Monero entered a period of high volatility after retreating from its new all-time high. The price of XMR underwent a sharp correction, causing mixed reactions in the market.

Although this asset has stabilized above the $500 mark, downside risk remains quite high. Technical and Derivative data suggest that retail investors should exercise caution, even though short-term prices appear stable.

Monero traders are pulling back.

Derivative data shows declining trader confidence. Monero 's open interest has decreased by nearly 20% in the last 72 hours, from $272 million to $217 million. This figure indicates that traders are closing positions rather than opening new ones, reflecting concerns about short-term price trends.

Interestingly, despite leveraged traders withdrawing, the funding rate remained positive. A positive funding rate means that Longing positions still outweigh Short positions. This suggests that many traders still expect prices to rebound, but the decrease in open interest indicates they are unwilling to take on risk during periods of high market volatility.

Want more Token analysis updates like this? Sign up for Editor Harsh Notariya's daily Crypto newsletter here .

XMR OI. Source: Coinglass

XMR OI. Source: CoinglassInvestors holding Longing positions in XMR are facing risks.

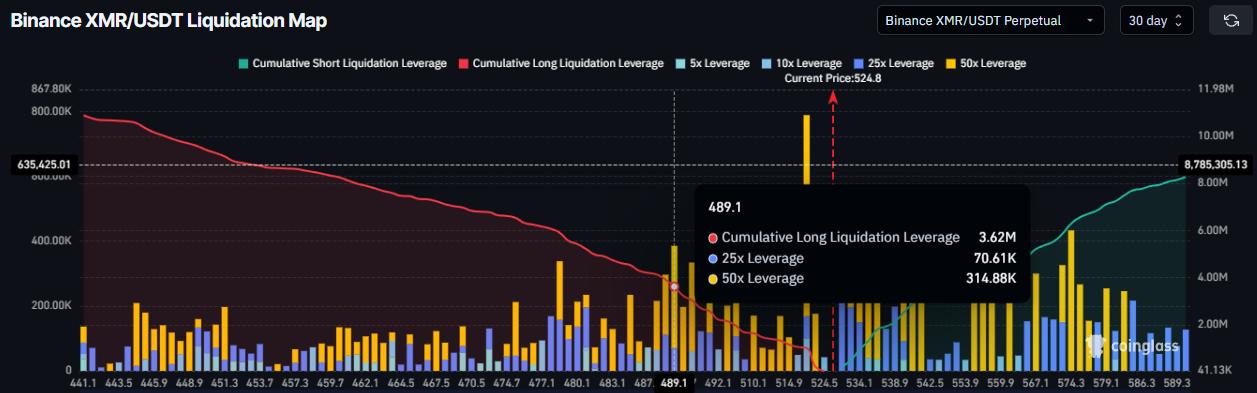

The liquidation map shows that the risk of a sharp decline remains below the current price level. Longing positions are significantly more prevalent than Short, leading to a high risk of price drops. Even a slight drop below the $500 support level could trigger an automatic liquidation wave, resulting in increased selling pressure.

Data shows that a price drop of just 3% below $489 would result in the liquidation of approximately $3.62 million in Longing positions. If this happens, the decline could be amplified as successive liquidation orders are triggered. This suggests that XMR prices still face the risk of a sharp decline, even though they have currently stabilized.

