A "fearful" sentiment returned to the market in the last week of January, leading to a dominance of Short positions. However, several data points suggest that some altcoins could trigger large-scale liquidations due to specific factors.

This week, altcoins like Ethereum (ETH), Chainlink (LINK), and River (RIVER) have the potential to trigger a combined liquidation of nearly $5 billion in the market. Here's why.

1. Ethereum (ETH)

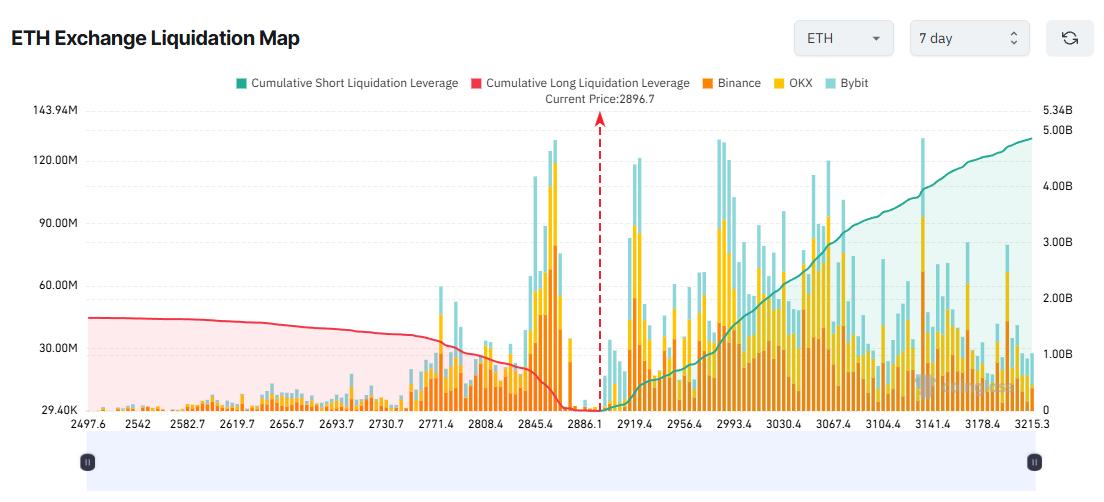

Ethereum's 7-day liquidation map shows a clear imbalance between the potential liquidation volume of Short positions versus Longing positions.

Specifically, if ETH rises back to $3,200 this week, short sellers could face liquidation losses exceeding $4.8 billion.

ETH liquidation map across exchanges. Source: Coinglass

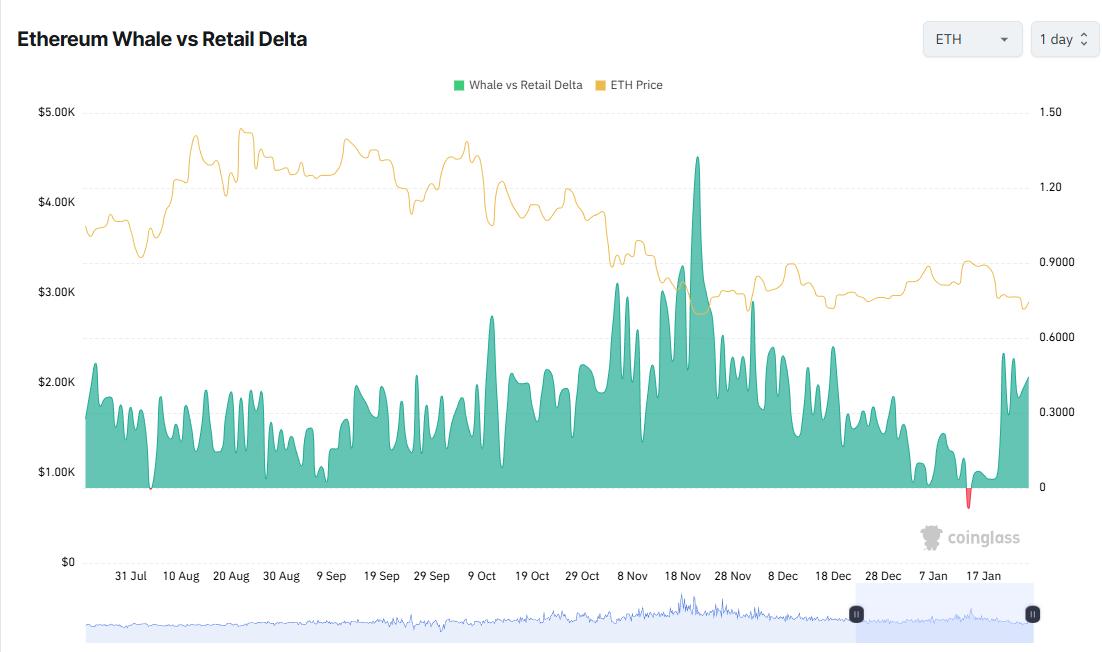

ETH liquidation map across exchanges. Source: CoinglassThere are clear reasons why investors need to be more cautious. According to CW's analysis based on Ethereum Whale vs. Retail Delta data, whales have regained control of ETH over the past week. This indicator has shifted from negative to positive and is rising sharply.

