It's the 95th edition of the Gems Corner, and today we'll be looking at the top three yield farms.

As the year kicks off, one of the main considerations in the minds of investors and traders is how and where to farm good yields. Because that’s the best way to stay capital-efficient. Your capital has to be running errands while you channel your energy into other vital ventures.

Thanks for reading The Gems Corner! Subscribe for free to receive new posts and support my work.

When it comes to yields on-chain, traders always look out for the following in a project — risk framework, yield source quality, team, liquidity & TVL, and strategy complexity, essentially.

Today, we’ll be looking at the top three platforms where you can deploy your idle capital and get decent yields.

Summerfi

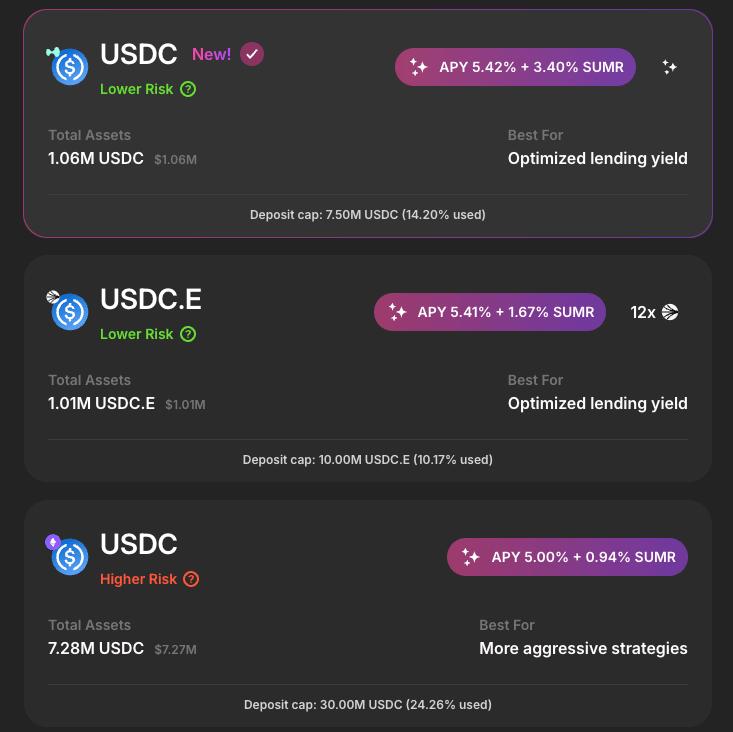

Built by the team behind Sky (formerly MakerDAO) and Oasis, Summerfi simplifies and enhances users’ interactions with lending, borrowing, and yield generation. Through their Lazy Summer product, users can deposit stablecoins into automated vaults and let AI handle everything.

Think of it like an autonomous car that optimizes the best routes and takes you to your destination while you relax and do nothing. Basically, you are getting paid to earn yield from DeFi’s proven strategies, optimized for risk and return. Also, their unique rebalancing feature ensures you keep earning by continuously optimizing your strategies.

Interestingly, their vaults don’t just offer attractive yields, but also dual rewards. Users get $SUMR emissions, 20% of protocol feespaid in USDC, and can lock tokens to boost rewards by up to 7x.

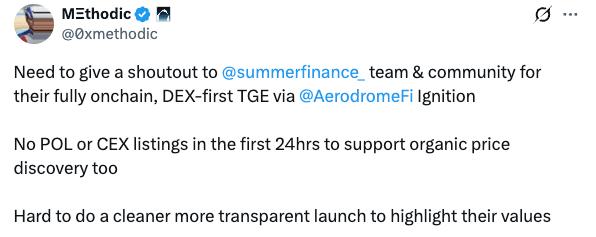

Summerfi recently launched their token, $SUMR, via Aerodrome’s Ignition and the launch of Smooth. At the current market cap, the token is still much undervalued; it has significant upside from here.