XMR Liquidation Map. Source: Coinglass

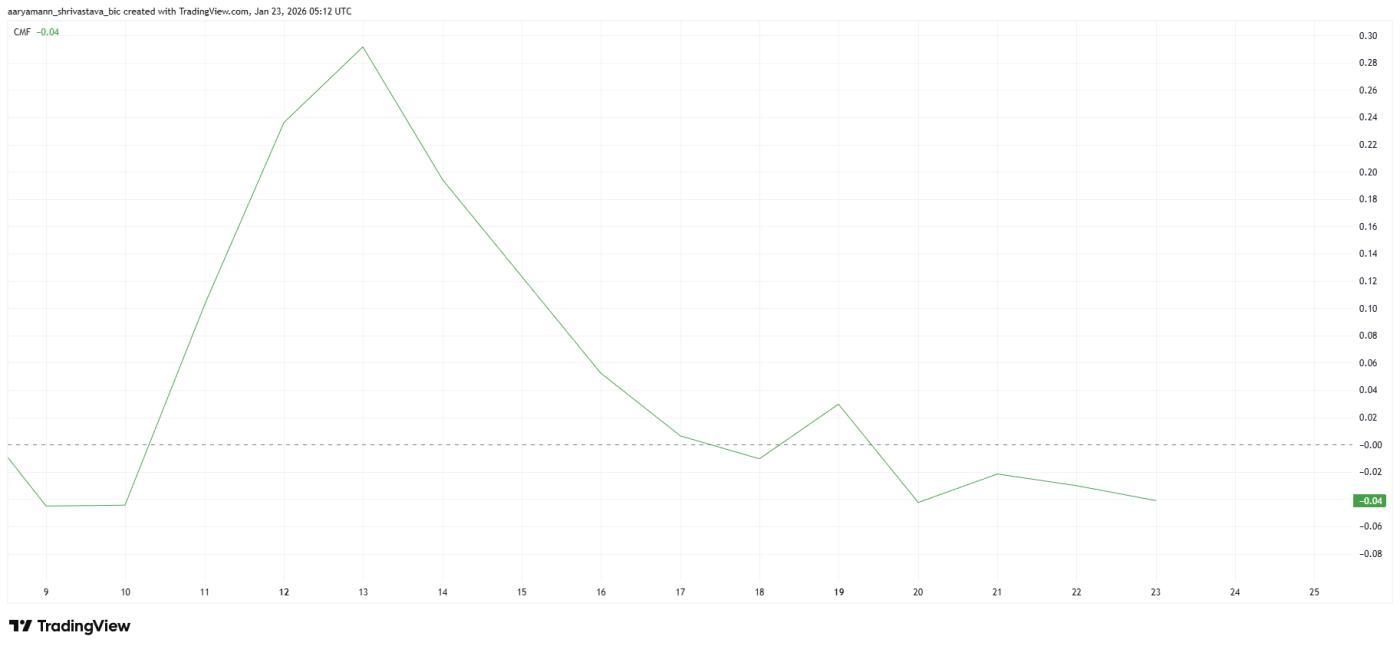

XMR Liquidation Map. Source: Coinglasson-chain money flow indicators also show cautious signs. The Chaikin Money Flow indicator has been declining sharply and continuously in recent days. The CMF measures Capital inflows and outflows based on price and volume, helping to record the behavior of retail investors.

When this indicator falls below zero, it means money is flowing out of Monero instead of into it. This shift suggests that retail investors are gradually reducing their positions instead of accumulating more. If the CMF remains negative, combined with weak Derivative , the price risks further decline.

Monero CMF. Source: TradingView

Monero CMF. Source: TradingViewXMR price may lose support level.

Monero is trading around $524 at the time of writing, holding above the psychological support level of $500. This is a crucial defensive zone that has attracted significant buying pressure during recent price corrections. Maintaining this level is vital to preventing a further sharp decline.

The 23.6% Fibonacci retracement level is currently near $503, often considered a support Dip in a bear market. Since the beginning of the correction, the price has held above this area, helping to limit the sell-off. However, increased liquidation risk coupled with weaker Capital flows suggests that a break below this support level remains. If the price clearly breaks below $500, XMR could retreat to around $450.

Monero price analysis. Source: TradingView

Monero price analysis. Source: TradingViewA strong recovery is still not ruled out. If funding rates remain positive and optimistic trader sentiment outweighs selling pressure, XMR could regain upward momentum. In that case, Monero price could move towards the $560 resistance level. If it successfully breaks through and sustains this level, XMR could even target $606, completely negating the current bearish outlook.