Ethereum Whale vs Retail Delta Index. Source: Coinglass

Ethereum Whale vs Retail Delta Index. Source: Coinglass“Retail investors are being liquidated, while whales continue to increase their Longing positions. The losers in this downturn are retail investors. Whales will continue to create fear until they give up,” a CW expert Chia .

A recent report by BeInCrypto also indicates that when ETH drops below $3,000, many whales take advantage of the opportunity to accumulate more ETH . This trend could push the price back up and cause those holding Short positions to face significant losses.

2. Chainlink (LINK)

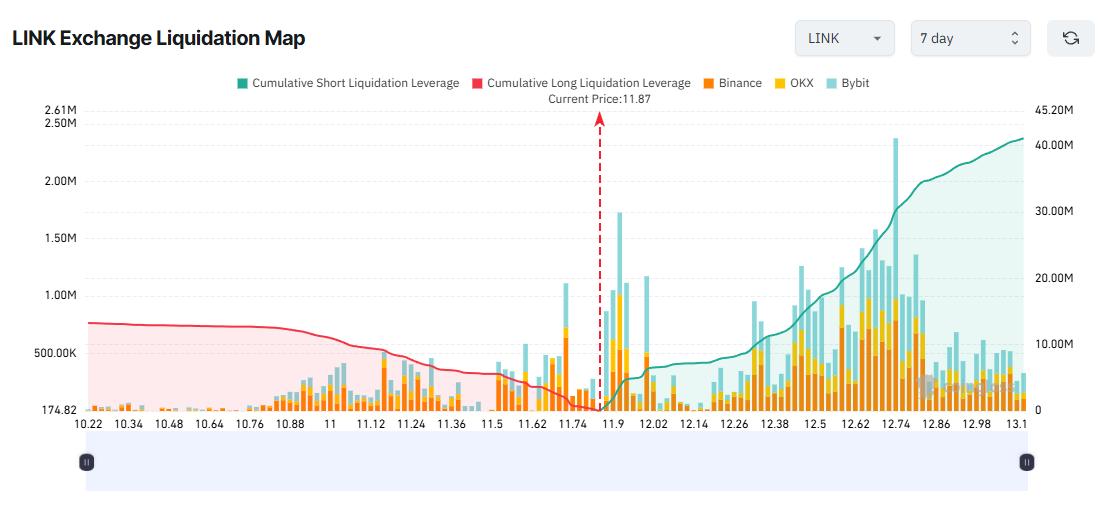

Similar to ETH, LINK is also showing an imbalance on the liquidation map. Negative sentiment in the altcoin market at the end of January led Derivative traders to increase Capital and leverage their Short positions in LINK.

This increases the risk if LINK recovers. If LINK rises back to $13 this week, the total potential liquidation value of Short positions could exceed $40 million.

