This article is machine translated

Show original

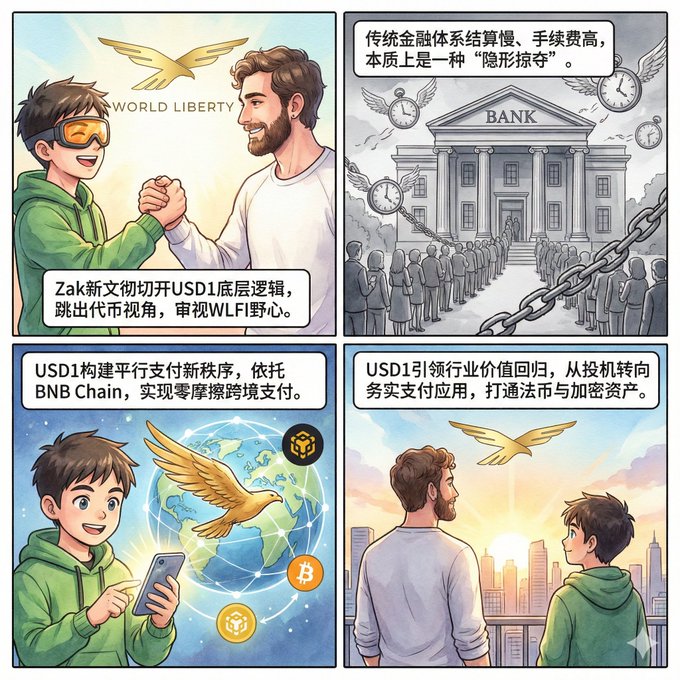

Many people's understanding of @worldlibertyfi may still be limited to its market hype, but Zak @zakfolkman's recent article undoubtedly cuts through the underlying logic of USD1.

It allows us to move beyond a simple token perspective and re-examine WLFI @worldlibertyfi's ambitions from the perspective of payment infrastructure—a "precise strike" targeting the pain points of traditional finance.

____🦅____🦅____🦅____🦅____🦅____🦅____

『The "Hidden Plunder" of the Traditional Financial System』 For families relying on cross-border remittances for a living, or ordinary people struggling with inflation, the traditional bank's 3-5 day settlement cycle and layers of fees are essentially a form of legal plunder.

This inefficiency not only devours 10% of freelancers' income but also incurs expensive hidden costs for the global trade supply chain due to delayed capital turnover.

The perspective presented by Zak @zakfolkman in his article shows us that WLFI is not attempting a mere improvement, but a complete replacement of this outdated mechanism.

____🦅____🦅____🦅____🦅____🦅____🦅____

『A "Dimensional Reduction Attack" of Frictionless Payments』

The core value of $USD1 lies in constructing a new payment order parallel to SWIFT.

By leveraging the high-performance network of BNB Chain, WLFI @worldlibertyfi minimizes the friction costs of cross-border payments, representing a decentralization of payment rights.

When transfers become as instantaneous as sending a message, even approaching free, $USD1 becomes a vehicle for inclusive finance.

This design allows hundreds of millions of users who previously lacked access to banking services to transcend national borders and credit score limitations, truly taking control of their wealth flow.

____🦅____🦅____🦅____🦅____🦅____

『"Value Return" After the Speculation Fades』

In Satoshi Nakamoto's white paper, the original intention of cryptocurrency was "peer-to-peer," not simply a speculative asset.

This article shared by Zak @zakfolkman also indicates that USD1 is leading the industry's return, shifting from frenzied candlestick chart speculation to pragmatic payment applications.

Within a framework of compliance and transparency, WLFI is not only repairing the trust damaged by industry chaos, but also bridging the final gap between fiat currency and crypto assets. This evolution from "hype" to "practicality" may be the final battleground for the stablecoin race.

____🦅____🦅____🦅____🦅____🦅____🦅____

Zak Folkman

@zakfolkman

01-27

The Real Stablecoin Revolution Is in Payments

Everyone knows stablecoins are being used for payments. That’s not news.

What’s actually interesting is how fast the infrastructure is maturing and how many real-world problems are getting solved right now. Not “someday.” Today.

And

WLFI's name is too hard to remember now, so I've given her a more literary name:

TVBee

@blockTVBee

01-27

起名达人又来了——给WLFI起个中文名

继给DBR起名"东北人"、给ZAMA起名"扎马"以后,蜂兄这次把"魔爪"伸向川普!

WLFI这个名字,华语区很难记住。

蜂兄把这四个字母拆成两部分,前两个字母WL,取"未来"一词的拼音首字母。WeiLai。

FI保持,像deFI、gameFi、rawFI里的"FI"一样。 x.com/blockTVBee/sta…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content