When Kraken announced the acquisition of Breakout in September 2025, it sent a very clear message to the cryptocurrency industry: prop trading had truly become a major trend. This was the first time a major cryptocurrency exchange had directly entered the prop trading space, combining Kraken 's institutional infrastructure with Breakout's Capital -based Capital model.

“Breakout gives us the opportunity to Capital based on actual ability rather than just who has the Capital ,” Chia Arjun Sethi, co-CEO of Kraken . “In a world that increasingly values what you know more than who you associate with, we want to build a system that rewards proven achievement, not just a resume.”

This deal reflects a larger trend: what was once just a craze among retail investors has now become an area attracting the attention of institutions and large Capital flows.

The numbers behind the boom

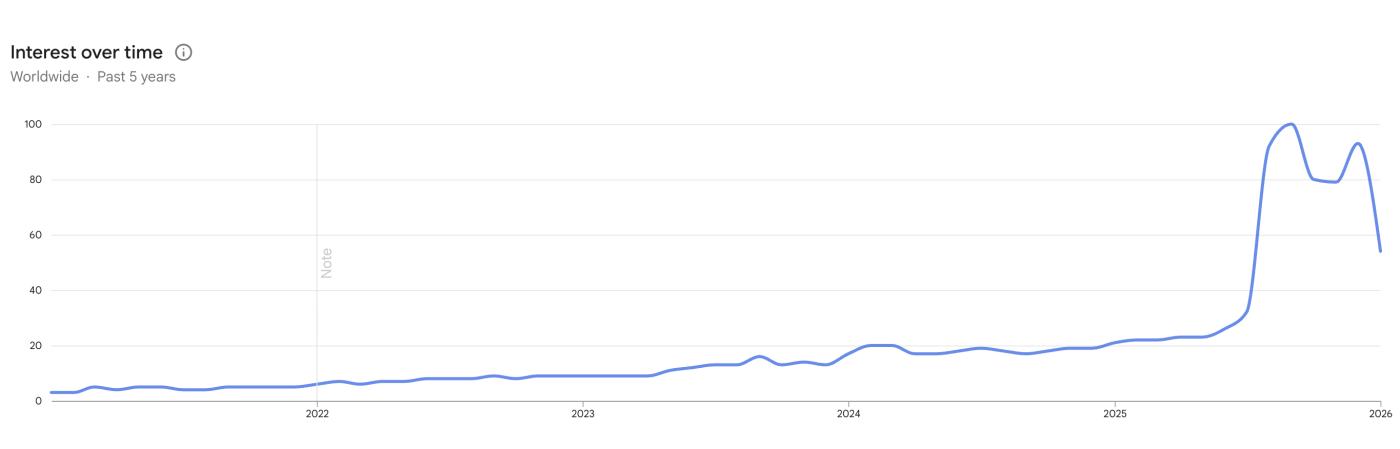

The prop trading industry has grown at an impressive rate. According to Google Trends, global searches for the term "prop trading" have increased by more than 5,000% from 2020 to 2025. The keyword recently reached a record high, indicating a surge in demand and interest in Capital trading programs.

Industry experts say the prop trading market was valued at $5.8 billion in 2024 and is projected to reach $14.5 billion by 2033. This annual growth rate far surpasses many other fintech sectors—prop trading has increased by 1,264% from December 2015 to April 2024, while searches for traditional investments have only increased by 240% over the same period.

In the crypto segment, the growth rate is even faster. According to a recent report, 90% of the top 20 prop trading companies saw an increase in Google searches in August 2025, with crypto-based companies showing outstanding growth.

Why are the big players paying attention?

Kraken involvement in prop trading is not an isolated move. Prior to acquiring Breakout, the exchange also acquired NinjaTrader for $1.5 billion along with Capitalise.ai, demonstrating a strategy of controlling the entire trading cycle for both retail and professional investors. Many in the industry predict that these deals are preparation for a potential Kraken IPO.

The acquisition of Breakout is particularly attractive because Kraken can integrate prop trading directly into Kraken Pro, allowing the exchange to identify and support talented traders while earning revenue from evaluation fees and profit Chia . Since its launch in 2023, Breakout has Capital over 20,000 trader accounts—and now, this client base will experience the liquidation and institutional-standard infrastructure of Kraken.

