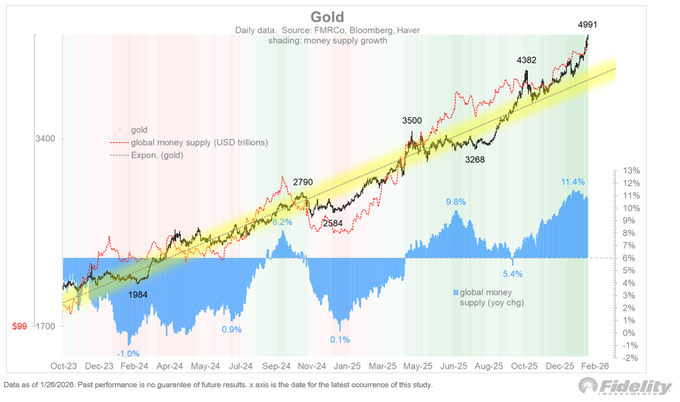

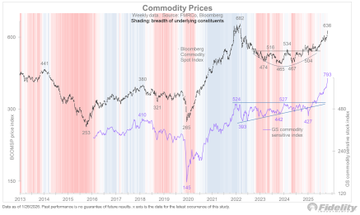

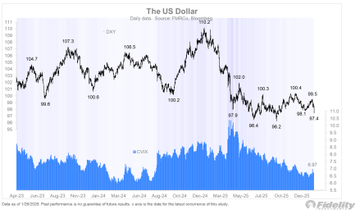

The bond market, precious metals, and currencies seem on edge, and as the chart shows below, there’s a bit of déjà vu with regards to the interplay of the 10-year Treasury yield, the dollar index, and gold. Tariffs or not, the world order is changing from a dollar-only standard to multiple spheres of influence, and the markets are taking notice. In fact, one could argue that all commodities are becoming strategic assets in this multipolar world. The chart below remains one of the more compelling ones out there. the move higher in yields and lower in the dollar are a mere echo of what we experienced in April. For instance, currency volatility is a fraction of what it was in April. But directionally, the currency move movements are worth noting.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content