This article is machine translated

Show original

The price has rebounded, but my position is gone – this is perhaps the most common experience for contract traders.

Lately, I've been reflecting a lot: why do my trades always fail? Why, even when the direction is right, do I still not make money?

Why do I panic and even sell at a loss every time the price bottoms out, when it's a good opportunity to buy? Why, even when I know it's going to reach a certain level, do I find it hard to accept when it actually arrives?

This is perhaps a classic case of inconsistency between knowledge and action, and the biggest pain point in trading. A sharp drop is an opportunity, but I often already have a large position before the drop. Facing huge unrealized losses, panic is normal. Then I'm trapped, without funds to buy more, or even afraid to buy because of the losses!

Ugh, it's so frustrating! Greed without reward, bluster without substance, missing opportunities – that's me!

For example, I was very convinced there would be a big move in the first half of the year, and I was still thinking about opening a contract. But I couldn't bear the losses, so even though the direction was right, I still couldn't make money. What am I supposed to do? Exchanges must love people like me!

子棋(重生版)

@cloakmk

01-28

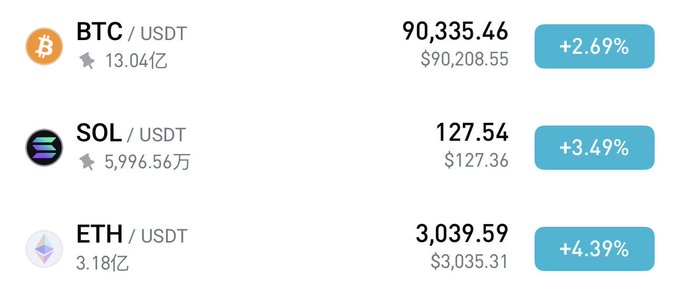

再次站上9万附近,二探最终还是来了,只不过又V回了!

我更愿意相信这次二探是为了清杠杆,毕竟摆脱美股单独下跌是不太符合常理的。#OKX

短期支撑88000 这里是历史多次反弹的成交密集带,且有呈W形态,若价格支撑上方且底部放量,那基本下跌就到位了!(概率大) x.com/cloakmk/status…

Sigh, it's all tears when I talk about it. Before, I wasn't worried about floating losses of tens of thousands of dollars, but now I can't even stand floating losses of a few thousand dollars.

It's Chinese New Year, so take good care of yourself and adjust your mindset.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content