Hey @_Checkmatey_ - any chance we can get an update on this number?

Thank you for all you do!

$BTC

Arca

@arcamids

03-04

Well, this blew my mind.

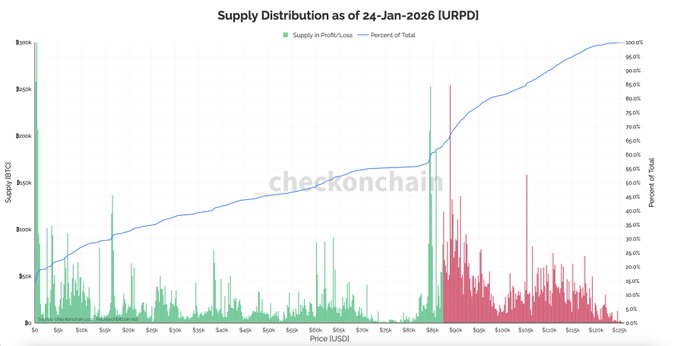

52% of every dollar that's ever been invested in $BTC has a cost basis above $90,000. 🤯🤯

Great pod @_DannyKnowles & @_Checkmatey_

Covered in today's report, just out.

James, are these reported figures based on this indicator ?

If so, in reality I’m not sure we can make such a precise claim using an indicator based on UTXOs model.

Some of the transactions captured (STXOs) are ultimately just internal transfers and end up distorting the data.

Realized cap is also UTxO based so it won’t help much.

Here's the secret, it doesn't actually matter.

Even with the most advanced filtering techniques there are, the results don;t vary by more than 5%.

As an ex-geotechnical engineer, plus or minus 5% is perfect precision.

Report here.

Ahah yes, I get what you mean, but sometimes 5% really matters.

They moved 4% of the total supply, and as a result some metrics get distorted by much more than 5%.

That’s why I wanted to hear your thoughts on this, thanks, James.

In markets, 5% never matters.

It's a mistake to worry about it tbh, you'll spend inordinate time trying to clean up something that just doesn't need to be cleaned.

Again, my background is designing massive excavations with a few 50mm boreholes as input information.

The 5% kills your budget, and engineering time, and achieves nothing useful.

Yes, I got what you meant, but James, listen.

What may be true for one metric doesn’t necessarily apply to another.

So even if you think 5% doesn’t matter here, that same 5% can have a much bigger impact on other metrics.

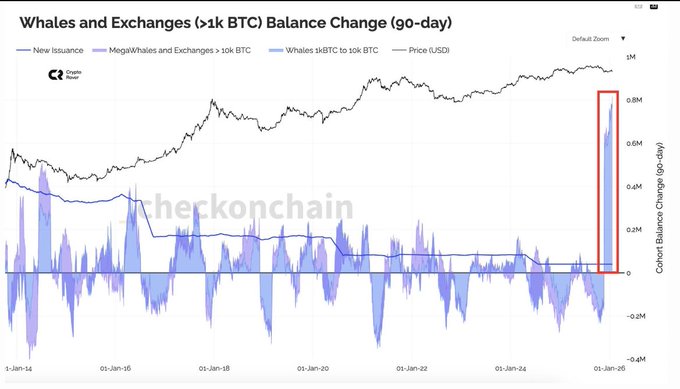

Look at this one, for example, this is your 5%.

That’s exactly what I meant.

So yes, I’ll keep paying close attention to these changes, even if they seem insignificant, because when you look elsewhere, you can clearly see that they can still have meaningful impacts that need to be taken into account.

I might be wrong, but I prefer working this way. It’s what works best for me and I don’t think asking this kind of question looks stupid.

Don't use wallet size metrics, you'll almost never see me use them because they are not useful, and are the one set that is affected.

I often consider deleting them from my site completely tbh.

Ahah, yes I agree James.

Being able to use this kind of chart requires actually understanding the real movements that took place.

I talked about it here (debunk) : x.com/darkfost_coc/status/2007...…

But that was just one example.

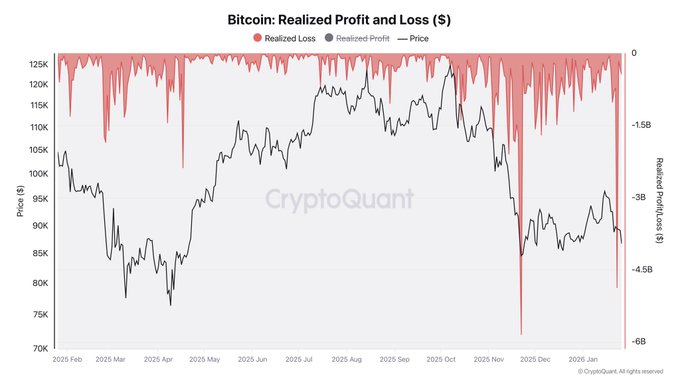

Here’s another one on realized losses.

In this example, it’s much harder to imagine and link a simple movement to such realized losses, yet it’s exactly the same underlying cause.

And I can find even more where the impact was significant that’s why I can’t agree with you here, for once…

However, it’s when we disagree that the discussions become even more interesting and insightful so thx James 👍

Darkfost

@Darkfost_Coc

01-02

❌ Whale are buying !

This is once again a flawed analysis.

The data have been distorted by the movement of nearly 800,000 BTC from Coinbase.

I keep repeating this point, but it still doesn’t seem to have been properly understood by most people, and I’ve never seen so many x.com/cryptorover/st…

I think where we differ, is these events don't matter in the vast majority of cases.

Did a tonne of people sell at a loss on that move down? Yes. Did an internal transfer move? Yes,

Does it actually change the conclusion? No.

Worry about the 95%, the 5% never changes the answer.

I have a more measured opinion, personally, James.

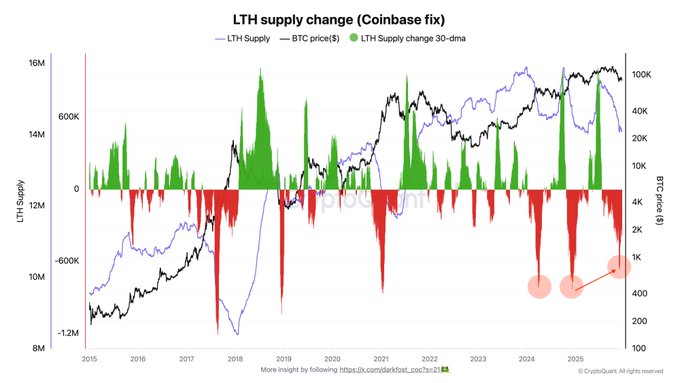

I had done the exercise regarding the evolution of LTH supply.

The conclusion to draw was quite different 👉 x.com/darkfost_coc/status/2002...…

Rather than seeing the largest LTH sales ever observed during this cycle, when the data is corrected, it turns out these sales were much more measured.

While the first analysis would have suggested entering a bear market, with an incredible LTH distribution, the second analysis points to very measured profit-taking that gradually diminished over time (a bottoming setup).

PS: I hope I’m not part of those angry clowns 😅

Darkfost

@Darkfost_Coc

12-20

🚨 LTH ARE SELLING LIKE CRAZY !!

This take is wrong ❌

I’ve said it several times, and I’ll say it again.

Since the movement of nearly 800,000 BTC by Coinbase, a large amount of on-chain data has been impacted.

Coinbase destroyed LTH UTXOs and created new ones when BTC was x.com/cryptorover/st…

No of course not. Perhaps I am just more comfortable working with unclean data because that is my engineering background.

Here is the trade-off --> you need a team of data scientists working all the time to maintain labels. Data becomes tens of thousands of dollars a year, which means analysts like us, never get access to it.

My solution --> learn to love the unclean data, because it's that or nothing.

Yeah I know, fully agree with that James,

But I like to think that’s why people seem to appreciate my work.

Sometimes this information can be really meaningful imo.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content