LINK liquidation map on the exchange. Source: Coinglass

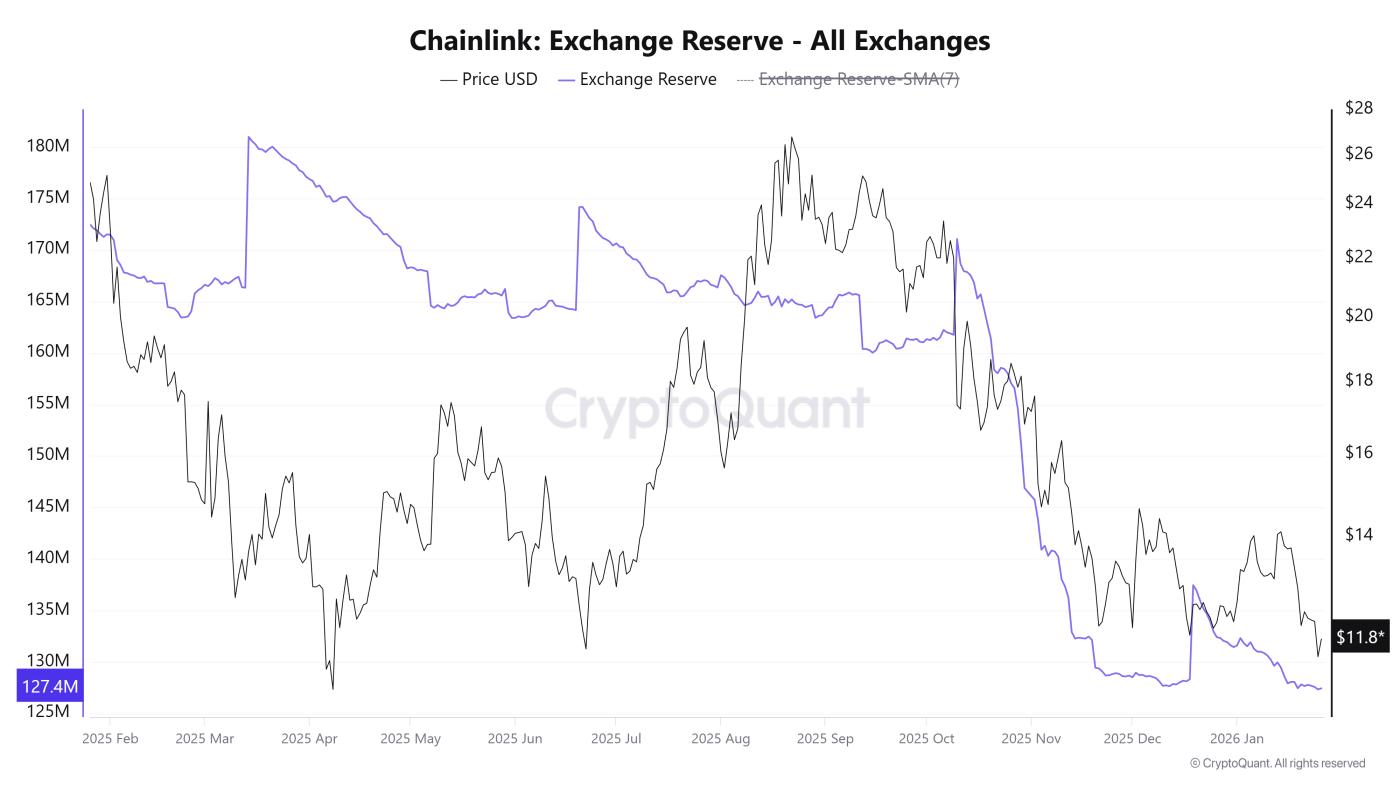

LINK liquidation map on the exchange. Source: CoinglassMeanwhile, data from exchanges shows that the amount of LINK held on exchanges has fallen to its lowest level in January, according to CryptoQuant. The chart shows that even with the price drop, investors are still choosing to accumulate LINK and withdraw it to their private wallets. This is a sign of long-term confidence in the project.

LINK is held in reserve on the exchange. Source: CryptoQuant .

LINK is held in reserve on the exchange. Source: CryptoQuant .In addition, data from the on-chain analytics platform Santiment indicates that LINK is one of the undervalued altcoins following the recent market downturn.

If buying pressure intensifies while prices continue to fall, the market could witness a sudden rebound. At that point, those holding Short on LINK would face the risk of significant liquidation this week.

3. River

River is a decentralized finance (DeFi) protocol that builds a stablecoin system using chain abstraction . Users can collateralize assets on one blockchain and borrow liquidation on another without the need for bridges or wrapped assets.

RIVER's market Capital has surged against the market trend, reaching a peak of over $1.6 billion . Just a month ago, RIVER's market Capital was still below $100 million.

This sharp increase has led to many traders rushing to buy due to FOMO (fear of missing out). As a result, Longing positions are currently dominant, making the potential for liquidation on the Longing side significantly valuable.