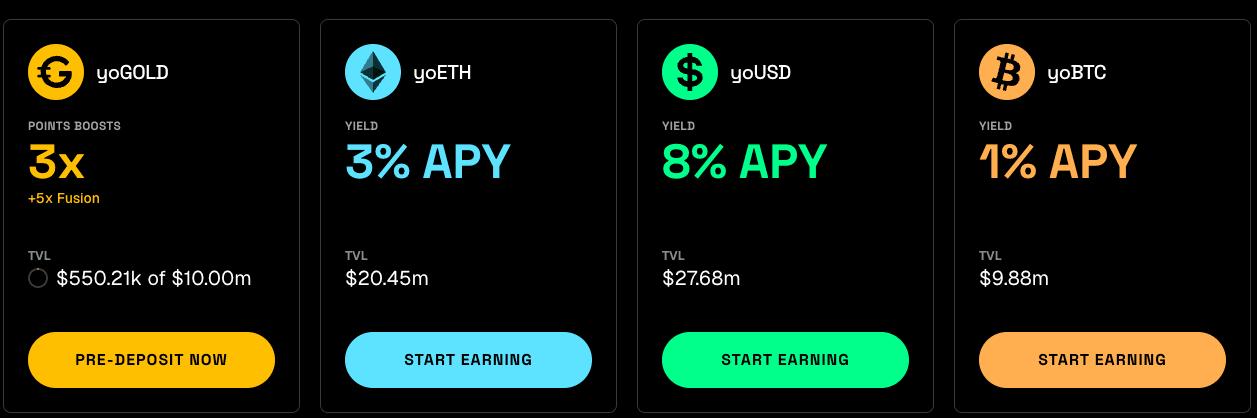

Similar to Summerfi, Yo focuses on simplifying how users deploy capital across onchain yield opportunities. Instead of manually managing positions, monitoring rates, or rebalancing strategies, Yo provides a streamlined interface that abstracts away much of the operational complexity behind yield farming.

Users get both decent yields and point boosts when they use any of their vaults. Their hottest vault is yoGold (in partnership with Tether Gold), which is still in its pre-deposit phase. I think it’s quite strategic, given the recent gold and silver rally.

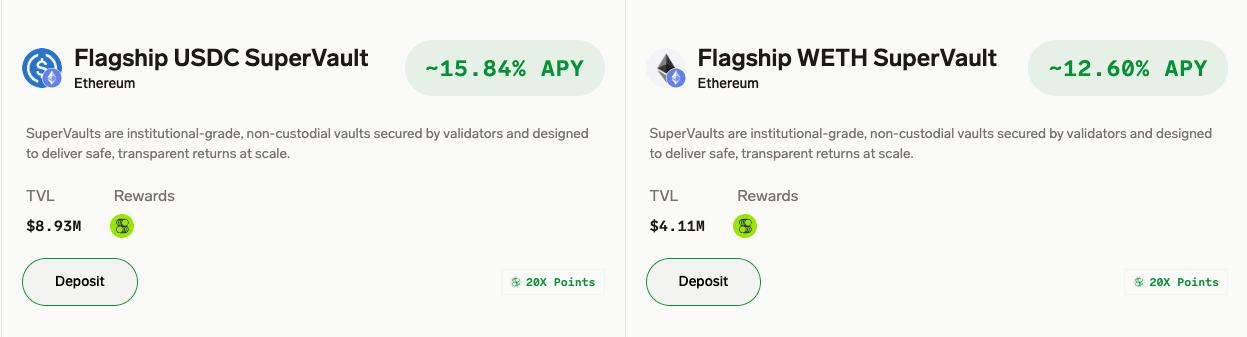

Also known as the user-owned neobank, Superform is bent on making on-chain yield more accessible by unifying how users discover, deploy, and manage capital across DeFi.

At the core of the platform are SuperVaults, which aggregate and package yield opportunities from multiple protocols and networks into composable, onchain products.

This approach removes much of the friction typically associated with cross-chain execution, strategy setup, and position management, while still allowing users to remain non-custodial. Users can earn yields and point boosts by deploying capital into their vaults.

Conclusively, the underlining thing about these platforms is that they aggregate yield opportunities for users. So instead of spending time jumping between protocols, you can access the best yields from a single dashboard.

Personally, I prefer Summerfi. Firstly because of its dual rewards structure and secondly, its rebalancing. I wouldn’t trade more yields for more points, anyday.

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.

Thanks for reading The Gems Corner! Subscribe for free to receive new posts and support my work.