This article is machine translated

Show original

"Termmax Turbo Breakdown"

Termmax seems to be consistently contributing around 3K-4K daily.

Yesterday I added 4K, but the road ahead is long and arduous!

In a bear market, the most important thing is to preserve capital for future gains!

Therefore, I generally choose stablecoins as a conservative investment during bear markets. As a pioneer in fixed-interest rate investments, @TermMaxFi's TermMax USDC Vault V2 is a typical stablecoin investment. As an investor, it's essential to understand its specifics. Let's take a closer look!

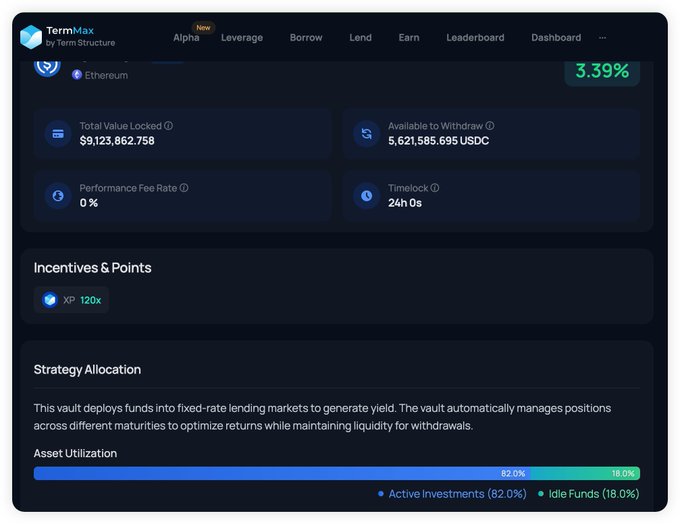

1️⃣ First, its locked funds, or TVL, are currently over $9 million USD; then, $5.6 million USD can be withdrawn, providing ample liquidity. Regarding fees, the 0% fee rate is quite generous; the 24-hour lock-up period is also within the normal range.

The strategy section below explains that this vault deposits user funds into a fixed-interest lending market to generate returns.

Here's the key point: this vault automatically adjusts the investment ratio across various lending markets.

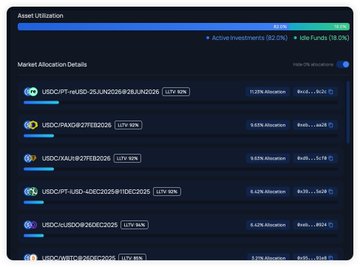

2️⃣ Regarding fund utilization, currently 82% is active in the lending market, with 18% idle.

Specifically, the lending market encompasses a wide variety of markets, not just USD and BTC, but also precious metals like gold.

The holding ratios appear relatively concentrated, with liquidation collateralization ratios in these lending markets all around 92%.

Summary:

1️⃣ Termmax's vault is primarily used in the lending market.

2️⃣ The lending market includes not only cryptocurrencies but also precious metals.

3️⃣ The investment portfolio changes according to market conditions.

4️⃣ From an investment perspective, TermMax exhibits clear characteristics of traditional finance (its investment portfolio and scope are broad, with no single source of risk). #TermMaxFi #TermMax @TermMaxFi

Termmax deserves a shout-out to River! 🤣

呃。。。

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content