Written by: Mahe, Foresight News

Original title: Gold and silver hit record highs, but has Bitcoin, the "digital gold," really fallen behind?

On January 23, gold and silver continued their strong upward trend, with spot gold hovering around $4,956 per ounce and silver reaching $98.79 per ounce, nearing the $100 mark, both setting new all-time highs. In contrast, Bitcoin fluctuated around $90,000.

This divergence highlights a structural shift in global markets: in an environment of uncertainty, traditional safe-haven assets are thriving, while Bitcoin is hampered by liquidity constraints and risk aversion.

The underlying drivers behind gold and silver reaching new highs

In January 2025, the price of gold was $2,600, and then it rose all the way up, with an increase of nearly 100% as of January 23 this year.

Silver, as the "volatility partner of gold," has outperformed gold. Starting in April 2025, the price of silver reached a new high after fluctuating upwards from $30, and its increase has exceeded 300% to date.

This surge stems from a combination of macroeconomic and geopolitical factors.

Central bank gold purchases are a key driver. The People's Bank of China added 27 tons of gold reserves in 2025, and the Reserve Bank of India increased its gold holdings from 10% to 16%, thanks to rising prices and diversification of its portfolio in US Treasury bonds. Against the backdrop of US debt exceeding $36 trillion, this de-dollarization trend positions gold as a tool to hedge against currency devaluation.

Geopolitical tensions escalated demand. The US tariff threats on Greenland and intervention in Iran triggered safe-haven inflows, pushing gold above $4,800. A weaker dollar—with the Wall Street Journal Dollar Index projected to fall 6% in 2025—further supported prices, making dollar-denominated metals more attractive to overseas buyers.

The collapse of the Federal Reserve's independence and the resulting credit crisis are severe, with the most pressing impetus stemming from an "institutional earthquake" in Washington. With the commencement of a criminal investigation into Federal Reserve Chairman Powell, the Fed's independence as the last line of defense for global monetary policy has been called into unprecedented scrutiny. When investors realize that central banks may become tools of political maneuvering, the long-term credibility of the US dollar is eroded.

Despite gold prices approaching the $5,000 mark, global ETF holdings and central bank reserve purchases continue to show net growth. This indicates a shift in market psychology: the concern is no longer that prices are too high, but rather that fiat currency holdings are too "cheap."

For silver, industrial demand has provided additional upward price momentum. Since 2021, the structural supply shortage has continued to widen, with mine production remaining flat while demand for solar panels, electronics, and AI infrastructure has surged. China's export restrictions, effective January 1, 2026, will exacerbate the silver shortage. Analysts predict an annual shortage of 200-300 million ounces, with industrial consumption accounting for 50% of supply. In the mid-to-late stages of a precious metals bull market, silver, due to its smaller market size and greater elasticity, often experiences extremely sharp catch-up rallies. The current gold-silver ratio is reverting to its historical average or even lower levels.

Renowned economist Hong Hao previously analyzed that as long as the expectation of improved global liquidity remains unchanged, the upward cycle of silver will not end. Although its volatility will be far greater than that of gold, its status as an "industrial necessity" in addition to being "digital gold" will provide solid support for it.

