70% of @solana' supply is now staked🔥

That's the highest it's ever been and it's happening while institutions are quietly building infra most people aren't paying attention to.

➠ What's happening with the capital onchain?

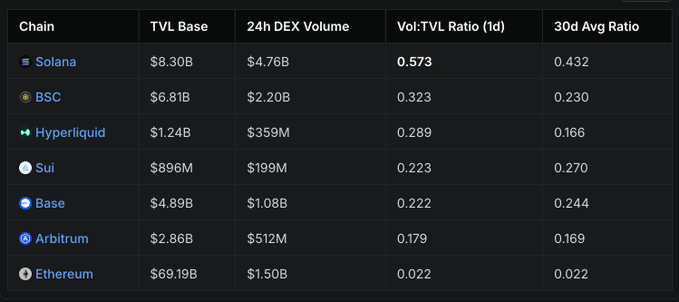

Solana is doing $4.7B in daily DEX volume with $8.3B in TVL. That's a 0.57 volume-to-TVL ratio. For context, Ethereum's ratio is 0.02, BSC is at 0.32, Base is at 0.22.

Solana's capital efficiency is 26x higher than Ethereum's. That means for every dollar locked on Solana, it generates 57 cents in trading volume. On Ethereum it is 2 cents.

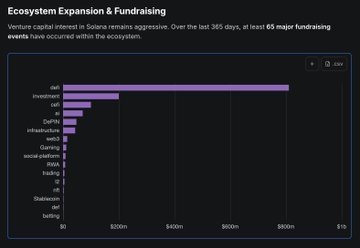

➠ Who's actually building here?

‣ RWA on Solana just crossed $1.1B

‣ Morgan Stanley filed for a Solana trust

‣ PayPal's stablecoin PYUSD has $1B+ circulating on the chain

‣ Ondo just launched on Solana, bringing over 200 tokenized U.S. stocks and ETFs to the network

‣ PumpFun launched Pump Ventures with a $3M hackathon (They're funding 12 projects at $250K each)

‣ Privacy tools are also gaining traction

‣ Solana mobile just airdropped SKR tokens to over 100,000 Seeker phone users

➠ Where's the revenue actually coming from?

Solana generated $10.15M in app-level fees in 24H. Most of that comes from DEXs and applications (not the base layer).

The chain itself stays cheap for users. The apps on top capture the value. That's actually how this is supposed to work, but most L1s can't pull it off because they don't have the throughput.

➠ What am I watching now?

1. The Spot ETF is growing (which is a different level of institutional validation)

2. Alpenglow upgrade is scheduled for 2026, the next phase of scaling after Firedancer. This pushes theoretical throughput closer to 1M TPS.

3. Jupiter Mobile is rolling out gasless transactions. If they nail the UX, this could be the first time crypto actually onboards noncrypto natives at scale

70% staking ratio + 26x better capital efficiency than Ethereum + institutional RWA growth + actual fee generation + upcoming catalysts = supply getting tighter while demand drivers are strengthening.

The setup is different than it was a year ago. Solana is becoming the chain where actual financial infra is being built and where capital actually moves instead of just sitting. Fundamentally, this is not the same network it was in 2023.

h/t to @DefiLlama for the infographics.

Take this piece as an informational update & not an investment thesis.

Thanks for reading. If this thread was helpful👇

1️⃣ Share to help others learn

2️⃣ Bookmark for reference

3️⃣ Follow @YashasEdu and join my TG t.me/YashasEdu for more such educative updates

What are your thoughts on @solana guys?

@hmalviya9 @belizardd @Hercules_Defi @kenodnb @thelearningpill @Defi_Warhol @TheDeFiPlug @Eli5defi @andrewmoh @0xTindorr @arndxt_xo @poopmandefi @0xCheeezzyyyy @Mars_DeFi @splinter0n @satyaki44 @0xTanishaa @bullish_bunt @cryptorinweb3 @TheDeFiKenshin @MeshClans

Solana will cook.

That's it. That's the tweet.

ppl still believe in Solana

Solana will win!

I am in that club too

Solana’s capital works, not rests.

Real finance finally going onchain.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content