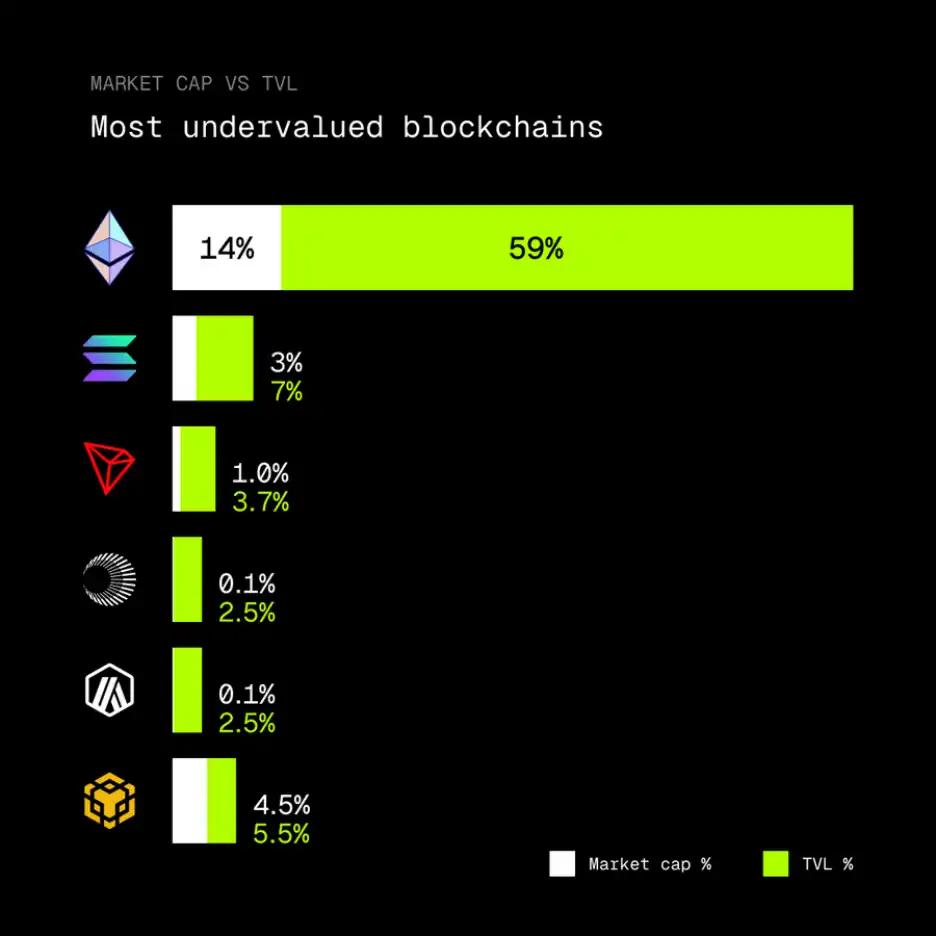

In the pricing logic of the crypto market, the ratio between the market capitalization of a public blockchain token and the asset size of its ecosystem is a key benchmark for measuring the capital efficiency and valuation rationality of a public blockchain.

However, as crypto KOL rip.eth pointed out, Ethereum currently carries 59% of the total TVL of the entire crypto market, but its native token ETH only accounts for 14% of the total crypto market capitalization.

This imbalance may mean that Ethereum is currently undervalued and is the most underestimated public blockchain.

The underlying reason for this inversion may be that Ethereum is undergoing a profound role change, gradually transforming into a "digital oil field," but it has not been fully priced in.

A large amount of TVL is locked in staking protocols, DeFi contracts, and the L2 ecosystem, causing a change in liquidity logic. Currently, market funds tend to chase oil (ecosystem applications), while ignoring the ownership value of the oil field itself (Ethereum).

Meanwhile, with the continued expansion of RWA, Ethereum is becoming the settlement platform for traditional financial assets. This ability to generate cash flow revenue will further drive its MC/TVL ratio back to a reasonable range.

In reality, Ethereum's prosperity is a precarious situation: while technological upgrades enhance performance, they may also distort real data; ecosystem subsidies are eroding the mainnet's ability to capture value to some extent; and regarding the long-term risks of centralized staking, the native DVT proposal will be key to maintaining the bottom line of decentralization.

Ethereum's challenge is no longer simply about scaling; it has evolved into finding a dynamic balance within the Blockchain Trilemma of maintaining decentralization, preserving technological advantages, and enhancing value capture. However, as market perception shifts or a fundamental-driven recovery cycle begins, this "valuation dam" may unleash tremendous potential.