Author: Matt Higginson, Alec Zorrilla, Julia Madden, Michael Kirchner

Compiled by: Will Awang, Web3 Xiaolu

Link: https://mp.weixin.qq.com/s/gqA8qXXiia_8P5qaqxKt6Q

We are often misled by the exaggerated stablecoin trading volumes in article headlines, indulging in the excitement of seeing them surpass Visa/Mastercard's trading volume, and dreaming of "plans canceled, ready to win" and replacing SWIFT. Comparing stablecoin trading volume to Visa/Mastercard is like comparing the volume of securities settlement funds to Visa/Mastercard—the two are incomparable.

Although blockchain data shows that stablecoin transactions are huge, most of them are not real-world payments.

Currently, most stablecoin trading volume comes from: 1) fund balancing between exchanges and custodians; 2) trading, arbitrage, and liquidity cycles; 3) smart contract mechanisms; and 4) financial adjustments.

Blockchain only shows the transfer of value, not why it was transferred. Therefore, we need to clarify the actual funding channels and statistical logic behind stablecoins' use in payments. To this end, we have compiled the article "Stablecoins in payments: What the raw transaction numbers miss, McKinsey & Artemis Analytics," aiming to help us dispel the fog surrounding stablecoin payments and see the truth.

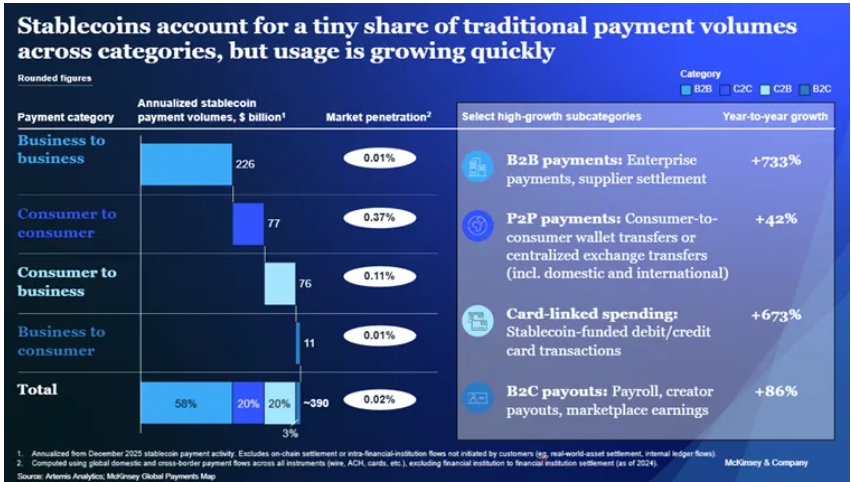

According to Artemis Analytics, the actual size of stablecoin payments in 2025 is estimated at $390 billion, more than double that of 2024.

It's important to clarify that actual stablecoin payments are far lower than conventional estimates, but this doesn't diminish the long-term potential of stablecoins as a payment channel. On the contrary, it provides a clearer benchmark for assessing the current market situation and the conditions necessary for stablecoins to scale. At the same time, we can clearly see that stablecoins are real, growing, and in their early stages in the payments space. The opportunities are enormous; it's just a matter of accurately measuring these figures.

I. Overall Trading Volume of Stablecoins

Stablecoins are gaining increasing attention as a faster, cheaper, and programmable payment solution, with annual transaction volumes reaching $35 trillion, according to reports from Artemis Analytics, Allium, RWA.xyz, and Dune Analytics.