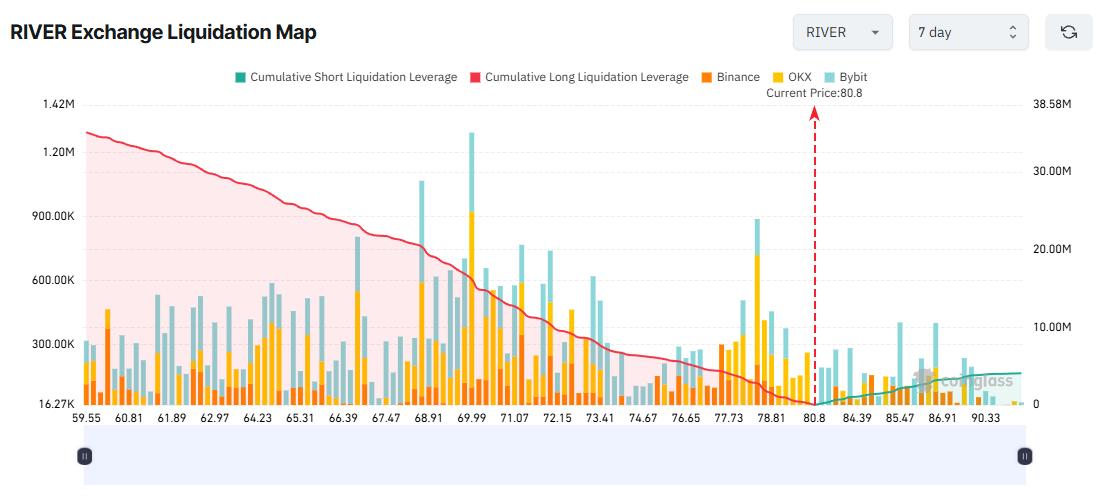

Liquidation map on the RIVER exchange. Source: Coinglass

Liquidation map on the RIVER exchange. Source: CoinglassIf RIVER goes against expectations and falls below $60 this week, Longing positions could be liquidated, resulting in total losses of up to $35 million.

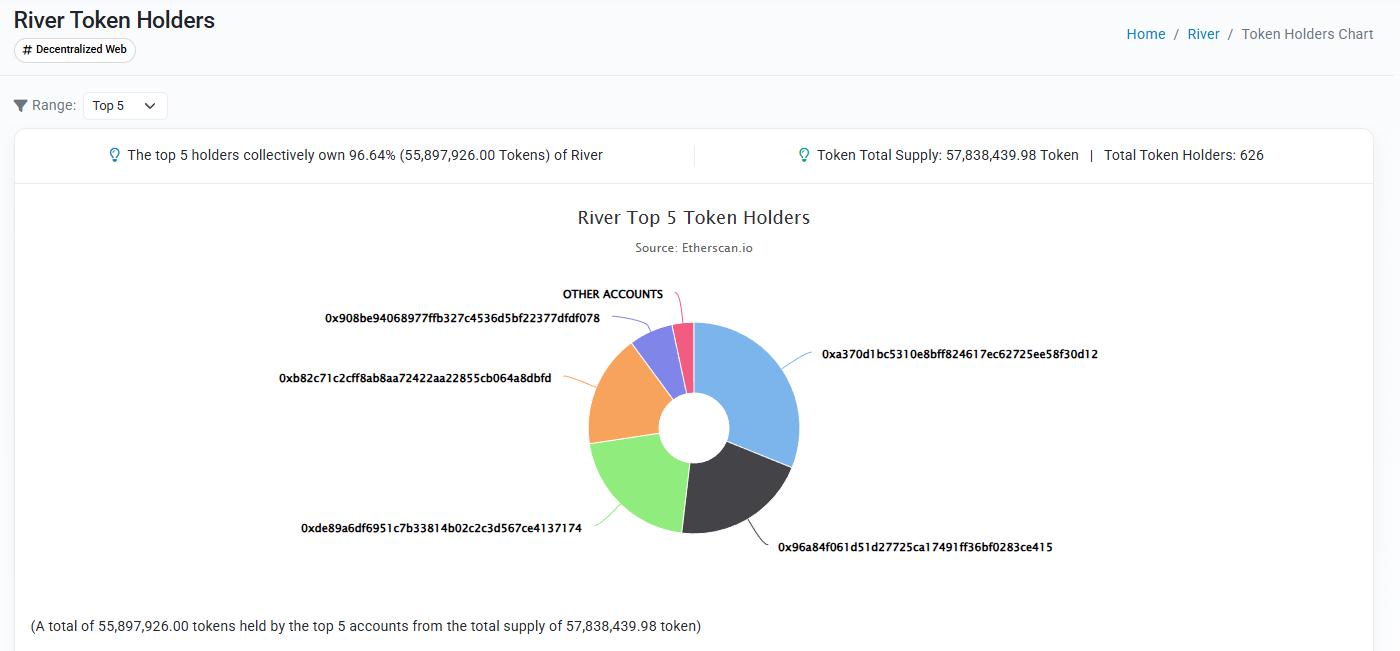

Is this scenario likely to happen? on-chain data is currently sending out several warning signals. According to data from Etherscan, the five largest River wallets control over 96.6% of the total Token supply, indicating an extremely high level of concentration.

The top 5 wallets holding the most RIVER Token . Source: Etherscan

The top 5 wallets holding the most RIVER Token . Source: Etherscan"It's controlled by insiders, that's all. They continue to manipulate. First MYX, then COAI, then AIA, and then almost to zero. Be very careful," investor Honey commented .

While some investors remain confident that RIVER will soon reach $100, many others express concern and doubt about the possibility of a price reversal. If this happens, the risk of liquidating Longing RIVER positions will increase significantly.

These altcoins are reflecting the different developments in the altcoin market at the end of January. Experts agree that the altcoin market is becoming increasingly selective . Only assets that attract interest from large institutions have the opportunity to attract more Capital and achieve sustainable long-term growth.