Hyperliquid (HYPE) has delivered one of its strongest weekly performances in months, surging 65% to reach a near two-month high of $34.5. The rapid move followed weeks of consolidation and reignited interest across derivatives-focused traders.

While the rally has been impressive, momentum indicators now suggest uncertainty. Investors are questioning whether HYPE can extend gains or if a corrective phase is approaching.

HYPE Traders Are Pouring Money

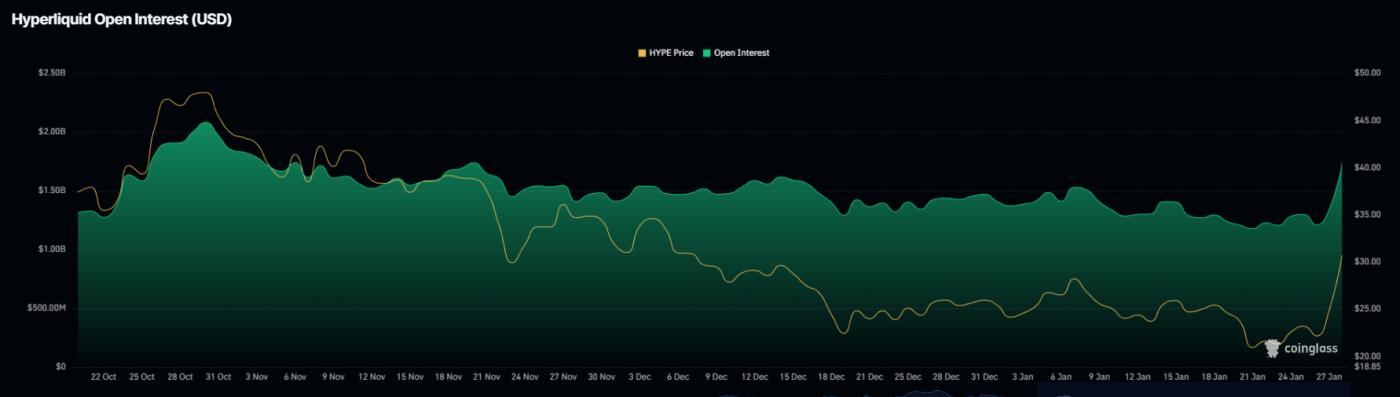

Market sentiment around Hyperliquid strengthened sharply as derivatives activity accelerated. Open Interest rose 43% within 48 hours, climbing from $1.21 billion to $1.73 billion. Such a rapid increase indicates a surge in new positions rather than short covering. This behavior typically reflects growing trader confidence in further price appreciation.

Funding rates have remained positive throughout the rally, confirming that long positions dominate short exposure. When funding stays positive during rising Open Interest, it suggests traders are willing to pay a premium to maintain bullish bets.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HYPE Open Interest. Source; Coinglass

HYPE Open Interest. Source; CoinglassThis structure often supports continued upside in the short term. However, it also raises liquidation risk if sentiment shifts abruptly.

From a macro perspective, momentum indicators are flashing caution. The Relative Strength Index for HYPE spiked above the 70.0 threshold over the past few days, entering overbought territory. This signals that buying pressure may be reaching exhaustion after the sharp advance.

Historically, similar RSI conditions for Hyperliquid have preceded pullbacks. Once buying momentum saturates, early entrants often secure profits. This selling pressure has previously led to swift corrections. Current conditions suggest the market may follow a similar pattern if demand fails to expand further.

HYPE RSI. Source: TradingView

HYPE RSI. Source: TradingViewHYPE Price Approaches Critical Test

Over the past seven days, HYPE price climbed from $20.9 to $34.5, marking a 65% increase. The rally coincided with strong moves in traditional commodities, including gold and silver. Hyperliquid’s HIP-3 open interest surged to $793 million on January 26–27, 2026, from $260 million a month earlier. This growth reflects rising demand for decentralized commodities trading and alternative market structures.

Despite the strong backdrop, price direction remains uncertain. Trading near $34.5, HYPE is testing a critical inflection zone. If the token manages to flip $35.3 into support, bullish momentum could persist. Under such conditions, technical projections point toward a potential move to $42.4 in the near term.

HYPE Price Analysis. Source: TradingView

HYPE Price Analysis. Source: TradingViewDownside risk remains significant if sentiment weakens. A failure to hold above $30.8 would likely trigger a broader correction. In that scenario, HYPE could slide toward $26.8 as selling accelerates. Such a move would invalidate the bullish thesis and signal a reset in market positioning.