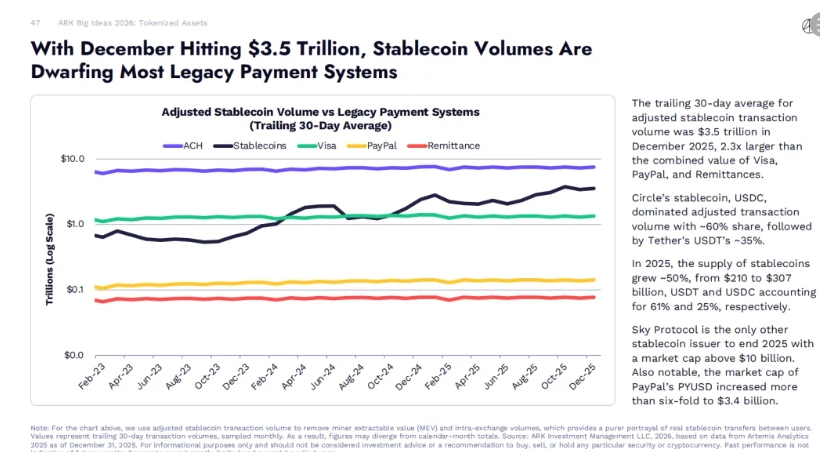

ARK Invest's 2026 Big Ideas data shows that in December 2025, the 30-day moving average of adjusted stablecoin transaction volume was $3.5 trillion, which is 2.3 times the combined volume of Visa, PayPal, and remittance services.

(Big Ideas 2026: Blockchain's Position in Future Trends)

However, most of these transactions are not actual end-user payments, such as payments to suppliers or remittances. They mainly include transactions, internal fund transfers, and automated blockchain activities.

To eliminate confounding factors and more accurately assess stablecoin payment volume, McKinsey partnered with Artemis Analytics, a leading blockchain analytics provider. The analysis results show that:

Based on the current transaction rate (annualized figures based on stablecoin payment activity in December 2025), the actual annual stablecoin payment volume is approximately $390 billion, representing about 0.02% of the total global payments.

This highlights the need for a more nuanced interpretation of the data recorded on the blockchain, and the strategic investment that financial institutions need to make, application-scenario-oriented, in order to realize the long-term potential of stablecoins.

II. Strong Growth Expectations for Stablecoins

The stablecoin market has expanded rapidly in recent years, with its circulating supply exceeding $300 billion, compared to less than $30 billion in 2020 (DeFillma data).

Publicly available market forecasts all indicate that there is strong expectation from all parties for the continued growth of the stablecoin market. On November 12 last year, U.S. Treasury Secretary Scott Bessant stated at a Treasury market conference that the supply of stablecoins could reach $3 trillion by 2030.

Leading financial institutions have made similar predictions, estimating that the supply of stablecoins will be between $2 trillion and $4 trillion during the same period. This growth expectation has significantly increased financial institutions' interest in stablecoins, with many exploring their applications across various payment and settlement scenarios.

When you filter for similar payment behaviors, a completely different picture emerges, with usage patterns being uneven. Typical scenarios are as follows:

Global Payroll and Cross-Border Remittances: Stablecoins offer a highly attractive alternative to traditional remittance channels, enabling near-instant cross-border fund transfers at extremely low cost. According to McKinsey Global Payments Map data, the annualized payment volume of stablecoins in the global payroll and cross-border remittance sector is approximately $90 billion. Based on McKinsey's Global Payments Map data, the overall transaction volume in this sector reaches $1.2 trillion, meaning stablecoins account for less than 1%.

Business-to-business (B2B) payments: Cross-border payments and international trade have long suffered from inefficiencies such as high transaction fees and long settlement cycles, which stablecoins can effectively address. Early adopters are leveraging stablecoins to optimize supply chain payment processes and improve liquidity management, with SMEs benefiting particularly significantly. According to McKinsey's global payments landscape data, the annualized scale of stablecoin-based B2B payments is approximately $2260 trillion, while the overall global B2B payment volume is approximately $1.6 trillion, meaning stablecoins account for only about 0.01%.

Capital Markets: Stablecoins are reshaping capital market settlement processes by reducing counterparty risk and shortening settlement cycles. Some asset management institutions' tokenized funds have already implemented automatic dividend distributions to investors via stablecoins, or direct reinvestment of dividends into the fund, eliminating the need for bank transfers. This early application scenario fully demonstrates how on-chain cash flow can effectively simplify fund operations. Data shows that the annualized settlement volume of stablecoins in capital markets is approximately $8 billion, while the overall settlement volume of global capital markets reaches $200 trillion, meaning stablecoins account for less than 0.01%.

