- Tariffs and U.S.–Iran tensions are increasing macro uncertainty, pushing investors toward caution and reducing short-term appetite for liquidity-sensitive crypto assets.

- With markets expecting no Fed rate cut, crypto prices are reacting more to policy tone and forward guidance than to the decision itself.

- Bitcoin and Ethereum remain tied to liquidity cycles, underperforming traditional safe havens until macro risks ease and monetary conditions become clearer.

Tariffs, U.S.–Iran tensions, and Fed rate expectations are reshaping global risk sentiment. This analysis explains how macro forces are influencing Bitcoin, Ethereum, and crypto markets.

TARIFFS AND CRYPTO MARKETS: TRADE POLICY AS A MACRO RISK FACTOR

Over the past week, tariff-related headlines have re-entered the market narrative at a sensitive moment for global risk assets. While tariffs are not new, their reappearance reminds investors that trade policy remains an active macro lever rather than a closed chapter.

Tariffs influence markets through a dual channel. On one hand, they raise uncertainty around global growth by disrupting supply chains and corporate planning. On the other, they can introduce renewed inflation pressure if higher import costs are passed through to consumers. Even when markets assume negotiations may soften final outcomes, the interim uncertainty alone is enough to alter positioning.

For crypto markets, tariffs do not trigger direct price reactions. Instead, their influence is indirect but meaningful. When tariffs raise doubts about growth stability or inflation control, investors often reduce exposure to assets perceived as liquidity-sensitive. In such environments, Bitcoin and Ethereum tend to trade more like high-beta risk assets than defensive hedges.

U.S.–IRAN CONFLICT AND CRYPTO: GEOPOLITICS, ENERGY RISK, AND SENTIMENT

At the same time, tensions between the United States and Iran have escalated rhetorically and militarily. Reports of U.S. naval deployments and warnings from Iranian officials have pushed geopolitical risk back into focus, even without direct confrontation.

Markets typically respond to Middle East tensions by reassessing energy risk. The possibility of supply disruption alone can support higher oil prices, which in turn feed inflation expectations. For investors, this combination creates a familiar dilemma: rising uncertainty with unclear policy responses.

Crypto markets sit awkwardly within this framework. While digital assets are often described as borderless or censorship-resistant, real-world trading behavior tells a different story. During periods of heightened geopolitical stress, crypto is frequently sold alongside equities as part of a broader reduction in risk exposure.

This does not negate long-term narratives around financial sovereignty or decentralization. Rather, it highlights the reality that in the short term, crypto prices are still shaped by portfolio-level risk management decisions rather than ideological positioning.

FED INTEREST RATE EXPECTATIONS AND CRYPTO LIQUIDITY DYNAMICS

Overlaying tariffs and geopolitics is monetary policy, specifically the Federal Reserve’s January meeting. Market expectations are unusually aligned: investors broadly anticipate no interest rate cut this week.

When consensus is this strong, the focus naturally shifts from the decision itself to the messaging. Investors are listening for clues about how policymakers interpret inflation progress, labor market resilience, and external risks such as trade tensions and energy prices.

For crypto, this distinction matters. A rate hold is already priced in, but any shift in tone can reshape liquidity expectations. If the Fed emphasizes patience and optionality, markets may interpret this as a path toward easing later in the year. If, however, policymakers stress renewed inflation risks, expected rate cuts could be pushed further out, tightening financial conditions.

In recent cycles, crypto has proven highly sensitive to these expectations. Even without immediate policy changes, shifts in forward guidance can influence capital flows into and out of digital assets.