For the prop trading industry, this is a confirmation of its value. When a large, reputable exchange like Kraken strategically bets on the Capital model, it shows that prop trading has moved beyond the retail investor frenzy to become a more sustainable industry.

The competitive landscape is changing.

The agreement between Kraken and Breakout has completely changed the game in the crypto prop trading sector. Long-established names like FTMO— XEM the gold standard in the industry since 2015—now not only have to compete with other prop trading companies but also with large exchanges that possess strong resources and established customer bases.

FTMO responded by expanding its crypto product range, adding 22 new trading pairs and improving spreads by July 2025, bringing the total number of crypto CFD instruments to over 30. The Czech-based company has served over one million traders and achieved a 4.8/5 rating on Trustpilot—key factors in a field where trust is paramount.

However, this acquisition also opens up opportunities for platforms to choose a different path. While exchange-affiliated prop trading competes on Capital and technology, a new group of crypto-based prop trading companies is emerging, focusing on both providing Capital and supporting trader training and development.

A new breakthrough: developing AI-integrated trading.

Kraken acquisition of Breakout shows that prop trading is entering a mature organizational phase, but it also highlights a gap that many new platforms are racing to fill. Currently, most prop trading companies—including Breakout—focus primarily on evaluating and Capital traders. What they haven't yet offered is a structured process for developing trader skills.

This is crucial because statistics show that only 5-10% of traders pass the initial assessment, and even fewer actually receive profit withdrawals from their Capital accounts. The biggest obstacle is not a lack of Capital, but rather psychological and technical issues that lead to trader failure.

Among platforms focused on skill development, Fondeo.xyz stands out as a prime example of the “new generation” of crypto trading props . This platform integrates AI coaching directly into its Capital process—a method that recognizes the importance of trading psychology to actual trading results. For traders who have struggled with traditional evaluation models, this combination of coaching support and Capital offers a distinctly different value proposition.

This approach also follows the global trend of developing AI trading tools. The AI trading market is projected to grow from $24.53 billion in 2025 to $40.47 billion in 2029, achieving an annual growth rate of 13.3%. However, most AI tools focus on order execution or analysis, while integrating AI coaching into prop firms' systems remains an untapped opportunity, with Fondeo.xyz leading the way.

What does this mean for traders?

For those looking to try their hand at crypto trading, the Kraken-Breakout deal presents both an opportunity and a warning. On the positive side, the involvement of a large institution increases credibility, provides better infrastructure, and creates a more stable platform. Traders from Breakout now have access to Kraken's security standards, institutional liquidation , and the backing of a major name in the crypto industry.

Conversely, institutional prop trading may be more competitive and less "lenient" with retail traders. Kraken itself confirms that Breakout's evaluation program is designed to be "very rigorous," testing risk management skills and discipline before Capital is granted. Most applicants will fail on their first attempt.

This creates a natural differentiation in the market. Traders confident in their abilities will choose large brands like FTMO or "exchange-affiliated" options like Breakout. Those who want to learn and get Capital—especially in a 24/7 crypto environment—can look to integrated platforms like Fondeo.xyz for long-term growth.

Looking ahead: The process of organizing prop transactions.

Kraken acquisition of Breakout is unlikely to be the last of its kind. With prop trading reaching record levels of interest and the market projected to be worth up to $14.5 billion, major exchanges and fintech giants may consider similar moves.

Industry experts predict a trend towards mergers and consolidations. Smaller companies with unstable payouts or a lack of transparency will struggle to compete with platforms backed by larger exchanges that possess more abundant resources. Meanwhile, companies that differentiate themselves—through superior technology, AI-powered trader development, or focusing on a specialized market segment—will find ways to survive and thrive sustainably.

Data from Google Trends clearly shows that interest in prop trading remains undiminished. For traders, this means more options, better infrastructure, and increasing recognition. For the industry, this development marks a shift from a phenomenon driven by retail investors to an asset class professionally held and operated by institutions.

As Sethi of Kraken Chia : “This is how modern financial platforms should operate: transparency, programmatic compliance, and expanding opportunities for anyone with an advantage.” By 2026, that advantage may come not only from trading skills but also from choosing the right platform to develop on — whether it’s a large institutional ‘giant’ or a small company focused on developing AI-powered traders.