Currently, the evidence cited by various parties to support the rapid adoption of stablecoins is mostly publicly available stablecoin transaction volume data, and people often assume that this data reflects actual payment activities. However, to determine whether these transactions are related to payment behavior, a deeper analysis of the actual meaning of on-chain transactions is needed.

(https://x.com/artemis/status/2014742549236482078)

Currently, the majority of real stablecoin payment transactions are highly concentrated in Asia, with Singapore, Hong Kong, and Japan serving as at least one transaction gateway. Global saturation has not yet been achieved.

While the aforementioned market forecasts and early application scenarios confirm the enormous development potential of stablecoins, they also reveal a reality: there is still a significant gap between market expectations and the actual situation that can be deduced solely from surface transaction data.

III. A Cautious Interpretation of Stablecoin Trading Volume

Public blockchains offer unprecedented transparency to transactions: every transfer of funds is recorded on a shared ledger, allowing people to monitor the flow of funds between wallets and various applications in near real time.

In theory, compared to traditional payment systems, this characteristic of blockchain makes it easier for the market to assess the adoption of stablecoins—traditional payment systems have transaction data scattered across various private networks, only disclosing aggregated data, and some transactions are not even disclosed to the public at all.

However, in practice, the total transaction volume of stablecoins cannot be directly equated with the actual payment volume.

Public blockchain transaction data can only reflect the amount of funds transferred, but cannot reveal the underlying economic purpose. Therefore, the actual scale of raw stablecoin transactions on the blockchain includes various types of transaction activities, specifically including:

Cryptocurrency exchanges and custodians hold large reserves of stablecoins and transfer funds between their own wallets;

The automatic interaction of smart contracts has led to the repeated transfer of the same funds;

Liquidity management, arbitrage, and transaction-related fund flows;

The technical mechanism of the protocol layer breaks down a single operation into multiple on-chain operations, thereby generating multiple blockchain transactions and increasing the total transaction volume.

These behaviors are an important part of the on-chain ecosystem and are likely to increase further with the widespread adoption of stablecoins. However, from a traditional definition, most of these behaviors do not fall under the category of payments. Directly aggregating and statistically analyzing them without adjustments would obscure the true scale of actual stablecoin payment activities.

This has very clear implications for financial institutions evaluating stablecoins:

Publicly available raw transaction volume data can only serve as a starting point for analysis. It cannot be equated with the popularity of stablecoin payments, nor can it be regarded as the actual revenue scale that stablecoin business can generate.

IV. A Picture of the Actual Scale of Stablecoin Payments

In our collaboration with Artemis Analytics, we conducted a detailed breakdown analysis of stablecoin transaction data. The study focused on identifying transaction patterns that conform to payment characteristics, including commercial fund transfers, settlements, salary payments, and cross-border remittances, while excluding transaction data primarily consisting of trading, internal institutional fund rebalancing, and automatic cyclical transfers via smart contracts.

Analysis shows that the actual scale of stablecoin payments in 2025 was approximately $390 billion, more than double that of 2024. Although the transaction volume of stablecoins still accounts for a relatively small proportion of the overall on-chain transactions and global payment volume, this data is sufficient to demonstrate that stablecoins have generated real and continuously growing application demand in specific scenarios (see chart).

(Stablecoins in payments: What the raw transaction numbers miss)

Our analysis yielded three prominent observations:

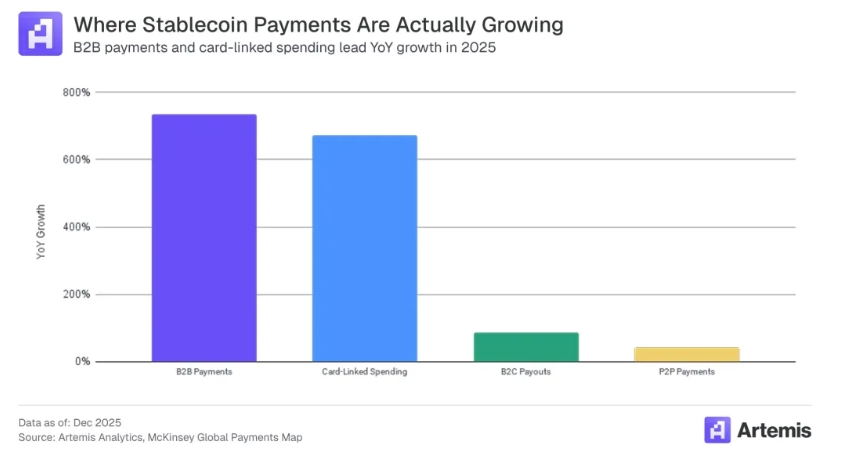

A clear value proposition. Stablecoins are gaining popularity because they offer significant advantages over existing payment channels, such as faster settlement speeds, better liquidity management, and lower user experience friction. For example, we estimate that stablecoin-linked bank card spending will grow to $4.5 billion by 2026, a 673% increase from 2024.

B2B is driving growth. B2B payments dominate, amounting to approximately $226 billion, accounting for about 60% of global stablecoin payments. B2B payments grew by 733% year-on-year, indicating rapid growth is expected in 2026.

Transaction activity is most active in Asia. However, transaction activity is uneven across different regions and cross-border payment channels, indicating that transaction volume will depend on local market structures and limiting factors. Stablecoin payments from Asia are the largest source of transactions, amounting to approximately $245 billion, or 60% of the total. North America follows closely with $95 billion, and Europe ranks third with $50 billion. Latin America and Africa each account for less than $1 billion. Currently, transaction activity is almost entirely driven by payments from Singapore, Hong Kong, and Japan.

As can be seen from the above trends, stablecoins are gradually taking root in a few proven scenarios. However, whether they can achieve wider and larger-scale development depends on whether the models in these mature scenarios can be successfully promoted and replicated in other regions.

Stablecoins possess the substantial potential to reshape the payment system, but unleashing this potential depends on the continued advancement of technological research and development, improved regulation, and market implementation. Their large-scale application requires clearer data analysis, more rational investment strategies, and the ability to identify valid signals and eliminate invalid noise from public transaction data. For financial institutions, only by embracing ambitious development plans while objectively understanding the current state of stablecoin trading and steadily positioning themselves for future opportunities can they seize the initiative and lead the industry's development in the next stage of stablecoin application.

About the author

Matt Higginson is a partner in McKinsey’s Boston office; Alec Zorrilla and Julia Madden are consultants in the Miami office; and Michael Kirchner is an associate partner in the New York office.

About Artemis Analytics

Artemis Analytics focuses on data and analytics for public blockchain activity, including cryptocurrencies, stablecoins, and other digital assets. The company's tools aggregate and standardize complex blockchain data, enabling the analysis of transaction patterns and ecosystem activity across multiple blockchains.

Methodology

Artemis Analytics and McKinsey collaborated using both bottom-up and top-down approaches to complete the estimates in this analysis. These estimates intentionally referenced known payment categories and therefore differ from Visa's published total stablecoin transaction volume and adjusted transaction volume, which may include bot-based payments, exchange-traded volume, and other high-frequency activity.

To estimate B2B payments, we first flagged stablecoin activity associated with commonly used custody and treasury management service providers. Based on previous industry research, we assumed that only 20% of the data reflects genuine B2B payments, with the remainder stemming from transactions or internal fund flows. To cross-validate our findings, we referenced the McKinsey Global Payments Map, which shows that the average size of B2B payment transactions is approximately $4,500 to $600,000. Filtering on-chain transactions within this range and excluding market makers and high-frequency trading entities yields a similar estimate: approximately 20% of B2B transaction volume is attributable to B2B payments.

Card-linked payments: By tracking known smart contracts and wallet addresses used to facilitate stablecoin-backed debit and credit card transactions, card-related transaction volumes can be identified. Artemis maintains proprietary tags for stablecoin-linked card projects, enabling direct tracing of these transfers.

Peer-to-peer (P2P) transaction volume is estimated based on data scraped from advertisements and listings on major P2P trading platforms. The reported transaction volume is adjusted downwards based on factors provided by previous academic and industry research to eliminate the impact of inactive listings and overstated transaction sizes.

Remittance activity was estimated using stablecoin-to-fiat trading pairs involving non-USD stablecoins on centralized exchanges. We conservatively assume that 10% of the trading volume reflects remittance-related fund flows, consistent with previous market research findings.