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?utm_source=chatgpt.com

BITCOIN AND ETHEREUM PERFORMANCE UNDER MACRO PRESSURE

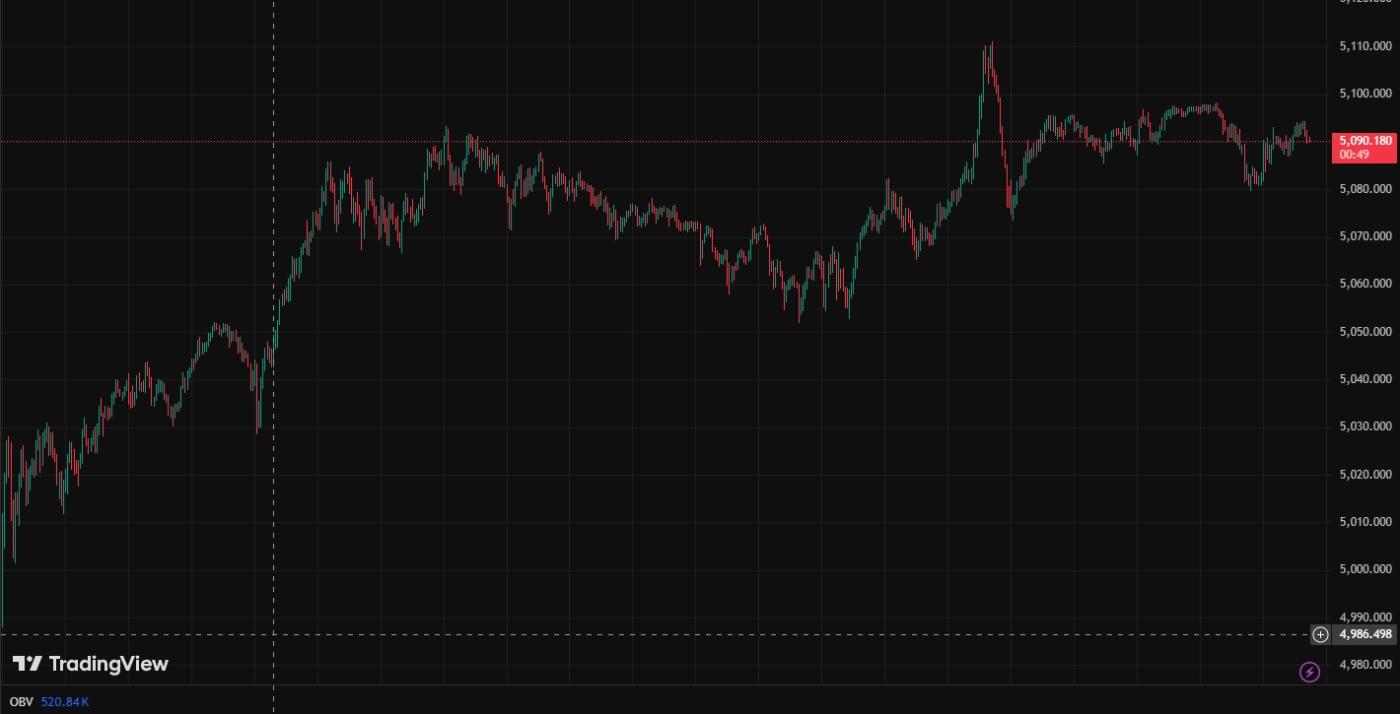

Against this backdrop, the behavior of major cryptocurrencies has been relatively consistent. Bitcoin has largely traded within a range, reflecting hesitation rather than conviction. Despite its reputation as “digital gold,” Bitcoin has not consistently attracted safe-haven flows during this period.

This divergence highlights a structural reality. Gold is a long-established hedge against geopolitical and monetary instability. Bitcoin, by contrast, still occupies a hybrid position. In moments of acute uncertainty, it is often treated as a volatile asset rather than a defensive one.

Ethereum has shown similar dynamics, often amplifying Bitcoin’s moves. As a higher-beta asset with deeper ties to risk appetite, Ethereum tends to underperform when investors prioritize capital preservation over growth. This pattern does not reflect Ethereum-specific weakness, but rather its sensitivity to broader liquidity conditions.

GOLD, SILVER, AND THE MESSAGE FROM TRADITIONAL SAFE HAVENS

While crypto has traded cautiously, traditional safe havens have attracted renewed attention. Gold and silver have benefited from the same forces weighing on risk assets: geopolitical uncertainty, inflation concerns, and doubts about the near-term policy path.

The contrast is telling. When precious metals strengthen while crypto remains range-bound, it suggests that investors are hedging risk rather than expressing confidence in reflation or growth. In this environment, crypto rallies typically require either a clear improvement in liquidity expectations or a powerful asset-specific catalyst.

CONCLUSION: MACRO UNCERTAINTY, LIQUIDITY TIMING, AND CRYPTO’S NEXT MOVE

Taken together, tariffs, U.S.–Iran tensions, and a widely expected no-cut Fed meeting form a single macro narrative rather than three separate stories. All point toward uncertainty around inflation, growth, and the timing of policy easing.

In the near term, this environment favors caution. As long as crypto remains closely tied to liquidity conditions, sustained upside is difficult when investors are pricing geopolitical risk and delayed monetary easing simultaneously.

However, this also creates asymmetric potential. Should tensions ease and the Federal Reserve maintain flexibility in its outlook, risk appetite could recover quickly. Crypto markets have historically responded rapidly once uncertainty recedes and liquidity expectations stabilize.

For now, the market is less focused on bold narratives and more focused on timing. In that sense, the current phase is not about conviction, but about patience.

Messari 2026 Crypto Theses: Why Speculation Is No Longer Enough (Part 1)

Galaxy Research 2026: Bitcoin, Solana, and Value Capture-1

Bitwise: Why Crypto Is Moving Beyond the Four-Year Cycle

〈Macro Pressure Builds: Tariffs, Iran Tensions, and Crypto〉這篇文章最早發佈於《CoinRank》。