Behind the Bitcoin slump

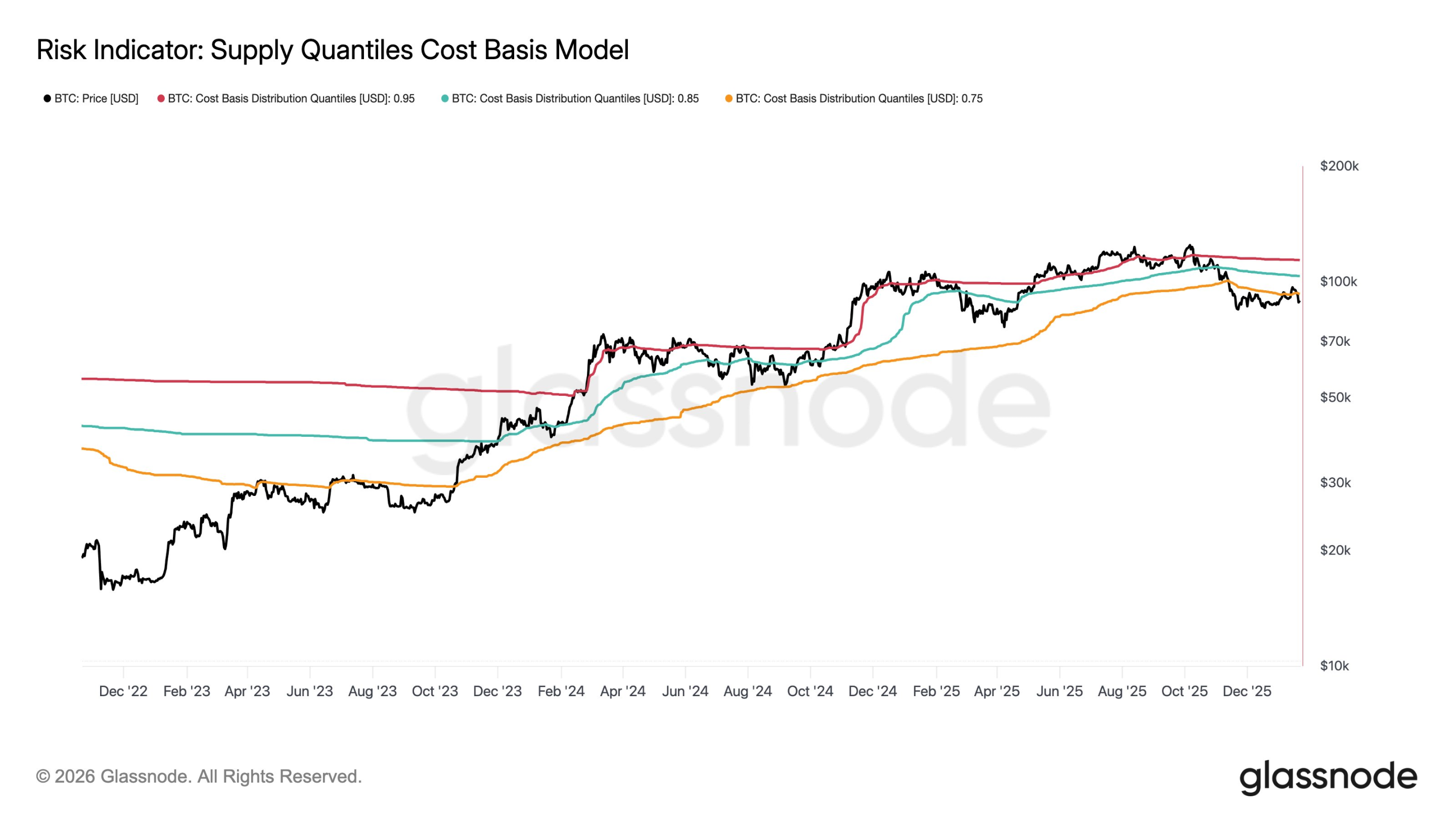

Bitcoin's trajectory presents a stark contrast. After peaking at $126,000 in 2025, it consolidated around $90,000. Glassnode noted that Bitcoin has lost its 0.75th percentile of supply cost and has failed to recover. Currently, the spot price is trading below the cost benchmark of 75% of the supply, indicating increasing distribution pressure. The risk level has shifted upwards, and unless it can regain that level, the market will be dominated by a downward trend.

Liquidity contraction is the primary culprit. Since 2022, the Federal Reserve has implemented quantitative easing (QT), withdrawing $1.5 trillion in reserves to curb speculative capital inflows into risky assets such as Bitcoin. The $19 billion leveraged sell-off in October exacerbated this problem, leading to a chain reaction of liquidations. While geopolitical risks have boosted gold, they have triggered risk aversion in the crypto space.

From a cyclical perspective, although BTC has not outperformed gold and silver since last year, in terms of absolute return multiples, BTC has risen from $15,000 to a record high of $126,000, an increase of over 800%, which is still quite impressive.

Wintermute reports that Bitcoin appears to be entering an upward channel after breaking out of its narrow 50-day trading range. The market landscape changed last week. For the first time since November, Bitcoin broke out of its range based on real money flows (rather than leveraged trading). ETF demand is returning, the inflationary environment is favorable, and cryptocurrencies are beginning to catch up with the overall risk asset rally. Monday's sharp drop, while dramatic, was a healthy correction. Leverage was quickly cleared, and the market avoided a vicious cycle, which is a positive sign. The current question is whether the tariff controversy is just a "bluff" or will evolve into concrete policy. The market leans towards the former; year-to-date, US stocks and the dollar are still rising, and interest rates have not been repriced.

If Bitcoin can hold above $90,000 this week and ETF funds continue to flow in, the breakout rally is likely to continue; if it falls below $90,000 due to subsequent selling, the range since November will once again become a resistance level.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush