Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author and source: 0x9999in1, ME News

The crypto market is generally trending upwards. The GameFi sector, which saw significant declines yesterday, rebounded, rising 4.64% in the last 24 hours. Within the sector, Axie Infinity (AXS) surged 36.94%, Ronin (RON) rose 12.36%, and The Sandbox (SAND) climbed 3.49%. Meanwhile, Bitcoin (BTC) rose 1.23%, surpassing $88,000, and Ethereum (ETH) climbed 1.70%, breaking through $2,900.

In other sectors, the DeFi sector rose 3.32% in the last 24 hours, with Hyperliquid (HYPE) up 13.72%; the Layer 2 sector rose 1.63%, with Linea (LINEA) up 10.36%; the Layer 1 sector rose 1.54%, with Zcash (ZEC) up 7.62%; the PayFi sector rose 1.54%, with Dash (DASH) up 4.35%; the Meme sector rose 1.40%, with Pump.fun (PUMP) up 9.61%; and the CeFi sector rose 1.19%, with Aster (ASTER) up 5.25%.

The crypto sector indices, which reflect the historical performance of the sector, show that the ssiGameFi, ssiDeFi, and ssiLayer1 indices rose by 7.48%, 4.12%, and 1.60%, respectively.

ETF Directional Data

According to SoSoValue data, yesterday (January 26, Eastern Time), Bitcoin spot ETFs saw a total net inflow of $6.8427 million.

The Bitcoin spot ETF with the largest single-day net inflow yesterday was BlackRock ETF IBIT, with a net inflow of $15.9258 million. IBIT's total historical net inflow has now reached $62.919 billion.

The second largest net inflow was into Grayscale's Bitcoin Mini Trust ETF (BTC), which saw a net inflow of $7.7454 million in a single day. BTC's total historical net inflow has now reached $1.959 billion.

The Bitcoin spot ETF with the largest single-day net outflow yesterday was the Bitwise ETF (BITB), with a net outflow of $10.9668 million. BITB's total historical net inflow has reached $2.16 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $113.539 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.48%, and a historical cumulative net inflow of $56.501 billion.

According to SoSoValue data, the Ethereum spot ETF saw a total net inflow of $117 million yesterday (January 26, Eastern Time).

The Ethereum spot ETF with the largest single-day net inflow yesterday was the Fidelity ETF FETH, with a single-day net inflow of $137 million. The total historical net inflow of FETH has now reached $2.728 billion.

The Ethereum spot ETF with the largest single-day net outflow yesterday was the BlackRock ETF ETHA, with a single-day net outflow of $20.2497 million. Currently, the total historical net inflow of ETHA is $12.486 billion.

As of press time, the Ethereum spot ETF has a total net asset value of $17.623 billion, an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 5.03%, and a historical cumulative net inflow of $12.419 billion.

BTC Directional Data

According to CoinFound data, 195 listed companies currently hold a total of 1,204,469 BTC, accounting for 6.05% of the total Bitcoin supply. Among them, Strategy Inc (MSTR) holds 712,647 BTC (an increase of 2,932 from the previous count), accounting for 59.17% of the total holdings of listed companies.

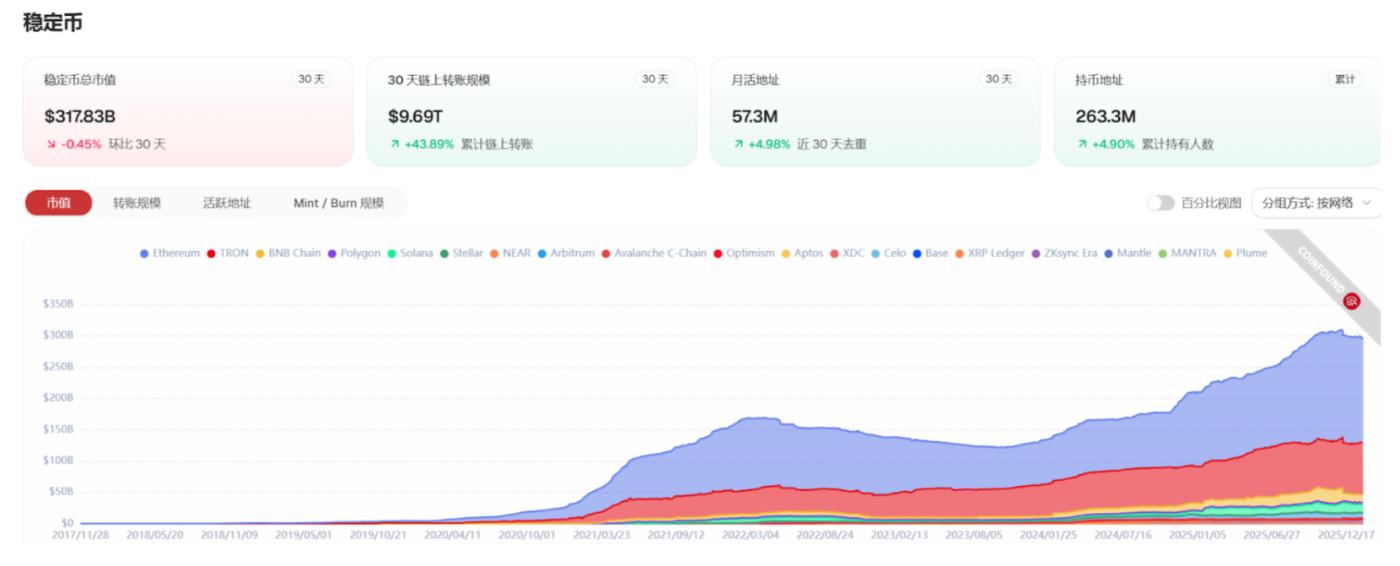

Stablecoin data

According to CoinFound data:

USDT market capitalization: US$198.98 billion

USDC market capitalization: $72.78 billion

USDS market capitalization: $10.98 billion

USDe market capitalization: $6.65 billion

PYUSD Market Cap: $3.79 billion

USD1 Market Cap: $4.68 billion

Market Dynamics:

Stablecoins lost $2.24 billion in market capitalization in 10 days as funds flowed into gold and silver as safe havens.

Tether announced that it added 27 tons of gold in the fourth quarter of 2025, bringing its total gold reserves to $12.9 billion.

The Hong Kong Special Administrative Region government confirmed at the AFF forum that it will issue the first batch of stablecoin licenses in the first quarter of 2026.

Summarize:

The stablecoin market has demonstrated remarkable resilience. While Bitcoin and Ethereum suffered setbacks due to the US government shutdown crisis and the strengthening of the yen, stablecoins maintained relative market value stability thanks to their high on-chain yields and the backing of physical assets (gold).

RWA direction data

According to CoinFound data:

Market capitalization of commodities: $5.12 billion

Market value of government bonds: $1.38 billion

Institutional fund market capitalization: US$2.66 billion

Private lending market capitalization: $29.24 billion

US Treasury bond market capitalization: $10.1 billion

Market value of corporate bonds: $260 million

Market capitalization of tokenized stocks: $1.67 billion

Market Dynamics:

Tether Gold holds over half of the market share in gold-backed stablecoins, and its XAU₮ market capitalization has surpassed $4 billion.

The total market capitalization of tokenized silver exceeded $400 million, and the total market capitalization of tokenized gold exceeded $5.25 billion, both setting new records.

Hivemind and CPIC launch $500 million RWA tokenization fund

Superstate raises $82.5 million in Series B funding to expand its tokenized equity infrastructure.

Summarize:

The RWA market is expected to maintain a steady growth trend in 2026. RWA remains one of the structural opportunities identified in 2026, with many institutions shifting from pilot projects to repeatable on-chain financial products. The market is moving from "pilot verification" to "large-scale commercial application".