Price is stuck. Commitment isn’t.

$BTC, $ETH, $SOL are all trading the macro tape right now.

Headlines move price. Volatility caps upside. Nothing sticks.

Now look at what capital is doing underneath.

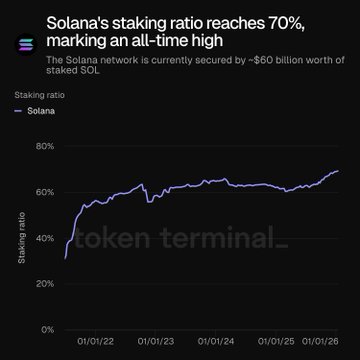

On Solana, 70% of $SOL supply is staked.

That is not passive behavior. That is capital opting out of liquidity to secure the network.

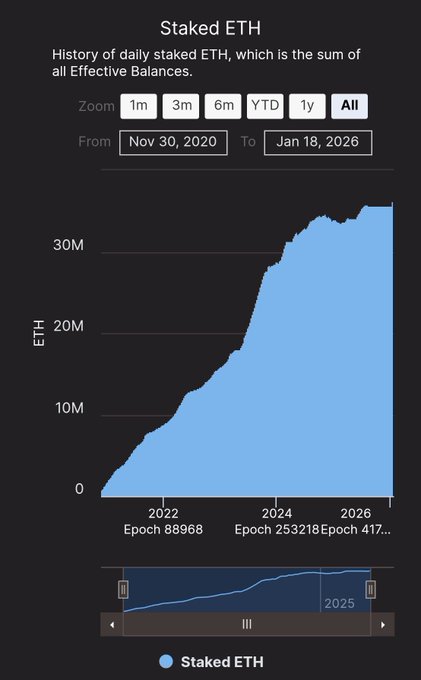

Ethereum shows the same intent, just expressed differently.

The staking entry queue is 2.6M $ETH.

The exit queue is effectively zero.

New capital wants in.

Existing capital is not leaving.

That’s the divergence.

In a risk-off environment, the normal sequence is: price weakens → optionality increases → capital unlocks.

This time, the opposite is happening.

Supply is being locked while price stays capped.

Not because of excitement.

Because of conviction.

This is not momentum demand pushing price.

It’s duration demand positioning ahead of it.

Price is still reacting to macro.

Staking is already looking past it.

That gap is where structure forms.

respect the market ':O

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content